Today, American’s have more than $1 Trillion in credit card debt.

That’s up $875 billion dollars since 2013.

And According to the Federal Reserve, only 45% of U.S. cardholders pay their card balances in full monthly.

That means nearly $650 Billion accumulates interest at an average annual rate of 16%.

Those are the facts… and they’re scary.

If you’re asking yourself the question what does this mean for me… you’re in the right place.

We want to keep this post tightly focused, so here’s what we’ll review:

-How does credit card interest work

-What happens if I only make my minimum payments

How does credit card interest work

When you use your credit card, your purchases are subject to an interest rate called the Annual Percentage Rate or APR.

APR’s vary based on the specific card issuer and credit scores.

Don’t be fooled by the name “Annual Percentage Rate.” Credit card companies use it to calculate your charges over your monthly expenses.

To find out how much interest you’re paying the calculation is simple:

Let’s suppose you have $10,000 on a specific card with a 16% APR…

Take 16% and divide it by 365.

This give you your daily interest rate of .04%

So if you carry your full $10,000 balance each day you’re going to add $4 in interest to that $10,000.

Each day that goes by you will accrue interest on that balance.

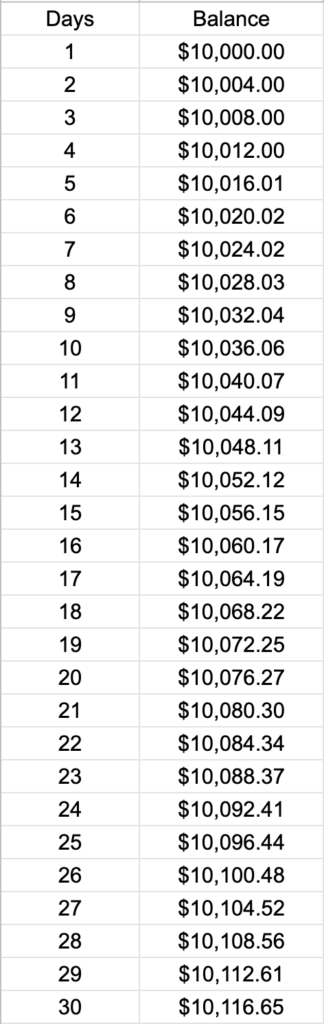

Day 1 – $10,000

Day 2 – $10,004

Day 3 – $10,008.16

Day 4 – $10,012.1633

Day 5 – $10,016.17

To calculate these we simply take the previous days balance and multiply it by 1.0004.

Through 5 days (assuming you’ve made no additional charges) you’ve incurred $16.17 in interest.

Let’s suppose you let 30 days accrue with no payments:

The balance is $10,116.65

60 Days:

$10,234.66

90 Days

$10,358.20

365 Days

$11,600

Now this is all theoretical.

In reality if you make no payments on a $10,000 balance you’ll incur late fees and charges, and probably have your credit card canceled and sent to collections.

But this is the basis for how credit card interest works.

Note to keep track of all your interest payments you’ll need to run this calculation for each card individually, consider each card typically has different interest rates.

Here’s a simple Google Sheet using the formula =SUM(B1*1.0004)

It’s simple.

You can go use Google Sheets to figure this out. It’s free and incredibly useful for all sorts of things.

In column one list out the days

In column two, row 1 (B1) list the beginning balance of your credit card.

In B2 compose the formula =SUM(B1*1.0004)

This formula looks at the value located in B1 and multiplies it by 1.0004 and enters the value inside B2 after you hit enter.

Then you can click on the bottom right of b2 and drag the formula down.

