You’ve probably heard of Goldman Sachs before. After all, they’re a well known American multinational investment bank and financial services company. Established over 150 years ago, they’re the 5th largest bank in the US with 36,000 employees.

Stemming from Goldman Sachs comes Marcus, an online platform that offers personal loans and savings accounts with better interest rates and less hassle.

In this Marcus by Goldman Sachs review, we will walk you through what Marcus has to offer as well as what you need to know in order to open an account with them.

We’ll talk about:

- What is Marcus by Goldman Sachs?

- Marcus Personal Loans

- Marcus Personal Loan Features & Rates

- How to Apply for a Marcus Personal Loan

- Marcus Online Savings Account

- Marcus Online Savings Account Features & Rates

- Marcus CDs

- How to Apply for a Marcus Online Savings Account or CD

- Who is Marcus for?

- Pros and Cons of Marcus by Goldman Sachs

What is Marcus by Goldman Sachs?

Marcus is an investment bank by Goldman Sachs that offers online savings accounts as well as personal loans.

Marcus offers three different products:

- Personal Loans

- Online Savings Accounts

- CD’s

Each product has its own unique features to it.

So let’s start with:

Marcus Personal Loans

Marcus offers unsecured personal loans for almost any purpose, but they are most typically used for home improvement or debt consolidation.

Here are all the options you’ll have to choose from when taking out a personal loan with Marcus:

- Debt Consolidation – This is an easy way to consolidate multiple unsecured debts so you’re left with one easy monthly payment. Plus, you’ll be paying less interest. If you’d like to see what your payment might be, you can check out their personal loan calculator.

- Home Improvement – You can take a home improvement loan to help cover the cost of renovations, which will help increase the value of your home.

- Wedding – The cost of a wedding can get pricey very quickly, but a personal loan could come in handy and allow you to throw the big wedding you couldn’t otherwise.

- Moving and Relocation – Moving expenses can be a huge hassle, not to mention the amount of stress it comes with. Getting a personal loan for the purpose of moving can give you peace of mind so you can relax.

- Vacation – Once in a while, a vacation is exactly what you need to unwind and relax. But, often times money stands in the way of this. If this is case, a personal loan for a vacation might be the right choice for you.

How much of your money are you saving? 🤷♂️

If you’re like most Americans, the answer is probably not enough.

Putting aside #money for your future is essential, but as many as 65% of Americans are #saving too little according to Bankrate.

👉 https://t.co/ga8d4cFSuT pic.twitter.com/LhM8cTTNnG

— Get Out of Debt (@getoutofdebtcom) January 17, 2019

Now that you’ve selected the purpose for which you’re taking out the loan, it’s time to check out the rates and features you should be expecting.

Marcus Personal Loan Features & Rates

- Loan Amount Limits: $3,500 – $40,000

- Typical APR: 5.99% – 28.99% (5.99% – 24.99% for NY residents)

- Loan Term: 3 – 6 Years

- After 12 consecutive monthly payments, borrower can choose to skip a payment without any fees attached to it.

- No Fees

- Funding Time: 1 – 4 Business Days

Requirements

- Soft credit check

- Score over 600

- Must be 18+ (19 in Alabama, and 21 in Mississippi and Puerto Rico)

- Valid US bank account

- Social Security Number or tax ID

How to Apply for a Marcus Personal Loan

All it takes is for you to fill out an application on the Marcus website.

Start by selecting the loan amount, then your preferred monthly payment, and reason you are applying for the loan, as illustrated below:

Then complete the following:

- First Name

- Middle Name

- Last Name

- Date of Birth

- Email Address

- Total Annual Income

- Monthly Housing Payment

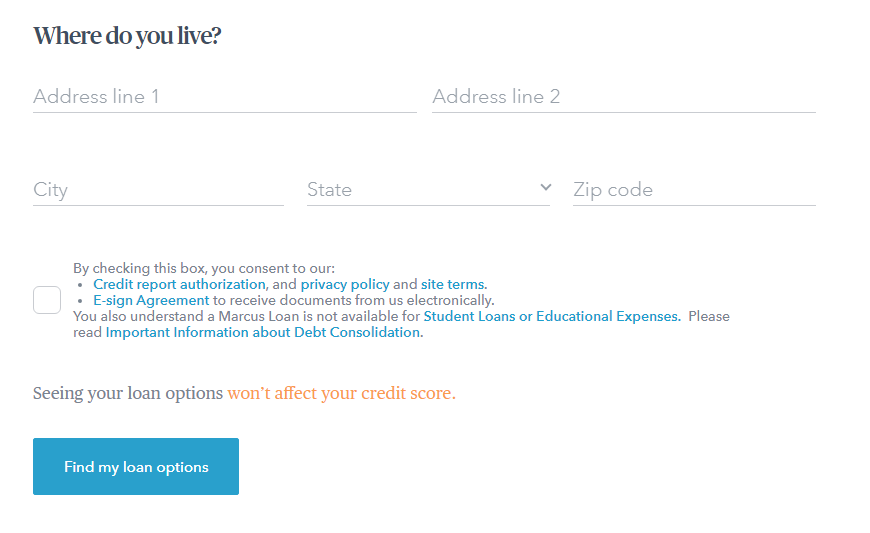

Now they need some information on where you live.

