Does debt-free living seem unrealistic? Many Americans think so.

As of July 2018, consumer debt in America totaled $3.918 trillion, including both non-revolving and revolving debt.

That means the average family owes more than $7,000 in credit card debt in addition to their mortgage, auto loans, student loans and other secured lines of credit.

While trying to climb out from the burden of debt is a common problem, one study found that most Americans feel ashamed to admit how much debt they really have, and 70% feel more of a stigma from credit card debt.

Stop feeling ashamed and take decisive action to attain debt-free living.

Is freedom from debt possible?

Absolutely. Here are 37 tips to get you there.

1. Stop adding more debt

The first step to gaining control is to stop adding more debt.

Many consumers find themselves in the vicious cycle of sending so much of their income to creditors that nothing is left for their basic needs, prompting them to charge again.

It’s a vicious cycle that doesn’t end unless you simply stop charging.

2. Cut up your credit cards

A debt-free life will never be a reality as long as you have easy access to credit cards.

Sound crazy?

Not really. A recent Bankrate survey found that 63 percent of millennials (ages 18 to 29) are saying ‘no’ to credit cards.

3. Pay with cash

Cash just feels differently when it’s leaving your hand.

Research shows paying with cash really does make you spend less.

So set your budget and then withdraw the cash to use. By paying with cash, you’ll be able to visually see the money leaving your pocket.

4. Know how much you owe

“Knowledge is power” is definitely true when you are on the road to being debt free.

Log into your accounts or gather your paper statements, and start a spreadsheet, handwritten notebook or personal finance app (there are a lot of free ones available).

Record your balances, interest rate, minimum monthly payment and the lender’s name.

If you have a lot of accounts, it’s a good idea to order a copy of your credit report from AnnualCreditReport.com to make sure you haven’t missed any. It’s free once a year.

Want to save money while living on a tight #budget? It’s possible! Here’s how: https://t.co/P2jwXdkDxo #debtfree #financialfreedom #moneymatters #debt #tips #GOOD pic.twitter.com/gY5eouB9rM

— Get Out of Debt (@getoutofdebtcom) April 17, 2018

5. Visualize being debt free

Don’t underestimate the power of a dream.

Think about all the freedom you will have once you are debt free, freedom from anxiety, a better quality of life and the ability to move onto lifelong goals that may have been out of reach before.

Visualize your goal to be debt free.

6. Set goals to be debt free

“Setting goals is the first step to turning the invisible into the visible,” stated life coach Tony Robbins.

For most, being debt free is a long term goal.

Stay motivated by setting smaller goals along the way. This will make the plan more realistic and attainable.

Determine a reasonable amount you can pay each month, and how long it will take you to pay off your debt completely.

Mark where you should be at the end of six months, one year, two years and so forth.

Accomplishing each milestone will keep you motivated.

7. Find the right budget for you

Everyone has different priorities. Work out a budget that eliminates non-essentials for your family.

It might be reducing the times you eat out or how many stops you make at Starbucks each week. Reduce your clothing budget by shopping at consignment stores. Find free entertainment. Look at free events in your area, or discount tickets to shows offered through the school system.

Don’t eliminate everything fun. Just find less costly alternatives.

8. Cut all costs you can

Are there expenses you can simply get rid of?

