If you are looking for a tool that will help you get out of debt, Undebt.it might be exactly what you need.

This tool was created by Jeff Donaldson, who was struggling just like you may be now. He used to think that debt was simply a part of adult life, until he realized that it didn’t need to be like that.

Donaldson worked super hard to get this tool put together to help him get out of debt, and now he’s shared it with everyone.

To show you a bit about Undebt.it and what it has to offer, we’re going to cover:

- What Is The Undebt.it App?

- How Does Undebt.it Work?

- Undebt.it Features

- Undebt.it Debt Payoff Plans

- Additional Features of Undebt.it

- YNAB Account Integration

- Undebt.It Premium vs Undebt.it

- Try Undebt.it Today

What Is The Undebt.it App?

Undebt.it was designed to help you get rid of debt by using various accelerated debt payoff methods. The app allows you to easily and conveniently create your own payment plan.

Currently, there are 2 versions of the app. You can choose between the free version, and Undebt.it+, their premium version.

Both versions of the app will allow you access to their different debt payoff plans. Of the debt payoff plans, the Debt Snowball Method and the Debt Avalanche Method remain the most popular.

How Does Undebt.it Work?

Through the app, you’ll pick a payment plan that works for you and your personal situation. You’ll be able to track your progress while following the plan.

Undebt.it will even show you when you’ll have paid each debt off, and when you’ll be completely debt free.

Here’s how to get started:

-

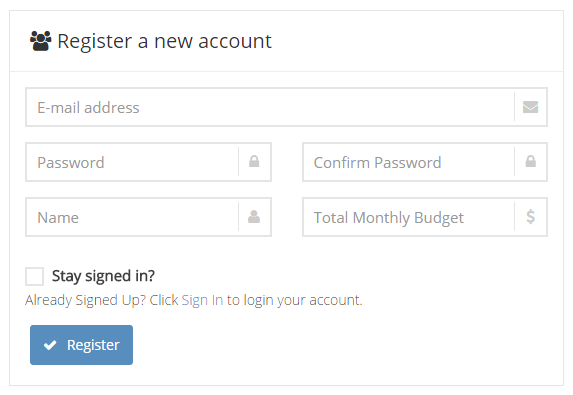

Create an account

We suggest you start with the free version to try it out and see if it’s a good fit for you before committing to Undebt.it+

When creating the account, you’re going to asked to set a budget. Make sure that you’re not putting more than you can afford to pay each month.

Then you’ll be prompted to…

-

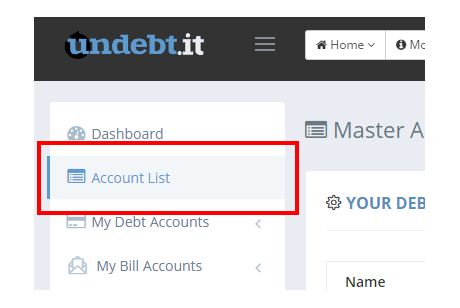

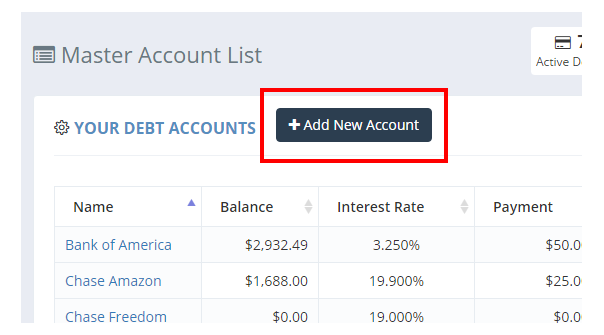

Add your debt information

This is where you’ll add information about all of your accounts.

You’ll need to know:

- Your current balance

- Interest rate

- Minimum payment amount

Undebt.it will not link to your accounts, nor collect any passwords to your accounts.

It works strictly based off of the information you provide. You have the ability to add all the accounts you wish, no limits. And with every account you add, you have the option to edit or delete it later.

Once all of this information is put in place you will…

-

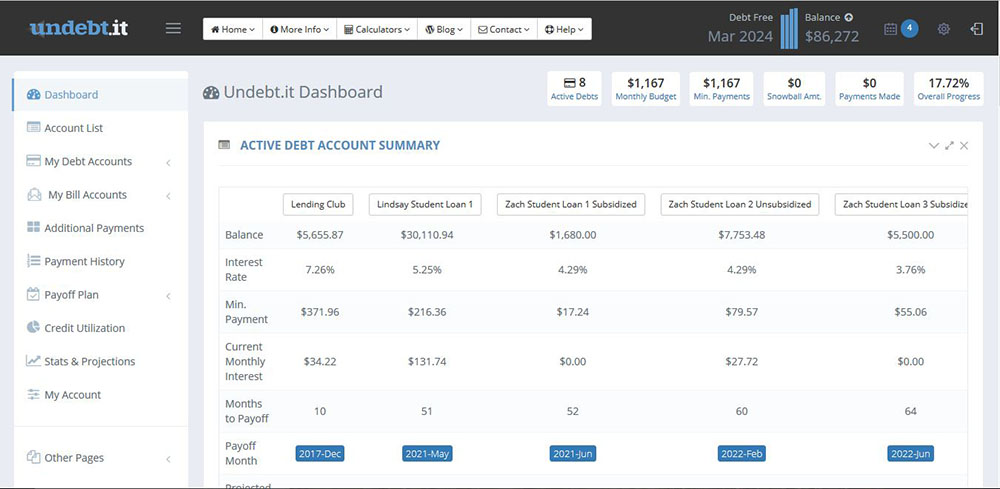

Go to the Dashboard

The Dashboard is the main place you’ll be spending your time. This is where you’ll see an overview of how everything is going.

