10 Best Money Saving Apps

We’re always looking for the best deal. The more we can save on a product, the more money we can put away for something else. If you struggle to save money, you are not alone. Only 16% of Americans save the recommended 15% of what they make, and 20% do not save anything at all. What’s the […]

Continue ReadingCheap Car Insurance | What You Need To Know

Car insurance is a requirement if you own a car. But, there’s no reason to pay more than you have to for it. The average cost of car insurance is around $1,426 per year. That breaks down to $118.63 per month. Of course, these costs will vary based on your personal circumstances, and especially your […]

Continue ReadingHow to Save Money on Food

We all want to have nourishing food on the table, but this isn’t always the easiest thing to do on a budget. There are several ways to save money on food everyday if you simply plan your grocery shopping better. According to a writeup in USA Today which was published in December of 2017, the average American […]

Continue ReadingHow To Save For Retirement

We all know that we need to save for retirement. But, not everyone has a clear understanding of how much or how to save for retirement. And that’s okay. How are you supposed to know exactly how much you’ll need to live out your last 20+ years? The truth is that unexpected expenses are bound […]

Continue ReadingHow Much Is Renters Insurance?

A lot of people believe that renters insurance is going to affect their monthly cash flow the same as having another credit card or loan payment. The reality is that it’s NOT! People are not protecting their things like they should just because they are just not well informed. In this article we are going […]

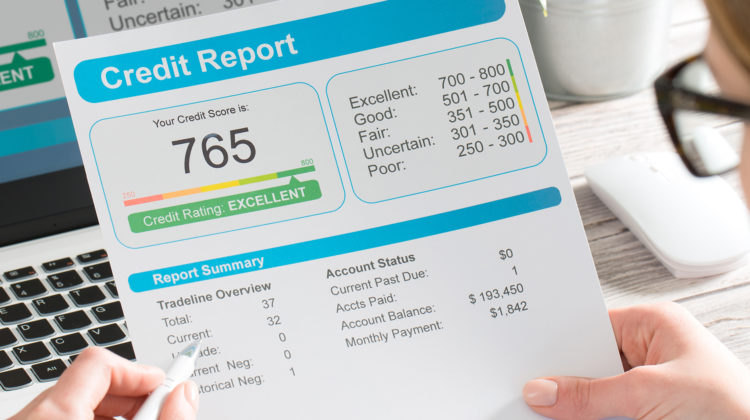

Continue ReadingWhat’s The Best Way To Build Credit?

Building credit might seem a bit complicated if you’ve never done it before. The biggest hurdle to overcome is being able to show a history of responsible repayments to qualify, when you don’t have any credit history in the first place. To overcome this challenge you need to select what type of building credit option […]

Continue Reading21 Christmas Budgeting Tips

It’s that time of year again when our thoughts turn to holiday giving. Unfortunately for many, this is also the time when we blow up our budget trying to get everyone the right gift. You can still enjoy the spirit of giving if you use these 21 Christmas budgeting tips. Remember, it’s never too late […]

Continue Reading7 Best Cash Back Credit Cards

A cash back credit card is one of the easiest way to earn rewards. They’re a useful tool to get paid for the things you’re already buying everyday. Sounds like a good deal, right? Well it is! It’s just a matter of identifying which is the right card for you and making sure your application […]

Continue ReadingYour 5 Best Personal Finance Software Options

Using a personal finance software means all of your financial data will be in one place. This makes it a convenient tool to manage your money and even help you achieve your long term financial goals. Let’s look more into how personal finance software can help you, and then we’ll introduce you to the best […]

Continue Reading27 Money Management Tips for Saving and Spending Wisely

There is always an assumption made that people in debt do not manage their money well. This is not always the case, sometimes things happen which create money problems. There are some simple money management tips that you can use whether you are saving or spending which can help you avoid more debt. Here are […]

Continue ReadingAbout Get Out Of Debt

Get Out Of Debt’s Mission is to provide resources on how to eliminate your debt, plan for retirement, own a home, save money, and invest wisely. We hope to educate you on how to meet your financial needs in an easy to understand and effective way so you can make the right decisions now and for your future.