Have you been considering negotiating your own credit card settlement? If so, it’s time to take charge and get started.

Not sure what your first step should be?

You probably have an idea of how the process works, but maybe you’re not sure how to tackle it on your own.

Don’t worry, we’ve got your back. We’ll explore all the steps you’ll need to go through to negotiate your own credit card settlement.

Plus, we’ll give you the tips you need to make sure you get the best settlement offer.

We will be covering the following:

- Validate Your Debt

- Check The Statute of Limitations

- Create A Budget

- Open A Bank Account

- Set A Target Settlement Amount

- Learning To Negotiate

- Determine Your Hardship

- Make The Call

- Reporting A Settlement On Your Credit

- Don’t Forget About Taxes

- Get Everything In Writing

Validate Your Debt

You’re only responsible for paying debts that belong to you. So, your first step should be to validate the debt and make sure you do indeed owe the money.

You’ll do this by sending a certified letter to your creditor or collection agency and asking them to verify your debt. You should expect a response within 30 days.

This will come in the form of a debt validation notice stating the debt belongs to you, and the total outstanding balance.

Or, they’ll simply let you know that they could not validate the debt. In this case, you’re off the hook.

What should you be asking in this letter?

- Who you owe and how much?

- How was that amount calculated?

- Can they send you any copies of any statements they may have related to the debt?

- Copy of the original contract

- Documentation stating that the collection agency is licensed in the state

- Request any a copy of any judgment they may have (if applicable)

We’ve put a lot of emphasis on making sure you validate your debt before proceeding any further. You might be wondering just why this is so important.

Here’s the reasons why you should validate your debt:

- The collection agency might not have the documents to legally collect on your debt.

- You may already have settled with your creditor

- The collection agency might have misplaced your documents and is collecting on a debt that they don’t actually have evidence for.

- Some collection agencies will go away when they receive debt validation letter, just to avoid the process.

Check The Statute Of Limitations

Once the debt has been validated, and you’re sure you owe the balance, check out the statute of limitations.

The statute of limitations is the time period in which a lawsuit can be filed. In other words, it’s the time period the creditor has to collect on that outstanding balance.

Once the statute of limitations has passed, a collector cannot sue you over the account.

Simply put, if your debt is past the statute of limitations, it is not considered legally collectible. You are not obligated to pay the debt, and what’s more is that it might not even be in your best interest to pay it. Since by law, they cannot sue you for this account, it really means you’re off the hook.

The statute of limitations varies state by state, so do your research and know the law where you live.

No matter which state you live in, the statute of limitations will begin the day of the last activity on your account.

Since every state has its own statute of limitations, make sure to review it before proceeding. This will allow you to have a much better idea of what you legally owe and do not owe.

Create A Budget

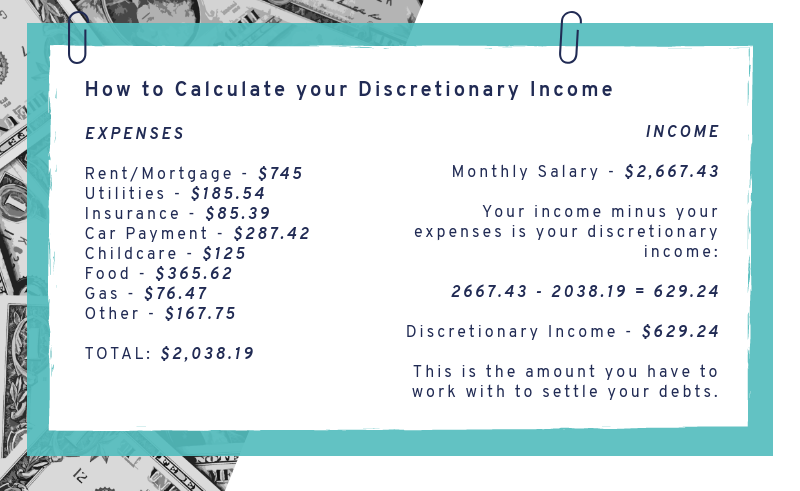

You need to determine how much money you’ll be able to set aside to complete these settlements. In order to do this, you’ll need to create a budget.

Start by calculating your monthly net income and then start subtracting your monthly expenses. The remaining amount is what we call your discretionary income. This is the money you’ll be able to save and ultimately put towards your settling your debts.

Don’t forget these common monthly expenses when creating your budget:

- Mortgage/ Rent payment

- Car payment

- Car insurance

- Food expenses

- Utilities

- Transportation

- Entertainment expenses

- Medical & Dental

- Dependent Care

- Child Support

- Federal or Private Loan

Check out our example on how to calculate your own discretionary income:

Going by the example above, your total monthly expenses add up to $2,038.19 and your monthly income is $2,667.43.

If you subtract your expenses from your income, you’re left with $629.24. This amount is your discretionary income. From this, you’ll need to decide just how much you can save every month.

Be realistic with yourself. The last thing you want to do is create an unmanageable plan that you can’t keep up with.

Maybe from that $629.24, you decide that you’ll be able to devote $475 a month to paying off your debts. Whatever number you decide on, make sure you stick to it.

Next, Open a Bank Account

Now that you’ve calculated your discretionary income, and have decided how much you’ll be able to save each month, you need to open a new bank account.

This account will be solely dedicated to getting out of debt, and you should put your $475 in it every month.

This is an important step that you don’t want to miss.

Do you think a creditor will be willing to give you a lower settlement when they see that you’ve got a little extra money stashed in your account?

The reason you’re opening a second bank account is to keep your personal account separate through this whole process.

Once you negotiate a settlement, you’ll want your creditor to take the payment from your new bank account. By doing it this way, your creditor will never be able to see what savings you’re keeping in your personal account.