- The dashboard will show you lots of information, including:

- When you will pay off the debt

- How much you will pay on interest

- When payments are due

- Record of past payments

How cool is that!

After you’ve reviewed the dashboard, you can look into the details page and…

-

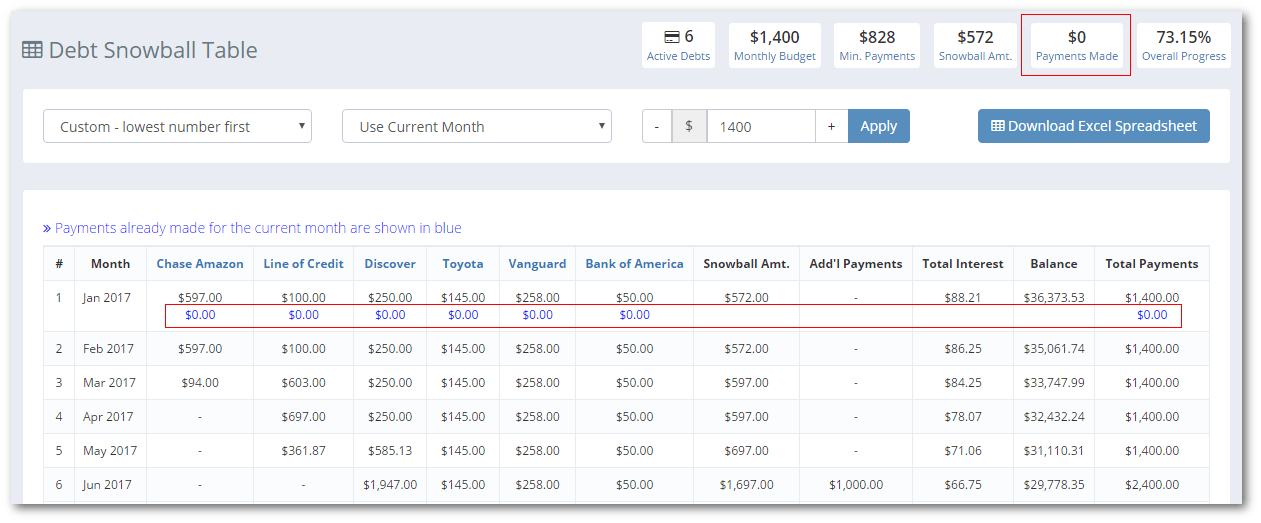

Review the Debt Snowball Table

This tool will automatically route you to the debt snowball method. You will have the ability to make changes and choose the best method for you.

When you select the method you prefer, you will be able to see a table that shows a detailed summary of each month’s payments. It will show you how the method you’ve selected really works, and how quickly you’ll payoff your debt.

Plus you’ll be able to export the tables to an excel file if you’d like to store this information somewhere.

Undebt.it Features

- Undebt.it can be used on computers, tablets or phones.

- You can add and manage an unlimited number of accounts.

- You have the ability to choose between multiple debt payoff plans, or even create a custom plan.

- Ability to sort and export your payment history.

- See your projected payoff dates and the total amount of interest you’ll pay for each account.

Undebt.it has multiple payoff plans you can select from, so let’s look into these and see what they have to offer.

Undebt.it Debt Payoff Plans

Don’t worry! Repayment plans are not set in stone. So, once you have selected a plan, you can easily switch to another.

-

Debt Snowball

If you select this method, you will be paying off your debts off starting with the one that has the lowest balance and working your way up to the highest.

By tackling your debts from lowest to highest, your smaller accounts will be paid off sooner. This is a great motivating factor for most people as they love to see an account back to $0.

-

Debt Avalanche

If you select this method, you will be paying off your debts in order of interest rates. So, you’ll begin paying down the card with the highest interest rate first while maintaining minimum payments on your other accounts. Then, you’ll move onto the next highest, and so on.

-

Debt Hybrid (Debt-to-Interest Ratio)

If you select this plan, you will be using a combination of both the snowball and the avalanche method together. This plan will help you eliminate debt, while keeping you motivated through the process.

-

Highest Monthly Payment

This plan is for people that are looking for some flexibility when it comes to their budget. It will allow you to free up money in order to make higher monthly payments.

-

Highest Credit Utilization

If you select this plan you will start paying down the accounts where you are closest to meet the maximum credit limit.

Your credit utilization plays a very important role in determining your credit score. This plan is most beneficial for those who are looking to increase their credit score.

-

Highest Monthly Interest Paid

This method centers around the amount you are paying each month, as opposed to the percentage rate.

