Are you concerned that your current retirement plan isn’t going to cut it?

Or

Have you not started saving for retirement yet and want to know where to begin?

No matter which situation you’re in, the reality is that we all worry about whether we’ll have what we need when it’s time to retire.

After all, we all want a comfortable retirement that doesn’t include stressing over money.

That’s why it’s so important to take the initiative and start preparing now.

We’ll help you determine how much you really need to save to have a comfortable retirement, and help you get on the right track to get there.

We’ll cover:

- When Should You Start Saving For Retirement?

- What About Social Security?

- Retirement Account Options

- How Much To Save for Retirement

- How Much Should You Save On A Monthly Basis For Retirement?

- What If Time Is Running Out And You Haven’t Saved Enough?

- 5 Tips For Saving For Retirement

- Conclusion

When Should You Start Saving For Retirement?

Honestly, you should have started saving yesterday. The reality is that you need to start saving for retirement as soon as possible.

The recommended age to start is in your early 20’s.

By starting earlier, you’ll have a greater opportunity to grow your funds throughout the years leading up to your retirement.

But, sometimes this just isn’t possible. Things happen in life that prevent us from saving like an unexpected job loss or medical expense.

The good thing is that it’s never too late to start saving for retirement. So, even if you haven’t done anything before today, you still can.

Of course, starting early will give you an advantage over those who wait, and you’ll see the difference in your bottom dollar.

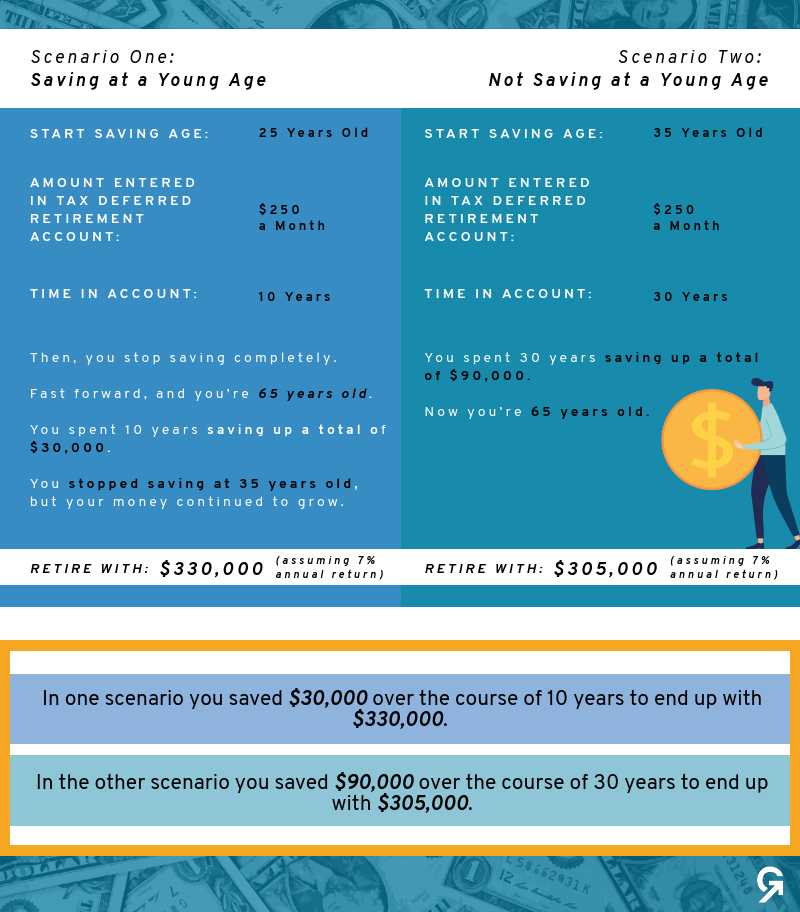

Scenario One: Saving At A Young Age

Let’s say that you start saving at 25 years old and you put $250 a month in a tax deferred retirement account. You continually do this for 10 years. Then, you stop saving completely. Fast forward, and you’re 65 years old. You spent 10 years saving up a total of $30,000. You stopped saving at 35 years old, but your money continued to grow. You’ll be able to retire with $330,000 (assuming a 7% annual return).

