If you’re getting heckled with calls from creditors and receiving past due bills in the mail everyday, you’re probably ready to throw your hands up and scream.

You can see the interest increasing your balances every month, but you can’t afford to pay them down. Your credit score has started to drop, and you’re worried that this debt is going to negatively affect your future.

You’re at the point where you need to do something about your debt, and you need to do it now.

You’ve heard of people calling and negotiating with their creditors for a settlement on a past due account.

That sounds like something that would benefit you, but you freeze when you pick up the phone. Talking about your debt and financial situation over the phone to a stranger just isn’t something you’re comfortable doing.

Well, don’t fret. We’re here to tell you that there’s another way to negotiate a settlement with your creditor.

If you are unable or unwilling to make a call, you can send a debt settlement letter instead.

Follow the steps in this guide to write an effective and persuasive debt settlement letter to your creditors.

Here’s what we’ll cover:

- What is a debt settlement letter?

- Why write a debt settlement letter?

- Steps to prepare before writing

- Steps To Write A Debt Settlement Letter

- Include A Header

- Explain Your Hardship

- Include Debt Information

- Paint The Picture

- Request Credit Report Removal

- Reiterate Your Situation

- Request A Response

- Send As Certified Mail

- What To Expect After Sending A Debt Settlement Letter

What Is A Debt Settlement Letter?

A debt settlement letter will include any offers from the debtor to the creditor to settle their unpaid debt for less than is owed.

This letter will explain the debtor’s current financial situation and reason why the account is past due.

Why Write A Debt Settlement Letter?

Trying to negotiate your debt down is a smart move to make. It won’t affect your credit report for years like a bankruptcy will, and you’ll be able to dig yourself out of debt in a shorter amount of time.

Directly calling and negotiating a settlement over the phone is the most effective and efficient way to get the process completed. However, if you are uncomfortable talking about your situation and going back and forth with your creditor, a debt settlement letter is a great option for you.

A debt settlement letter will give you the opportunity to explain your hardship and give an offer to settle your debt, without any direct interaction with your creditor.

By sending the letter, you eliminate the possibility of your creditor interrupting you or catching you off guard with a question you are unsure of how to answer.

Steps To Prepare Before Writing

1. Validate The Debt

The first thing you need to do is gather all the information on your past due accounts. Look through your bills, and any other notices you may have received in the mail.

Compile a list of your debts and who currently holds them. If it’s been a while since you’ve paid on your accounts, you may be unsure of where to locate them.

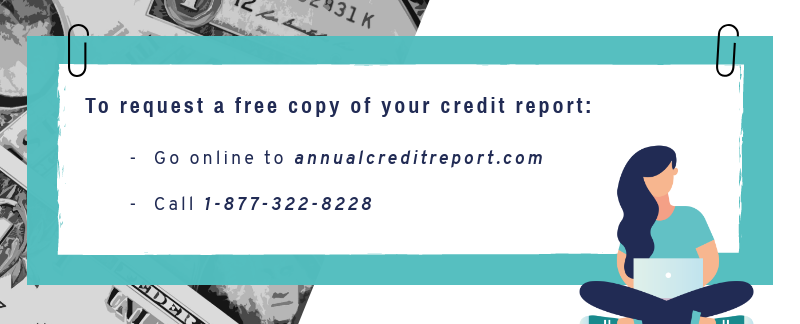

No worries, just request a free copy of your credit report. This will detail out any open credit lines or accounts.

You’re entitled to a free credit report each year from each of the three major credit bureaus, Experian, Equifax, and TransUnion.

Some of the accounts on your credit report might look different than you remember. It’s possible that your original creditor sold your debt to a collection agency who is now listed on your report.

By law, a debt collector must send you a notification that your debt has been sold. So, look out for any official notices that will tell you who now holds your account.

If you see a duplicate or unfamiliar trade line reporting on your credit, make sure to call and inquire about it.

Once you have organized a list of your accounts, the next step is to validate each individual debt with the corresponding creditor.

Remember, you only have to pay on a debt if it is validated. So make sure the company proves that to you.

If the company can validate the debt, then it is a collectible debt, and you do owe the balance.

However, if the company cannot validate your debt, they must cease collections and you can request to have the account removed from your credit profile.

At this point, you should have a list of your verified debts and who they are owed to.

2. Check The Statute Of Limitations

Once you have validated your debts, you’ll want to spend some time organizing all the information from your creditors.

