When you take a loan out or apply for a credit card, you will hear the term "APR" or annual percentage rate. But what is APR and what does it mean? Most people do not know what it is or how it works. So, we are providing this handy guide. We're going to cover: What Is APR? How Does APR Work? APR versus Interest rate Simple and Compounding Interest How … [Read more...]

Debt Types

Wells Fargo Personal Loan Review

You might think that a personal loan is the solution to your current problem. But, you might not know the actual ins and outs of the product and how to get one. So we've decided to gather all the imperative information you'll need in order to get a Wells Fargo Personal Loan. This way, you'll be able to see if it's the right fit for you. And if it's not, you'll have a base … [Read more...]

How A Secured Personal Loan Works

If you applied for an unsecured loan and weren’t approved, a secured loan might be just the right option for you. But before applying for this type of loan, it's important that you learn the basics so you can decide if it's the right choice for you. To accomplish that, we will go over the following: What Is A Secured Personal Loan? Where Can You Apply For a … [Read more...]

Fingerhut Credit Account Review

You’ve probably heard of Fingerhut at some point, right? But do you know how Fingerhut actually works? Is Fingerhut a good move for someone with bad credit? And what are the qualifications in order to be approved? We'll go over all of this and more so you can decide if this is the right choice for you. We're going to cover: What is Fingerhut? How Fingerhut … [Read more...]

How An Unsecured Personal Loan Works

An unsecured personal loan can be a great option when you need money quickly. But, there's a lot more to know about them before you go ahead and submit that application. What's the credit requirement on an unsecured personal loan? Are there any hidden fees? What documentation will you need to complete the process? These are just a few of the questions that you might … [Read more...]

How To Pay Off Credit Card Debt Fast: 5 Foolproof Strategies

When you are in debt, it is easy to feel trapped. But, you certainly aren't alone. Credit card debt in the United States exceeded $1 trillion in 2017. For many people, this means they are not saving for retirement. Many people are also making only minimum monthly payments, meaning it will take longer to pay off credit card debt. If you are planning to purchase a home, … [Read more...]

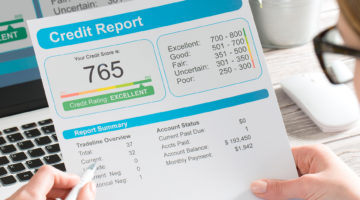

What’s The Best Way To Build Credit?

Building credit might seem a bit complicated if you've never done it before. The biggest hurdle to overcome is being able to show a history of responsible repayments to qualify, when you don’t have any credit history in the first place. To overcome this challenge you need to select what type of building credit option is best for you. Once you have a full understanding … [Read more...]

7 Best Cash Back Credit Cards

A cash back credit card is one of the easiest way to earn rewards. They're a useful tool to get paid for the things you're already buying everyday. Sounds like a good deal, right? Well it is! It’s just a matter of identifying which is the right card for you and making sure your application is approved. So, let's look at some of the factors you should consider when … [Read more...]