If you’re a big Nordstrom shopper, chances are that you’ve probably considered applying for their credit card before.

And why wouldn’t you? What sounds better than earning rewards for the purchases you’d already be making at your favorite department store.

But, have you taken the time to really look into The Nordstrom Credit Card?

We’ll take you through in the in and outs of The Nordstrom Credit Card so you’ll be able to decide if it’s right choice for you.

We’ll cover:

- What is The Nordstrom Credit Card?

- Do You Qualify For A Nordstrom Credit Card?

- The Nordstrom Cards Comparison

- The Nordstrom Card Levels

- Features and Benefits of The Nordstrom Card

- Rewards Redemption Pros and Cons

What is The Nordstrom Credit Card?

Nordstrom is an American department store that operates in the United States, as well as Canada and Puerto Rico.

It’s a full service department store, where you’ll find women, men, children’s clothing, shoes, handbags, accessories and jewelry.

Additionally, they have a full service home section. Here you’ll be able to find bedding, furniture, bath products, holiday decor, and much more.

Basically, if you’re looking for it, Nordstrom will have it.

And that includes their own credit card.

The Nordstrom Credit Card comes with access to special sales and discounts, as well as free alterations and even a welcome bonus.

This card can be used at Nordstrom, its family stores, and anywhere Visa is accepted. The Nordstrom family of stores includes Nordstrom Rack, HauteLook, and TrunkClub.

The best part is that you’ll be earning rewards on every purchase you make.

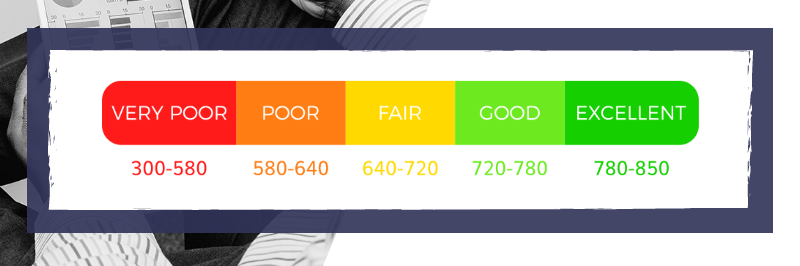

Do You Qualify For A Nordstrom Credit Card?

In order to qualify for The Nordstrom Credit Card, your credit must be in excellent standing.

The card is subject to approval, and this decision will be made based on your creditworthiness.

There’s also certain restrictions when it comes to age.

Age Restrictions:

- 18 years or older to apply

- 19 years or older if you live in Alabama and Nebraska

- 21 years or older if you live in Mississippi and Puerto Rico

The Nordstrom Cards Comparison

Nordstrom offers 2 different credit cards:

The Nordstrom Credit Card Quick Stats

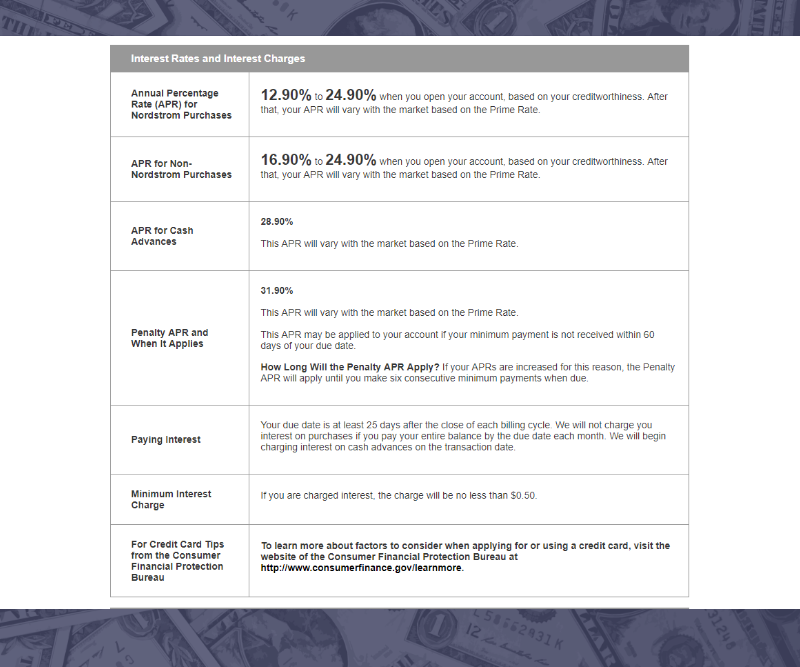

- APR for Nordstrom Purchases: 12.65 – 24.65%

- APR for Non-Nordstrom Purchases: 16.65 – 24.65%

- APR for Cash Advances: 28.66%

- Cash Advance Fee: Either $10 or 5% of the amount of each cash advance, whichever is higher.

- No Annual Fee

The Nordstrom Credit Card Bonus Features

- Earn 2x Points per Dollar online & in store at Nordstrom, Nordstrom Rack, HauteLook, and Trunk Club.

- Earn 1x Point per Dollar anywhere that Visa is accepted.

You can check out all of the terms and conditions inside the Schumer Box. You’ll be able to find the Schumer Box on any credit card agreement.

We’ve included it for you here for easy access:

The rewards you’ll get with each of the cards will be the same.

However, The Nordstrom Visa Signature Card also comes with $500,000 travel insurance, roadside assistance and extended warranties (of up to one additional year).

