Are you tired of manually tracking your finances month after month?

Then it’s time to start thinking about using an app that will do it all for you. But with so many options out there, it can be confusing figuring out where to start.

We’re going to explore two of the top financial apps, Everydollar vs Mint.

We’ll give you the details and insights you need to make a decision on the app that will work best for you and your personal situation.

We’re going to cover:

- What Is EveryDollar?

- How EveryDollar Works

- What Does EveryDollar Offer?

- Pros and Cons of Everydollar

- What Is Mint?

- How Mint Works

- What Does Mint Offer?

- Pros and Cons of Mint

- Which Is Better: Everydollar vs Mint

EveryDollar

What Is EveryDollar?

EveryDollar is a budgeting app created by Dave Ramsey to help users make the budgeting process easier.

The software aims to give every dollar a purpose, hence the name. By knowing where every dollar is going, you’ll have complete control over your finances.

The software follows ‘Dave Ramsey’s Baby Steps Journey’ and will keep you updated on where you’re at in the journey.

It’ll walk you through how to:

- Save $1,000 emergency fund.

- Pay off all debt using the snowball method

- Save 3–6 months of expenses

- Save 15% for retirement

- Start a college fund for the kids

- Pay off the house

- Build wealth and give

Currently, the software is available for residents of the U.S. and Canada.

How EveryDollar Works

When you start with EveryDollar you will need to create an account, and enter the following information:

- Name

- Email address

- Password

- Country

- State

- Zip code

Once this is completed, you will receive an email of confirmation. This indicates that you are ready to create your budget!

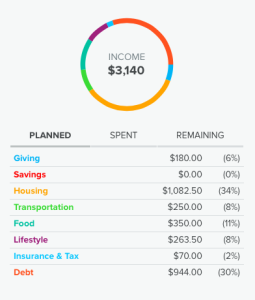

EveryDollar has 8 different spending categories that you can select from when creating your budget. It also has the ability to create custom categories of your choice.

Once you have selected the categories you are going to use, right next to it, you can place the amount you wish in the planned field. This will be the amount you are projecting to spend in that category.

Next to the planned category, you’ll find the remaining category. This will track how much you’ve actually spent in each category, compared to how much you anticipated you’d spend.

It’ll look like this:

The software has two different versions to choose from: Free or Paid with EveryDollar Plus.

Free Version: If you choose to use the free version of Everydollar, you’ll need to manually update your accounts. Once you do this, the software will help keep you organized and illustrate your spending habits. It will also let you know if you are on or off track by providing graphs and charts to illustrate.

Paid Version: The paid version, called EveryDollar Plus, will automatically sync with your bank accounts and update your information for you. So, you will not have to worry about doing it manually like you do with the free version.

If you want to test the paid version, they offer a 15 day free trial. If you choose to stay with it, they will charge you a $99 annual fee.

What Does EveryDollar Offer?

With EveryDollar, you can:

- Create monthly budgets – With this you will be able to create a monthly budget where every dollar has a purpose.

- Add and split transactions – You can divide a transaction between categories. So splitting the charges on a receipt is no problem.

- Track your spending habits – You’ll have the ability to track your spending habits and be able to determine if you need to make adjustments.

- Track Dave’s Baby Steps – The software will allow you track the seven baby steps that Dave Ramsey suggests we follow to beat debt and build wealth.

- Connects you with local experts – Providing help by helping you discover hidden money in your budget.

- Make funds available to meet your savings goals – This software will help you accomplish this by keeping track of everything you’ve saved for a specific goal, and what is still needed to accomplish it. So you’ll know when you’ll be able to:

- Purchase a big ticket item

- Go on vacation

- Put a down payment on a house

- Repair your car

Manage your #finances better with these 15 apps & tools that will help you stay debt-free. https://t.co/IcdoefmrX5#money #debt #loan #moneymatters #moneymoves pic.twitter.com/b4QX3IIeAw

— Get Out of Debt (@getoutofdebtcom) May 3, 2018

Pros and Cons of Everydollar

Like everything in life, this app also has pros and cons. To make sure you have all the information you need to make your choice, we have listed all of the pros and cons for Everydollar.

Pros

- Very easy and simple to set up

- Keeps track of your progress and tracks where you are at in Dave Ramsey’s Baby Steps Journey

- Offers a free basic version that will allow you to stay on track with your budget.

- Offers a paid version that will make it easy for you to keep your accounts updated.

- Allows you to connect with local experts to get financial help.

Cons

-

- The free version requires you to manually enter all of your accounts and transaction.

- Free version will not allow you to sync with your banks or credit card companies.

Mint

What Is Mint?

Mint.com is a web based personal finance program that is completely free. It only takes a matter of seconds to open an account, and it has the ability to download and link your financial data quickly.

