Having issues budgeting on your own? Are you tired of creating your own spreadsheets to keep track of your budget?

Luckily, there are budgeting apps that can make it easier for you.

Here we’re going to explore two of the top financial apps out there, Mint vs YNAB.

We’ll go through their features and show you how they work, so you can decide which financial app is the best fit for you.

We’re going to cover:

- What Is Mint?

- What Does Mint Offer?

- How does Mint Work?

- Pros and Cons of Mint

- What is YNAB?

- What Does YNAB offer?

- How Does YNAB work?

- YNAB Pros and Cons

- Mint vs YNAB

What Is Mint?

Mint.com is a free web based personal finance program that allows you to download and link all of your financial data together. It’s super simple to open an account and get started with them.

This program will automatically update all of your financial data in just a matter of seconds when you log in to their site. It has a ton of cool features that’ll help you visualize your spending in an interactive way.

With over 15 million users, Mint has been an extremely useful tool for many people.

What Does Mint Offer?

Mint has a lot of different features that come in handy when you are budgeting, so let’s explore them and see what they are all about.

- All in one– With this feature, you’ll be able to see all of your account balances, bills, and credit score in one place so you’ll know where you stand where you can improve.

- Track bills –All of your bills will be organized in one place. This will help you stay on top of your payments, which is a big factor when it comes to budgeting.

- They offer:

- Bill Reminders

- Bills Due Alerts

- Low Funds Alert

- Unusual Spending Alert

- Rate changes

- Large purchases

- They offer:

- Easy budgeting – This feature allows you to identify your spending patterns and help you create a budget that’s easy to stick to. Your financial information will be illustrated with charts and graphs on a month to month or year to year basis, so it’ll be easy to compare and make the necessary changes.

- Free credit score – This feature gives you access to your credit score, at no cost to you, and will alert you when there’s been a change in your score. By knowing your score ahead of time, you’ll be able to tell if you qualify for certain financial products, like credit cards, loans, etc.

- Alerts and advice – This feature will alert you whenever there are important changes going on with your accounts.

- You’ll receive alerts when:

- You’re being charged a fee

- You’re going over budget

- Any unusual or suspicious activity is seen

- When your payments are due

- You’ll receive alerts when:

- Simple categorization – Mint’s purpose is to help you create a budget that’s easy to stick to. This feature will help you place your expenses in a category for easier tracking.

- Investment tracking – Investing well can make all the difference for your future. Mint will help you compare your portfolio to the market and benchmarks. This feature will also show all of your investment accounts such as 401K, IRA’s, Mutual Funds and brokerage accounts.

- Security – Coming from the makers of trusted companies like Quickbooks and TurboTax, Mint strives to constantly improve their security measures.

How does Mint Work?

Mint evaluates your financial situation in order to provide an alternative solution for you.

Then, Mint will refer you somewhere that will be able to help you.

Mint does not charge you any fees, and will only make money from their referrals.

To start using Mint, register on mint.com or through their app

Start by clicking on Sign Up Free

Then you are going to enter:

- Email address

- Phone number

- Password (you’ll be asked to confirm the password once more)

Then click on Create Account

After that you will go ahead and select your Country from a drop-down list and place your Zip Code. You won’t be asked to give your address.

Then you will be asked to add all of your accounts.

Make sure to include your bank accounts, loans, credit cards, and anything else you might owe on. This will allow Mint to start figuring out how much you owe, as well as how much money you have in your accounts.

You must log in to all of your accounts through the Mint application.

Once you’ve added all of your accounts and it’s time to Create a Budget, just click on the plus sign illustrated below to get started.

You will be prompted to choose a category, to state when that payment will take place.

You can select from:

- Every Month

- Every Few Months

- Once

If you wish to start every month with the previous month’s leftovers, you can check the box as illustrated below:

Then place the amount to be paid and click on Save

You are going to continue adding all type of transactions you typically pay throughout the month, as well as anything you pay yearly or every other month.

If you want to create Goals for yourself, you should follow the steps as illustrated below:

These are the goal options they offer:

After this they will have you review your payment plan, where you’ll be able to make any adjustments you need.

At this point, Mint will give you an overview of your finances and you’ll be able to start developing your budget. Once you do, Mint will start offering alternatives and suggestions to help your financial situation.

Once you’ve established your account and have been using it for a few months, you may be able to see trends and analyze areas where you can improve.

