Balancing a checkbook nowadays doesn’t seem as important as it use to be. But, it’s a great way to help you keep track of your expenses if you can get in the habit of doing it at least once a month.

By spending the time to balance your checkbook, you’ll be able to recognize financial changes you could make that’ll benefit you in the long run.

Balancing a checkbook is pretty straightforward, the only goal is to stay on budget!

To show you how to balance a checkbook, we are going to cover:

- What Does It Mean To Balance Your Checkbook?

- What Do You Need To Get Started ?

- How To Balance A Checkbook

- Why is balancing a checkbook important?

- Never Do: Bounced Check

What Does It Mean To Balance Your Checkbook?

Balancing a checkbook isn’t as difficult as it may seem. It’s actually pretty easy once you know what you’re doing.

If you were to look at what it really involves, it’s just recording every deposit and withdrawal you make on a daily basis.

If you have payments that are set to be withdrawn automatically, make sure to write those down in advance so you always know how much you have left to work with.

Once you’re in the habit of balancing your checkbook, it will only take you a few minutes to do it. It only involves writing down the transactions and doing the right calculations to determine your remaining balance.

The two main reasons it would be beneficial to do this are:

- Allow you to know how much money is available in your checking account at all time

- You’ll be able to know if your bank account is reporting an error or even notice any fraudulent activity in your account.

Keeping track of this will make your financial life better and more sound.

What Do You Need To Get Started ?

There are a few things you need to gather to be able to start to balance your checkbook.

- A checkbook register

-

- Usually you get one with your checkbook when you open a bank account. You can also purchase them online.

- If you don’t have one and still want to balance your checkbook, you can use a notebook or a spreadsheet on your computer. No need to complicate yourself.

- You need a list of all transactions in the past month for the account you are trying to balance out

- List should include:

- Purchases

- Withdrawals

- Deposits

- Bank charges and fees

- Anything that was added or subtracted from your account.

- List should include:

-

- Receipts

-

- Make sure to hold on to receipts for big purchases, until you are sure you’ve balanced your checkbook. If you need to dispute a transaction, you’ll need proof of your spending.

-

- Recent bank statement

- Having a bank statement with you will allow you to know your previous balance and your current balance. You’ll be able to see all transactions and be able to compare your deposits, withdrawals and purchases. It comes in handy to verify your information because you can end up finding errors.

Does the word budget send chills up your spine? 😰

It shouldn’t!

Budgets allow you to have some control over what you spend. 💪 https://t.co/qSmbNdYS5c#budget #TuesdayMotivation #Financial pic.twitter.com/zXEVgjRdZl

— Get Out of Debt (@getoutofdebtcom) February 12, 2019

How To Balance A Checkbook

1. Record your income and all your transactions

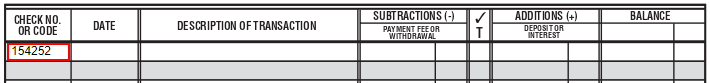

To record them, you’ll use a check register.

These slip right into your checkbook, and tend to come with your checks. They were created to help you keep track of your income and all transactions made through that account.

What type of transactions will you record?

- Deposits

- Purchases

- ATM withdrawals

- Checks you write

- Automatic debits

- Fees

Remember you can always use a notebook or a spreadsheet on your computer to balance your checkbook if you don’t have a checkbook register.

2. Find your current balance

To get your current balance, you can check online, go to an ATM, or contact your bank.