This plan is focused on having you pay less interest, which makes it similar to the Debt Avalanche Method.

-

Custom Plans

If you opt to create a custom plan for yourself, you’ll be able to manage it through the app. Within the custom plan selection, you have 2 choices to begin building from:

- Highest number first – Means you will pay off highest number first

- Lowest number first – Means you will pay off lowest number first.

Both of these can be seen in the Debt Details page.

If this is your idea of financial planning, you may want to rethink your strategy.

You shouldn’t rely on luck to improve your #Finances.

Take action to learn how to properly #save money and #invest; you’ll have better odds of #FinancialSuccess! 👉https://t.co/UGu69fUwqs pic.twitter.com/H76KfMtjlh

— Get Out of Debt (@getoutofdebtcom) January 8, 2019

Additional features of Undebt.it

Aside from the standard features, Undebt.it has some cool tools you’ll want to check out.

Let’s take a look:

-

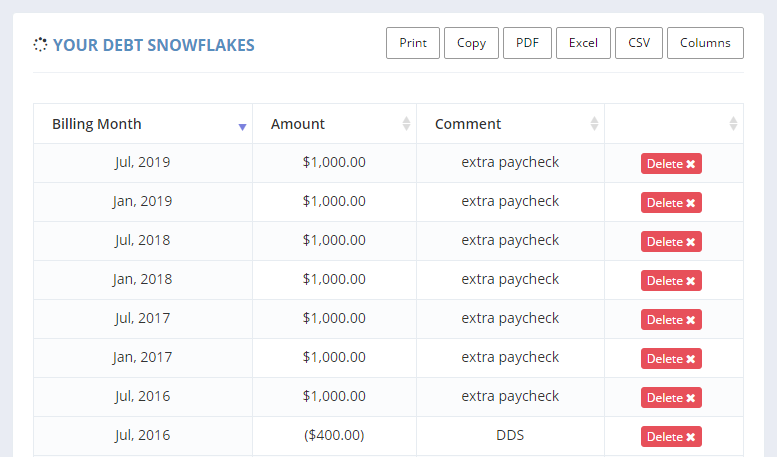

Use Debt Snowflakes for Additional Payments

The Debt Snowflake tool will allow you to add additional payments to your current plan.

You’ll find this option under the Debt Snowball Plan.

If you were to receive unexpected money, like a bonus or tax return, you can put it towards your debt by entering it under this tool.

-

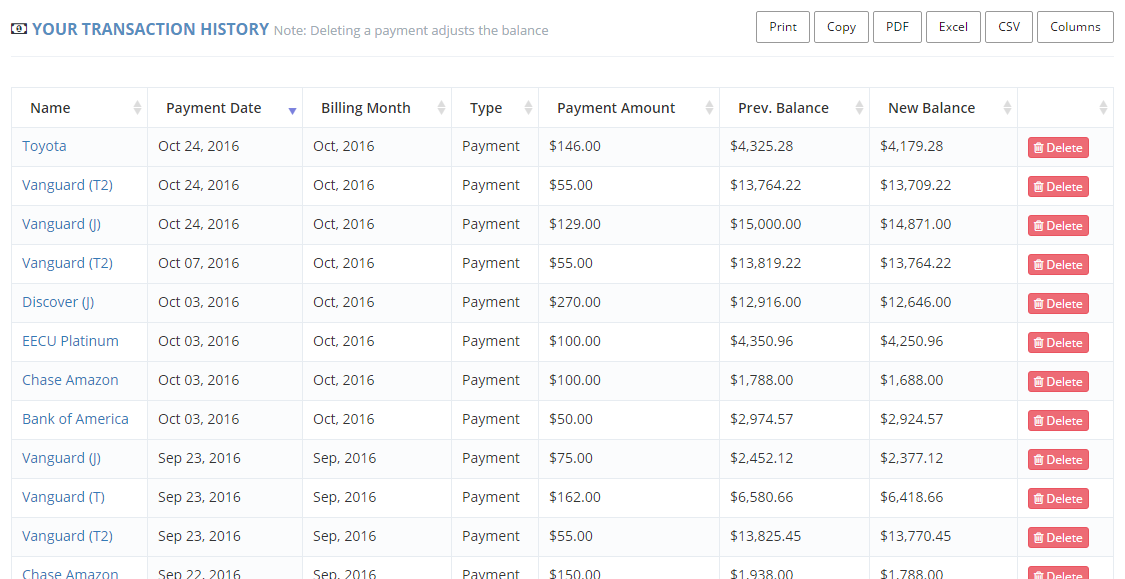

Keep track of your payments & purchase

You’ll be able to track all of your past payments and purchases on your Dashboard, as well as on the Details page.

When you add a payment, the system will automatically adjust the due date and your account balance.

You can sort this information as you’d like, and you have the option to export it.