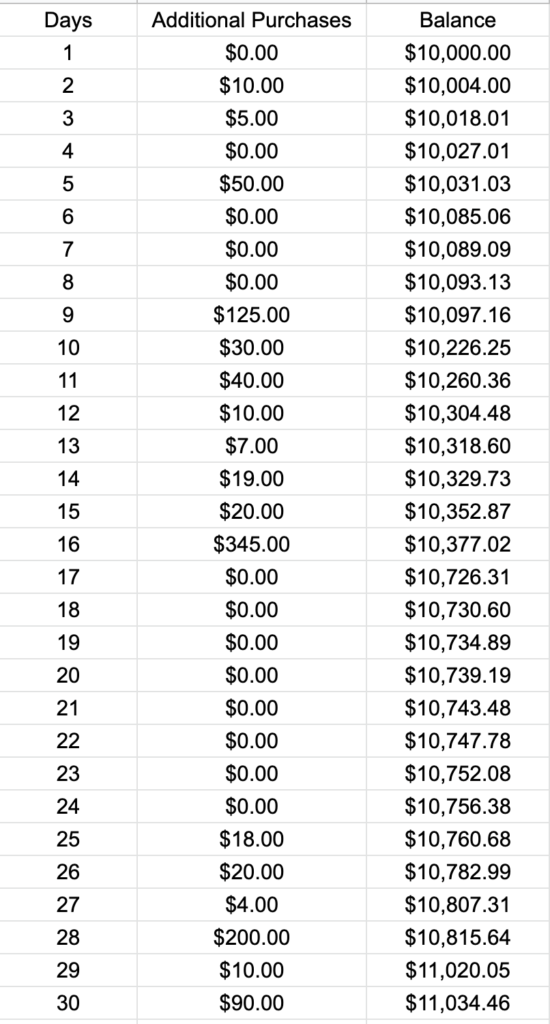

If you want to include additional purchases you simply add a column and adjust the formula to take into account the additional purchases:

Here the formula in C2 =sum(C2+B2)*1.0004

We’re simply adding the additional purchases to the balance that will incur interest.

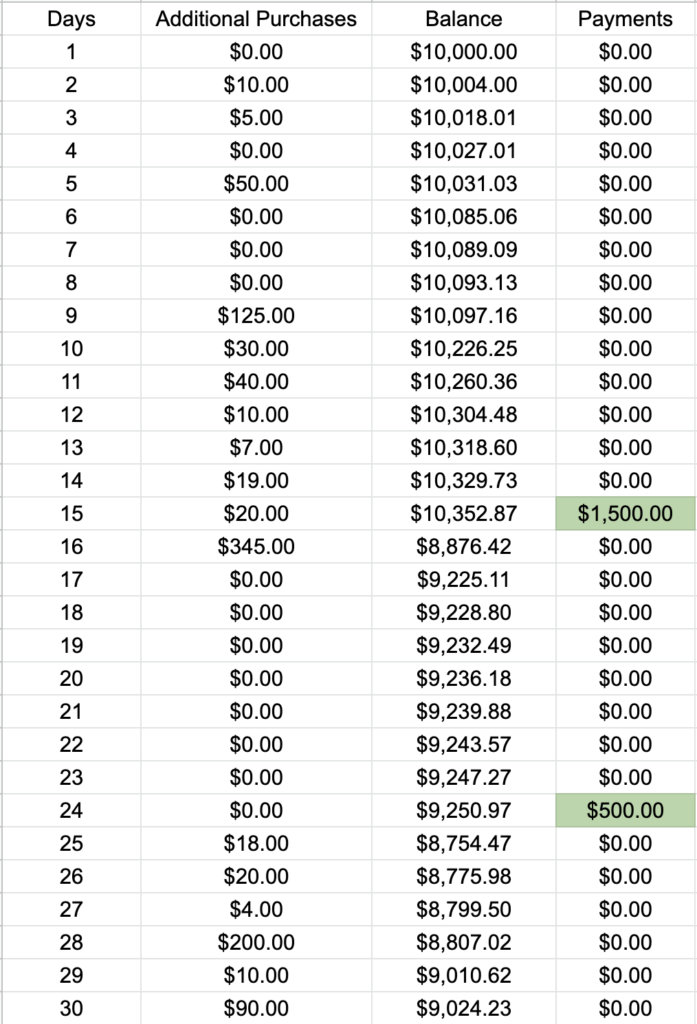

And finally if you make payments you can do something like this:

And the C2 formula is now =sum(C2+B2-D2)*1.0004

This subtracts the payments from the balance.