Pros and Cons of Mint

Pros

- Free of cost software

- Offers credit score for free

- Easy to set up

- Easy to use

- Graphs and charts reports that show your spending history

Cons

- Doesn’t allow you to create a zero based budget

- Has had synchronization issues in the past, based on reviews

- Doesn’t allow you to pay your bills through the app

So, there you have it. Everything you need to know about Mint and how it works. Let’s start exploring YNAB.

The average American is #spending far more on the weekends than they are throughout the week.

However, if your financial goal is to get out of debt, your weekend binge spending is probably hindering those goals. Help curb your #weekend spending. 💪 https://t.co/UGu69fUwqs pic.twitter.com/2a7iAbIQj9

— Get Out of Debt (@getoutofdebtcom) February 22, 2019

What is YNAB?

YNAB stands for You Need a Budget, and it’s a multi platform personal budgeting program based on the envelope method.

What’s the envelope method?

You’re going to break down your budget by category, and designate a specific amount for those expenses.

Every time you get a paycheck, you are going to place the budgeted amount in the envelope you have designated for each different expense. Once you’ve spent the money in that specific envelope, you’ve reached your budget and cannot purchase anything additional until your next paycheck.

Any additional money that you have left at the end of the month, you’re going to put towards eliminating your debt.

YNAB does not offer a free version like Mint does, but there is a 34 day trial period. After the trial period, the monthly cost is $6.99 which adds up to $83.88 a year.

What does YNAB offer?

- Bank Syncing – It allows you to see all of your accounts in one place which helps you stay in control of your finances and keep to your budget.

- On the Go – You’ll be able to see your information in real time, from any device.

- Debt Paydown – This feature helps you learn how to get out of debt and even better…stay out of debt.

- Goal Tracking – The point of budgeting is to help you reach your financial goals. This tool will allow you to state a goal and track your progress.

- Reporting Bliss – This feature allow you to see reports in form of charts and graphs, making it easy for you to understand your trends.

- Personal Support – This feature gives you the option to join live workshops to assist you with creating and sticking to a budget.

How does YNAB work?

YNAB has 4 basic rules that you need to follow in order to get the best use out of their software.

Here’s how it works:

Rule #1: Give every dollar a job

If you give every dollar a job and follow the plan you’ve created, you’ll have the ability to save, prioritize, and spend how you should.

As soon as you receive your paycheck, you’ll need to determine how to disperse your money throughout your expense categories.

Based on YNAB’s plan of action, they give you steps within the rules to make it easier on you. For instance, rule #1 has three steps:

- Find some money

- Prioritize each dollar

- Follow your plan

By prioritizing and following a plan you’ll be stress free or at least be a lot less stressed because you’ll know how much money you have and where it’s going.

By knowing how much money you have versus how much you need to pay, you’ll be in control of your finances.

Rule #2: Embrace Your True Expenses

Don’t forget to plan ahead and think about any expenses you might have down the road.

What happens if your car breaks down, or when it’s time for holiday shopping? These things aren’t on your mind on a daily basis, but you need to plan ahead on how to deal with them.

Write down any large expenses you have coming up, and break them down into manageable monthly payments.

Let’s say that you are planning to go on a vacation. You’ve estimated that you’ll need about $1,500 for this trip, and you’re planning to go 12 months from now. Since you’ve taken the time to make a plan, you’ll be able to divide the cost of the trip into small amounts that you’ll pay throughout the year.

Divide $1,500 by 12 months, and it equals $125. This means that you need to save $125 a month for the next year, in order to be able to afford your vacation.

Rule 3: Roll With The Punches

We all overspend sometimes. And if you do, that just means you’re going to need to adjust your budget. Circumstances might change your plans, but that doesn’t mean you shouldn’t reach your goals.

If you overspend in one category, take a look at the rest of the categories and determine where you can free up some cash in order to balance it out.

Let’s say that you budgeted $250 for groceries, but you ended up spending $295. This means that you’re $45 over budget in that category. But, you also set aside $150 for entertainment. Simply take the $45 out of your entertainment budget in order to make up the difference on your groceries. That still leaves you with $105 to play with in the entertainment category.

Make the moves you need to in order to keep your plan on track!

Rule #4: Age Your Money

Just because you have the money set aside, doesn’t mean you need to spend it all. If you can, spend less than the amount you have designated for each category. This way, you’ll be able to put that extra money towards next month’s expenses.

This might be a little tricky in the beginning, but with the help of the other 3 rules, you should become more aware of your spending habits and be able to adapt them.

