A debt payoff planner may very well be your best friend in helping you shed off those piles of debt.

If you’re not sure which one to pay off first, there are plenty of apps and tools available to keep your spending habits on track. Utilizing these will slowly help you inch closer towards financial freedom.

Below, we’ve developed a full review of 14 helpful apps and tools to get you out of debt as soon as possible.

Debt Payoff Planner: 15 Apps & Tools to Stay Debt-Free

Debt Payoff Planner Apps

1. Pay Off Debt

Pay Off Debt App by Jackie Beck has been around since 2009 and has been downloaded by over 51,000 app users, although it only has 11 reviews in the iPhone App store.

While you’ll pay $4.99 as a one-time download fee, as far as debt payoff planners go, it has everything you need to stay motivated, organized, and confident about paying down your debt.

It allows you to stay on track with your expenses by inputting each debt and connecting accounts from loans, credit cards, mortgages, and even not-so-official debts like IOU’s to friends or family.

Pay Off Debt shows you amortization tables and a summary of your debt as a whole, and lets you make your own notes.

It takes it all into account: interest rates, starting & current balances, your planned monthly payment, payment recorded dates, estimated time left, and even taxes & insurance (escrow) when adding a Mortgage/HELOC type debt.

Through all of that, it provides you with a customizable debt repayment plan that you choose based on your needs.

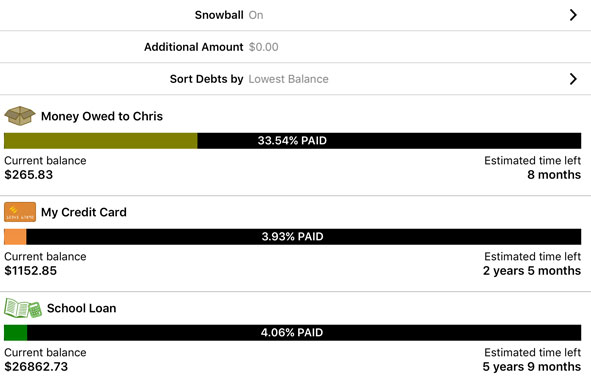

Check out this insider peak of the app. The user easily swipes between their organized debt list, to a detailed debt summary, and even turns on the “Snowball” effect which allows users to organize and pay down debts faster while saving them the most money on interest… pretty cool, huh?

Download: iPhone

2. ChangeEd

The concept of ChangeEd is pretty simple. It takes your leftover change from your bank account spendings and applies it to your student loans.

However, that’s the one kicker… it doesn’t work with other debt types- only student loans. But since 60% of millennials or their parents carry student loans, this should still be pretty useful if you’re in the market for a helpful debt payoff planner.

The best part of the ChangEd App is that it doesn’t require large payments, so there is no need to budget.

It first analyzes your natural spending habits straight from your bank accounts and gathers up “leftover” cents to make a full dollar amount. Then your leftover change gets transferred straight into its own FDIC-insured bank account. Lastly, once the new account hits $100, ChangEd makes an automatic extra payment towards your loan.

For example, let’s say you head to Starbucks and you buy a small coffee for $2.44. ChangEd would take an extra $0.55 to round up to $3 and transfer it into the FDIC-insured account. When the account has built up at least $100 in “leftover” change, bada-bing bada-boom, you just made an extra payment without even trying.

It’s pretty much the definition of a painless payment and you can download the app for just $1/month.

Download: Apple

3. Digit

Something worth mentioning right about now is an app called Digit. It’s ranked at #29 in the Finance category of the Apple Store and is sitting at a solid 4.8-star review with over 44.7k reviewers.

Digit works similar to ChangEd in the sense that it analyzes your spending habits, takes little cents here and there, and distributes them into an FDIC insured and 128-bit encryption secured bank account. Basically, “128-bit encryption secured” means that it’s pretty freakin’ safe (this is the same encryption level the U.S. military uses).

From there, you are free to distribute the funds into wherever you’d like, as often as you would like. So, if paying down debt is your main concern, it’s a painless way to start saving money to meet your debt goals.

(Want even more tools to help you understand, manage, and track your get out of debt progress? Pair your debt payoff planner with the Ultimate Get Out of Debt Checklist and be on your way out of debt in no time. Download the free Get Out of Debt Checklist to help kickstart your debt free journey, here.)