Complete the following with your address, then click on the check box and then click on Find my loan options

Once you do this, they’ll go ahead and do a soft credit check through TransUnion to see if you qualify for a loan.

After that’s complete, they’ll go over your options with you and you can decide if you’d like to move forward or not. It’s a really easy process and you’ll receive your money within 1 – 4 business days.

Marcus Online Savings Account

The Marcus Online Savings account pays significantly more than the national average. Plus, it comes with a competitive interest rate.

Marcus Online Savings Account Features & Rates

- No Minimum Balance Requirement

- No Monthly Account Maintenance Fee

- No Overdraft Fee

- No Wire Transfer Fee

- Earn 2.25% APY on balances over $1.00

- Ability to add 4 external accounts

Be aware that Marcus does not offer ATMs, so the best way to access your money will be through a wire transfer.

Based on what it shows, Marcus online saving account offers a good interest rate comparing it to other local banks.

Fact: The average #SocialSecurity check for a retired worker is $1,355 per month (as of Nov. 2016).

Is that enough for you to #retire comfortably?

If not, the time for you to start saving for retirement is NOW!

👉 https://t.co/4e43cK2W5D pic.twitter.com/sVKfd0JcJH— Get Out of Debt (@getoutofdebtcom) January 15, 2019

Marcus CDs

Marcus CDs offer competitive rates and not only that, they also have two options you can choose from. Both of these options will require a minimum deposit of $500.

Option One: High Yield CDs

Marcus has a high yield CD which requires you to leave money in your savings account for anywhere from 6 months up to 5 years.

Their APY rates are as follows:

- 1 year CD for 2.55%

- 3 year CD for 2.65%

- 5 year CD for 3.1%

If you decide to make an early withdrawal, you’ll receive a penalty on the highest paying CD based on the term of your CD:

You’ll receive the following interest:

- 90 days of interest if the withdrawal takes place in less than 12 months.

- 270 days of interest if the withdrawal takes place in 2 years to five years

- 365 days of interest if the withdrawal takes place in more than five years

Option Two: No Penalty CDs

The Marcus No Penalty CD is a liquid CD with a term of 13 months. This CD will only require you to keep your money there for 7 days after you open the account. If you decide not to continue, you will have total authority to remove it without penalty.

This allows you to have access to your money if an unexpected event were to happen to you and you need the money immediately. Or better yet, if you find a better interest rate somewhere else, allowing you to grow your money even more in less time.

This type of CD:

- Allows you to earn a 2.35% APY

With this type of CD you’re able to get a good return on your money, without having to worry about any penalties being attached to it.

How to Apply for a Marcus Online Savings Account or CD

When opening a Marcus Online Savings Account, 13 Month No Penalty CD, or 1 Year High Yield CD, you are going click on Open an Account

Once here, you’ll be asked to select the type of account you want to open.

You’ll need to choose from:

- Online Savings Account

- Certificate of Deposit

- No Penalty CD

If you select Certificate of Deposit you’ll be asked to select one of the following terms and APY:

- 6 month – 0.60% APY

- 9 month – 0.70% APY

- 12 month – 2.75% APY

- 18 month – 2.65%APY

- 24 month – 2.70% APY

- 3 year – 2.75% APY

- 4 year – 2.80% APY

- 5 year – 3.10% APY

- 6 year – 3.15% APY

As illustrated below:

Make sure to select what best suits your needs.

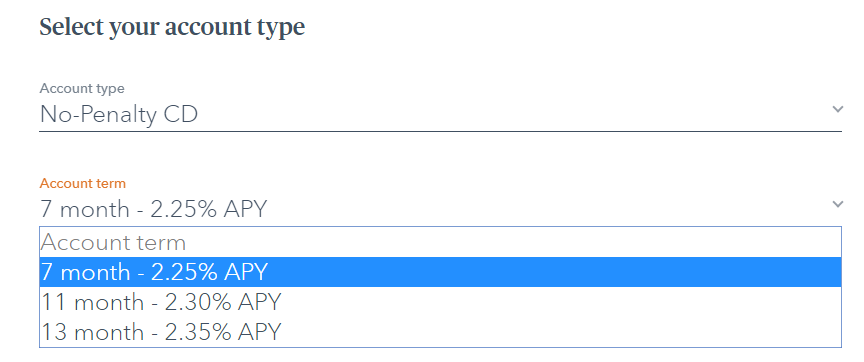

If instead you select ‘No Penalty CD’

You’ll have to also select from a dropdown list a term and APY from the following:

- 7 month – 2.25% APY

- 11 month – 2.30% APY

- 13 month – 2.35% APY

As illustrated below:

Make sure to select the option that best suits your needs.