You can see above on day 15 if a $1500 payment is made what will happen to the balance and if no new purchases are made, what will happen to the interest.

Now, what happens if you only make your minimum payments:

What happens if I only make my minimum payments

Credit card companies want you to make only your minimum payments.

Why?

Because this is how they make their money.

I believe the best way to describe this is via an example…

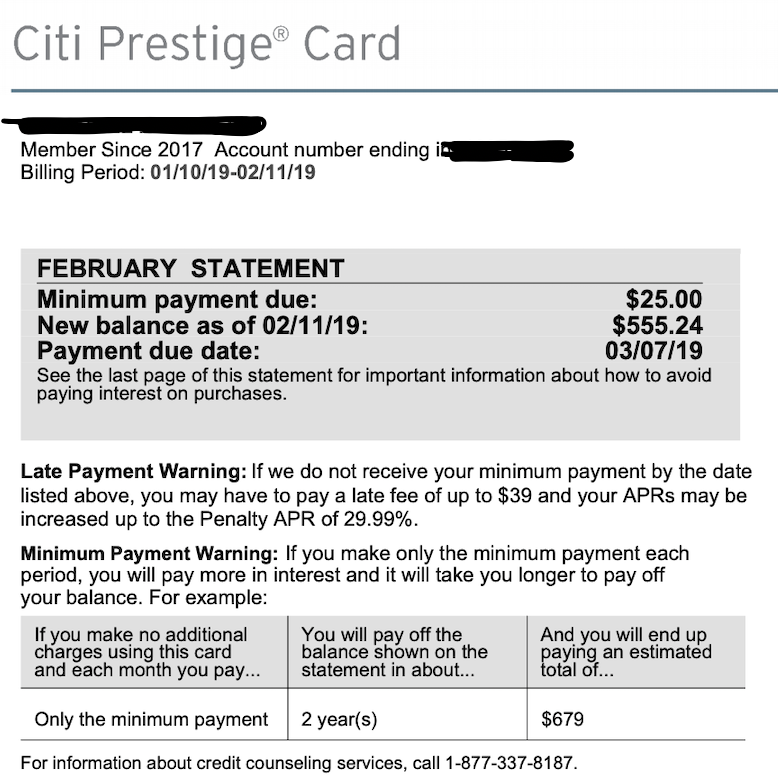

Here is a snapshot of a clients’ credit card statement:

Be honest with yourself… how often to you actually look at your statement?

After dealing with tens of thousands of clients, I’d be confident the majority of people don’t actually look at and understand the statements they receive.

But if you do, there are some very good insights.

Above, you’ll notice it describes how long it would take to pay off the balance shown if you only make the minimum payment.

Now the balance is $555.24… but if we only make the minimum payments on this particular account the total payback would be $679.

That’s 22.29% more than the actual balance.

And that’s if there are no additional charges on this card

All of that additional $123.76 is just interest.

This is where the credit card companies make their money.

This example is is on a card with a balance of $555.24…

But typically we see clients with thousands, or tens of thousands of dollars in credit card debt and they’re ONLY making the minimum payments.

You can see if this happens, you’re trapped forever.

Typically minimum payments are calculated by taking 2-5% of the balance.

If you’re running up high limits and only making minimum payments, you may never pay off your debt.

You’ll be married to your debt.

It’s important if you have debt, that you make more than the minimum payment, and if you can’t you need to reach out for professional help.

There are a lot of debt settlement companies, that can help put a stop to interest and fees and reduce the overall debt owed.

Leave a Reply