The beauty of Digit is that you don’t even have to think about it and you legitimately forget that you’re even saving money in the first place.

The amount transferred into your new Digit account each day will fluctuate depending on how much you spent that day which may throw some users off due to the uncertainty… but in the end, it analyzes your spending so it is never likely to take more than you can afford.

If that doesn’t calm your nerves, Digit makes it simple to transfer funds back into your bank account and also comes provided with overdraft protection and “low balance” alerts so you always know where you financially stand.

This may be a little suave for some users, but for the savvy at heart, it’s a painless way to save up for an unlimited amount of goals and pay down debt.

Digit can be purchased for $2.99/month coming out to $35.88 /year. The oxymoron of spending money to save money may thwart some users but for those who are serious about saving in little ways to make a big difference, it may be worth it.

4. Debt Payoff Assistant

For being a free app available in the Apple store, the Debt Payoff Assistant takes the “Best Free App Award” in my opinion.

It focuses on paying down debt the Dave Ramsey way with the all famous Debt Snowball strategy.

When using this type of strategy, you list out all of your debts by order of interest rate and pay down the lowest interest rate debt first, while paying the minimum payment on all other debts.

Once the lowest interest rate debt is paid off, you take what you were paying on the first debt and start piling it onto the second lowest interest rate debt payment.

And just like a snowball effect, once the second debt is paid off, you take what you were paying on the second debt, and start paying it to the third lowest rate.

It’s a killer strategy that gives you a sense of accomplishment and motivation that is often so difficult to find when paying down debt and makes paying down debt almost like a game.

While this app focuses on the Snowball Method, you are free to customize your own by multiple payoff strategies like:

- Lowest Balance First

- Highest Balance First

- Highest Interest First

- Custom Ordering

For being a free app, it comes with a number of debt calculators like Payoff Date Calculator, Mortgage Calculator, and Loan Calculator as well as amortization tables to show you how interest, principals and remaining balances are affected by your payments.

And finally, my favorite part is the charts, reports and percentage progress bar. These easily allow you to visually interpret how each payment is making a difference.

While it may seem small and ineffective at first, as you stick with the Debt Snowball method, it becomes very apparent how all your hard work has paid off. It’s very rewarding and motivating to see this represented visually in the graphs and especially the progress bar.

Download: Apple

5. Debt Manager

The Debt Manager app costs $0.99 and offers its users with a clean interface.

Like many of the other apps, its main focus is to get you out of debt the fastest and easiest way possible while emphasizing the Debt Snowball Method.

It also allows you to use interactive graphs and progress summaries for easy visualization of your debt breakdown like comparing debts side by side and seeing your total costs per month.

The biggest defining quality that The Debt Manager offers users is the “What If” feature. The “What If” feature is essentially a customizable calculator that allows you to play around with different interest rates, payment amounts and pay off dates which enables you to see total interest saved and how long it will take you to get out of debt.

This can be a useful tool for those who are able to pay extra variable payments whenever the opportunity arises.

Additionally, The Debt Manager offers users debt payoff hints and tricks from debt experts along their payoff journey. When it comes to smart debt payoff, expert advice is essential, so I found this to be not only motivating but also extremely helpful in building my self-confidence for paying off debt the right way.

Download: iPhone

6. Debt Control

Debt Control is a useful app when it comes to splitting debts with other people like roommates, friends, and even spouses.

Let’s say you and you’re 3 friends are planning a trip to Rome. Clearly, there will costs that the group will want to split such as room and board, dinners out, plane tickets, and excursions booked.

Debt Control makes it simple to cut costs across multiple parties and keep track of IOU’s to friends and family.

Debt Control has 3 main ways to view your debts:

- Who You Owe

- Who Owe’s You

- Total Expenses

As a free app, it takes the stress and confusion out of repaying debts to others and keeping track of debts owed to you.

With the Group Share feature, you are able to share your bills with other people who also have the app, which allows everyone in the group to easily keep track of everyone’s portion of the bill. Splitting bills made simple!

While I personally find the app more useful as a way to easily split group debts, Debt Control doesn’t stop at just bill splitting. One can appreciate the fact that you can also add in individual debts, like loans or credit card bills. This way you are able to efficiently keep track of all expenses across the board.

