If you applied for an unsecured loan and weren’t approved, a secured loan might be just the right option for you.

But before applying for this type of loan, it’s important that you learn the basics so you can decide if it’s the right choice for you.

To accomplish that, we will go over the following:

- What Is A Secured Personal Loan?

- Where Can You Apply For a Secured Personal Loan?

- Personal Loan Amounts

- Why Get A Secured Personal Loan?

- What Are Secured Personal Loans Based On?

- Secured Personal Loan Rates

- How to Get a Secured Personal Loan

- Secured Personal Loan Advantages and Disadvantages

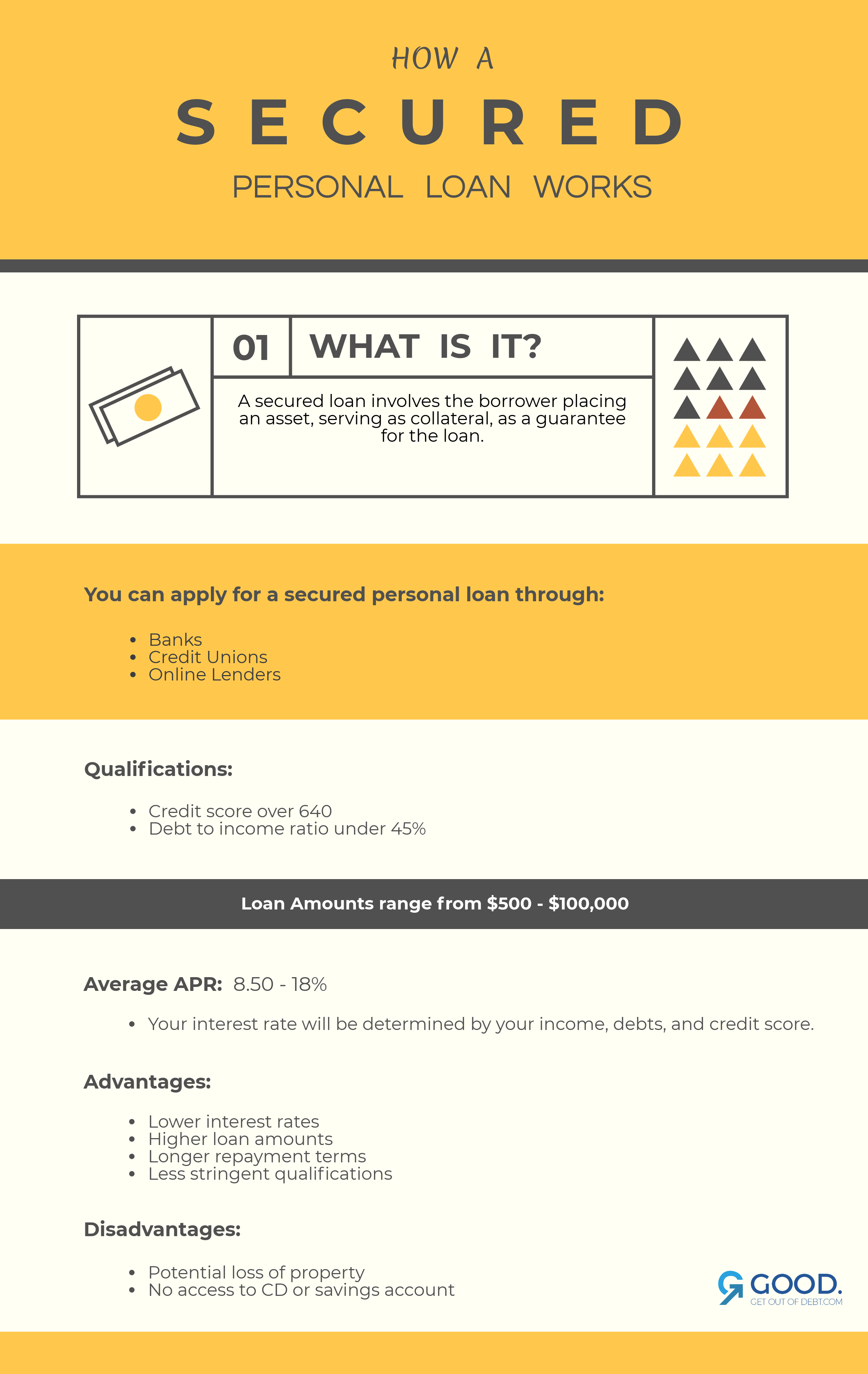

What Is A Secured Personal Loan?