List out your individual accounts, and be sure to include:

- Name of creditor

- Creditor’s phone number

- Amount owed

- Date on the account

Next, you’ll want to check if you’re within the statute of limitations to be sued for the debt or not. Each state has different rules, so do some research and pay close attention.

Check this chart out to find the statute of limitations for your state.

If your debt exceeds the statute of limitations, you have much better odds for a favorable settlement deal.

3. Choose Which Accounts To Settle

Now that you organized your debts and checked out the statute of limitations, start with your oldest account.

The older the debt, the easier it will be to settle. That makes your most aged account the easiest one to tackle first.

If it’s been a while since you’ve paid, your creditor might have given up hope on collecting this debt a long time ago. So anything you offer them now is an improvement over what they were expecting to get.

With your oldest debts first, list out the accounts that you’d like to settle.

4. Choose An Amount To Offer

Now it’s time to decide exactly how much money you can allocate towards your different accounts.

If you haven’t created a budget, now is the time to do so. You’ll need to know exactly how much money you’re putting aside every month to pay off your debt.

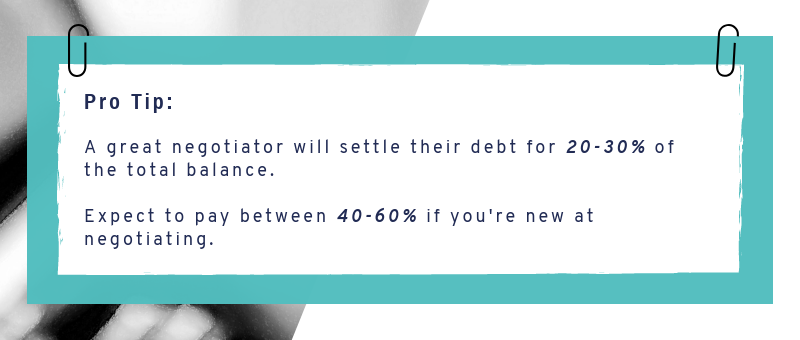

The negotiation process might take a little back and forth.

So whatever you do, do not put your best and final offer in your original letter. Put a low, yet reasonable, amount that is below your set budget.

You should expect your creditor to counter your offer, and meet somewhere in the middle. So, it’s important to leave yourself a little bit of wiggle room to work with.

With a plan of action in place, it’s time to start writing your letter.

Steps To Write A Debt Settlement Letter

1. Include A Header

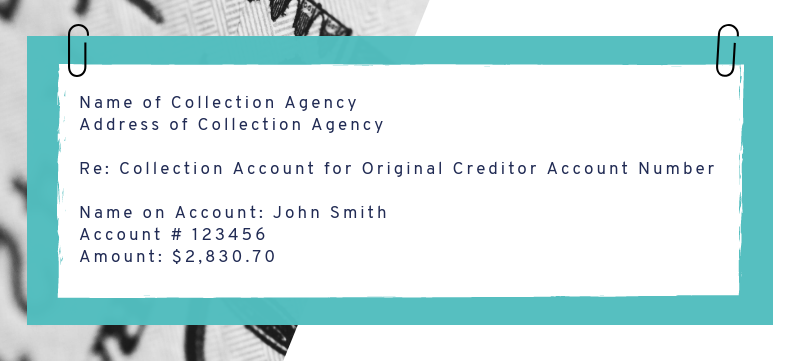

First things first, create an organized and legible header for your letter. This formality shows your professionalism and alerts the recipient to the prevalent account information they’ll need to proceed.

So what exactly goes into a header?

The first thing is to address the creditor, so you’ll want to include the creditor’s name and their address.

Next, you’ll want to provide the creditor with the name on the account, the account number, and the balance owed.

It should look a little something like this:

By structuring your letter this way, your creditor can easily see the account in question and the amount owed.

2. Explain Your Hardship

Start your letter off by introducing yourself and indicating the reason behind writing the letter. Tell your creditor about your situation and why you’ve been unable to pay the balance on your account.

The better your creditor understands your financial hardship, the more they may be willing to help you. So, don’t leave anything out.

Explain why times have been tough for you, and let them know that you’re trying to do the honorable thing by settling your debt to avoid bankruptcy.

3. Include Debt Information

After you’ve explained your circumstances, reiterate the amount that you owe, and give the creditor your initial settlement offer.

Remember that your initial offer is not your final offer. Start well below your budget, and leave room to negotiate with your creditor.

There’s 2 different ways to negotiate a settlement:

- Pay the settlement in full

- Pay monthly installments

You’re more likely to have a company accept a settlement offer if you are able to pay it upfront and in full. Creditors prefer this method because they’re guaranteed to get their money and it’s a done deal afterwards.

