So, you’ve found yourself drowning in debt?

You aren’t the first person, and you won’t be the last.

We live in a society where we often feel we need to have the latest gadget, the newest car and the biggest house. This leads to debt.

Being in debt is never easy. Illness, job layoffs, and divorce are just some of the life events that can lead to debt.

That means we all need to think about how to get back on track.

Here are 10 ways to help you get back on track and be debt-free.

We’ll cover:

- Cut Up Your Credit Cards

- List All Your Debts

- Make A Budget

- Cut Out All Unnecessary Purchases

- Find A Repayment Strategy That Works For You

- Pay More Than Minimum

- Ask Your Creditors For Help

- Consider Debt Consolidation

- Think About Debt Settlement

- Consider Bankruptcy As A Last Resort

1. Cut Up Your Credit Cards

If you have credit cards, you’ll use them. Identify one credit card for emergency use then cut the rest up.

The last thing you want to do is add more debt.

Find the card to keep by doing this:

- Check rates – check the interest rates on your cards and find the lowest one.

- Review perks – if cards have similar rates, check out bonuses like cash back.

- Check due date – if one card has a more convenient due date and the rates and perks are the same, keep that one.

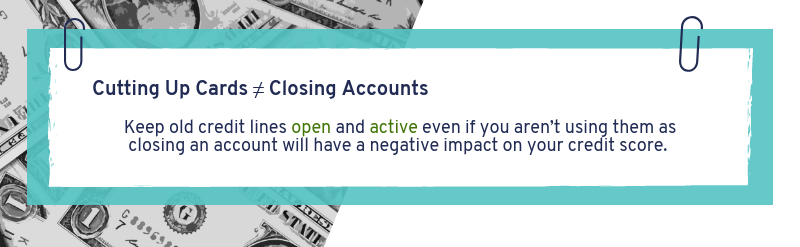

It is usually not a good idea to close your credit accounts. Keeping the accounts open can help improve your credit score if you are making regular payments.

2. List All Your Debts

Make a list of everyone you owe money. Make a note of all your balances. This list will help you create a strategy to pay off your debts.

Before you get started, make sure you download your free credit report. This will help you make sure you have not missed any of your debts.

Now comes the hard part:

- Add up all debt

- Decide how long you want to take to pay it off

- Divide all debt by the length of time to pay

Before you decide how long you want to take to pay off your debt, you’ll have to figure out how much you can afford to spend on reducing your debt every month.

Your total will probably make you feel bad initially, but remember, the overall goal is to prevent things from getting worse.

Even if you didn’t realize you were drowning in debt, this is a good exercise for everyone.

3. Make A Budget

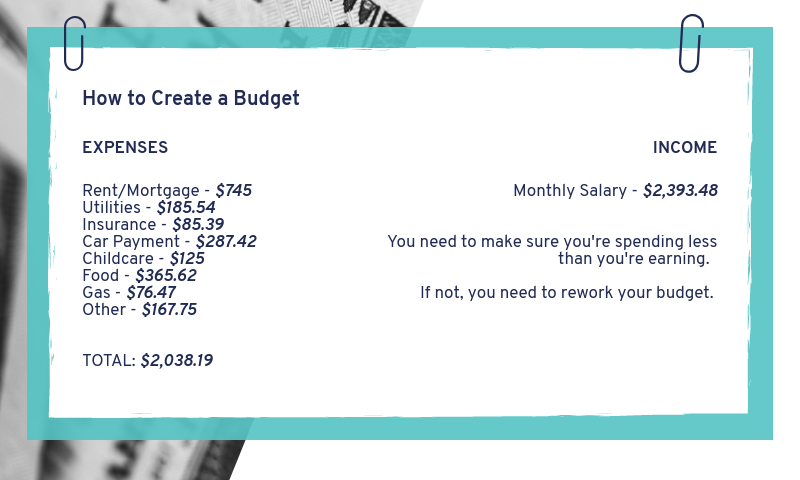

None of us has unlimited money every week or month. Before you decide how much you can use to pay down debt, you must know how much you have available.

First, write down how much money you are bringing home. Then you need to know how much you already spend.

Write down and add up these common expenses:

- Home expenses – rent, electric, and heat payments should be listed. Since electric and heat are often variable, gather the documents for a whole year and divide the total payments by 12.

- Auto expenses – car payments, auto insurance, repair costs should be counted as should gas. Figure out your total repairs and gas expenses and divide them by 12 since your car payments and insurance payments should be fixed.

- Necessity expenses – groceries, telephone, and clothing expenses should be calculated as well. Once again, take an estimate of what you spend over the year and divide by 12 to get a monthly payment.

- Other expenses – cable bills, internet service, health insurance premiums or co-payments, and other bills should also be listed as a monthly expense.