A secured loan involves the borrower placing an asset, serving as collateral, as a guarantee for the loan.

You can place any of the following as collateral:

- Money in savings account

- Certificates of deposit (CD)

- Your car (Auto equity loan)

- A Property (Home equity loan)

Whichever you decide, it will become the guarantee of the loan, serving as security to the lender.

That means that if for any reason you do not pay according to the terms of the loan, the lender has the legal right to take possession of the collateral. In most cases, it will be sold in order to cover the amount due.

Where Can You Apply For a Secured Personal Loan?

You can apply for secured personal loan through:

- Banks – to use a bank as a lender, the borrower needs to have a good credit score as well as a savings or CD to use as collateral.

- Credit Unions – credit unions offer affordable loans to borrowers with poor credit.

- Online Lenders – if you use an online lender you are likely to get higher rates, but you’ll end up receiving the money in less time.

Personal Loan Amounts

The amount of money you can borrow will really come down to the financial institution you are applying for the loan with. Each institution will have their own cap on the maximum amount you can borrow, but they vary from $500 to $100,000.

That’s quite a large range!

So, be sure to verify with your potential lender whether they loan up to the amount you’re looking for before you proceed. The last thing you want to do is get to the loan signing and realize you’re not getting the amount of money you really need.

Unsecured Personal loans can really help you when you need it the most. You can use a #PersonalLoan to consolidate credit card debt or pay for an unexpected emergency.

But, there’s a lot more to know about them before you submit that application. https://t.co/jqJEP1GGpT pic.twitter.com/4dVuqdKNC9— Get Out of Debt (@getoutofdebtcom) January 2, 2019

Why Get A Secured Personal Loan?

A personal loan can be a practical option for many reasons, and it can be used for almost anything.

When you apply for a personal loan, some lenders will want to know the reason you’re applying for the loan. As long as you’re using the money legally, you can do whatever you’d like with it.

There are certain situations where a secured personal loan might be a good idea for you.

Consolidate Credit Cards

If you have multiple credit cards with high balances, you can apply for a personal loan which will allow you to have only one monthly payment with a fixed interest rate.

Plus, the interest rate on the personal loan will be lower than that of a credit card, so you’ll start seeing the savings immediately.

Refinance Student Loans

It might seem like student loan payments are never ending, and the interest rates can be high. In some cases, you may be able o get a personal loan with a lower interest rate that you can use to pay those student loans off.

Important information:

If you were to consider using a secured personal loan to pay off your student loans, there are some things to be considered before you do:

- You will lose the possibilities of any loan forgiveness programs in the future.

- You will lose your tax advantages.

- No ability to place a forbearance or deferment if you can’t afford a payment.

- A personal loan might not be enough to cover your whole student loan debt.

Big Ticket Item

When taking out a loan in order to make a purchase, it’s important to evaluate if the reason you are getting into more debt is because the item is absolutely necessary, or just a want.

When it comes to larger purchases, you might be given the option to finance the item. If this is offered, compare the interest rate offered with the financing with that of the personal loan.

Consider which option will offer you the lowest interest rate, as this is probably the one you’ll want to go with as you’ll be saving more in the long run. More times than not, the personal loan will offer the lower interest rate.

Large Event

There’s lots of reasons to throw a large event, but one of the most common ones is a wedding.

If you were to cover all of the expenses for a wedding on a credit card, it could take you forever to pay it back. Plus, interest will constantly be adding up as you do.