Living paycheck to paycheck can be extremely stressful. If you’re able to free up some extra space in your budget, you’ll feel like you have more control over your finances. By doing this, you’ll be able to plan for your future instead of worrying if you can make ends meet this month.

To start you are going to click on Try YNAB Free for 34 Days

Once here, you are going to signup using either a google account, or register with an email and password.

Then click Try YNAB free for 34 days

It will take you to the terms of service, once you have read through them, click Agree

Then YNAB welcomes you and click Let’s Get Started

You’ll be prompted to answer the following question:

Which of these brought you to YNAB? (You can select one or select all that apply)

- Paying off debt

- Saving for a big purchase or vacation

- Saving for retirement

- Breaking the paycheck to paycheck cycle

- Help! I’m broke

- Other

Choose your answer and click Next or simply Skip to the next section

Then you’ll be asked to answer these two questions:

Select what best identifies your situation and click Next or if you rather skip it click on Skip

At this point you have opened your account with them, click Done

Now you are going to click on each individual category and customize it as you wish, but be sure to start adding your account information.

In the upper center you will find the following, click Start to begin setting your goals

On the right hand side you will see the following information that will give you all the details you need in regards to your finances.

Total:

- Budgeted

- Activity

- Available

- Inflows

And at the bottom will be a small summary of:

- Underfunded

- Budgeted Last Month

- Spent Last Month

- Average Budgeted

- Average Spent

Not so complicated, right?

YNAB Pros and Cons

Pros

- Easy to set up

- Easy to use

- Ad free application

- Offers a great support staff and provides online classes, videos, and messages

- Constant syncing of all your transactions for accurate balances.

- Connects with almost all banking institutions

Cons

- No free version

- The simplicity of the app may mean it lacks features other softwares have

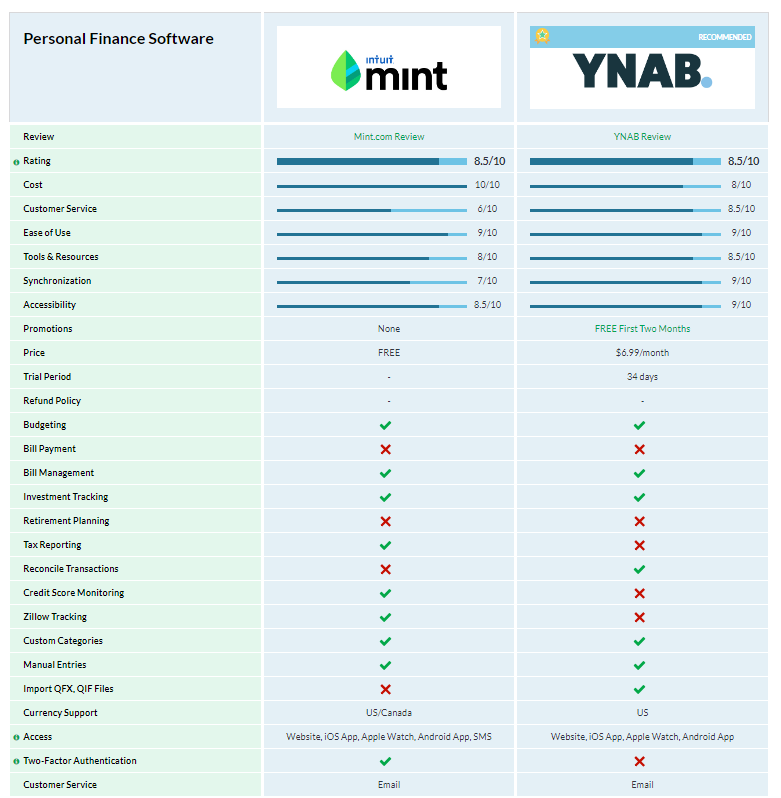

Mint vs YNAB

Conclusion

Both Mint and YNAB were designed to help you create a budget and analyze your spending patterns so you can make the modifications necessary to reach your financial goals.

But, they do have a few key differences that you should consider when selecting the right option for you.

Mint is a free app that also offers you access to your credit score. However, they have had some issues with synchronization in the past which have not been reported with YNAB. And while YNAB also offers you online classes to help you with your budget, there is a cost attached to the application.

So, it all comes down to picking the app with the features that will assist you the most.

Mint vs YNAB: Which one works best for you?

Leave a Reply