When you’re making less than you’re spending it’s a recipe for disaster. This means you’re only going to get further in debt.

Make a realistic budget that you know you can stick with. Once you do, use any extra money to reduce debt.

4. Cut Out All Unnecessary Purchases

You’re in debt because you spend too much. The best thing you can do is find out where you’re spending money.

Ask yourself these questions:

- Are you stopping at Starbucks on the way to work for coffee?

- Do you grab a soda or snack on the way home from work?

- Are you eating dinner or lunch out every day or most days?

If you answered yes to any of these questions, you should be able to cut some of these expenses.

These little purchases add up fast and they’re not necessary. Yes, it’s nice to be able to splurge occasionally, but not at the risk of more debt.

You should be able to cut out some of these expenses. Use the money you save to pay down your debt. This will help you get back on track faster.

You may also want to think about putting the money you save in an emergency fund so you do not need a credit card for emergencies.

5. Find A Repayment Strategy That Works For You

Everyone is different and that applies to paying down debt. You must find out what works best for you to eliminate your debt.

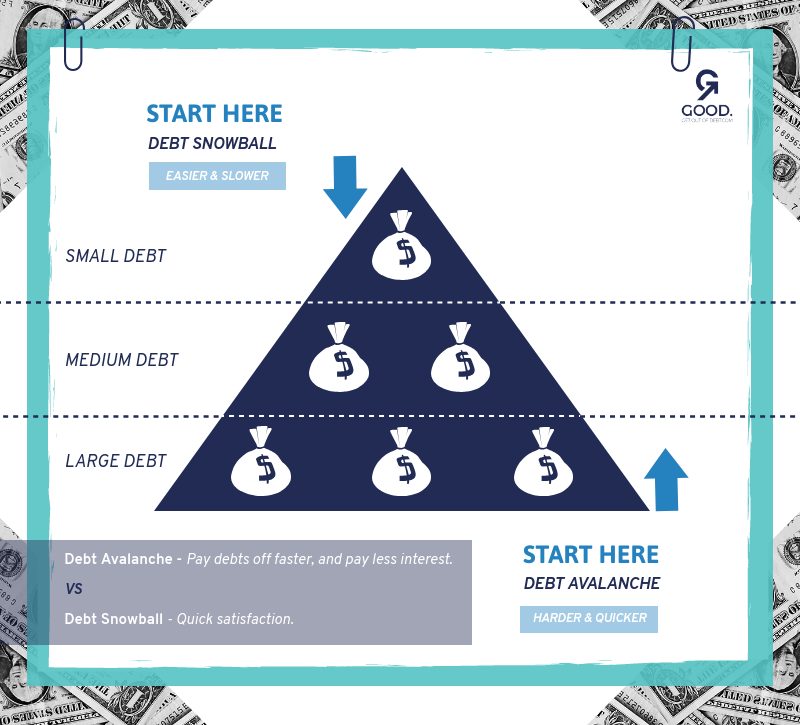

Here’s some options:

- Smallest balance – take your lowest balance and pay that debt off first and move to the next one in line. This is often referred to as the Debt Snowball method.

- High interest – reduce the amount you’ll pay over time by paying off your highest rate debts soonest. This is often referred to as the Debt Avalanche method.

- Combination payments – pick one of each and pay on them every month.

Keep in mind, you’ll probably have to pay your minimum payments on all your accounts every month to keep from damaging your credit.

Once you’ve found a strategy that works for you, make sure you don’t lose sight of what you’re doing.

It doesn’t hurt to review your strategy from time to time to see if you’re really doing what’s best.

6. Pay More Than Minimum

Paying only the minimum every month means more interest in the long run.

You can avoid feeling like you’re getting buried by paying more than your minimum payment every month.

Even if you can’t pay double your minimum, pay what you can as it will help reduce the debt faster, over less time. Even a few extra dollars every month can make a difference.

You can also consider making two payments a month.

If you currently have a minimum payment of $25 try making two payments of $25 every month and you may be surprised at how fast you can get your balance down to zero.

Another thing you may not have considered is splitting your payments.

Let’s assume for a minute your minimum payment is $25. Instead of sending one payment of $25 every month, send $12.50 every two weeks.

Over the course of one year, instead of making 12 payments, you’ll have made 13. This means you’re paying your debt faster.

You’ll have to check the calendar to make sure your minimum payment is on time to make sure you aren’t charged a late fee.

Want to save money while living on a tight #budget? It’s possible! Here’s how: https://t.co/P2jwXdkDxo #debtfree #financialfreedom #moneymatters #debt #tips #GOOD pic.twitter.com/gY5eouB9rM

— Get Out of Debt (@getoutofdebtcom) April 17, 2018

7. Ask Your Creditors For Help

Creditors don’t like to have customers in default.