On the other hand, a personal loan will allow you to make it all happen without the unknown factor of compounding interest and wondering when it’ll ever be paid off. With a personal loan you’ll have a set term, and you’ll know exactly when you’ll be finished paying it off.

Taking a secured personal loan will be better option in this type of situation as you will end up paying less because secured personal loans will offer you a lower interest rate than a credit card will.

Improve Your Credit

A personal loan can help you improve your credit score.

How?

Well, it actually could help you in two different ways:

-

- Your credit mix accounts for 10% of your credit score. By adding a personal loan into the mix, it should help to improve your score.

- A personal loan will lower your credit utilization ratio, which accounts for 30% of your credit score. By taking out a personal loan, you will increase the amount of available credit you have.

What Are Secured Personal Loans Based On?

Secured personal loans will have certain underwriting requirements.

Secured Personal Loan Qualifications:

- Credit score over 640

- The higher your credit score, the lower of a risk you are in the eye’s of the lender

- Debt to income ratio under 45%

- Your debt to income ratio is calculated by dividing your recurring monthly debt by your gross monthly income, and expressed as a percentage.

There are many reasons certain credit cards can be useful to those with bad credit.

📈 They help you rebuild your credit score.

💰 They can assist you in times of financial emergencies.

🎁 These cards even provide you with rewards.👉 https://t.co/A3Xz19GUnn pic.twitter.com/0zl5UthjBm

— Get Out of Debt (@getoutofdebtcom) December 3, 2018

Secured Personal Loan Rates

Your interest rate will be based on the following:

- Your income

- Debts

- Credit score

These three important factors will be examined to verify if you qualify for a loan, and the rate you will receive if you do.

The way this works is that your application is graded, and that determines your interest rate.

There are three different grades: A, B and C. There’s no standard range for each grade, the individual financial institution will decide what their range will be for each different grade. The higher your credit score, the higher your grade.

Grade A

If you fall into the range of borrowers with an “A” grade, you’ll pay the lowest personal loan interest rates out there.

Grade B

If you fall into the range of borrowers with a “B” grade, you will pay bit more in interest than those with an “A” grade.

But remember how each lender has their own requirements?

Just because one lender gives you a “B” grade, doesn’t mean another lender may not give you an “A.” So, be sure to look into the credit score requirements for each institution and see where your score falls along their range before you apply.

Grade C

If you fall into the borrowers with a “C” grade, you will have the highest interest rate. Your loan will still be approved, but you will be paying just a little more than others.

The average annual percentage rate on a personal loan will range from 8.50% to 18%.

However, you can even expect to see rates north of 18%. Once again this is going to be based on your credit history, income debt ratio, the length of the loan, the amount, and the lender you are working with.

Since you do offer an asset as collateral when taking out a secured personal loan, you’re seen as less of a risk in the eye’s of the lender. For that reason, secured personal loans have comparatively extremely low interest rates.

How to Get a Secured Personal Loan

To get a loan, follow these steps:

Step One: Decide How Much You Need To Borrow

Why are you taking out a loan in the first place?

Determine how much money you’ll need in order to cover your expenses.

Then, figure out if your current income is sufficient enough to cover the monthly payment you’ll have on the loan.

Step Two: Evaluate Your Situation

Evaluate your situation and identify your needs. Is a personal loan the best choice for your situation?

Depending on the asset you’re choosing as collateral, consider the consequences of defaulting on the loan. Are you risking your home or life savings with this loan?

If you decide that a secured personal loan is right for your situation, be sure to apply for the amount of money that you need, and not any more. You don’t want to be on the hook paying back more than you need to.

Step 3: Verify Credit Score

By knowing this important piece of information, you’re setting yourself up to get the best results.

Why?

Because you have the ability to know in advance if you’ll qualify for this financial move.

Step 4: Find The Right Lender

Compare lenders, shop around, and make the right decision for you!

A good place to start is looking into your local bank or credit union. No matter where you go, it’s important that you have a clear understanding of what you are getting into and everything the loan entails.