Download: Android

7. CreditWise From Capital One

If building credit is your main objective for getting out of debt, CreditWise from Capital One is one app that you will want to at least add to your arsenal of Get Out of Debt planners.

While its main function is to provide you with a breakdown of your TransUnion credit score, accounts, and inquires, it also provides you with hints, tips, and action plans for building credit and dealing with debt.

If you need to understand how your debt affects your score and what is keeping your score lower than you may want, CreditWise can provide you with exactly what may be holding you back and ways to improve.

For example, want to know how much your score could change if you pay off half your credit card debt or all your debt?

CreditWise has what they call a Credit Simulator which will fluctuate your TransUnion score based on the debt pay off decisions you make. So if your goal was to pay your debt off in order to build credit for a new car or a new home, CreditWise is just as handy as any other debt payoff planner!

One of the best parts? It’s totally free and you don’t need to be a Capital One client to download it… the app is available to anyone and everyone.

8. EveryDollar

EveryDollar is another app that doesn’t only help users with debt management and control, but a ton of other useful money management tricks.

All-in-all, EveryDollar is a budgeting app to its core, so it will also help you manage your hard earned money and all other sorts of incomes and expenses. Like CreditWise, it’s another app that you will want to add to your arsenal in order to get out of debt the quick, easy, and painless way.

Created by the Dave Ramsey brand, its purpose is to serve you with a personal budgeting partner while providing you a simple way to manage your money with a zero-based budgeting approach.

With zero-based budgeting, you want to make sure that every dollar of income you have is accounted for and serves a specific purpose. Whether that dollar be used for paying rent or mortgage, making a student loan payment, paying down a credit card bill, investing it, spending it at the grocery store, or going out to dinner with a friend, you need to know how every dollar (given the name of the app) is being utilized.

This is why EveryDollar makes it simple to create a fully customizable budget in less than 10 minutes and then allows you to sync and split spending habits while tracking every dollar down to the cent.

This makes it super simple to see where extra money may be laying around to pay down debt.

EveryDollar is free for all Android and iPhone users, but are given a free 15-day free trial to the upgraded version, EveryDollar Plus. After the trial is over with, users will then need to pay $99 per year to have access to these exclusive features of the app:

- Connect app to your bank to import transactions to quickly track spending

- Manage money and check account balances for connected financial accounts

- Request a phone call to speak with our amazing support team

(Want even more tools to help you understand, manage, and track your get out of debt progress? Pair your debt payoff planner with the Ultimate Get Out of Debt Checklist and be on your way out of debt in no time. Download the free Get Out of Debt Checklist to help kickstart your debt free journey, here.)

9. Debt Payoff Planner + Calculator

Debt Payoff Planner + Calculator is great for focusing on the two major and most popular strategies for tackling down your debt: The Debt Snowball, which focuses on taking down debt by the smallest balances first, and Debt Avalanche which focuses on taking down the highest interest rates first.

The app also gives you the option to create your own custom plans if you’d rather come up with your own payoff strategy or have specific debt types that you’d like to pay down first.

Getting started is extremely easy in that there is no login required and it’s totally free to start using. All you need to do is download it in the app store of your iPhone or Android and get down to business by completing these 4 steps:

Steps You Need to Take:

- Enter your loans and debts

- Enter any additional monthly payments you can make

- Choose a debt payoff strategy

- Get your custom free payoff plan

While the free version is great for most purposes like tracking payment dates, accessing graphical views of your payoff timeline, and using the Debt Calculator to determine the optimum payment plan and see how long it will take you to pay a debt off, there is also a Pro Version you can upgrade to if you wish.

Debt Payoff Planner Tools

10. Debt Calculator

Debt Calculator is a free and simple tool to help give you a clear, bird’s eye view of when you can expect to get out of debt.

It is a free calculator offered by CNN which allows you to punch in your debt types, principal amount, interest rate, and monthly payment. Simply hit submit, and out comes an expected get out of debt date along with the projected interest you will pay.

But unfortunately, it’s simply a calculator and nothing else. It won’t organize your debts, or give you helpful tips for getting out of debt, but it’s a good tool to use for a foundational understanding of where you lie with your debt.

It’s very easy to switch around payment amounts as you pick repayment strategies and see where you will stand with each one.

11. Unbury.me

Unbury.me is also a Debt Calculator that will help you visualize all of your debts across one platform as you list them out. Similar to the CNN calculator above, all you need to do is enter in each debt amount, the interest rate, and monthly payment and it will give you a projected pay off date along with estimated interest paid.