While a creditor is under no obligation to make payment arrangements with you, many of them do. You must take the first step and call them.

Explain your situation, make an offer and see what they say. Consider making an offer of less than what you know you can pay. In some cases, they may be willing to accept an offer close to what you can pay, and you can negotiate up.

Remember, creditors usually prefer dealing with debtors than collection agencies.

If you have debts held by collection agencies, call them immediately. Ask about payment arrangements for the debt or try to reach a lump-sum settlement.

Again, offer less than you know you can afford in case they ask for more. Make sure you know the maximum you can pay before calling.

Most creditors are reasonable if you reach out to them and tell them what your issues are. They would rather work with you than lose you as a customer, or have their debt remain unpaid.

Remember, it costs a company money to chase non-paying customers. If you call them before things get out of hand, you stand a better chance of reaching an agreement.

8. Consider Debt Consolidation

Does one monthly payment at one interest rate sound appealing? If it does, then you may want to think about debt consolidation to get back on track.

If you’re drowning in debt, debt consolidation might be a great option.

- What is debt consolidation? – consolidation is taking out a single loan to pay down multiple loans.

- What are the benefits of consolidation? – you’re making one monthly payment at the same interest rate. You will know every month how much you need to spend to get out of debt. No more worrying about minimum payments on different credit cards.

- When is consolidation a good option? – if you feel like you’re drowning in debt and aren’t making progress lowering your principal balances, this may be a good option.

Debt consolidation isn’t right for everyone. It is one option to explore to get out of debt faster.

While you may initially see a drop in your credit score, over time, your score will increase if you use a debt consolidation loan.

Debt consolidation also may result in additional fees up front including application fees. Explore all your options.

Here’s a comprehensive guide on how to do #debt consolidation. Read here to learn more: https://t.co/eR8ph6uDjG#money #loan #finances #moneymatters #financialfreedom #financialliteracy pic.twitter.com/AxrjTm3iWv

— Get Out of Debt (@getoutofdebtcom) May 25, 2018

9. Think About Debt Settlement

Does paying half, or less than what you owe in total sound good? One of the most overlooked options you may have is debt settlement. A reason this is overlooked is most people do not know this option exists.

While you may attempt a credit card settlement on your own, it’s generally a good idea to work with a debt settlement company.

- What does a debt settlement company do? – The company you hire will contact your creditors and try to negotiate an affordable settlement. If you have debts held by a collection agency they will contact them too.

- What is the goal of a debt settlement company? – The goal is simple: settle your debt so you are paying back less. The final goal is to make a deal where you pay less than what you owe — this amount could be 50 percent to 70 percent of your total debt.

- What should I look for in a debt settlement company? – Consumers should work with a debt settlement company with a good reputation. Find out what fees they charge, whether they operate legally in your state, and how long their plan will take to final settlement.

Do your homework and don’t deal with a company who makes unusual requests or demands high upfront fees without offering you a solid plan to settle your debt. Carefully research debt settlement company options before deciding.

10. Consider Bankruptcy As A Last Resort

Sometimes no matter what you do, you can’t seem to find a way to pay off your debt.

If you have reviewed all options carefully, and you’re still not able to find a solution, bankruptcy may be your final option.

It’s important to remember bankruptcy will result in a mark against your credit for a period of up to 10 years. You need to understand if you’re drowning in debt how bankruptcy works.

There are two types of bankruptcy which may be considered:

- Chapter 7 bankruptcy – Chapter 7 allows debtors to get a fresh start. You file your paperwork with the court, generally with the help of an attorney. If your wages are being held back because of debt, this will stop. If you are facing eviction or foreclosure, this process will also stop. When your bankruptcy is approved by the court, credit card debt, and other eligible debts will go away. This is called a “discharge”.

- Chapter 13 bankruptcy – Chapter 13 is also called “wage earners” bankruptcy. A plan is put in place with the court to repay your debt over a period of up to five years. Under the plan, you may a fixed amount to the bankruptcy trustee every month and they pay your creditors. At the end of the plan, most of the debt you have remaining will be cancelled.

Bankruptcy is a legal process which should be used only when no other option works.

Back child support, most back taxes, and student loans are not cancelled in bankruptcy proceedings.

There are other restrictions which you should discuss with a qualified bankruptcy attorney. It isn’t a good idea to attempt filing bankruptcy on your own.

Conclusion

Ignoring your debt won’t make it go away, in fact it could make things worse.

There are different reasons why people find themselves drowning in debt but having a plan to get back on track is important.

You shouldn’t feel like you’ve failed because you are in debt. The important thing is you’re taking steps to resolve your debt and get back on track.

Instead of letting debt take over your life, explore the 10 ways to help you get back on track.

What tips and tricks have you used to help reduce your total debt? Let us know in the comments!

Leave a Reply