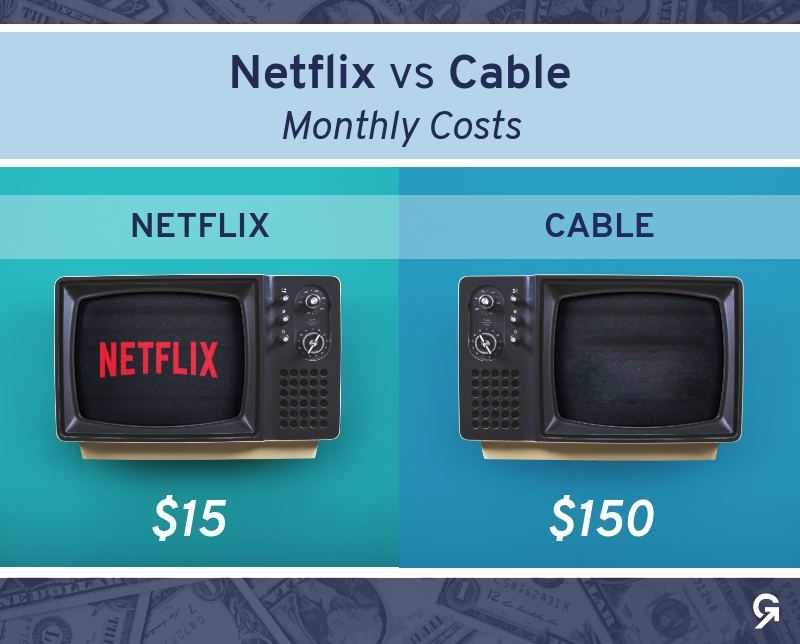

Is cable television essential? Opt for less costly Internet streaming options.

What about that gym membership? Opt for free alternatives, like going for a jog outside.

Remember every little $10, $20, $30 adds up.

9. Use the envelope system

Put cash in an envelope labeled for each category of expenses.

For example, you might have an envelope for groceries, gas, clothing and miscellaneous. Use those envelopes only for what they are labeled for.

This system helps you stick to your budget.

10. Start an emergency fund

An emergency fund will help you avoid reaching for your credit card when unexpected expenses come up.

Before you prioritize your debt, save up at least $1,000. That will ensure you have enough to cover most home repairs and an auto insurance deductible if you get in an accident.

11. Use free budgeting tools online

Take advantage of online tools, many of which are free.

They allow you to track your budget, bills and transactions all in one convenient place. Many offer phone apps, so you can input data on-the-go.

Microsoft also offers free excel spreadsheets that are already formatted for tracking your budget and your debt.

Manage your #finances better with these 15 apps & tools that will help you stay debt-free. https://t.co/IcdoefmrX5#money #debt #loan #moneymatters #moneymoves pic.twitter.com/b4QX3IIeAw

— Get Out of Debt (@getoutofdebtcom) May 3, 2018

12. Sell stuff you don’t need

Think carefully about things you don’t need, especially big ticket items, such as that extra car, motorcycle or ski equipment that hasn’t been used in five years.

Sell items online to make some extra cash.

This is especially important if you are renting a storage unit to house all those non-essentials. If you are paying an average $150/month for a storage unit, that’s $1,800 a year.

Think carefully about what you need to keep.

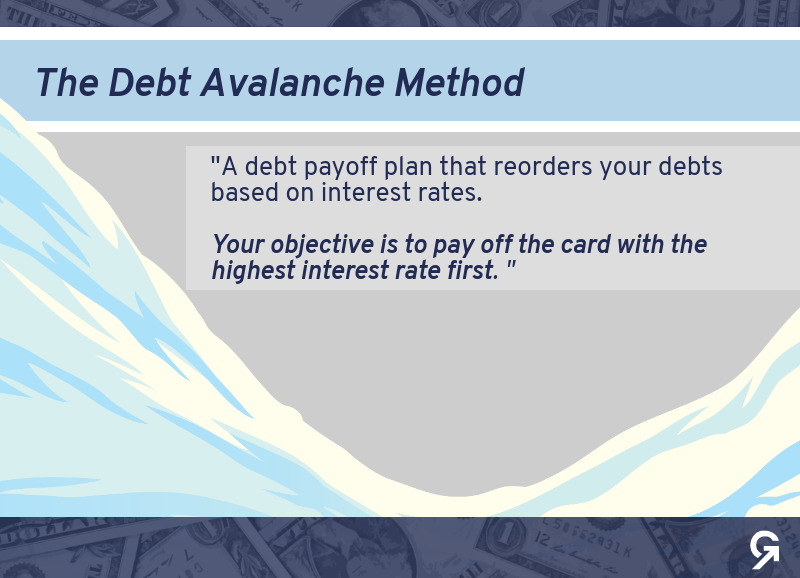

13. Prioritize your debt

Strategize about what needs to be paid off first. Higher interest cards should be your priority.

The quicker those balances are gone, the quicker your debt will go down.

High interest cards or loans will cost you more over time. Get rid of them!

14. Pay off debt one-at-a-time

Trying to pay off a bunch of debts is overwhelming. Tackle them one-at-a-time.

You might choose to start with the smallest balances. These will get paid quicker, simplifying your monthly budget.

