Are you at the point where you’re in the red every month, but you don’t know where you can cut back?

Are you not sure how to organize your finances or create a budget plan in the first place?

Getting your finances organized can be overwhelming. But, we’re here to help you.

We’ll show you how you can break down your budget and allocate your funds appropriately.

Then, we’ll hook you up with our monthly budget template so you can stay on top of your finances with no problem.

We’re going to cover:

- What Is A Budget?

- How Important Is A Budget?

- Categorizing Your Expenses

- Recommended Budget Guidelines

- How To Make Your Budget Work For You

- How To Create Your Monthly Budget Template

What Is A Budget?

A budget is an estimate of your income and expenses for a specific time period.

By creating a budget, you’ll know in advance if you have enough money to cover all of your expenses. And if you find that you don’t have enough money to cover all of them, you’ll be able to prioritize your spending to focus on the things that are most important.

Planning ahead of time will help you manage your money and balance your expenses with your income. If you don’t do this, and end up spending more than you make, you can find yourself in a really difficult position.

A lot of people spend more than they earn. They dig a little hole, that just gets a little bit deeper everyday. Eventually, the debt adds up and becomes overwhelming. Unfortunately, by the time you get to this point, you already feel like you’ve lost control.

When you set out to create your monthly budget, you should distribute your income across every spending category, and end up with a $0 balance. By doing this, you’re allocating your money and making sure that all of it has a purpose.

How Important Is A Budget?

A budget is extremely important.

Why?

Do you want to:

- Get yourself out of debt

- Save and plan for retirement

- Invest in your future

- Payoff your mortgage

- Save for your children’s college fund

If you plan on doing any of these, you are going to need a budget.

By creating a plan and determining where every cent of your money will go, you’ll be able to maximize your savings or payoff debt in no time.

In order to begin creating a budget, you’ll have to allocate a percentage of your income towards each category of expenses. Once you have your expenses organized, it’s just a matter of determining how much you can set aside for each.

Categorizing Your Expenses

Your expenses should be divided into the following categories and within each category we will illustrate what is considered:

Housing

- Mortgage

- Insurance

- Rent

- Taxes

- Utilities

- Homeowner repairs

Food & Grocery / Cleaning & Household Products

- Groceries

- Eating out

- Snacks

- Cleaning supplies

- Paper

- Plastic products

- Detergents

Auto & Transportation

- Auto Payment

- Maintenance /Repairs

- Bus Transportation

- Gasoline

- Oil Changes

- Parking

- Insurance

- Taxi

- License

- Tolls

- Registration

Miscellaneous

- Phones/ Cell Phones

- Internet

- Cable / Satellite TV

- Child care

- Gifts

- Clothing for every member of the household

Medical

- Health care premiums

- Over the counter medications

- Specialists

- Copays for Medical & Dental

- Eyeglasses / contacts

Personal & Discretionary

- Hair / Nails

- Recreation

- Entertainment

- Education

- Hobbies

- Gaming

- Alcohol or Tobacco

Savings

- Retirement

- Emergency Fund

- Unexpected events (auto, medical, dental, insurance expenses, speeding tickets, etc…)