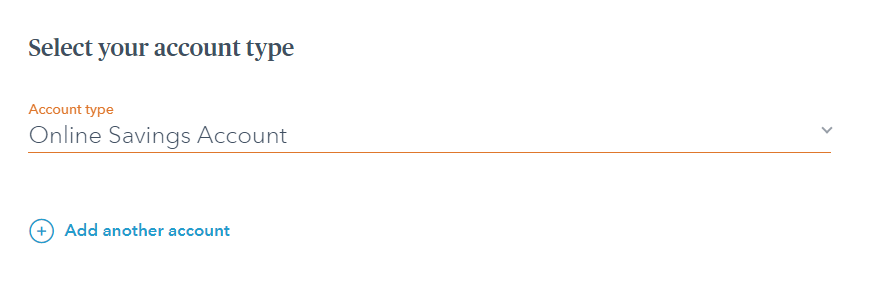

After you’ve selected one of the following you will be prompted to complete the same information you would if you were to open an Online Savings Account.

Before we move forward to the following step, also know that you are able to select more than one type of account, just by selecting Add another account as illustrated above.

Once you are finished selecting and adding all the accounts you would like to open, you’ll need to complete the following:

Personal Info:

- First name

- Middle name

- Last name

- Country of citizenship

- Social Security Number or Individual Tax ID

Then you will be asked your contact information:

- Physical address

- Apt/Suite

- City

- State

- Zip code

- Email address

- Primary phone number

- Alternative phone (optional)

Then you’ll be asked about employment information.

You’ll have to select one form the following:

- Full Time Employed

- Part Time Employed

- Self Employed

- Unemployed

- Retired

Each one of these will prompt you to other dropdown lists, so let’s explore your options:

If you select Full Time Employed:

You’ll be asked your occupation and your income range

Anytime you are asked to select your occupation, this is the dropdown list you will get:

There are a couple of options to choose from.

After selecting an occupation, you will be asked to select your income range.

You’ll need to select one of the following:

If you select Part Time Employed instead, you’ll be asked about the same two things, occupation and income range.

Same thing goes with Self Employed, they will ask you, your occupation and income range.

Now if instead you select Unemployed, you’ll need to select from a dropdown list, your primary source of wealth.

You’ll need to select from the following:

Your last option is Retired. if you select this, you’ll also have to choose your primary source of wealth from the following dropdown list.

Once this is done you’ll be asked to answer the following question:

Want to add a joint account owner? If you want to add someone to your account this is the time to do it.

You’ll select from:

- Yes, I want to add a joint account owner and confirm we’re both here to complete the application.

- No, not right now. To add a joint account owner later, call our Contact Center. (If you are opening a CD, you must call within 3 business days.)

Then you check on the box that states that you agree to the terms and policy and click continue as illustrated below:

Then you will be prompted to sign some additional documents before your account can be funded.

At this time, you’ll need to transfer money from another existing account you may have to the new account you are opening with Marcus by Goldman Sachs.

And that is all it takes to apply for either an Online Savings Account or a CD with Marcus.

