Whether your credit score is riding high in the 800’s or you’ve had a few challenges and it’s bouncing around 550, odds are that you’ve wondered how credit scores work and what you can do to fix yours.

If so, you’re far from alone.

Since your credit score covers many years, there isn’t a one-size-fits-all solution.

But there are plenty of quick and easy ways to get your credit score moving in the right direction. Some of them might surprise you.

That’s why we’ve put together 9 ways to improve your credit score.

Here’s what we’ll cover:

- Pay Down Credit Card Balances

- Manage Your Utilization Ratio

- Pay Your Bills On Time

- Consider Setting Up Auto-Pays

- Understand What Goes Into A Credit Score

- Keep Old Lines Of Credit Open

- Don’t Open Too Many New Accounts

- Shop Smart For Loans

- Request A Credit Report

- Top 9 Ways To Improve Your Credit Score Infographic

- Take Control And Achieve Your Goals

1. Pay Down Credit Card Balances

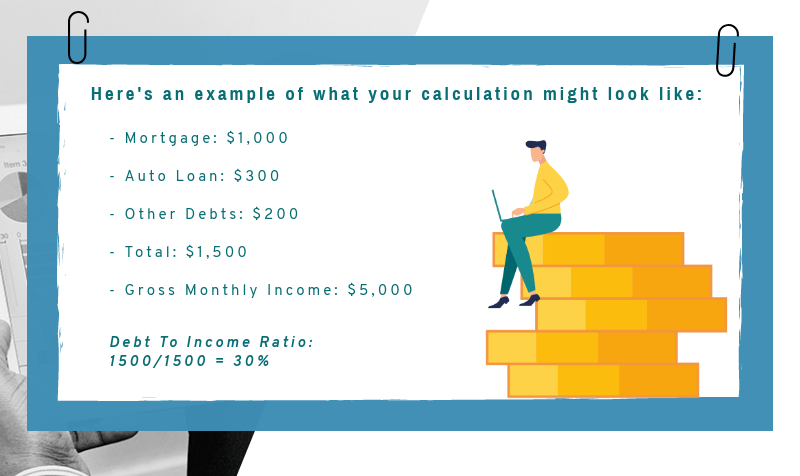

It’s important to understand the concept of a debt-to-income ratio. This is the percentage of your income that goes towards paying debts.

The higher your debt-to-income ratio is, the lower your score.

You can figure out your debt-to-income ratio by dividing your monthly debt payments by your gross monthly income.

Here’s an example to help you figure it out:

This affects your score because it shows lenders your ability to manage debt.

And what many people don’t stop to calculate is the full cost of maintaining a credit balance. Running a credit balance translates to interest charges, and American consumers pay nearly $100 billion in interest on credit cards per year.

“Pay down your balances, and keep those balances low,” Pamela Banks, senior policy counsel at Consumers Union, suggested.

2. Manage Your Utilization Ratio

Utilization ratio? Yep. It’s actually pretty simple.

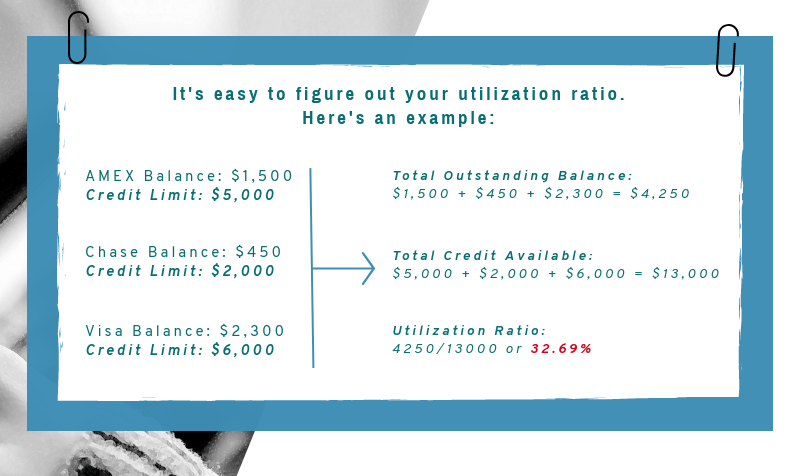

Your utilization ratio is the amount of credit you’re using on revolving accounts (e.g., credit cards) compared to the total amount of credit you have available.