How does a $338,000 return sound after only putting $30,000 in?

By investing early, you’re putting your money to work and giving it an opportunity to grow exponentially.

We wouldn’t suggest that you stop saving at that 10 year mark either. Just because you got a head start doesn’t mean you’re done. $330,000 is a good base, but it’s probably not going to be enough to cover all your needs.

You spent 10 years saving up $30,000 for it to turn into $330,000. Imagine how much you’d have after saving for 20 or 30 years…

But what happens when you push it off and start saving later in life?

Scenario Two: Not Saving At A Young Age

Let’s say that you start saving at 35 years old and you put $250 a month in a tax deferred retirement account. You continually do this for 30 years. You spent 30 years saving up a total of $90,000. Now you’re 65 years old, and your retirement account should be at $305,000 (assuming a 7% annual return).

Huge difference, right?

In one scenario you saved $30,000 over the course of 10 years to end up with $330,000.

In the other scenario you saved $90,000 over the course of 30 years to end up with $305,000.

Now that you’ve seen how the math works, why would you wait to start saving?

Well, you might be under the impression that social security benefits will be sufficient enough to carry you through a comfortable retirement.

But, that’s not the case.

What About Social Security?

According to recent studies, social security will not be enough to cover your needs through your retirement.

You might be surprised to hear that the average social security retirement benefit is only $1,413 a month.

That’s $17,000 a year.

Can you live on $17,000 a year?

Most likely not. It would be nearly impossible to live on $17,000 a year after taking into account all of your necessary expenses. It’s just not a sufficient amount of money to live a decently comfortable life.

So, you know that you need to start saving now to avoid this.

But, where should you put your money?

Retirement Account Options

When it comes to retirement, the recommendation is that you open a tax favored retirement account.

There are 2 popular options:

- 401k

- Individual Retirement Account (IRA)

They have different features that you’ll want to explore, but with both you’ll be able to defer the taxes on the money you save as well on the returns you earn.

How Much To Save for Retirement

You’ll need the equivalent to 70% of your pre retirement yearly salary to live comfortably.

But, don’t forget to factor in your expenses. 70% will probably cut it if you’ve paid your mortgage off by the time you plan to retire.

But, if you’re planning to build a new home or travel the world, you’ll need more money. In these cases, you’ll want 100% or more of your pre retirement yearly salary saved up.

Part of figuring out how much you will need comes from estimating the expenses you’ll have.

What do you plan on doing in your retirement?

The following are common retirement expenses:

- Traveling

- Purchasing A Car

- Purchasing A House

- Health Insurance

- Utility Bills

- Credit Card/Loan Payment

- Food, water, etc.

The more honest you are with yourself and the more accurate you are with these numbers, the better of a situation you will be in to determine the amount you’ll need to have a comfortable retirement.

Write down your current expenses and estimate how they’ll change as you continue moving towards retirement.

Will your mortgage be paid off when you turn 50?

Do you plan on taking on a new auto loan soon?

Include any and every expense you can think of. The last thing you want to do is end up in a situation where you’re spending more than you calculated every month.

Once you have these numbers, it’ll be easier for you to create a retirement savings goal.

It’s recommended that you revisit these calculations every year. That way, you’ll be able to determine if there’s any changes or adjustments you need to make to your current retirement savings plan.

Now that you’ve determined the amount that you’ll need to retire, it’s time to figure out how you’ll get there.

How Much Should You Save On A Monthly Basis For Retirement?

We’ve said it before and we’ll say it again, you need to save as much as you can for retirement. However, that varies greatly from person to person and situation to situation. One person might be in the position to save $100 a month, while another can put away $3,000 a month.

To provide some guidelines, the recommended retirement savings is anywhere from 10-15% of your paycheck when you start to save in your early 20’s.

