Want to build your credit, but not sure where to start?

It’s not as difficult as it may seem.

A lot of people are under the impression that building credit from scratch is hard to do. But the reality is that it’s not. It’s just a matter of knowing the right moves to make.

We’ll take you through the steps necessary to start building your credit today.

We’re going to cover:

- Check Your Credit Report

- Start Building Credit

- Apply For A Secured Credit Card

- Apply For A Credit Builder Loan

- Get A Co-Signer

- Become An Authorized User

- Turn Rent Into Credit

- Pay On Time

- Diversify Your Credit Accounts

- Don’t Open Too Many Accounts

- Don’t Close Old Accounts

- Avoid Paying Late

- If You Don’t Use It, You Lose It

- Don’t Borrow More Than You Can Afford

- How Long Will It Take To Build Credit?

- Conclusion

Check Your Credit Report

The first thing you should do is get an understanding of where your credit score currently stands.

You might be thinking, “I have never used any credit, so my score must be 0.”

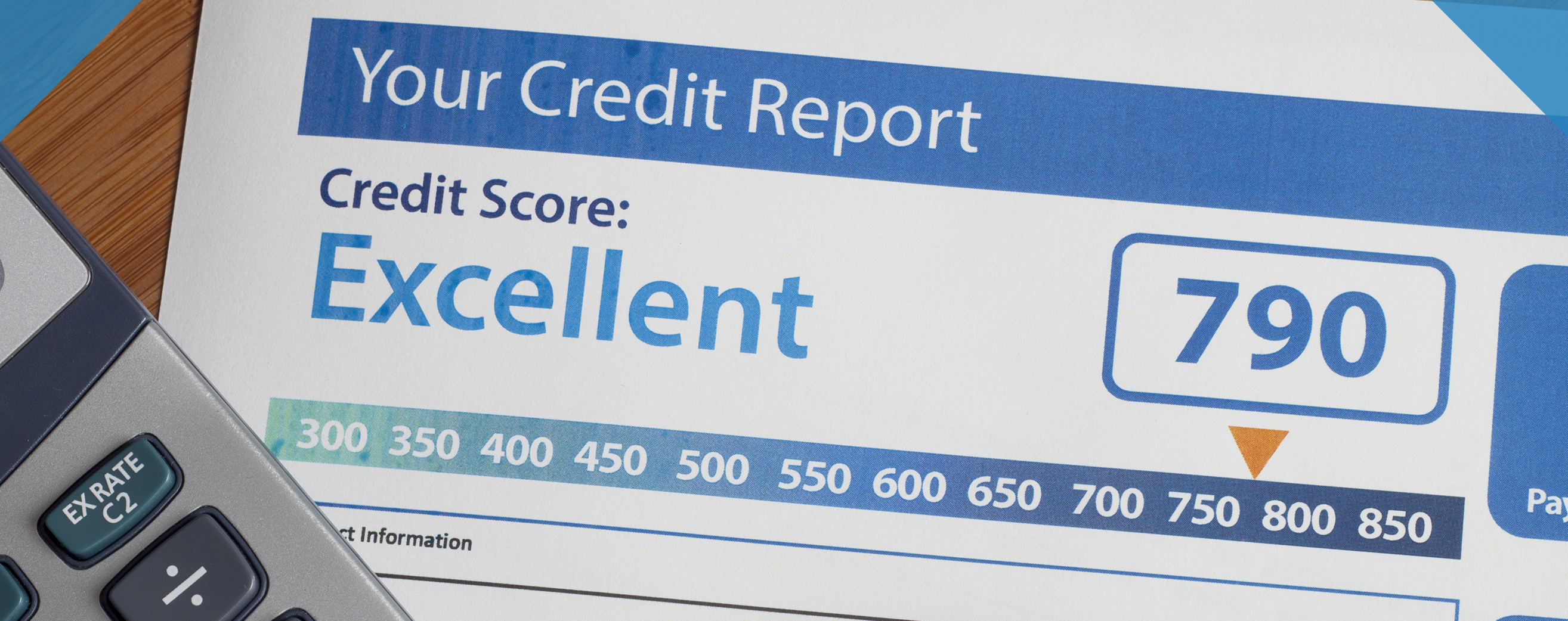

Well, that’s not exactly how credit works. Scores range from 300 – 850, so a 0 rating isn’t possible.