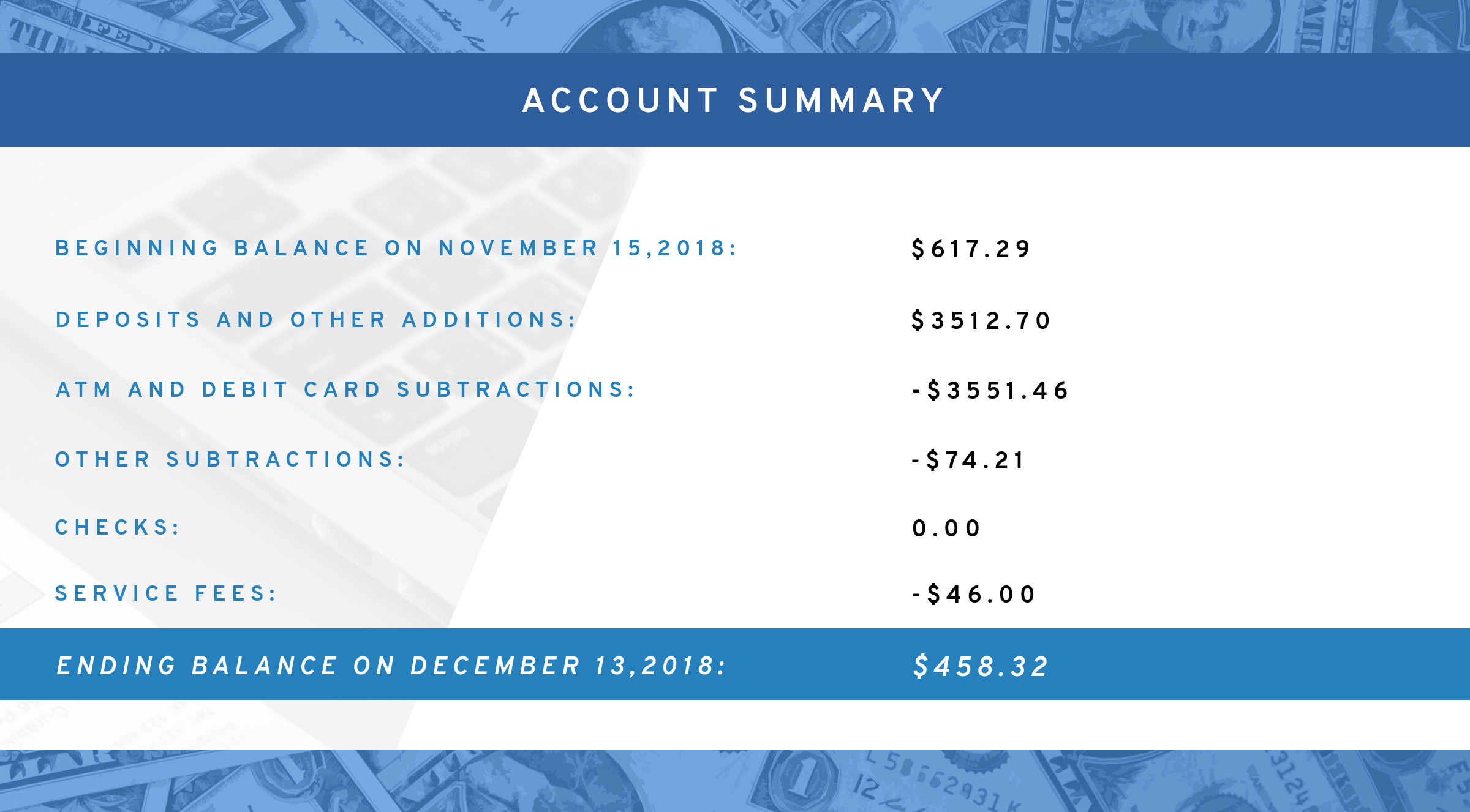

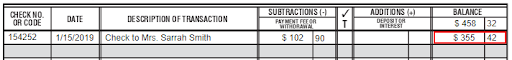

Example of a bank statement:

The balance you’ll use is the ending balance, all transactions need to be from that point on.

Once you have the balance, you are going to go to the top right hand side of the checkbook register and write the amount.

For this example we are going to use $458.32 as the current balance.

With that balance, you are going to start balancing your checkbook.

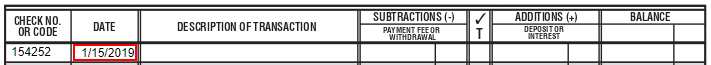

Step 3. Record all transactions

Start by writing down any withdrawals or deposits made through your account. But, be careful of where you’re placing them.

Use the subtraction column to write down any transactions that involve withdrawing money. When it comes to deposits, use the addition column.

For every transaction or check you must write down the following information:

- Check Number or code – number of the check you handed out, or any specific code to identify the transaction, like a confirmation code. If you make a payment over the phone, it’s more likely that you’ll receive a confirmation number. When doing payments online, you usually receive an email confirmation that the payment was made, but if they give you a confirmation number, make sure to write it down in this section.