Additionally, you’ll realize the self-satisfaction that comes with paying off a debt quicker, giving you added motivation to keep going.

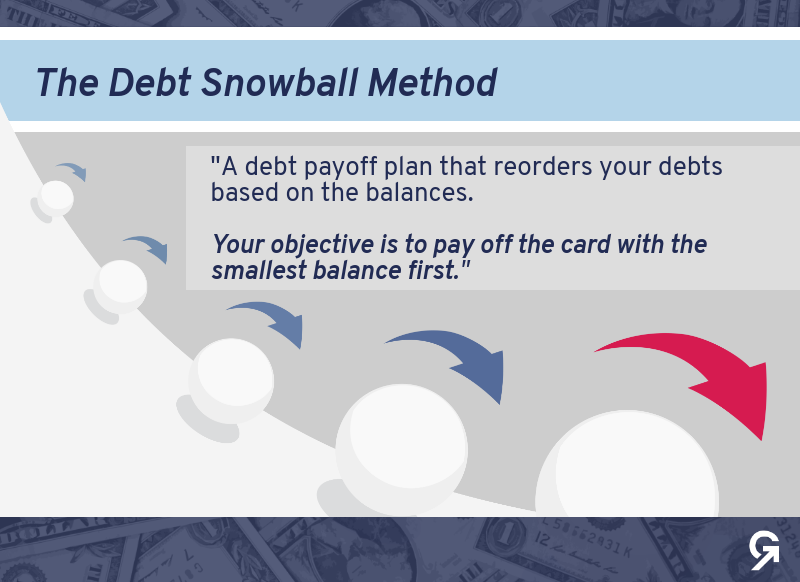

15. Use the “debt snowball” method

“Debt snowball” is a one-at-a-time method that gives you the satisfaction of seeing your debt melt away.

Simply write down your debts from smallest to largest, disregarding interest rates.

Make minimum payments on everything, sending any extra money to the smallest debt until it’s paid.

When it is, repeat the process moving on to the next smallest debt. The money you put toward your principal snowballs each month, getting larger as you pay off debts.

16. Find ways to make extra money

Even people with full-time jobs often find time to crash and watch hours of TV at night. How about putting those hours to good use.

Many companies pay users to test websites, take surveys, or do freelance writing and data entry.

Just a few extra hours a week could give you enough cash to give your payoff plan a boost.

17. Find free entertainment

Communities are overflowing with free entertainment.

In addition to just getting out and enjoying the great outdoors, many cities host monthly art fairs, movies in the park, free concerts and numerous other festivals throughout the year.

Instead of bowling, paying high fees to ride go-carts, playing mini-golf or going to the movies, spend quality family time doing things that don’t cost so much.

18. Ask for a raise

Don’t be afraid to ask for more money. Even a small raise adds up.

Think strategically before you ask for a raise, though.

Volunteer for added responsibility. Have a good attitude about feedback and make improvements. Take advantage of free training.

Your manager will be more likely to grant your request if you are adding value to the team.

19. Ask creditors for help

Don’t view creditors as the enemy.

Talk candidly about your situation, especially if you can prove financial hardship.

Creditors will often waive interest rates temporarily if you are unemployed or experienced an unexpected medical bill.

However, reach out when you are still in good standing, not after several months of missed payments. Tell the creditor you would like help managing your debt.

20. Ask for an interest rate reduction

All they can say is ‘no,’ right? And, many times it will be ‘yes.’

If you have a good history of paying bills, it’s likely your creditor will work with you.

Negotiating interest rates is pretty commonplace. Just ask.

Lowering your interest rate can save you thousands over the course of your debt payment plan.

21. Shop with a grocery list

Grocery stores are set up as huge marketing experiments.

Don’t fall for all the cool stuff at the end caps. Make a list, and stick to it.

Many local stores now offer a service that allows you to order online and pick up your groceries at curbside. This is a great way to stick to your list.

22. Start couponing

“Extreme couponing” is a buzzword that has turned many away from the practice. It implies something that requires a massive amount of time. It doesn’t have to be that way, though.

Pick one store. Learn their coupon offerings, weekly special cycle and policies.

Many stores offer simple apps that allow you to pick your coupons, and just input one code at check-out. No clipping, organizing or remembering to bring your coupons.

23. Pay bills on time

As you can see, payment history accounts for 35% of your credit score.