If you haven’t opened any lines of credit, a score might not be reporting yet. That is okay. Once you start making the moves necessary to build your credit, you’ll see your score continue to update.

You’re entitled to a free credit report once a year from each of the 3 major bureaus.

To Get Your Free Credit Report:

- Online: Annualcreditreport.com

- Phone: 877.322.8228

Once you have your report in hand, review all of your biographical information and make sure it’s correct. You should be looking for any signs of identity theft which may affect your score.

Start Building Credit

Credit can be a bit of a tricky cycle. The way it usually works it that you need an existing credit history to qualify for additional credit.

So if you don’t have a credit history, it might be hard to qualify for your first credit line.

To make the approval of your application a bit easier, there are some ways that you can build your credit for the first time without much trouble.

1. Apply For A Secured Credit Card

If you’re building your credit score from scratch, the recommendation is to start with a secured credit card.

A secured card is backed by a cash deposit that you make upfront. The deposit amount is usually the same amount as your credit limit. This is held as collateral in case you fail to make payments.

You’ll be able to make purchases and will have a monthly payment. If your balance is not paid in full, interest will incur.

This is not meant to be a long term solution. You should simply use a secured credit card as an opportunity to build your credit to the point that you’ll qualify for a conventional credit card.

Once the account is closed, or upgraded to unsecured, your security deposit will be refunded to you.

An unsecured card is a great option for someone new to the credit game because the security deposit eliminates the creditor’s risk.

2. Apply For A Credit Builder Loan

A credit builder loan is exactly what it sounds like. It’s a loan taken out with the purpose to help you build credit.

So how does it work?

The money you want to borrow will be held in an account by the lender. The money will not be released to you until the loan is paid off in full.

While you’re making regular payments on the loan each month, the lender will report the activity to the credit bureaus.

In return, you should see movement with your credit score.

Credit builder loans are available at community banks, credit unions, and online.

3. Get A Co-Signer

If you do not qualify for a loan or credit card on your own, you may look into the possibility of a co-signer.

You’ll need to find a willing co-signer who has a credit score that meets the approval requirements.

It’s important you understand that both you and the co-signer are held responsible if the loan is not paid in full.

Because of this reason, many people do not want to put themselves on the line for someone else.

If you’re in need of a co-signer, your family and friends are probably your best options.

Take your credit score from 😒 to 💪. Check out our list of 7 best credit cards for those with #NoCredit! https://t.co/24TpZ465ad#MondayMotivation #MondayMorning #financialeducation pic.twitter.com/4Nzo6Iej30

— Get Out of Debt (@getoutofdebtcom) October 1, 2018

4. Become An Authorized User

Finding someone that may be willing to add you as an authorized user on their card can be challenging, but it’s worth a shot.

Once you become an authorized user, you’ll be able to make purchases and begin building your credit.

Many people will be skeptical about this because the authorized user will have access to make purchases, but they are not legally responsible for paying the balance.

So, you’ll be able to swipe the card, but you aren’t on the hook to pay it at the end of the day.

It is 100% the responsibility of the card owner to make sure the bill is paid.

However, non payment of the bill will affect your credit score the same as the card owner.

Pro Tip: Some card issuers will report the activity made by authorized users to the credit bureaus, and some do not. Make sure you verify that the card will report to your credit before moving forward.

Before you become an authorized user, check the following:

- Verify the account is in good standing

- See if the account has a high balance

- History of payments in the account

All of these factors will play a part in determining how your credit score is calculated.

If the account is in bad standing, has a high balance, or a history or non or late payments, you will have much more difficult time increasing your credit score through this method.

5. Turn Rent Into Credit

Sometimes your rent payments are reported to the credit bureaus. This is a great opportunity to build a positive history of on time payments. Doing this may be enough to establish sufficient credit to qualify for a loan or credit card.

Some companies that offer these services are:

- RentTrack

- Rental Kharma

- Rent Reporters

- ClearNow

- PayYourRent

- eRentPayment

Services could be for free, or a fee may be attached. Make sure you read the fine print before making your final decision.

6. Pay On Time

35% of your credit score is based on your payment history.

It’s especially important to make your payments on time when you’re first starting to build your credit.

Mistakes will have a larger effect on your score when you have limited or no credit history.