- Date of transaction or check – date when you gave out the check or date the transaction was made.

- Description of the transaction – This is where you’re going to write where the money went to. Whether you wrote a check, or made a purchase, you’ll want to record what it was.

- Be descriptive enough that it’ll allow you to recognize the transaction if needed in the future.

- Be specific, like: Online Payment AT&T (you are noting that the payment was done online and was made to AT&T), another one could be Dinner at Olive Garden (you are noting that you went out for dinner at Olive Garden). By doing it this way, you’ll be able to remember the transaction if you need to go back to it in the future.

- Be descriptive enough that it’ll allow you to recognize the transaction if needed in the future.

- If it’s a Subtraction or an Addition – record all of the withdrawals, as well as all of the deposits.

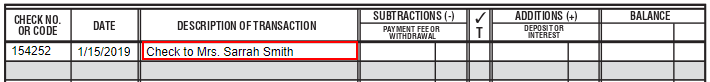

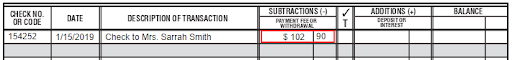

Let’s say that you handed Mrs. Sarrah Smith a check for the amount of $102.90.

This is the way you would record it.

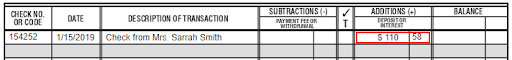

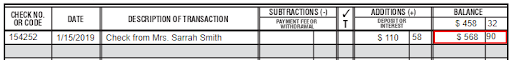

But let’s change it a bit. Let’s say that instead of you giving this check to Mrs. Sarrah Smith, she gave it to you for the amount of $110.58.

This is how you would record it.

- Balance left – Once you’ve added all transactions into the right field, you are going to add or subtract depending on the type of transaction it was.

For example: This transaction was a check you gave Mrs. Sarrah Smith for the amount of $102.90. Because of this you are going to subtract that amount from your balance, and end up with $355.42.

For this transaction you received a check from Mrs. Sarrah Smith for the amount of $110.58. You are going to add that amount to your balance and end up having a balance of $568.90.

Now let’s practice a little and see how it goes.

- Let’s say that you have this list:

- Gas (1/19/2019)- $25.00

- Groceries (1/21/19) – $45.28

- Online payment At&t (1/21/19) – $70.32

- Credit for returned merchandise in Walmart (1/23/19) – $59.78

- Payroll deposit (AMG Inc. on 1/25/2019) – $864.21

- Dinner at Olive Garden (1/25/19)- $86.45

- Movie tickets (1/31/19) – $32.96

And you started with a balance of $458.32

You are going to add the date, description, and amount in the subtraction field since this was an expense you had.

Gas (1/19/2019)- $25.00 (will be illustrated as follows) you are going to subtract the $25.00 from your balance, leaving you with a balance of $433.32.

Now you went for groceries and you are going to add the date and description in the subtraction field since this was another expense you had.

Groceries (1/21/19) – $45.28 (should be recorded as follows) you are also going to subtract that $45.28 from your balance and end with a balance of $388.04.

Now you had to pay your cell phone bill and you are making this payment online, and since it’s a payment you made you are going to add it to the subtraction field.

Online payment AT&T (1/21/19) – $70.32 (should be recorded as follows) you are also going to subtract that $70.32 from your balance to leave you with a new balance of $317.72.

Starting to understand how this goes?

So let’s continue…

You went to return an item at Walmart that had an defect and Walmart returned the funds to your bank account.

Credit for returned merchandise in Walmart (1/23/19) – $59.78 (you are going to record as follows) For this transaction you are going to place it in the addition column and add it to your balance.

So now you have a balance of $377.50.

For this next transaction, we’re going to record a payroll deposit that went directly into your bank account.

Payroll deposit (AMG Inc. on 1/25/2019) – $864.21 – (Record it as follows) This transaction needs to be added as an addition. Once added, your total balance will be $1,241.71

You decided to go out for dinner tonight, just cause you got paid and wanted to do something a little different.

Dinner at Olive Garden (1/25/19)- $86.45 – (record as follows) Since you are adding an expense, you are recording it as a subtraction and your balance will decrease to $1,155.26.

There’s a great movie in the theaters and you want to go see it. So, you went and purchased the tickets.