Every time you log into the site, it’ll automatically update all of your financial data. The web interface is easy to use and there are graphs to help illustrate and understand all of your financial data.

With over 15 million users, Mint is a very helpful tool to create a budget and to be able to view all of your accounts in one place.

How Mint Works

Mint is a free software that doesn’t have any hidden fees attached to it. Instead, Mint works by identifying your financial needs and providing suggestions to help you tackle them. Every time Mint offers a recommendation and you apply, they will get a referral fee for it.

There is the option for premium access which gives you the ability to access your credit report and score.

To start using Mint, register on mint.com or through their app by providing the following information:

- Name

- Email address

- Password

- Country

- State

- Zip code

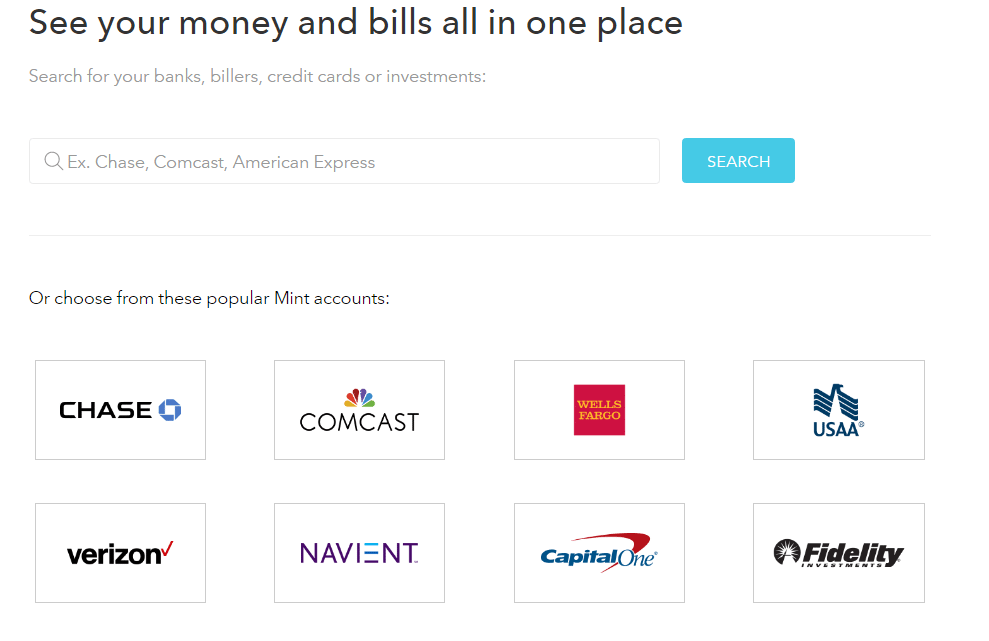

Once this is completed you will be prompted to sync all of your accounts, like:

- Checking accounts

- Savings Accounts

- Credit Cards

- Loans

- Retirement

- PayPal

- Mortgage

- And any others

Mint makes it easy because all you need to do is search from a drop-down list that is already provided for you.

It’ll look a little like this:

Your information on Mint is protected with the same security features that your bank offers.

Once all of your information is synced, Mint will start providing an overview of your finances. From this point, you’ll want to start developing a budget. Mint will offer you suggestions based on your finances, but you can increase or decrease the budget at any time.

Once you have been using Mint for a few months, you will have the ability to analyze your spending trends and verify where you can improve.

Mint gives you the ability to divide your purchases into multiple categories, allowing you to have a better knowledge of your spending habits. This is a great feature since it will help you determine where you need to make adjustments.

What Does Mint Offer?

With Mint, you can:

-

- All in one– With this feature you will be able to see all of your balances, bills, and credit score all in one place.

- Track bills – You’ll be able to organize all of your bills and be on top of them. You’ll receive reminders to make sure you don’t forget to make your payments on time.

- They offer:

- Bill Reminders

- Bills Due Alerts

- Low Funds Alert

- Unusual Spending Alert

- Rate changes

- Large purchases

- They offer:

- Easy budgeting – They will help you create a budget that will be easier to stick to by identifying your spending patterns. They offer charts and graphs that will illustrate the information for you, showing your your spending on a month to month basis as well as a year to year basis. You’ll be able to make any adjustments to the suggested budget at any time.

- Free credit score – They will provide your credit score at no cost. By having access to your credit score, you are open to many options that could save you a lot of money. They will help you learn how your credit score works and how to make it better. This feature will also provide alerts whenever there is a change with your credit score.

- Alerts and advice – They will be on top of providing you will all the important information you’ll need to avoid having any financial issue.