Set A Target Settlement Amount

Once you’ve saved enough in your new bank account, you should start figuring out exactly how much you’d like to negotiate each debt down to.

Start by writing down every account you owe a balance on and which creditor or collection agency is owed what.

Now you’ll be able to determine:

- Which debt you’d like to attempt to negotiate first.

- Your target settlement amount for each account.

When setting a target settlement amount, remember that the average credit card settlement is around 48%.

The more you do it, the better you’ll get at it. So, don’t expect to knock 70% off your outstanding balance your first time around.

Let’s say you have a Chase credit card with a balance of $7,428.29.

If this is your first negotiation, you might aim for a 40% reduction on the debt. This would mean you’d pay $4,456.97

Once you’re a little more experienced, you might try for a 70% reduction. That would put your total outstanding balance down to just $2,228.48.

Just by having better negotiation skills, you could potentially save another $2,228.49 on this settlement alone. Imagine how much that could add up when you’re working on several cards.

The difference between paying 40% and 70% is huge. This is why so many people leave it to the professionals. It’s just not worth risking paying more than you have to.

Learning To Negotiate

At this point, you’ve got a master list of your debts and the amount you’d ideally like to settle for. Seems like the next logical step would be to present this offer to your creditor, right?

Not so fast.

Keep in mind that a creditor or collection agency will counter your first offer. So, make sure your initial offer has some wiggle room for negotiations.

Never give your creditor your final offer right off the bat. Use your negotiation skills to bring them down closer to what you can afford.

Remember that a great settlement is around 30%. Of course, your results will depend partly on your negotiation experience.

So, if you’re aiming to settle a credit card account at 50%, start way lower. Maybe only offer your creditor 20% at first. This will give you room to go back and forth.

Hopefully, you’ll be able to settle for under 50%. No matter what you do, do not agree to settle for above what you can afford.

If you simply cannot afford your creditor’s final settlement offer, you can either:

- Agree to pay the amount if the creditor will accept monthly payments

- Wait until you’ve saved up more money

Once you’ve decided upon your initial and target settlement offers, it’s time to get started.

It doesn’t take much to manage your #finances even on a tight #budget. Check out these tips on saving #money: https://t.co/P2jwXdkDxo#debtfree #getoutofdebt #moneymatters #moneymoves pic.twitter.com/YkKJqt07j4

— Get Out of Debt (@getoutofdebtcom) May 23, 2018

Determine Your Hardship

When you call your creditor to ask for a credit card settlement, the first thing they’re going to do is ask you why you’re behind.

You’re going to need to be able to explain your situation in detail to your creditor.

There are a million different reasons why people fall behind on their bills. Typical ones include job loss, unexpected event or medical bills, etc.

Be honest with your creditor about what’s been going on that caused you to fall behind.

The reason you’re behind is referred to as your hardship. The more convincing you are of your hardship, the more likely it’ll be that your creditor will try to help you out with a lower offer.

So, be honest but convincing. Let your creditor know that you’re doing everything in your power to make things right with the account, but that outside circumstances have made it nearly impossible for you.

Make The Call

Your creditor is going to ask you a few questions in order to identify you and locate your account. Once this happens, it’s time for you to explain your hardship.

Make sure you don’t leave anything out or unsaid. This is your one opportunity to show your creditor that a lower settlement is necessary because of your unforeseen circumstances.

Once you’ve explained your hardship and have told your creditor that you’d like to make a settlement, they will begin with an offer.

By letting your creditor give out the first offer, you’ll give yourself the upper-hand. Now you’ll have a clear idea of your creditor’s starting point. From that, you should be able to begin your negotiations around it.

Reporting A Settlement On Your Credit

As part of your negotiation, ask your creditor to report the account as “paid as agreed upon” on your credit report.

Most times, a settlement will be reported as “settled” on your report. This will continue to hurt your score.

Keep in mind that a lot of creditors won’t agree to this. But, it never hurts to ask, right?

If your creditor will not report the account as “paid as agreed upon”, it’s okay. The important thing is that the account will show that the debt has been paid on the report.

Tip: You will see an increase in your credit score as a result of your debt minimizing. So don’t get frustrated if your creditor doesn’t agree to report it as “paid as agreed upon”

Don’t Forget About Taxes

Taxes. No one likes them, but they’re always around. And unfortunately, a settlement is no different.

The amount that was forgiven is taxable. Your creditor may send you a 1099 form for the amount that was forgiven or canceled.

If this does happen, keep in mind that you’ll need to add this to your filing for the year.

But, it does not happen all the time.

So, be aware that it might happen and keep your eyes out for that 1099.

Get Everything in Writing

While it’s a tiny last step, it is a huge one. Make 100% sure that once you agree to a settlement with your creditor, that you get it in writing.

Request a copy of the settlement offer for yourself. This will be a detailed document.

Once you have the agreement in writing, you should make the payment(s), and be done.

Remember how the first thing we did was validate the debt?

Well, let’s say a collection agency approaches you 3 years from now. They tell you that they’ve bought your debt and you now owe them the outstanding balance on the card you know you paid.

When that happens, it can be a huge headache.

But by having the supporting documents, you’ll be able to quickly rectify the situation. If you don’t have any proof of your settlement, you’ll have to start from square one all over again.

It’s so simple to avoid this, so make sure you get the settlement in writing.

Conclusion

Learning how to negotiate your own credit card settlement can be a bit stressful and confusing in the beginning.

We hope you’ll take the steps we’ve given you and use them to start your own credit card negotiations. The more you do it, the better you’ll get at it. So get yourself organized and get started.

Remember that if you do get too overwhelmed, there are reputable debt settlement companies out there who can assist you.

How low were you able to negotiate your first settlement? Let us know in the comments!

Leave a Reply