One of its best features is the different strategies it can come up with for repaying your debt. As you choose a repayment plan and slide the payment slider to greater or lesser amounts, you can see the graphs will reflect your choices.

This makes it extremely easy for users to see if using the Debt Avalanche Method (highest interest rate first) or the Debt Snowball Method (lowest principal first) will benefit them more. For a free online tool, I’d say it definitely falls into the “This is pretty useful” category!

Users don’t need a login to use it, however, I highly recommend creating an account. Especially if you have multiple debt types with varying interest rates, creating an account will allow you to come back and see your payment progress without having to re-enter all your loan information.

Save yourself some time and money, and use this free tool!

12. Undebt.it

I’d go as far to (un)officially announce that Undebt.it may be the best free tool out there for those looking to get out of debt and manage their accounts and expenses in one centralized platform.

At a glance, Undebt.it is a debt calculator that creates easy and customizable repayment plans to use to pay down your debt in an organized manner. But once you get into it, Undebt.it presents users with tons of other useful features like Credit Utilization charts, Payment and Transaction History, progress bars and in-depth pay off projections and so much more…

For the kick-it-in-to-high-gear users who really want to take down their debt in an organized and easy manner, they can upgrade their free account to Undebt.it Plus for $12/year.

Upgrading will unlock another 17 features that the app has rolled out for users like amortization charts so you can see how you are being affected by interest rates, account autopay’s which allows you to make payments without even thinking about it, text message reminders, a support team, and even Debt Snapshots which help keep you motivated and on pace to pay down your debt.

If you’re unsure about creating an account, Undebt.it has created a demo account for anyone who is interested to use so they can test drive the tool without the commitment or without even handing over your email address.

Additionally, all users will be given a free 30-day trial to try out the Undebt.it Plus version without the hassle or commitment of entering in your credit card information making it essentially risk-free.

If there is one software that wants to see you get out of debt without charging you an arm and a leg to get you there, it is Undebt.it.

13. Mint.com Financial Goals

This tool comes for free when you have a Mint.com account. It also has features such as setting up of financial goals which you can integrate easily with your finances every month.

You can also review a repayment plan after filling in all your loan or credit card account linked to a certain financial goal.

14. Debt Eliminator

This is also another debt payoff planner tool offered for free. Made by financial guru Suze Orman, this tool will not save any details you entered into the calculator.

However, it also offers its users a customized full debt payoff plan.

Having these debt payoff planner tools and apps can help increase your motivation in paying your debts fast. You’re also sure to come up with strategies suitable for your needs with the help of these apps and tools.

You may also use the mobile apps offered by your lenders or a debt servicer to help you monitor your payments. Each of them may have varying setups and functions.

However, having more options will also make it easier for you to select one that fits your preferences.

(Want even more tools to help you understand, manage, and track your get out of debt progress? Pair your debt payoff planner with the Ultimate Get Out of Debt Checklist and be on your way out of debt in no time. Download the free Get Out of Debt Checklist to help kickstart your debt free journey, here.)

15. YNAB

YNAB (youneedabugdet.com) allows users the ability to synch all their bank accounts in one place and track purchases. At first glance it appears to be very similar to Mint.com

YNAB has a very specific strategy designed around 3 rules they believe are very important.

Rule #1 – Give every dollar a job –

Every dollar should be allocated to a certain purpose

Rule #2 – Embrace your true expenses –

Reduce stress by allocating the proper amount of money to all your expenses.

Rule #3 – Remain Flexible –

Anticipate and adjust for unforeseen expenses or overspending in some months and save appropriately to stay within your long term goals.

When comparing YNAB vs Mint, Mint appears as more of a report card than a useable tool. Mint is significantly more popular, but YNAB’s budgeting component truly helps you understand and make better budgeting decisions.

These 15 debt payoff planner tools can help you payoff debt, stay within budget, and focus on your long term goals.

Used any of these?

Tell us what you think in the comments below

Which among the debt payoff planner apps and tools do you prefer? Please share your choices in the comments section below.

haven’t used any. no room on my phone

I have tried Mint. It was really great but I didn’t know what to do with it at the time. I will try it out again!