- They’ll provide alerts when:

- You’re being charged a fee

- You’re going over budget

- Any unusual or suspicious activity is seen

- When your payments are due

- They’ll provide alerts when:

- Simple categorization – As Mint evaluates your spending, they will categorize it to make it easier for you to track. You can rename it or re-categorize your transactions at any time. If you make any changes they will apply this change to the same future charges.

- Investment tracking – They offer you advice and tips when it comes to investing. They want to make sure that this fundamental piece of your financial life is well taken care of. They’ll also let you know when you are paying unnecessary fees, which will open more opportunities for savings.

- They will help you compare your portfolio to:

- The Market

- Benchmarks

- They also show you all of your investment account like:

- 401K

- Brokerage accounts

- IRA’s

- Mutual Funds

- They will help you compare your portfolio to:

- Security – They are constantly improving their security measures. They come from the makers of Quickbooks and TurboTax, which are trusted companies due to the sensitive data they store and work with. They also work with a multi factor authentication process to make sure that your information is safe and that you are the only one accessing this information.

Establishing a budget and sticking to it isn’t easy, but it’s the best way to be in control of your finances! 💪

If you want to save yourself the time, download our simple budget template. https://t.co/1ZEMviS5o7#budget #FridayFeeling pic.twitter.com/xSlDlGRbkI

— Get Out of Debt (@getoutofdebtcom) November 30, 2018

Pros and Cons of Mint

As with anything, there is good and bad. We are going to discuss them with you here.

Pros

- Free of cost software

- Free credit score tracking

- Has a very quick set up process

- Excellent way to set financial goals and achieve them

- Easy to use program

- Great report showing your spending history

Cons

- Will not be able to create a zero based budget

- Has had synchronization issues in the past based on reviews. Clients state that account information will now sync appropriately with software.

- Can no longer pay your bills through the app or program, as this was recently cancelled by Mint.com

Which Is Better: Everydollar vs Mint

If you have the time to manually input your financial information on a monthly basis in order to keep track of your spending, you can do this for free with EveryDollar.

But if you want to take the easier route of having the software do it all for you, you have two options:

Option 1: Pay a $99 fee for EveryDollar Plus

Option 2: Go with Mint.com for free

EveryDollar is a relatively new app compared to Mint, who has had time to make adjustments to their platform.

When it comes down to security, your information is safe with either one.

At the end of the day, EveryDollar and Mint both provide multiple ways for you to create and manage your budget wisely. Plus, they’re both loaded with great features and benefits.

So, the decision really comes down to your personal preference.

The upside is that there’s nothing wrong with trying them both out, and seeing which one better suits your needs.

Which software do you prefer, EveryDollar or Mint? Let us know in the comments!

Up Next: 15 Debt Payoff Planner Apps & Tools

I have used Mint for over a year, and I love it. It is so easy to use. It is so helpful to be able to monitor all of your accounts in one place.

Great, very helpful, didn’t know about every dollar

Nice review. They both seem to have some good positives. I think that I would like Mint better.

Interesting, thanks for sharing

Excellent, thank you!

Could not be .ore informed now

I love all the information and pros and cons provided. This was really helpful.

these are very interesting ideas! thank you

I prefer EveryDollar

A very good review! Mint.com sounds like something I might try.

I’m glad you covered the fees.

Haven’t used it yet but do know folks who have & say its pretty good.

I’ve tried Every Dollar but not Mint. I’m glad I found this article! It’s helpful in determining how to compare the options they offer.

Great article!

Sounds like trying out the free version of EveryDollar is a good way to decide if it’s worth $99 / year to you.

Very informative. I could see using one of these apps.

Very Helpful!

Super helpful! Thank you so much!

I used Mint like once but then deleted the app. I might start using it again

I use Mint but I find it pretty lacking on mobile devices. I need something better. I’ll look into everydollar.

Very helpful

I’ve heard of these apps and they’re great. Thanks for the review it’s very informative and detailed.

I’ve heard of Mint before but never used it. Now after reading this I think I’ll give it a try!

Been using mint for years will never try anything other then mint

This site is extremely informative and helpful!

Interesting read! Very well written!

It’s nice to know there’s another option available besides Mint. I’ll have to look into Everydollar in more detail in the near future.

I generally just make a budget

I am going to try this! Amazing idea! In need of it bad

Super helpful information & easy to understand comparisons of the different tools! Both seem very helpful & easy to use.

Really helpful information. extremely informative and very great tips that I need to follow.

Helpful review! It sounds either the free version of EveryDollar or Mint is for me!

Very useful information.

They both sound good, but intrusive with respect to your bank, savings and investment accounts being online without any mention of security.

Great Information

Very informative.

Great article, will try it

all this info is very helpful!

This is such a helpful article. I love that all of the information is laid out so plainly.