Look into requirements like:

- Collateral requirements

- Max loan amounts

- Repayment terms

- Interest rates

If the information you get in return is not what you are expecting or you believe you can get a better offer somewhere else, go ahead and compare deals before you apply for the loan.

Step 5: Complete Loan Application

There is certain information that you’ll need in order to submit your application:

- Name

- Social Security Number

- Date of Birth

- Email address

- Phone Number

- Mailing Address

- Employment Status

- Income information

- Monthly mortgage or rent payment

- Amount you want to borrow

- Purpose of the loan

- Term

These are just the basic questions, so don’t be alarmed if you’re asked to provide additional information beyond what’s on this list.

After you submit your application, you should receive a response within a few hours. However, it could take up to 24 hours to hear back in some cases.

Each financial institution works differently. In some cases, you’ll be asked to provide income documentation and proof of collateral after your application is approved. In other instances, you might be asked to complete this process in advance.

If your application is denied, the financial institution might provide you with alternative options to consider.

Step 6: Receive Funds

Once everything is in place, you’ll receive your funds. Some lenders will deposit the money into a checking account while others will send you a check. Each lender has their own way of doing things, so be sure to be aware of your lender’s policy.

Once you have the money, it’s time to put it to use!

Don’t forget to make your monthly payments on time. Not doing so will cause you to pay extra in fees and your credit score to drop.

Secured Personal Loan Advantages and Disadvantages

As with anything, there are advantages and disadvantages to getting a secured personal loan.

Knowing the pros and cons ahead of time can really help to make your decision easier, so we’ve gathered the information for you.

Advantages of Secured Personal Loans

A secured personal loan offers many advantages if you were to compare it to other types of loan options.

And they are:

Lower Interest Rates

The collateral you provide with a secured personal loan serves as security to the lender. Because of this, they’re able to offer you lower interest rates.

Higher Loan Amounts

Since your loan is guaranteed by your collateral, you’re more likely to have the possibility of obtaining a higher loan limit. Since some larger loans are backed by assets like property, the lender feels secure that you will repay the loan with so much at stake for you.

Longer Repayment Terms

Along with higher loan amounts, secured personal loans often come with flexible repayment terms for your convenience.

Less Stringent Qualifications

Since the loan is backed by collateral, the lender is less concerned with your credit score. Yes, there will be minimum requirements that you’ll have to meet, but your report won’t be scrutinized like it would be with other lending options.

The same goes with your employment history. While other loans might put an emphasis on the duration of your employment, secured personal loans are less concerned with this.

Disadvantages of Secured Personal Loans

Placing one of your assets as collateral can seem like a good idea when you feel like you don’t have another option when it comes to borrowing money. But, it’s important to understand the consequences of what could happen.

Potential Loss of Property

If you cease payments and default on your loan, the lender has the right to take your money or asset. Most likely, any physical asset will be sold to recoup the cost of the debt.

Make sure you’re positive that you can repay the loan according to the agreement before you place a valuable item as collateral for a loan.

No Access to CD or Savings

If your collateral is in the form of a CD or savings account, you will be unable to touch it again until the loan is paid off in full.

So, if you were to need to access that money in an emergency, you would no longer have the option. Make sure you have a separate emergency fund set up, before you place your CD or savings account as collateral.

Is A Secured Personal Loan Right For You?

By now you should have a pretty good idea of how a secured personal loan works, the rates and fees you should expect, and even how to get the process started.

As you’ve seen, secured personal loans can be extremely useful when used in the right circumstances. But, you need to be aware of the consequences if you do end not being able to pay and defaulting on the loan.

At the end of the day, it comes down to figuring out whether or not this is the right fit for your personal situation.

Do you have any questions on how a secured personal loan works? Let us know in the comments!

Up Next: How An Unsecured Personal Loan Works

Man im so far in debt i dont think i can come out of it

this can be scary when you already in debt to create new accounts, but it is a good idea to pay off old loans and start over with one payment.