-

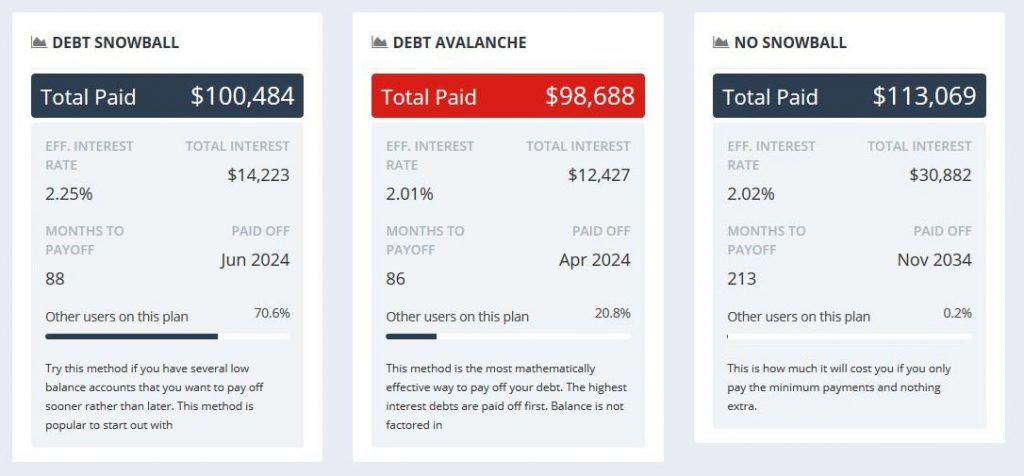

Compare Debt Payoff Methods

With this feature, you can go to the Compare Methods page and see how each plan will work for your personal circumstances. This will allow you to determine if you’ve selected the best option for you.

You’ll be able to compare:

- Time to payoff

- Amount of interest

- Total amount paid

This information helps you see where your at and where you can be depending the plan you’ve selected.

-

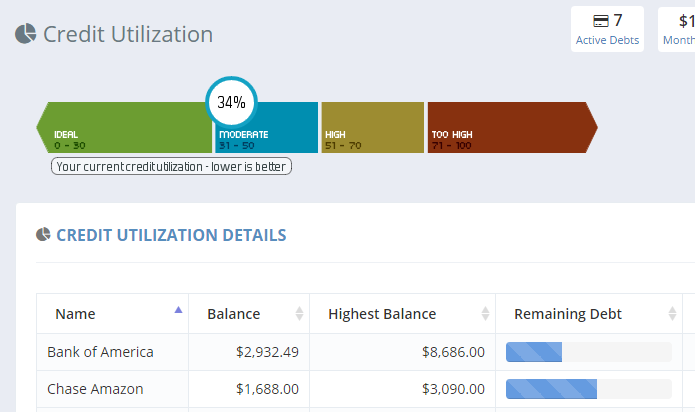

Track your credit utilization

Undebt.it will keep you updated on your credit utilization ratio. You’ll be able to see a pie chart which illustrates your various accounts and where you’re at. This is a great feature for those of you who are visual.

-

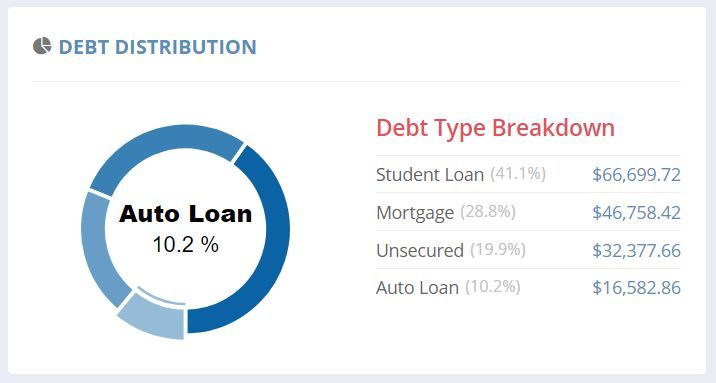

See How Your Debts & Interest Rates Are Distributed

These graphs will show you how your debts are distributed, so you can easily see where your money is going and how it breaks down.