Example

Let’s say that you just got your first credit card and you make the payment on time for the first 4 months. But, something happens in month 5 and you miss your payment due date.

Since the account has only been open for 5 months, your history of on time payments is at a 80%.

But, you learn your lesson and you never miss another payment. Now you’ve made 399 out of 400 on time payments, and your average is back to 99%.

So when you’re just starting out, any small mistake will have a much larger impact on your credit history than it would for someone with an extensive credit history.

Payment history is the single biggest factor in your credit score. It’s imperative that you make your payments on time every month if you want to build your credit score.

But, not everything you pay will be reported to your credit report.

Examples:

- Insurance payments

- Utilities

- Cell Phone

Paying these types of bills on time won’t help increase your credit score because they are not reported to their three major credit bureaus. However, paying late or not at all will be reported and you’ll see a decrease in your score.

7. Diversify Your Credit Accounts

Having various types of accounts reporting to your credit will increase your score.

Here are some common accounts:

- Mortgage

- Personal loans

- Auto Loans

- Credit card (revolving credit)

- Student loans

Having variety in your credit mix helps, but don’t go opening new accounts and taking on debt just to diversify.

8. Don’t Open Too Many Accounts

Opening too many new accounts in a short period of time can have a negative impact on your credit score.

When you apply for credit, you’ll get a hard inquiry that’ll remain on your report for 2 years.

Too many hard inquiries in a short period of time will alert lenders. It’ll appear like you’re desperate for credit and could minimize your chances of an approval.

Hard inquiries are sometimes necessary and you shouldn’t be afraid of them. But be aware that too many of them in a short amount of time will have negative effects.

9. Don’t Close Old Accounts

The average age of your accounts makes up for 15% of your credit score. The longer your credit history, the better your score will be.

Your length of credit history is calculated by collecting the age of each trade-line, and getting the average. Opening a new card lowers the average length of your credit history.

Closing an account will have the same effect on your average length of credit history. Additionally, closing an account will lower your total credit limit. In return, your credit utilization ratio will drop and your score will lower.

10. Avoid Paying Late

Negative information like late payments or debt collections will remain on your credit report for years.

It’ll be difficult to build credit with negative marks like those against you.

So it’s important to make sure negative information is kept off of your report.

11. If You Don’t Use It, You Lose It

When you don’t use any credit for six months, your account may go inactive, and your score will decrease.

If you want to keep your account active, but don’t plan on using the card much, we suggest you designate it for an automatic debt of some sort.

You can use it to pay your:

- Car Insurance

- Subscriptions

- Mortgage / Rent

- Car payment

Make sure that when your payment runs, you’re set up to make the payment on time.

12. Don’t Borrow More Than You Can Afford

30% of your credit score is based on the amount you owe, or how much debt you’re carrying.

Borrowing more than you can afford can lead to serious problems like foreclosure, repossession, and even bankruptcy.

How do you avoid this?

Don’t purchase anything you can’t afford to pay back in full at the end of the month.

How Long Will It Take To Build Credit?

Building credit can be a little bit unpredictable.

Your score will start reporting once you have had an account open and active for longer than 6 months.

During those first 6 months make sure you keep your credit utilization ratio under 30% and pay the balance off every month.

Once your credit is established, be sure to monitor it periodically.

Identity theft, financial fraud and credit report errors can all be found in your credit report. If you take the time to review your credit report, you’ll be able to catch these errors quickly.

If you do find an error, notify the credit reporting agency right away.

Like we said before, you’re entitled to a one free copy of your credit report from each of the three major bureaus once a year. But, there are credit monitoring services where you can keep track of your score all the tiem.

You can check your credit score for free on:

- CreditKarma.com

- CreditSesame.com

There’s also the option of using a more advanced site that comes with a fee to monitor your score:

- myFICO.com

Using one of these sites will give you constant access to your credit score, and it’ll update on a weekly basis. So, you’ll never be in the dark about what’s going on.

Plus, if you notice an error you’ll be able to dispute it right on the site.

Conclusion

Building credit isn’t difficult, but it will take time.

By taking the right steps from day one, you’ll be able to build a solid credit history before you know it!

Have you taken the steps to start building your credit? Let us know in the comments!

Up Next: 7 Best Credit Cards For No Credit

Leave a Reply