Check out the image below to learn how to calculate your own utilization ratio:

Anthony Sprauve, spokesman and senior consumer credit specialist at FICO, recommended using only 30 percent of your available credit at any given time.

3. Pay Your Bills on Time

Obviously, making payments on time benefits your credit score. You’d think this goes without saying, but it doesn’t.

Payment history contributes to your credit score more than any other single factor.

If your bills are marked late by 30-60 days, your credit score could lower 60 to 110 points. And a payment of 90 days late will affect your score for up to 7 years.

To add fuel to the fire, you could receive a penalty APR, which can be as high as 29.99%. If you have a promotional 0% APR on a credit card, the rate could be forfeited and reset to the default.

According to an Urban Institute study mentioned in Forbes, over one third of Americans have been reported for nonpayment of a bill. Although most companies won’t send a bill to collections just because it’s a day or two late, they will use late payments as an excuse to raise your interest rate.

Pay bills on time every time.

4. Consider Setting Up Auto-Pays

This goes hand in hand with paying bills on time. Despite our best intentions, sometimes we forget – or life throws us a curveball – and before we know it, a bill is a few weeks late.

Automatic debiting ensures that your payment is always on time.

There are two ways to set up auto payments.

The first is through the website of your credit card company.

The second is through your bank’s website. Additionally, most banks and credit unions offer overdraft protection that will protect you from fees.

Experts also warn credit card holders to take the time to review bills, so you don’t lose track of them – or your spending.

5. Understand What Goes Into a Credit Score

Your credit score consists of way more than just whether you pay bills on time or whether you’ve filed for bankruptcy.

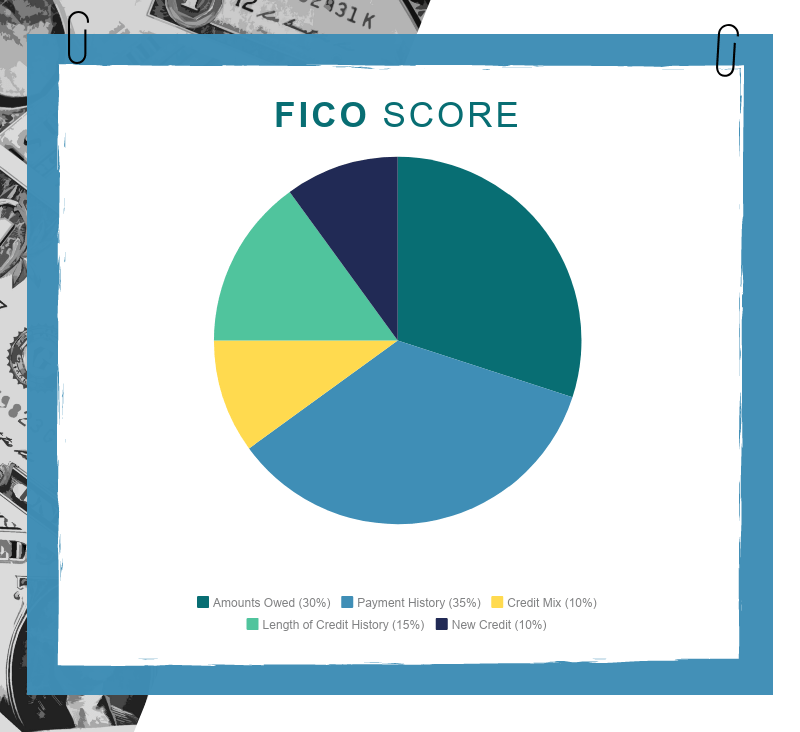

FICO publishes an easy-to-understand pie chart that breaks down all of the elements of your score:

Your credit scores is calculated based on:

- 35% = Your payment history

- 30% = The total amount of your debt

- 15% = The duration of your credit history

- 10% = Amount of ‘new credit’ accumulated

- 10% = The different types of credit you hold

But what goes into each of these?