That makes it the most important factors that goes into your credit score. Do whatever you need to do to pay on time, even if it’s only the minimum payment.

Maintaining your credit score is critical to keeping expenses down, not just for getting future loans.

For example, your car insurance company will run your credit as part of their formula to determine your rate.

24. Use all extra cash for paying off debt

It’s exhausting to be on a tight budget.

When extra money comes, it’s tempting to buy that new furniture you’ve been wanting or to take a trip.

However, the faster you can pay off your debt, the faster you can start living a debt-free life.

25. Refinance to a lower APR card

Find a zero percent or low interest offer for those high interest cards.

This will give you an opportunity to pay down your balances, without interest accruing in the meantime.

Note that the interest rate usually increases after a certain time period, so try to pay it off before the introductory rate runs out.

Check out our 9 Best 0% APR Credit Card Offers

26. Refinance your high interest debt

If your credit is good and you have a regular job, you could qualify for a low-interest loan to replace all those high interest cards.

By doing this, you’ll save on interest and only have to keep track of one monthly payment.

27. Refinance your mortgage

Even one percentage point on your mortgage interest can save you $50 to $100 per month, putting more cash in your pocket.

Find a mortgage calculator online to find out just how much you could save by reducing your interest rate.

28. Pay more than the minimum payment

By law, creditors are required to print on your statement how long it will take you to pay off the balance making only minimum payments.

For example, if your balance is $15,000 and you pay 15% interest, and you are making a minimum monthly payment of $625, it will take you more than 13 years to pay it off.

Minimum payments are fine for the snowball method, but you should always have one balance that you are paying more on.

29. Cut out the impulse purchases

Five out of six Americans admit they make impulse purchases.

Apply number 21.

Make a list and stick to it.

30. Track your expenses

“Ignorance is bliss” is not a good motto for budgeting.

Use software or a phone app to categorize your expenses.

This not only lets you know exactly how much money you have available in your checking account, but it allows you to easily spot areas that need improvement.