Now keep in mind that the older you start saving for retirement, the higher the savings percentage will be.

If you’re starting to save after your early 20’s have passed, here are some recommended percentages based on your age group:

- 25 to 34: 19%

- 35 to 44: 23%

- 45 to 54: 27%

- 55 to 64: 22%

- 65 to 74: 8%

As you can see, the older you are, the more of a percentage you’ll have to contribute. You need to identify your needs and expenses now so you’ll be able to determine your savings target.

What If Time Is Running Out And You Haven’t Saved Enough?

Saving for retirement is a daunting task, and no matter what you have saved, it probably doesn’t feel like enough.

If you feel like time is running out, and you need a boost in your savings, look for ways to make room in your budget.

How do you find room in your budget?

- Change Your Spending Habits: Write down and analyze all of your monthly expenses. Do you go out for expensive dinners every weekend? Do you have cable but hardly use it? This is the time to cut back on these things and put the additional money you’ll save towards your future retirement fund.

- Reel In Retirement Plans: Do you have a big plan to spend a month touring Europe? Aspirations like these are great to have, but you have to be realistic when it comes to your budget. If you’re not going to retire with the amount of money you anticipated, you might have to rework your plans. Compromise and plan a cruise instead so you can stay within your means.

- Delay Retirement: This obviously won’t be your first choice. Who wants to keep working when they could be done? But, if you need a few extra years to really build a solid retirement fund, push it back and retire at 68 instead of 62.

Delaying your retirement for a few years is not ideal. But, it could make a huge difference in terms of the lifestyle you’ll have when you do get there.

It doesn’t take much to manage your #finances even on a tight #budget. Check out these tips on saving #money: https://t.co/P2jwXdkDxo#debtfree #getoutofdebt #moneymatters #moneymoves pic.twitter.com/YkKJqt07j4

— Get Out of Debt (@getoutofdebtcom) May 23, 2018

5 Tips For Saving For Retirement

- Start Today: Let today be the day you begin saving for retirement, even if it’s just $1. Start saving and investing as much as you can now so your assets have time to generate more earnings for you. This will make it a lot easier to hit that savings target.

- Use Your 401k: If your employer offers a 401k, you should jump at the opportunity. A lot of times, they’ll also match part or all of your contribution. Make sure you’re contributing enough to take advantage of their match. This will get you on the road to your savings target much quicker.

- Open An IRA: Consider opening an IRA to help grow your retirement capital. You’ll have the option of a Traditional IRA or a Roth IRA. Depending on the type of IRA you open, you may be eligible for tax free withdrawals once you hit 59 ½.

- Automate Your Savings: There’s less of a chance your money will make it into your savings account if you’re manually moving it every month. Increase the possibility of growing your savings with automatic transfers. This way, a predetermined percentage of your income will go into your savings without you having to think twice about it.

- Expect The Unexpected: You might think you’ve planned enough ahead and have everything sorted out when it comes to your retirement financials. But the truth is that anything can happen. So, try to inflate your savings as much as you can. By doing this, you’ll help yourself prepare for any unforeseen expenses you’ll experience later on.

Conclusion

Make the commitment to yourself and your future by starting to save for your retirement today.

Take a good look at your expenses, and the lifestyle you expect to lead in your golden years. Set a savings target and develop a plan to reach it.

The earlier you can start saving, the better.

By starting to save in your younger years, you’ll give your money the time it needs to generate additional earnings. Doing this will assist you in reaching your savings goal sooner.

Put in the hard work now so you can sit back, relax, and put your feet up when the time comes.

Have you started saving for retirement yet? Let us know in the comments!

I was laid off in 2011 and took early retirement. I was lucky enough to have a pension to fall back on. I thought I could pair down my expenses and be ok. What really surprised me was the cost of heath care insurance. For just myself it costs $600 to $700 a month. I had no idea. And if I use it, I have a very high deductible which I need to fund in my emergency fund. Please make a point of providing these costs to those planning for retirement or about to retire so they are aware.