-

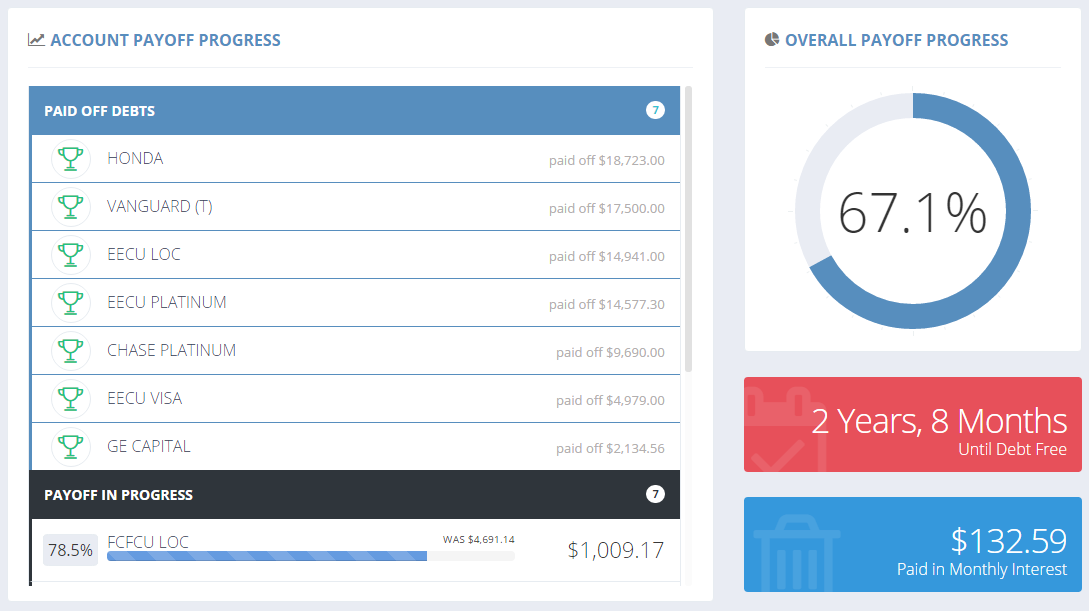

Check Your Debt Payoff Progress

On the Progress page, you’ll be able to see the strides you’ve made to pay off your debts.

You’ll see a list of the accounts that have been paid off, as well as how long it’ll take you to pay off your current balances.

But these are not the only features you have to choose from. They also offer:

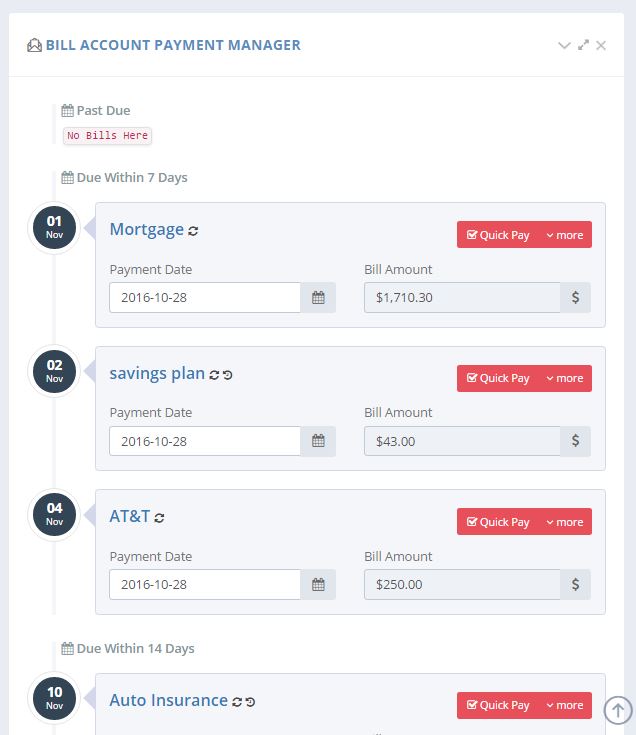

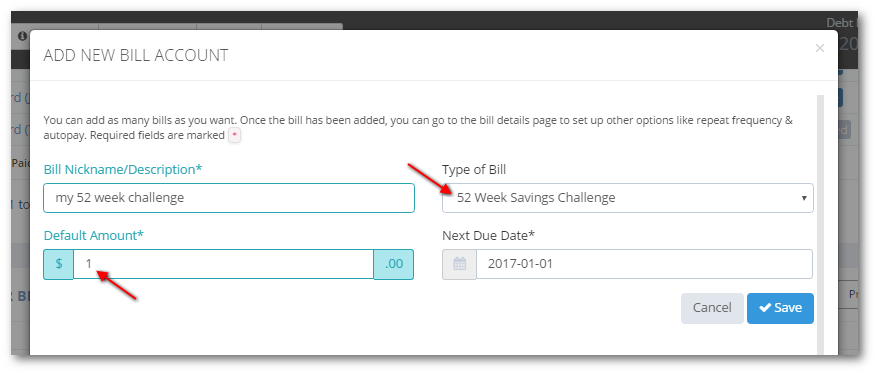

- Bill management – with this you’ll be able to manage your recurring non-debt accounts.

- Things like:

- Cable

- Phone

- Utility bills

- Things like:

This additional feature:

- Repeat bills every month or year, based on how you set it up

- Record your bill payments automatically

- Allows you to add unlimited accounts

- Text messages with payment reminders

- Show your bill history

- Display:

- Past due accounts

- Payments due within 7, 14 and over 14 days

-

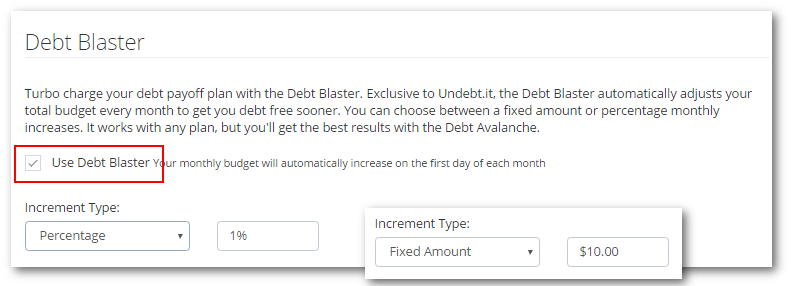

The Debt Blaster Payoff Method

This is a debt payoff method that has been developed by Undebt.it.