- Down payments on large purchases

- Vacations or trips

Debt Payments

- Credit card debt

- Personal Loans

- Subscriptions

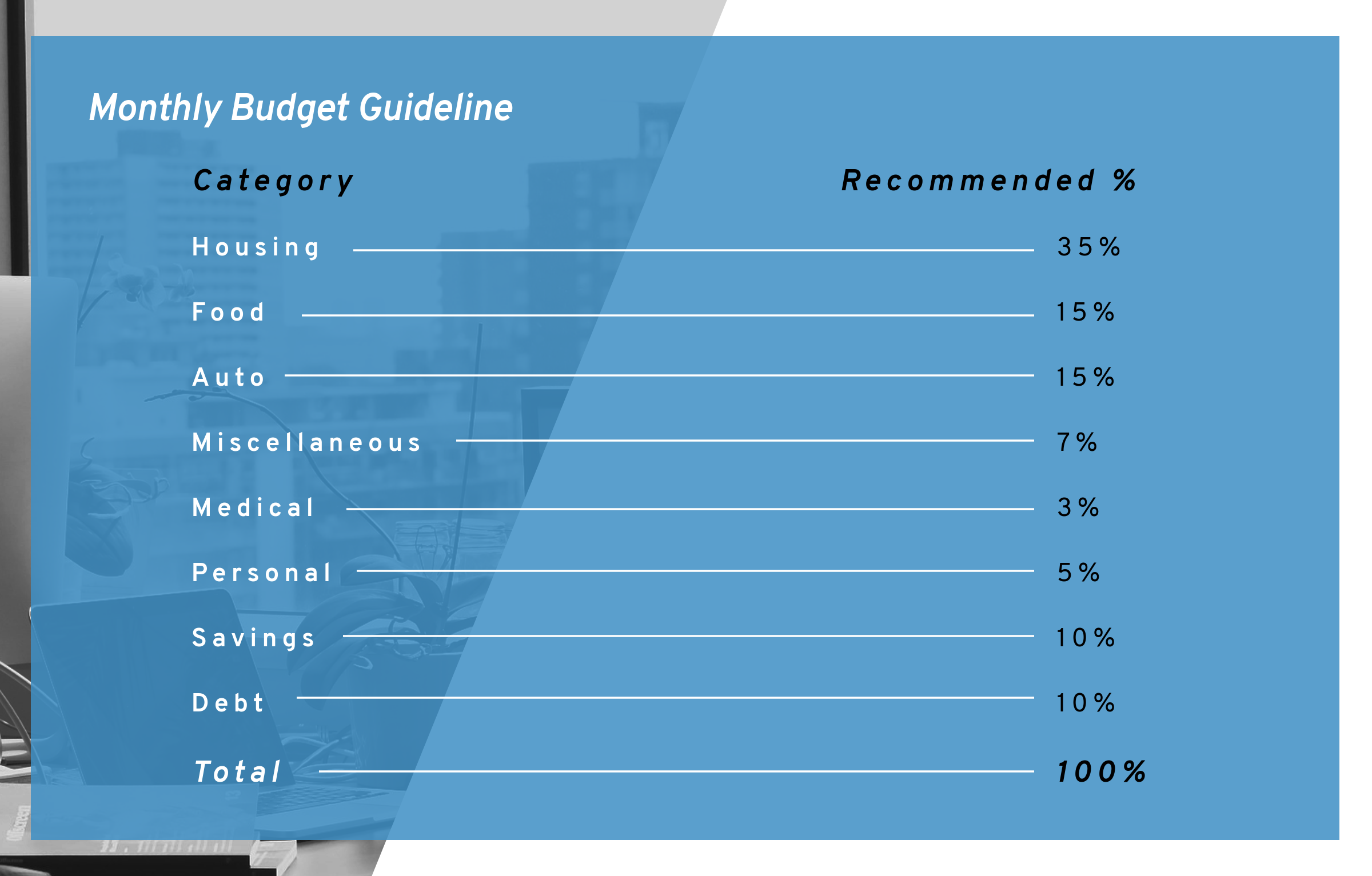

Recommended Budget Guidelines

Each expense should have a percentage assigned to it. This way you can make sure that you have enough for everything else.

So the recommended percentages are:

How To Make Your Budget Work For You

You need to be able to organize your expenses and make adjustments if needed. In this section we are going to explore all of the different categories and give you ideas on where to cut back if you need to.

So let’s start with housing:

Housing

It its important that your housing does not exceed this if you want to be able to live comfortably and have everything you need. Yes, we all sometimes wish for a bigger house or a more modern amenities, but don’t forget the costs associated with those luxuries.

In order to accomplish your financial goals, stick within the 35% budget guideline.

So how does that break down?

Let’s say that you have a monthly gross income of $3,200. If you were to set aside 35% of your income for housing, that equates to $1,120 a month.

Are you spending more than 35% on housing?

- If you own your home, look into refinancing with a more favorable interest rate.

- If refinancing is not an option, how about a less expensive insurance policy?