I’ve used Every Dollar and Mint before, though not actively using anything right now. We do budget through the Dave Ramsey plan, though.

Debt Calculator

I’ve never used any of these apps, but I’m very interested in trying one. I am most interested in the Debt Payoff Assistant. Thanks for the info about these apps!

I’ve just started trying mint!

That’s great! Mint is awesome for putting everything in one place, organizing your assets, and keeping track of paying down debt!

cool

I’ve never used any of these apps before, I’ll have to look through and see which one works best for me.

I didn’t realize there were so many helpful apps out there. Fantastic ideas!

Ive used the Debt Calculator before and I am currently downloading the debt payoff planner 5o use.

I have not used any of the apps yet. But after reading this I believe I might try a couple. I really do like the way ChangED works and it looks like a really great tool for students.

I’ve used Mint before. wasn’t too bad.

no i don’t use any of these apps, i don’t like paying for any apps

I WILL HAVE TO DO MORE RESEARCH BUT i LIKE WHAT i AM SEEING

I typically stay away from such apps, but some of them look useful.

I’ve actually never used any of these apps! It’s great that they are available though!

I use Mint.com

I haven’t used any of these but since reading this I think I would like to try a few of them.

I have downloaded Every Dollar but I had a problem with my phone being to full and had to delete it. Will retry as I definitely need it!

I haven’t used them because I was unaware of them, but they look like a great resource I’ll check out.

CreditWise From Capital One is super helpful. We also have a Capital One card.

Debt Calculator is a good tool!

I am interested in Debt Eliminator and I plan on installing it soon.

debt calculator is a really cool tool and helps me think through my debts and the cost

I use creditwise to help me keep an eye on things

I’ve never used any of these apps as I don’t own a cell phone.

good information i will check these out!

I have not used any of these apps

i don’t use a cell phone, but these look like some viable ways to help cut debt

Debt calculator is good

I haven’t used any of these apps. I am intrigued by Digit and would be interested in using Digit if it was free.

I’ve used CreditWise and other similar credit monitoring sites for a while. Credit Karma and Credit Sesame are good. Nerd Wallet also offers tons of help. Debt Calculator certainly helps too. Will have to check out these other ones for better management!

I haven’t ever used any of these apps nor have I ever thought to look for debt management and pay off apps! Now I want to use them all!

These tools all look very useful! How interesting! Fingers crossed for the win!

That debt calculator is a very instrumental tool! I just showed it to my wife and she is working with it. Thank you!

I have used Mint (LOVE! But my current credit union isn’t supported by MINT). I have also used EveryDollar. Again, I love the app, but it doesn’t work for those of us who budget by paycheck, not monthly.

I have not tried any of these but some of them sound interesting like Debt Control and unbury.me. I’m going to have to check them out. Thanks!!

I have CreditWise from Capital One and like that I can keep an eye on my credit. I also just downloaded Debt Payoff Assistant to see how that goes I heard Dave Ramsey has some good courses and am going to give this a try, I was keeping track on paper but I think this will be easier than me constantly losing the paper.

Interesting, this is one of many articles about apps

Thanks!

I have tried Mint.com

I use Mint, but for my debt payoff I like to use Acorns. They roundup all your purchases to the next dollar and set that money aside for savings or debt payoff. Super easy to use. If you want to try it out use my link for a bonus!

https://www.acorns.com/invite/CTVUQA

I have never heard of these apps until now, but the undeb.it tool has definitely caught my interest. Thanks for the good read and advice!

Would love to try these apps.

Only have one debt, back child support, Just started working & I plan on taking as much down as I can and pay it off in a year or less if possible.

I’ve never used any of these, but I plan to use Undebt.it. this year.

I like using Digit and Creditwise – would like to get on board with Everydollar because I’ve heard such good things about it.

I honestly have never used a debt payoff planner app before because I figured it wouldn’t be all the helpful however I’m now seeing advantages to it. I think I’ll download one and give it a try.

Lots of helpful info!

ive used creditwise, my problem however is with one credit card that royally screwed me over.. lured me in with an 18 month interest free account, but neglected to tell me anything not paid off after the 18 months wouldnt just go on my card to be paid later.. it would be due all at once.. leaving me with a $287 bill that being on a limited income (disability) i couldnt come up with.. now its ruining my decent credit, because i cant pay it off… but they reached out to me and offered me a deal.. i could pay off only a portion of what i owe.. 1000+ instead of 2,000 plus.. which sounded great.. until i read in 3 equal payments.. like i have an extra 300 lying around at the end of paying off all my important bills like car loan, and rent…. i went from having a 680 credit to a 530 credit score.. and cant even use my credit union to help me purchase a first home because they want a minimum 620 score..