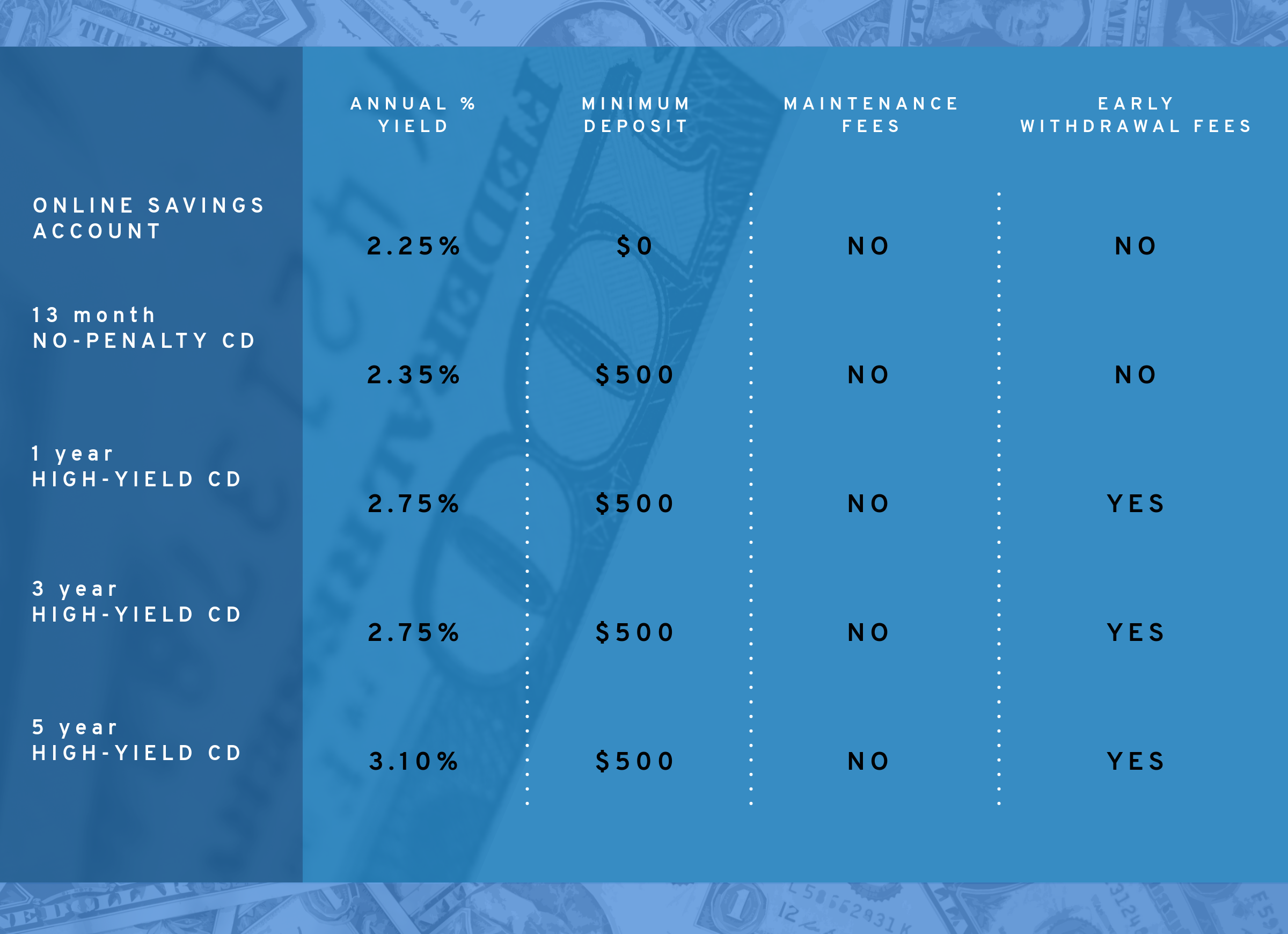

To make it easier for you, we’ve added the following image that will allow you to see what the Annual Percentage Yield, Minimum Deposit, Maintenance Fees, Early Withdrawal Fees for each account, Marcus offers:

Now that we mainly know what Marcus is, what they offer, their rates, their requirements, the question is…

Who is Marcus for?

Marcus by Goldman Sachs may be a good fit for people who are interested in competitive interest rates, who have a credit score in the range of good to excellent.

Marcus is for:

- Someone that wants an account free of any fees, where they could save money.

- Someone that doesn’t need a checking account and wants a good interest rate on a saving account.

- Someone that likes to move money quickly via wire transfer.

- Someone that is in the need of a personal loan that has a good to excellent credit score. (660 and above will have better odds for approval).

Pros and Cons of Marcus by Goldman Sachs

Let’s explore the pros and cons for Marcus by Goldman Sachs and see what we found:

Pros

Marcus by Goldman Sachs has a lot to offer you as they continue to add additional products to their line. The financial products that they have right now are strong competition for their competitors.

- Offer high APY rates on their saving and CD accounts

- No minimum balance required to open an account

- You can earn high interest rates even with just $1.00

- No maintenance fees

- Free wire transfers

Cons

Marcus by Goldman Sachs offers slightly less than other banks will.

- They don’t offer checking accounts

- They don’t offer ATM cards

- Limited access to mobile banking

- No dedicated app

Like with everything in life, there’s the good and the bad when it comes to Marcus by Goldman Sachs. You’ll have to evaluate the pros against the cons and see if it’s the right decision in your personal situation.

Conclusion

Based on this review we’ve done on Marcus by Goldman Sachs, we can say that the products offered are competitive within their market, and definitely worth looking into.

I don’t know about you, but I jump at any opportunity to make my money grow and Marcus by Goldman Sachs has products that’ll do just that. By making smart financial moves now, you’ll be able to enjoy yourself more later on.

Have you applied with Marcus by Goldman Sachs? Let us know in the comments!

Up Next: Wells Fargo Personal Loan Review

Leave a Reply