If you do not have a lump sum of money to offer, you can propose a settlement that includes a monthly installment. This way, you’ll make monthly payments until the debt has been cleared.

If you choose to go this route, lay the terms out in your letter. You’ll want to show the creditor how much you’ll be paying per month, and how long it’ll take to pay off.

Make sure these numbers fit within your budget, you don’t want to agree to a settlement you cannot pay.

4. Paint The Picture

So you’ve introduced yourself, explained your extenuating circumstances, and have offered a settlement amount.

Now what?

Paint the picture of your finances to your creditor.

Yes, they know that you’ve had struggles which have caused you to fall behind on your payments. But, do they know the full story?

This is your time to convince your creditor that you’re doing everything in your power to make good on your accounts. Show them how this one debt fits into your finances as a whole.

You shouldn’t have to sell a kidney to pay off a credit card balance. Be honest, yet persuasive enough to convince your lender you need help.

It doesn’t take much to manage your #finances even on a tight #budget. More tips on saving #money here: https://t.co/P2jwXdkDxo#getoutofdebt #debtfree #financialfreedom #moneymoves pic.twitter.com/2Y9FsJAUXL

— Get Out of Debt (@getoutofdebtcom) May 16, 2018

5. Request Credit Report Removal

Put in a request for your creditor to have this debt removed from your credit report after it is cleared. By doing this, you’ll remove a late account from your report and in return, increase your credit score.

Depending on the company, they may or may not agree to these terms. Don’t be alarmed if the company comes right back and gives you a hard no on this.

However, that does not mean the accounts have to stay on your credit report forever. You are able to contact the bureaus on your own and request the removal once you have proof that the debt is cleared.

6. Reiterate Your Situation

End your letter by reiterating your situation and the circumstances that caused you to end up here. Make sure your creditor knows that you’re doing everything in your power to settle the debt.

Let your creditor know that you are trying to avoid a bankruptcy and that this settlement offer represents your best efforts to make good on your unpaid balances.

7. Request A Response

What’s the point of taking the time to draft and send a letter without at least expecting a response?

Be sure to indicate in your letter that you’d like their decision in writing, whether it be an acceptance, refusal, or request for new terms.

8. Send As Certified Mail

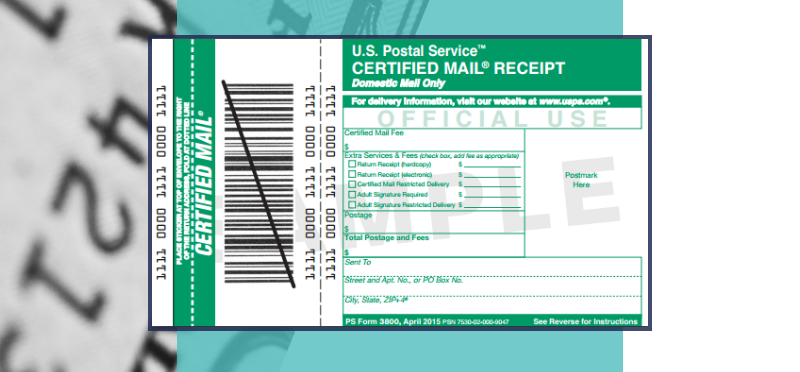

Now it’s time to sign, seal, and deliver your letter. But, you can’t hand deliver it, so how can you ensure it got there?

Take the extra time and money to send your letter via certified mail.

When you make this request at the post office, you will fill out the following form:

By doing this, you’ll be able to see when the letter is delivered. For your own protection, you’ll want to keep track of all interactions you have back and forth with your creditors.

So you’ve sent in the letter and saw that the company received it. What happens now?

What To Expect After Sending A Debt Settlement Letter

It will probably take around 2-3 weeks for you to hear back from your creditors. When they do reach out to you, it will be with one of the following outcomes:

- An acceptance

- A denial

- A request for new terms

- A negotiation request

Once you get their initial response, it’s just a matter of using your negotiation skills to go back and forth until you reach a settlement you can both agree on.

Conclusion

Making decisions when it comes to your finances is no joke, and a debt settlement letter is a great tool to help yourself get out of debt and on the road to financial freedom.

Following our step-by-step guide will ensure that your debt settlement letter has all the necessary elements to negotiate a lower settlement with your creditors.

Have you had success with a debt settlement letter? Let us know in the comments!

Up Next: 15 Debt Payoff Planner Apps & Tools

Leave a Reply