This is a turbo charged method created to help you excel your debt payoff plan. The way it works is that it automatically increases your budget by a small amount every month, so you’ll be able to pay your debts off quicker. You can do this by either a fixed amount or by a percentage.

-

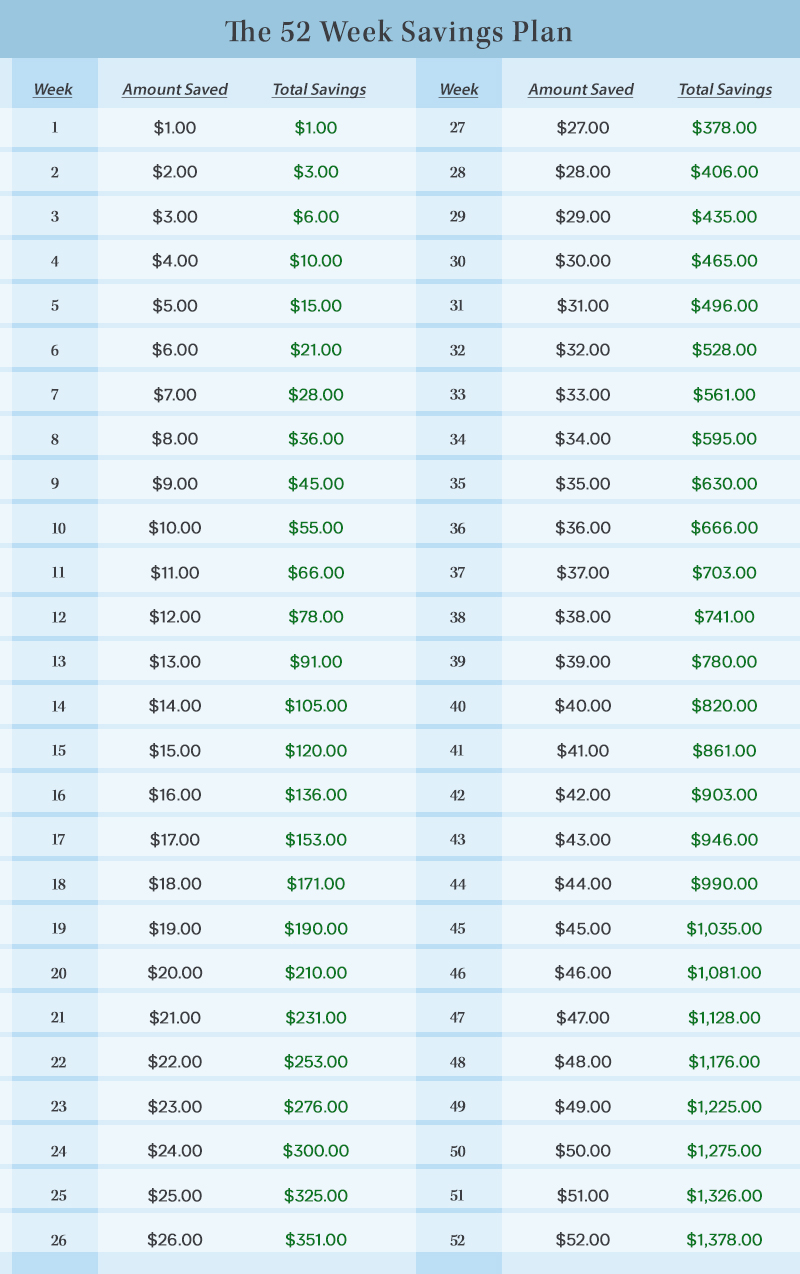

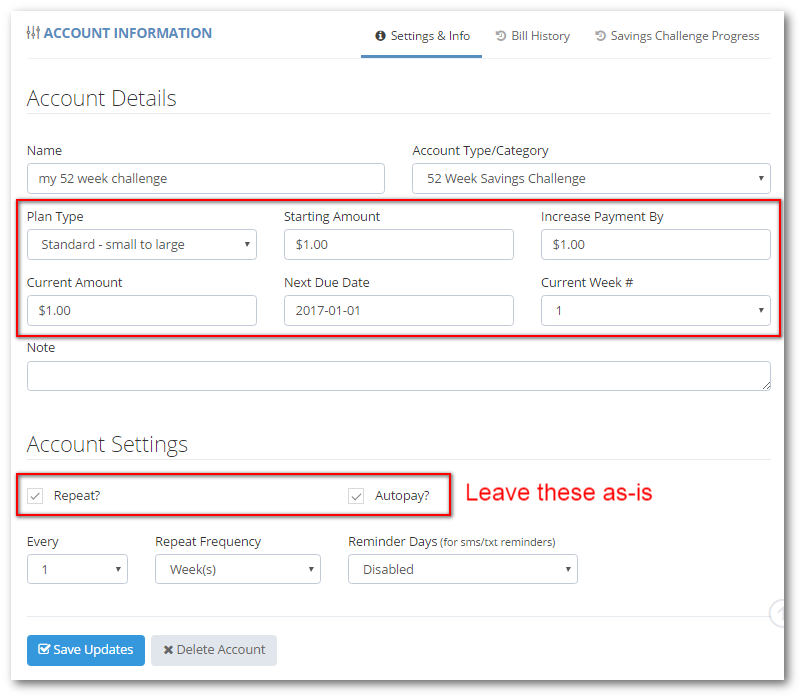

52 week saving challenge

This is a popular method that has been known for quite some time now. This challenge will allow you to save by putting away small amounts of money every week.