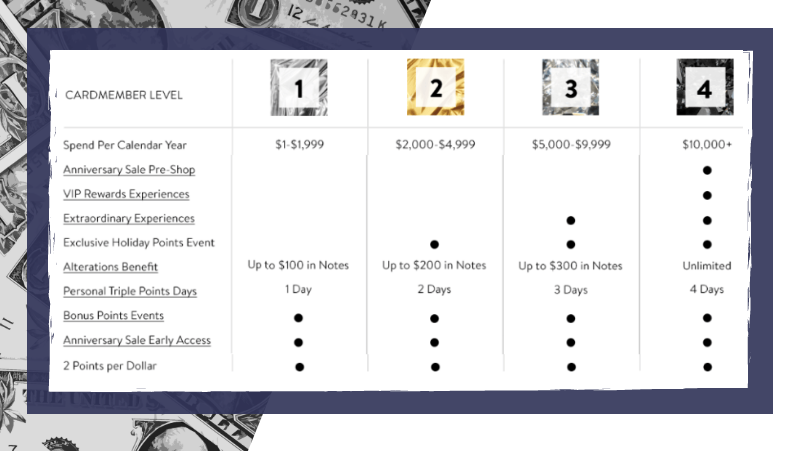

Based on your spending level, Nordstrom will place you in a level of their program. There are 4 different levels and each one has its own benefits associated with it.

Take your credit score from 😒 to 💪. Check out our list of 7 best credit cards for those with #NoCredit! https://t.co/24TpZ465ad#MondayMotivation #MondayMorning #financialeducation pic.twitter.com/4Nzo6Iej30

— Get Out of Debt (@getoutofdebtcom) October 1, 2018

The Nordstrom Card Levels

Level One

Spending a minimum of $1,999 per calendar year places you in level one.

You’ll be eligible for these rewards:

- Personal Triple Points Day

- Alteration Notes (Up to $100 total)

- Anniversary Sale Early Access

- Bonus Points Events

- Nordstrom Notes

Level Two

Spending $2,000 to $4,999 per calendar year places you in level two.

You’ll be eligible for these rewards:

- 2 Personal Triple Points Days

- Alteration Notes (Up to $200 Total)

- Exclusive Holiday Points Event

- Anniversary Sale Early Access

- Bonus Points Events

- Nordstrom Notes

Level Three

Spending $5,000 to $9,999 per calendar year places you in level three.

You’ll be eligible for these rewards:

- 3 Personal Triple Points Days

- Alteration Notes (Up to $300 Total)

- Extraordinary Experiences

- Exclusive Holiday Points Event

- Anniversary Sale Early Access

- Bonus Points Events

- Nordstrom Notes

Level Four

Spending $10,000 or more per calendar year places you in level four.

You’ll be eligible for these rewards:

- 4 Personal Triple Points Days

- Unlimited Alterations

- Anniversary Sale Early Access Pre-Shop & Early Access

- VIP Rewards Experience

- Exclusive Holiday Points Event

- Extraordinary Experiences

- Bonus Points Events

- Nordstrom Notes

Features and Benefits of The Nordstrom Card

With The Nordstrom Credit Card, you’ll be rewarded for the purchases you make.

The card comes with a few valuable benefits you should know about:

- $40 Bonus when a purchase is made upon approval

- Earn 2x the points per every dollar spent with Nordstrom, Nordstrom Rack, HauteLook, and TrunkClub.

- Receive at least $100 in free alterations. This will come in the form of a reimbursement for the cost of alternations in Nordstrom Notes.

- No Annual Fee

Nordstrom also rewards their clients with some great perks:

- Personal Triple Points Days: Customers have the option to pick 1 day a year where they’ll earn 3x the point on purchases made using The Nordstrom Card at Nordstrom, Nordstrom Rack, or HauteLook.

- Alteration Notes: Cardholders have the opportunity to be reimbursed for alterations in the form of Nordstrom Notes.

- Anniversary Sale Early Access: With this reward, you’ll have exclusive access to shop all new arrivals and brands at sales prices before the sale even starts. Early access to the Anniversary Sale is available online and in store.

- VIP Rewards Experience: You’ll have the ability to enjoy a private Fall fashion shopping event for you and a guest. Options include a spa experience for you and a guest or a dinner for you and up to 3 guests.

- Exclusive Holiday Points Event: Receive special invitations for special events during the holidays.

- Extraordinary Experiences: You’ll have great opportunities to have exclusive access to top designers and something called “behind the scenes adventures.”

- Bonus Points Events: The ability to earn more points for your purchases during special bonus point events. These will take place throughout the year.

- Nordstrom Notes: Every cardmember will earn 2x per dollar on purchases made with The Nordstrom Card at Nordstrom, Nordstrom Rack, HauteLook, and TrunkClub. For every 2,000 points you earn, you’ll get $20 in Nordstrom Notes. Qualifying purchases can be made online or in store.

Reward Redemption Pros and Cons

Pros

- Once you have earned 2,000 points, your rewards will be automatically issued in the amount of $20 in the form of a Nordstrom Note.

- Nordstrom Notes can be used with other offers they may have running at the same time.

- The ability to put your rewards onto a gift card that does not expire.

Cons

- You cannot combine points in your Nordstrom Rewards Member Card with your Nordstrom Visa Credit Card.

- Points can only be used in participating stores.

- Nordstrom Notes usually expire one year after the date of issue.

- Nordstrom Points usually expire after three years.

If you’re a big Nordstrom shopper, chances are that you’ll really benefit from the rewards that come along with the card.

But at the end of the day, it’s a credit card like every other. So, you need to take a good look at the Schumer Box and make sure you can handle it before you apply.

Are you fan of the rewards that come with The Nordstrom Credit Card? Let us know in the comments!

Up Next: 9 Best 0% APR Credit Card Offers

Leave a Reply