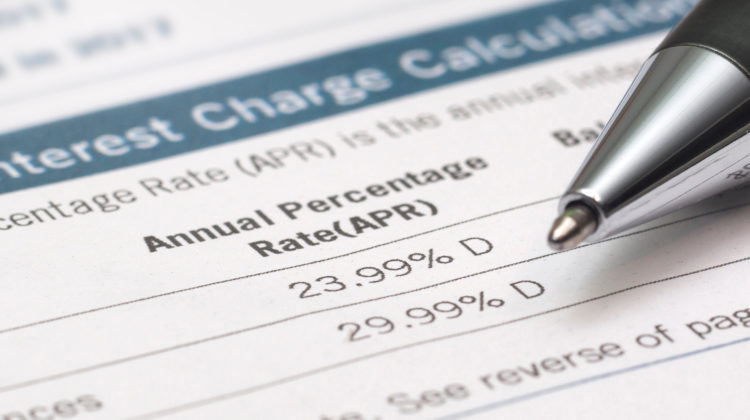

What Is APR? | Understand & Calculate APR

When you take a loan out or apply for a credit card, you will hear the term “APR” or annual percentage rate. But what is APR and what does it mean? Most people do not know what it is or how it works. So, we are providing this handy guide. We’re going to cover: What […]

Continue Reading403b vs 401k | Picking A Retirement Plan

Most of us do not work for employers who offer a fully-funded pension plan. The result of this is we need to have a method of saving money for our retirement. While most of us will be entitled to collect Social Security upon retirement, the benefits may be insufficient to maintain our lifestyle. Many people […]

Continue ReadingHow To Create A Zero Based Budget

Budgeting is a necessity if you are working towards your financial goals. Whether you are saving for retirement, a vacation, or planning to go back to school, getting a handle on your spending habits is a must. Budgeting tools are important and deciding what type of budget works best for you and your family is […]

Continue ReadingWhat Does Renters Insurance Cover?

So you’re currently renting, and you’re not sure if you should get renters insurance. What does renters insurance cover? Doesn’t the landlord’s property insurance protect you and your belongings? How much is it going to cost? And what is the cost dependent on? These are all common questions you might have about renters insurance. We’ll […]

Continue ReadingDebt Consolidation Loan | What You Need To Know

Are you feeling like you’re drowning in debt and can’t seem to find a way to lower your balances? Or Have you been attempting to negotiate a lower interest rate from your creditor with no luck? You’re probably struggling with: High interest rates Too many bills to pay High monthly payments Less spare money to […]

Continue ReadingWells Fargo Personal Loan Review

You might think that a personal loan is the solution to your current problem. But, you might not know the actual ins and outs of the product and how to get one. So we’ve decided to gather all the imperative information you’ll need in order to get a Wells Fargo Personal Loan. This way, you’ll […]

Continue ReadingHow A Secured Personal Loan Works

If you applied for an unsecured loan and weren’t approved, a secured loan might be just the right option for you. But before applying for this type of loan, it’s important that you learn the basics so you can decide if it’s the right choice for you. To accomplish that, we will go over the […]

Continue ReadingAbout Get Out Of Debt

Get Out Of Debt’s Mission is to provide resources on how to eliminate your debt, plan for retirement, own a home, save money, and invest wisely. We hope to educate you on how to meet your financial needs in an easy to understand and effective way so you can make the right decisions now and for your future.