How It Works: This challenge was created with the intention that you save money every week for a whole year. When you start the challenge you will start by saving $1 the first week. The second week you’ll put away $2, and so on.

You’ll end up putting away $52 during the last week of the year. Once the year has completed, you’ll have $1,378.

Sound good right? In the table below you can see how you’d be saving weekly.

Here is a little of information about the challenge:

- You can select a plan type out of these:

- If you select Standard – You will save from small ($1) to large ($52).

- If you select Backwards – You will save from large ($52) to small ($1)

- If you select Fixed Amount – You will save an equal amount per week of $26.50, so there won’t be any changes to your weekly savings amount.

- Starting Amount: When you start with the Standard plan you will start with a $1 saving, but you have the ability to increase that amount.

- Increase Payment By: If you select to change this field, you will be altering the amount you save weekly. For example, when you start with a $1 saving, you will end up with a saving total of $1,378. But, if you decide to change it to $2, all of your savings will double on a weekly basis. So, by the end of the year you’ll end up with a savings total of $2,756.

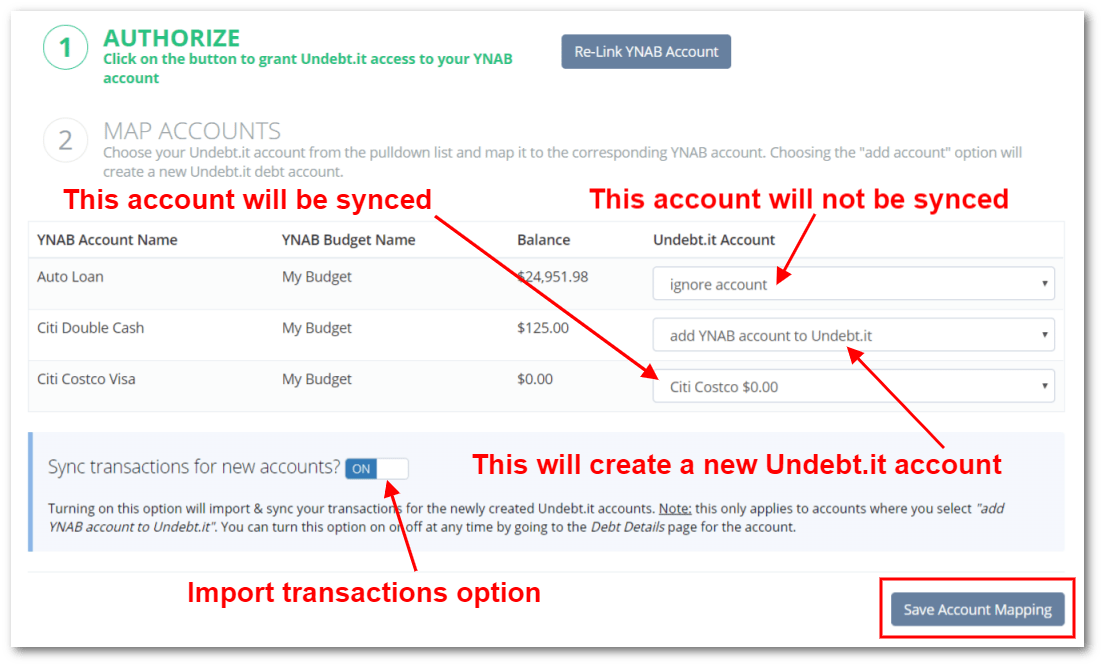

YNAB Account Integration

If you have a You Need a Budget (YNAB) account, you have the ability to sync your YNAB account with Undebt.it.

You can select specific accounts, or choose all of them, to sync and track through Undebt.it. Doing this will ensure that your account balances are always up to date.

Get The Guide

Undebt.it wants to you be able to navigate through this useful tool and feel comfortable doing so. So, they’ve created a 40 page Undebt.it user guide for your convenience.

It pretty much explains everything there is to know about the app, and where to find it.

It explains pretty much everything there is to know and where to find it.

They even have a demo account that you can log into and explore and see if this is the tool you are looking for.

Login Information

Username: [email protected]

Password: tryme

Undebt.It Premium vs Undebt.it

Illustrated below are the features that are available with the free version of Undebt.it vs Undebt.it+, their premium version.

Check out all these perks you get with Undebt.it+

To get started and see if Undebt.it works for you, the free version will work just fine. But, if you want to have other options and have access to more features, Undebt.it + might be the way to go.

Based on comparisons, Undebt.it has a lot to offer that other similar tools do not, including more debt payoff plans to choose from than any other app out there.

Try Undebt.it Today

You’ve got nothing to lose by giving Undebt.it a try.

Plus, you’ll probably get out of debt sooner than you were expecting.