Great tools to have to help you realize and pay off your debt.

I love the Mint app for financial planning. So helpful!

My first time hearing about any of these. Will have to look into them, they seem as if they can be very useful and helpful. Thanks

I have never used any of these. Thanks for the info.

I use digit, very helpful because it’s an account I don’t see daily so it helps me be able to save for trips.

I have been using Creditwise from CapitalOne’s plan for a while now. It’s pretty good and tells me neat things about the credit and such. Such as people looking at my credit scores, or if there’s suspicious activity ongoing, and at what dates and what sites involved.

This was super helpful and you must find one that works for your time and budget and goals!

Some of these don’t apply to me, but I might try #1

I just downloaded Every Dollar the other day and am starting to work my way into it.

Thanks for the info!

I’ve used Mint and just started CreditWise recently. We’ll see how I like it.

There’s plenty of debt resources at the touch of your palm today!

I found some of these to be worth checking out but have not used them begore

Haven’t tried any of these yet, but looking to download a few to get started, this is a great review to help me choose which ones I should try!

Never used any of these they are interesting.. but i cannot use any on my gov’t phone. I use a laptop. so will for sure check some out

I’ve heard of Every Dollar but have only used Mint. I love Mint because it just makes you more aware of how you’re spending your money and aside from some small category corrections you might have to make, it’s pretty autonomous and tracks very accurately.

I havent tried any of these but I might because I need some help focussing on paying off my debt.

I’ve used CreditWise as it comes with my Capital One credit card. I didn’t know about these other sites and apps, however. Thanks so much – this is a valuable resource.

If I had room on my phone, I would use one or two of these.

I use Digit and it’s fantastic, easily saved up a nice little savings fund from literally pennies being saved each day.

I have tried Mint. It’s great in theory, but could use some work in practice. Every few weeks ago, a different one of my accounts would have an issue connecting and I was usually unable to get that account to reconnect.

I did not use any of these apps yet.

never used any but I will check them out thank you warm regards

These are all nice tools. I use Creditwise.

I haven’t tried any of these but that is changing now!!!

I haven’t used none but I have heard about a few like Mint and Credwise

i haven’t used any of these, let a lone heard of them. thanks for the run down

Haven’t used any yet…

I’ve never used a payoff planner, but frankly, I didn’t know they existed until I read this article! This is definitely something for me to investigate further!

I have used Payoff Debt and I really like it.

I have not used any yet but looking into it.

I just got Debt Payoff Assistant because it looks like it will work best for me. We will find out.

I use Mint and Creditwise. Great stuff for free!

Debt payoff and calculator sounds interesting, I didn’t know about any of these

Digit is amazing!

I’ve used Mint,its pretty good

I’ve used mint, but nothing has really helped me.

A lot has changed since Consumer Credit Counseling…Thanks for the summary!

I really like YNAB. I don’t like Digit. Probably because when I used it, it was free. I don’t like that they started charging for it.

I have used debt calculater a few times.

I have not used a y of these apps.

I have not used these. I don’t make enough to change what I’m doing.

I have not used any, I make my own budgets

I’ve used Mint but they didnt really explain anything very well on the app.

Interesting, maybe I should use one of these!

Not familiar with any except debt calculator

Although I don’t currently use any of these apps I am really interested in Debt Calculator

I have never used any of these! Need to try these!

i’ve used mint.com for at least 10 years now!!!! Love it. I’ve also used digit in the past and just started using every dollar thanks to Dave Ramsey

I have used digit and it’s pretty good, though I don’t use it often.

I havent used any of these applications, but I think this is a great list of potential tools to help get out of debt. It is refreshing to see a website that is focused on providing long term debt solutions, instead of quick fixes.

I will be installing some of these apps soon!

I have Digit and its amazing!!

I have tried Mint & Digit in the past. Though never re-downloaded them when I got a new phone.

I tried YNAB on a trial basis, but never downloaded it! I probably should!

I used Pay Off Debt and it’s easy to use and helps a lot.

great info!