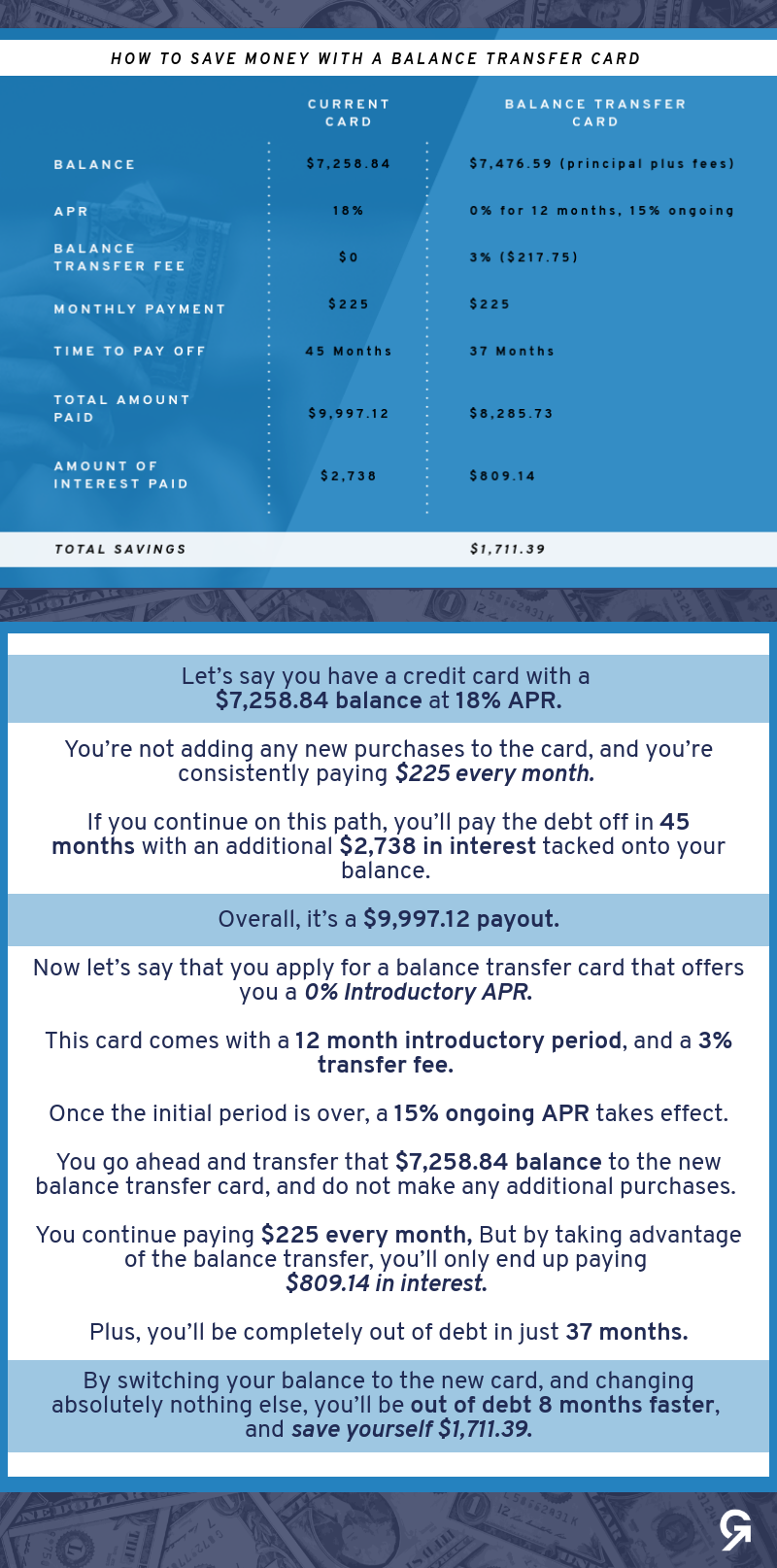

31. Make a credit card balance transfer

If you can’t get your credit card company to lower your interest rate, consider transferring the balance to a card with a low or zero percent introductory rate.

You may have to pay a balance transfer fee, but in the long run you’ll save on interest.

Here’s an example of how a balance transfer card can save you money:

Check out our 5 Best Balance Transfer Cards

32. Automate your debt payments

It takes a lot of discipline to go beyond minimum payments on a regular basis.

Determine the amount you can pay and set it up to automatically come out of your checking account.

That way there’s no decision. It’s done.

33. Learn to say ‘no’

This means saying no to yourself, friends and family. That means no to extra “things” and recreation.

Explain to your children you are on a budget, and offer some alternative, free activities.

Don’t accept every invitation to an evening out with friends. Offer to host a pot luck at your home.

Get creative and think of ways to get social without spending a ton of cash.

34. Give up expensive hobbies

Golf, snowing skiing, boating, traveling the world.

These hobbies will just have to wait until you pay off your debt.

They are good things to visualize yourself doing (Number 5).

Sometimes, we #spend beyond what is necessary. So here are helpful #creditcard tips to lead you out of #debt! https://t.co/HUyKCNnUON #debtfree #financialfreedom #creditscore #moneymatters pic.twitter.com/GUz2EJzLMp

— Get Out of Debt (@getoutofdebtcom) April 29, 2018

35. Use your tax refund to pay down debt

Instead of planning a trip or splurging on a big-ticket item, use your refund to pay down your debt.

Enjoy the satisfaction of paying a big chunk at once, and getting out of debt faster.

36. Borrow from family and friends if you can

Keep it professional with a written agreement, and explain you don’t want the money for free.

Offer to pay a small interest rate. They’ll make money from the loan and you’ll get a much better rate than your credit card.

37. Consider debt consolidation or debt settlement

Debt settlement vs debt consolidation, which is best?

While there are fees that apply, debt consolidation is a good way to get all your debts under one loan, usually with a lower interest rate.

Debt settlement on the other hand, is an option if you are struggling to make minimum payments, or have suffered financial hardship (i.e. job loss, medical expenses, divorce).

Debt can cause emotional stress, tension within the family and damage to your quality of life.

One study found that people who struggle to pay off debts are more than twice as likely to experience depression, anxiety and other mental health issues.

Take decisive action to bring your debt under control, and improve your overall quality of life. Start on your path to debt free living today!

Which tip are you going to start with? Let us know in the comments!

Up Next: Drowning In Debt? Here’s 10 Ways to Get Back on Track

We will be putting many of these suggestions to use in 2019.