The reality is that having a roof over your head is a high priority. So, if you have to exceed the 35% budget guideline here, you won’t really have a choice. But, be sure to adjust the percentage of another expense to compensate for this one.

Food & Grocery / Cleaning & Household Products

Together, these costs should add up to be around 10 – 20% of your monthly income. Keeping your family healthy and in a clean home is definitely a necessity.

If you can, try to actually spend 18% here, and keep that other 2% for unexpected situations. Maybe you’re in the middle of a busy day of errands and you stop at CVS to pick up your prescriptions. But, the candy aisle catches your eye and you can’t resist purchasing a snack.

We often don’t think about these little indulgences, but those little things here and there can add up very quickly and derail our budget plans. So, by keeping that extra reserve, you won’t have to worry about going over budget for a small treat.

So how does that break down?

Let’s say that you have a monthly gross income of $3,200. If you were to set aside 10-20% of this, it’ll be $320 – $640 a month.

Are you spending more than 10-20% on Food?

- Start bringing your lunch to work with you. You’ll be surprised at how quickly these savings can add up over the course of a week or month.

Do your best to stay within this suggested range. If you exceed the limit here, you’ll have to cut back somewhere else.

Want to slash your #grocery tab? 🛒🛒

Saving #money on groceries is easier than collecting binders of #coupons and buying 455 rolls of toilet paper.

We’ve compiled a list of simple (and some unexpected) tips to help you maximize your #Grocery budget. 👉 https://t.co/Vk7vPPc7Ew pic.twitter.com/vSU2JE3Mm6

— Get Out of Debt (@getoutofdebtcom) December 11, 2018

Auto & Transportation

Auto & transportation should be around 15 – 20% of your monthly income. However, there’s a lot to take into account here, and these costs aren’t always fixed.

While you’re not paying for an oil change, tolls, registration, maintenance & repairs every single month, you do need to be prepared for when these costs do come up.

Example: It’s February and you’re finalizing your budget for the next month when you receive documentation that your registration is due in March. Based on your usage, you’ll also need an oil change in April.

Expenses like this easily throw us off track. But, you’re taking the time to plan ahead, and it will pay off.

All you have to do is make some adjustments to your budget plan for the next 2 months. If you know that you’ll need to put upwards of 20% of your budget towards auto costs, be sure to cut back by 5% somewhere else.

So how does that break down?

Let’s say that you have a monthly gross income of $3,200. If you were to set aside 10-20% to your auto & transportation costs, it’ll be $320 – $640 a month.

Are you spending more than 10-20% on Auto & Transportation?

- Shop around for cheap car insurance

By creating a monthly budget template, you’ll be able to take care of these extra costs without any issues.

Miscellaneous

So how does that break down?

Let’s say that you have a monthly gross income of $3,200. If you were to set aside 8-10% of this, it’ll be $256 – $320 a month.

Are you spending more than 10-20% on Miscellaneous?

- Consider dropping cable for a subscription service like Netflix

- Don’t underestimate the power of coupons when purchasing gifts

If you can’t find the additional money needed by cutting back here, look at some of your personal & discretionary expenses. Can you do without some of those to make the room necessary for child care?

Medical

Medical should comprise 3% of your income. Keep in mind that you most likely won’t be getting sick every month. The months when you’re healthy, you’ll only be paying your premium. So, any cash that you have left after that should be put into savings.

Medical costs can be unpredictable. You never know when you’re going to get sick or into an accident that could be a big financial hit.

So how does that break down?

Let’s say that you have a monthly gross income of $3,200. If you were to set aside 3% for medical, it’ll be $96 – $160 a month.

Are you spending more than 3% on Medical?

- Shop around for a cheaper health insurance policy

- Save money with generic prescriptions over name brand

If you have any unused money at the end of the month, make sure to save it. There’s nothing better than having that money there for when you actually really need it.

Personal & Discretionary

This should be around 5 to 10% of your income. This category of expenses is more for our wants, and not about what we really need.

Yes, we all love to have some extra cash to go out with friends, to the movies, a basketball game, or even a concert once in a while.

But, you shouldn’t be pulling money from other areas to spend more here. And you definitely shouldn’t be putting any extraneous charges on your card for these purchases either.