Payment History: Your repayment history is the single most important factor of your credit score. Lenders use this information to predict your future behavior. Making consistent and timely payments proves that you can handle your finances.

Total Amount of Debt: How much debt do you currently have? Do you constantly max out your credit cards? Experts suggest that your debt should be 30% or less of your total credit limit. Over 30% suggests that you’ve spread yourself too thin, and cannot manage your debt in relation to your income.

Duration of Your Credit History: The duration of your credit history takes into consideration how long each account has been open, and if you have used them recently. A longer history provides proof of your long term financial behavior.

Amount of “New Credit” Accumulated: It look suspicious when you open too many lines of credit at once. This behavior indicates a financial struggle and desperation.

The Different Types of Credit you Hold: Your ability to repay a variety of debts demonstrates that you can handle different types of credit and makes you less of a risk in the eyes of a lender.

It’s important to know all the factors that go into your credit score.

As you can see, some factors are weighted more heavily than others. These are the areas where you should focus your efforts.

6. Keep Old Lines of Credit Open

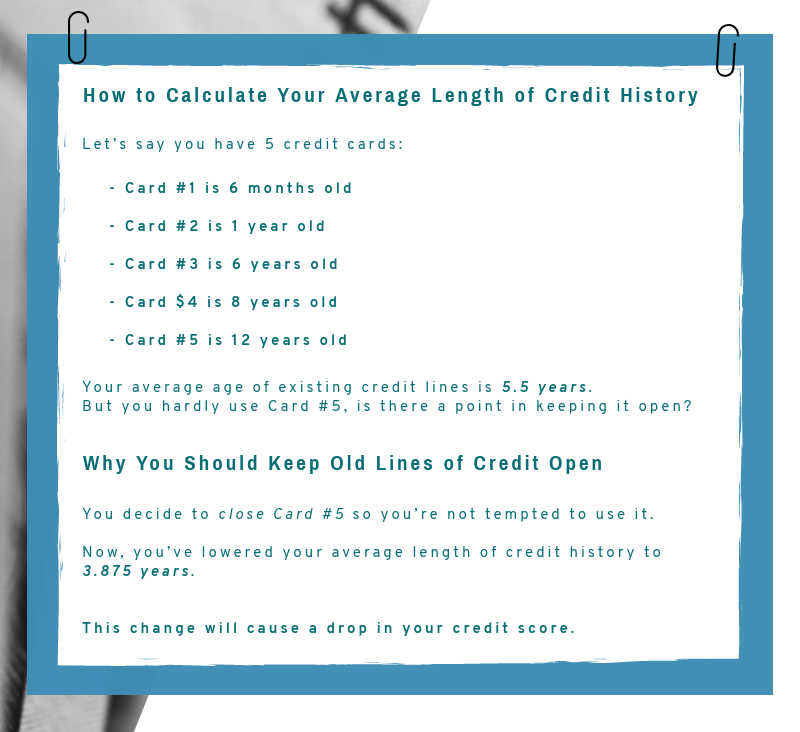

The classic tip of cutting up old credit cards and closing accounts is actually a terrible one.

According to FICO, one of the factors that creditors evaluate is the age of existing credit lines, so closing an old account will lower the average age of your available credit.

Closing multiple old accounts in a short period of time could end up harming you far more than it helps.

How? Check out the example below:

7. Don’t Open Too Many New Accounts

Just like closing an old account, opening a new account will lower the average age of your credit, according to FICO.

Don’t hesitate to open a new account if you need to build a credit history and will handle it responsibly, but understand there’s a risk in opening too many new accounts.

You can look at it this way:

Every time you open a new account, an inquiry is made on your credit. An inquiry is reported to your credit any time you go and apply for anything new. Whether it be a home loan, car loan, credit card, or even if your apartment complex runs your credit, that action shows up on your report.

Inquiries aren’t bad in themselves, but the problem occurs when you bunch many inquiries together.

Too many inquiries can be a sign of desperation.

For example:

Let’s say you have good credit and are looking to get the best credit card on the market. So you choose the Chase Sapphire Reserve card. You go to Chase and you apply, but for some reason you are turned down.