So here you have it! All you need to know about the Undebt.it app and how it can help you.

Have you tried Undebt.it yet? Let us know in the comments!

Up Next: 15 Debt Payoff Planner Apps & Tools

No. I have not tried it.

I haven’t tried it either but it sounds very interesting.

This is very informative and helpful! I will have to try out the app now. Thanks!

No, I’ve not tried it.

I haven’t tried this either but very informative. Any tips is a start for me to debt freedom!

This looks good, but not for those who dont understand finances very well.

very good advice,illustration was excellence

Great article!

cool

looks like a ton of useful features that would help me get excited about paying off our debt and give us a clearer picture of where we stand

Very useful information for everyone to use, but especially those who are in debt.

interesting

Sounds like a great app.

This is a very useful review.

Very Useful and Informative.

Nice

Thank you for covering this it’s a very interesting article and some great insight into Undebt.it app. I’m going to try the free version to start and see how I like it and if it’s good for me. This seems like something I can work with.

Seems like a very useful tool. I’m gonna give it a try!

Nice

Seems like a decent tracker, might need to try it

This has definitely helped me! Never new about this undebt.it tool until now! Thanks!

This is explained in such easy-to-understand terms. I will be recommending this to some of my friends that are affected by the government furlough.

very helpful.

thanks for the advice

Looks like a great tools! Going to read more about it.

This looks useful because of its flexibility.

lots of detailed information

I love how apps keep people connected to their financial resolutions.

Wow! Wonderful tool.

Very interesting tool. I like the ideas outlined to aide in saving and paying down debt too. I think we might have to try it

DID NOT TRY IT- LOOKS A BIT TOO INVOLVED FOR THE TYPE OF PERSON WITH TOO MUCH DEBT…MAYBE A AMAZON ECHO INTERFACE WOULD MAKE IT EASIER TO USE…

Keep educating us!

Sounds like an amazing app! Making money decisions much easier and giving multiple options to choose from easily. Even helping with the budget and bill paying, all on our phone! I am definitely going to give it a try.

Sounds like a great app!

Sounds cool but there’s so much to absorb. If it were that simple, I wouldn’t be in the predicament that I’m in. Very informative though.

This sounds like a great program. Especially for those wanting to get out of debt!

sounds very interesting but i haven’t tried it yet. thanks for sharing

Interesting, informative & great review.

Wow, Now Thats an App.! This is something that works for you.

Great article! Very useful information.

This is great information! Haven’t heard about this app before. Definitely worth checking it out.

It’s informative but I will have to do more research. The app seems ideal but I need to know more.

Thanks for the information that you did provide.

Sounds like something to use once I start my new job

I like that it doesn’t link with your bank accounts. There’s more peace of mind when you don’t have to do that!

Thanks for the review. I’ll check it out. Def need guidance on money habits and management on paying off somethings.

This is a lot to digest!

I wish I would have known about this app last week. I spent a ridiculous amount of time working on my snowball on Excel! Lol

It looks interesting and comprehensive, although it looks a little involved as well. However, it could work if a person takes the time to read through and make notes.

I have not tried it, as I have other apps/websites that are working well for me. But, I appreciate the opportunity to see other tools available. I especially like the steps you show and pictures! Fantastic!

Nice detailed review! Thanks!!

This is a great review, I like the idea of the app and the + features, I wish it had more other budgeting and what if scenario options that you could play with.

This is my first time hearing about this app, I will look into it.

There is power in knowledge and boy is this a lot of knowledge!!

A well written description of the Undebt.it app. It includes everything you need to pay down your debt at a pace with which your most comfortable. Two-thumbs up!

This sounds like a great app! I think I will give it a try and see how much it can help me get my budget and savings back on track. This was a very informative blog post.

reviews like this helpa lot

Such a thorough review. Thanks for sharing!

A lot of information with answers.

I haven’t tried it. It sounds great for someone who has a lot of debt.

Great resource!

Great tool, sounds like it would be very helpful!

thanks so much for all the good tips

warm regards

Looks cool!

Great article! Very informative!

This is a great review. Wish I heard of this app sooner.

I have not tried this … thank you for all the info

Sounds useful having the reminders, I’ve been late on some payments here and there just because I’m sometimes too busy with work.

Very detailed review! Very informative!

Very useful

so many plans to choose from, it’s almost overwhelming. but definitely a handy app to have if you have debt and don’t know where to start in terms of paying it off

I haven’t tried it yet, but this post has me really intrigued. I’ll be trying it out very soon. It looks like it can work.

Thanks for the info.

When there are so much apps and tools to help you, reviews are great to get a understanding to fit your needs!

Looks interesting but i have not tried it yet.

Looks useful and practical.

Thanks for all the great info! Very helpful and informative!

wow! you guys are really making it boom

These reviews ARE helpful, but if they could be a bit shorter, that would help. Thanks!

Food for thought…

Wow! Great information. This review taught me a few things.

Interesting article! I had no idea this app even existed! Will be checking it out!

Very interesting app.

The app looks very useful, but I’m a bit concerned about the safety of the data…

Looks very useful. I am interested in trying this out.

This is a good app!