So how does that break down?

Let’s say that you have a monthly gross income of $3,200. If you were to set aside 5-10% for personal & discretionary expenses, it’ll be $160 – $320 a month.

Are you spending more than 5-10% on Personal & Discretionary?

- Start eating out less

- Cut back on the number of extracurricular actives you’re a part of.

As human beings we want to have fun, enjoy life, and spend quality time with others. And there is nothing wrong with that, if we organize ourselves and stay on track.

Establishing a budget and sticking to it isn’t easy, but it’s the best way to be in control of your finances! 💪

If you want to save yourself the time, download our simple budget template. https://t.co/1ZEMviS5o7#budget #FridayFeeling pic.twitter.com/xSlDlGRbkI

— Get Out of Debt (@getoutofdebtcom) November 30, 2018

Savings

Savings should be around 10 to 15% of your income, and are crucial for a successful future. If you want to retire one day, you’ll need significant savings.

The more you save, the less stressed you’ll be.

Why? Because if something comes up, you’ll be able to handle it.

Let’s say you want to purchase your first home. With enough savings, you’ll be able to afford a substantial down payment that will lower your monthly costs. Or say a family member is in need of some extra cash, you’ll be able to help them out without it affecting your monthly budget.

So how does that break down?

Let’s say that you have a monthly gross income of $3,200. If you were to set aside 10-15% for savings, it’ll be $320 – $480 a month.

When it comes to savings, try to be closer to that 15% mark. You must also decide how you’d like to split your savings between your standard account and your retirement plan.

Debt Payments

Debt payments should be around 5 to 15% of your income.

When you use your credit card for a purchase, you’re essentially buying it for a higher price. Why? Because if you don’t pay your balance in full, you’ll end up paying interest on it.

You need to ask yourself how long i’ll take you to pay something back when you’re thinking about swiping your card.

So how does that break down?

Let’s say that you have a monthly gross income of $3,200. If you were to set aside 5-15% for debt payments, it’ll be $160 – $480 a month.

The more you can put towards your debt payments and the less you use your credit card, the better it is for you in the long run.

How To Create Your Monthly Budget Template

Let’s say that you make $20 a hour, and work the standard 40 hours a week.

That means you have a monthly gross income of $3,200. Once that’s broken down, you’re bringing home about $2,643 a month.

Now, let’s break that down and see where you’re spending:

- Rent – $1,140

- Monthly Rent – $962

- Utilities

- Water – $51

- Electricity – $92

- Garbage Pickup – $35

- Food – $400

- Groceries – $350

- Snacks – $50

- Car – $245

- Car payment – $139

- Gas – $106

- Miscellaneous – $214

- Internet/ Cable / Phone – $89

- Cell Phone – $65

- Clothes shopping – $60

- Medical – $86

- Medical Premium – $71

- Copay – $15

- Personal & Discretionary – $166

- Hair & Nails – $105

- Movies – $61

- Savings – $320

- Retirement 401K – $240

- Savings account – $80

- Debt – $300

- Credit card – $118

- Minimum payment is $68

- You want to give an extra $50

- Personal loan – $133

- Subscription – $49

- Gym – $35

- Netflix – $14

- Credit card – $118

Total: $2,871

Your expenses were $2,871 last month, but you only took home $2,643.

That means you’re short $228.

By creating a budget, you’ll be able to make the proper adjustments to ensure you don’t go over.

If you’re short $228, you’ll need to think about where you can cut back.

Adjustments could be made in:

- Miscellaneous: You can decide not to go shopping and save that money for other expenses.

- Personal & Discretionary: You can decide not to get your hair and nails done this month and leave the movies for some other time.

- Debt Payments: You can just pay the minimum payment on the credit card (which is not the best route to take) but it’s an option.

But, you’ve made those changes and it’s not sufficient to cover your expenses.

Looking for more savings? Consider:

- Find an apartment that costs the same or less than the one you have now

- Look for one that will include utilities garbage pickup in the price

- Carpool with someone and save some money on gas

- Cut on your internet, cable and phone bill

- Save on your cell phone bill. How? Find a different company that will give you a better offer.