That one inquiry will have a very low impact on your score.

But let’s say then you go to American Express and get turned down, and then Bank of America, and then Citibank all within a few days of each other.

One inquiry turned into 4 within a few days. This shows desperation in your desire to obtain credit and lenders will assume your risk is higher.

So keep your inquiries low and don’t open too many accounts within a short time frame.

8. Shop Smart For Loans

Yes, you should shop smart everywhere, but particularly when it comes to a loan.

Searching for any type of loan – auto, mortgage, student, etc. – will show up on your credit report. Multiple inquiries can start to look bad and raise questions.

Fortunately, credit agencies will let it slide if the inquiries are all placed in a short period of time. They’ve learned to flag this as a search for a single loan rather than a search for multiple lines of credit.

So if you’re applying for a loan, don’t dilly-dally. Get all of your searches done in a short period of time and lock in the best rate.

9. Request a Credit Report

Everyone is entitled to one free annual credit report from each of the three major credit bureaus, so take advantage of it.

While looking over it can help you spot identity theft or outstanding charges you didn’t know were due, the reports can often be confusing – especially if you have a less-than-spotless history.

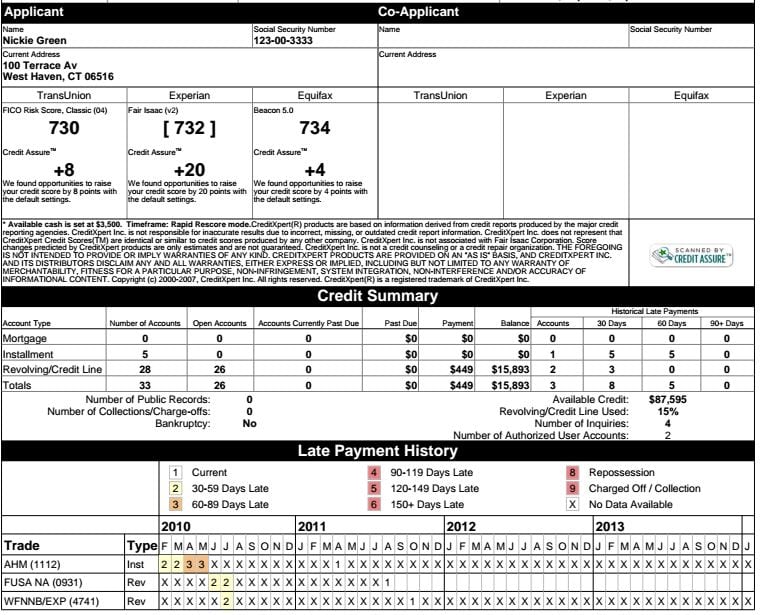

Take a look at the sample credit report below. Can you decipher what everything means?

Enlisting the help of an expert who can explain your credit score and credit history may be necessary.

Here’s 4 other resources you can use to pull your credit:

Identity IQ: Plans range from $6.99 to $29.99 a month, but all of them include some type of credit monitoring, alerts, and identity theft insurance. The Protect Max plan even includes $1,000,000 worth of identity theft insurance.

Identity Secure: Identity Secure offers a 30 day trial for $1. Included in this is a copy of your credit report from each of the 3 major bureaus. Additionally, you’ll have credit monitoring and even identity theft protection.

Freecreditreport.com: This website will give you a free copy of your Experian credit report. This includes updates every 30 days.

CreditKarma.com: Credit Karma has a lot of tools to help you understand and manage your score. You’ll be able to access your TransUnion and Equifax scores with weekly updates for free.

Most banking institutions now give you access to a copy of your credit score for free. Some will have the report on file but many banks give you the score. For example, CapitalOne uses their CreditWise to update consumers.

Take Control and Achieve Your Goals

With these tips, you can stop asking, “What can I do to improve my credit?”and start doing it.

Improving your credit is just like getting in shape – it can’t be done in a single day, but with consistent effort, you’ll amaze yourself.

Follow these 9 tips to help improve your credit score today.

How much have you been able to increase your credit score? Let us know in the comments!

Leave a Reply