Movie tickets (1/31/19) – $32.96 (record as follows). Once again since this is an expense you are going to add in the subtraction field and decrease your balance to $1,122.30.

Those are all of the transactions you needed to add to your check register.

Now, you’re left with a balance of $1,122.30.

Make sure to write everything down, you don’t want to miss anything. This will allow you to have a balanced checkbook.

Something to point out is that…

It’s easier to maintain a balanced checkbook when you are the only one that is using that bank account. But when you are sharing an account, you need to be more active in registering these transactions. If you’re sharing the account, designate one person to balance the checkbook, and make sure the other one reports all their transactions.

Once you get the hang of balancing a checkbook, you’ll be able to do this easily, even with multiple bank accounts. Just make sure to keep a separate register for each account.

4. Maintain your balanced checkbook

When balancing your checkbook, try to decide when you are going to balance it.

- Are you going to do it every time you make a transaction?

- Are you going to do it weekly?

- Are you going to do it when you sit down to pay your bills at the end of the month?

5. Reconcile your checkbook

Always compare your checkbook with your bank statement when it arrives.

Bank statements will offer additional information you might not know, that could help you keep your checkbook balanced.

- Your bank will add any interest that’s accrued in your account – So make sure to add these to your checkbook.

- They will add any fees that may apply to your account – make sure to subtract these from your checkbook

6. Verify if there are any mistakes in your checkbook

You might find discrepancies between your numbers and your bank statement.

Try to figure out where the mistake is. You might have transactions that are still pending that might not show, or maybe you made a simple error in your calculations.

- You might have added or subtracted something that was not correct and that changed the balance on your checkbook. Always double check your math.

- You might have missed a transaction that is showing in your bank statement but not on your checkbook. We all live a busy life, we might miss a transaction or two. But it’s fine, the important thing is to correct it as soon a you find the mistake.

- Make sure to keep an eye on transactions that you may have recorded in your checkbook but have not cleared yet, or you might have transactions listed in the checkbook that are not listed in that statement.

- If this is the case, just subtract or add the balance of the transactions after the last date in your bank statement and make sure it adds up.

Tip: Be sure to place a check mark next to every check that has cleared. This way you’ll be able to stay on top of your finances.

7. Report fraudulent charges

If you notice any fraudulent charge on your account, make sure to notify your bank immediately. If you notice that there are transactions that you don’t remember making, your bank may be able to refund you the money until a proper investigation is done.

It’s better to report any suspicious activity with your account than allowing it to go for a while. As soon as you see something, report it!

8. Finish your balancing

Once you’ve double checked everything, draw double lines under the balance amount in your check register. This will allow you to easily know the last time your checkbook was balanced.

Why is balancing a checkbook important?

Banks make mistakes all the time. Balancing a checkbook can make the difference. You might be thinking that doing this seems like something from the past, maybe even something that your grandparents did back in the days.

But reality is that many financially responsible people still do it. This is how they protect their money and make sure that there are no errors when it comes to their capital.

Balancing your checkbook might even help you spend less. How?

Because you’ll know exactly how much money you have in your bank account and how much you are spending on things that have a priority, keeping you on budget and avoiding unnecessary purchases.

Never Do: Bounced Check

When you write a check, chances are you won’t have a current bank statement in front of you. Without knowing how much money is currently in your account, there is a chance that you might not have the money to cover the check.

Having a balanced checkbook will allow you to know if can write that check or not, helping you to avoid a bounced check.

When a check bounces, your bank will charge you a fee for the incident. But not only that, some companies will also charge you a fee if the check bounces.

So your bank will charge you a fee and the entity you paid with that bounced check might charge you too. So by making this mistake, you are going to pay more than you should.

You can avoid a bounced check if you place overdraft protection on your account. This will make sure to cover you in the event of something like this to happen.

Conclusion

Although it may not seem like it, balancing your checkbook is an important skill to have. You’ll have a clear sense of how much you are spending, as well as how much money you have.

It will help you stay on budget, detect errors, avoid fees, and maybe even find fraudulent transactions.

This is not a practice that’ll go away with technology! So, the sooner you learn, the better.

Do you regularly balance your checkbook? Let us know in the comments!

Up Next: Easy Monthly Budget Template

Very helpful tips.