- Check your subscriptions. Are you using Netflix or the gym enough to warrant the monthly cost?

Conclusion

It’s easy for money to fly out of the window when you don’t carefully track where it’s going. By creating a monthly budget, you’ll know exactly what expenses your income is dedicated to.

This way, you’ll be able to monitor your progress and know ahead of time if you need to make any adjustments.

What’s the hardest part about staying within your budget? Let us know in the comments!

Lots of good info!

Awesome!

Not too bad. The percentages are a good idea to keep things in perspective. We work with the Dave Ramsey budgeting which is similar and saved us from ourselves after years of being terrible with money.

ok i guess, i have no debt

Good I guess

This is a good, thorough guide! I agree with the budget percentage breakdown, I think once you divide everything up and prioritize expenses, it’s easier to wrap your head around and have confidence in your budget.

thanks so much!

This is great! Budgeting is so important. It’s also important to be thorough when writing one.

Great break down of how to plan and execute a budget! I’m defintly going to get setting my budget plan up now that I’ve been inspired! Thanks!

This is a solid budget plan for anyone still in the workforce. Those of us who are retired and who have any health problems, however, must spend FAR more than 3% on medical expenses. My wife and I must spend a minimum of 25% each month on medical expenses, and we have several friends who must send even more.

it was good info for people not all that good with money and young people What really upset me was links for the tweets that I would tweet but the contest site would not recognize

Pretty comprehensive! Would help if I had more money to budget in the first place.

pretty simple and easy to follow, i prefer using a spreadsheet to do my budgeting

A ton of good information. I think you covered all of the bases!

I haven’t followed a budget, so I can’t say what is the hardest part. If I had to guess though, for me, it is probably food, specifically going out to eat.

This is so helpful! Especially the breakdown with expenses and what goes in each category.

Very well put together website.

Very Informative.

So relevant to 2019 debts

I agree with Wolfbane. This probably works great for someone in the workforce. But, for those of us that are retired, it just doesn’t work.

This is great I have mine all logged down but added travel as I have to travel to see my grandchildren and that is on the will not give up list. I cut out most snacks since I’m on a diet anyway, and I use vinegar for most cleaning. My little cut backs help to make up for the travel to see the grandchildren. Your list is great and a perfect start!

Great template, thanks for the starting point!

Can’t stick to a budget.

nice tips thank you warm regards

I think that yall did a awesome job. Really know about this debt that I am trying to pay off. Hopefully this company will be able to help me in the situation that I am in.

Thanks, Good breakdown for budgeting.

What a great article! Love it!

Superb suggestions on how to set up a budget. One of the keys I’ve found is to stick to the budget once you set it up. If you have figured out a way to save money, but don’t follow the budget, it’s no good.

Great ideas! Would be so grateful to win this contest!

Pretty simple and easy to follow. Great ideas!

After being married for 40 yrs I like reading what’s out there , so I can keep up with the times

This is wonderful – I have learned a lot and cannot wait to tell my husband what I learned!

Very helpful

the budget guidelines and how to decrease possible spending in the various categories is quite helpful. this is pretty comprehensive, thanks!

Thanks, looks good.

You guys nailed it, budgeting should be taken very seriously!

It’s so much easier to get started on a budget when you have a template to work from!

What about a guide for re-starting things after losing everything? I have a family friend who got hit hard with the recession of the late 2000s and was trying like crazy to rebuild. Thanks!

Covered it all IMO

Great info!

Well written and easy to understand. I feel like this would be a good class for high school and college students to take. So many people have no idea what they’re doing!

Very good critique

These are all very reasonable steps to better credit. I’ve taken some of them myself and improved my credit a great deal. Still lots of work to do though which can be exhausting alongside everything else in life.

Most is good, but I think you are underestimating what medical costs can be for someone with a chronic health problem. And yes, young people have those, too…

This is a great read! My biggest challenge with budgeting is balancing detail and flexibility.

Very easy to follow. I will use to simplify my budget

This is relevant to me, and I have taken some of the suggestions others have made that work for me…though I will say the hardest thing about staying on budget is when you have several emergencies in a row that deplete your emergency fund.