Car insurance is a fact of life for millions of drivers.

The only state in the United States where car insurance is not a requirement is New Hampshire. However, drivers there must demonstrate they have the financial ability to pay for damages if they cause an accident.

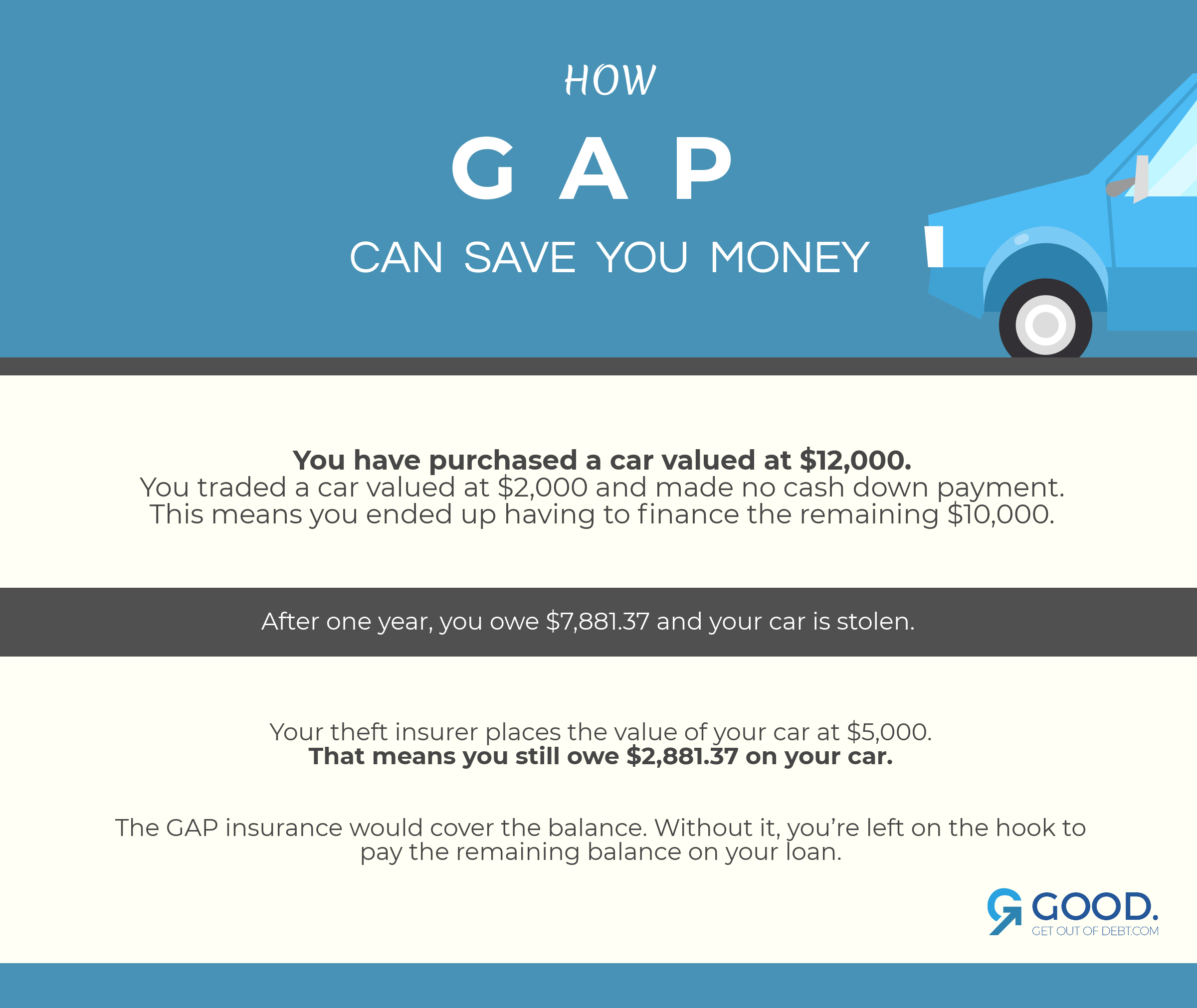

Everyday, there are thousands of roadway accidents. In some of these cases, a car is totaled, and the owner of the car is left owing thousands of dollars while having to buy a new car. This can be a problem if their insurance company decides the value of the car is less than what they owe.

This is when GAP insurance may come in.

Here are 13 questions and answers about GAP insurance.

1. What is GAP Insurance?

Gap insurance is optional. Your insurance company may offer to cover the difference between what you owe on your car and what the actual cash value is.

Remember, the actual cash value is what the car is worth at the time of the accident. It is not the amount you paid for the car.

GAP insurance is helpful if the insurance company decides your car is totaled. This decision is made based on:

- The cost to repair your car is higher than the Kelley Blue Book® value

- Repairs plus salvage value is higher than cash value

- Repairs would result in the car being unsafe

GAP insurance may also be helpful if your car is stolen. It is designed to cover the difference between the cash value of your car at the time of the theft and what your insurance is offering to settle for.

2. How does GAP insurance work?

GAP insurance is not designed to “stand alone”. This coverage pays an additional amount of money to the car owner after their regular insurance coverage pays out.

When you have “comprehensive” insurance it may already cover theft and collision. Your insurance adjuster makes a decision about the value of your car at the time of the theft or accident. They pay you that amount.

If you have GAP insurance, you could get an additional amount if your car is stolen or wrecked. You must have the “original” coverage to have GAP coverage.

3. Why should I have GAP insurance?

You may wonder if GAP insurance is worth the money. Here are two cases where it could be well worth the dollars you spend on premiums.

Facts: You purchased a car three months ago for $8,000. You borrowed $5,000 and you are still making payments on the vehicle of $100 a month. You have only paid $300 towards your car so you still owe $4,700.

On your way home from work you are hit by a truck and your car is deemed totaled by the insurance company. The insurance company decides your car is worth $3,500. They issue you a check in that amount. You still owe your car finance company $1,200. Your GAP coverage would pay off your loan.

Here’s another case where GAP insurance can be helpful:

4. What are the types of GAP insurance?

There are three primary types of GAP insurance which you may be able to obtain. They are:

- Return to invoice – the coverage would equal the difference between your insurer’s payment and the exact price the car cost you.

- Return to value – this coverage would equal the difference between the payment received from your insurance company and the value of your car when brand new. This coverage is used most often when you purchase a used car.

- Vehicle replacement cover – this coverage is designed to replace your car with the exact car you lost. The coverage would replace your car that had all the same specifications. The amount of coverage would be the difference between what your insurance company paid and the cost of replacement.

It is worth noting that the replacement cover will allow you to purchase an “upgraded” car if you opt to use the funds that way.

There may be other GAP coverage options available that may be more customized to your specific needs. You should talk to the provider about these options.

5. Are there things GAP insurance does not cover?

Yes! GAP insurance will not pay your car payment if you are out of work. It will not cover any of the following either:

- Vehicle repairs after an accident

- Balance owed if your car is repossessed

- Rental car needed after an accident

- Balances you carried over on a new car loan from an old loan

- Warranties you added onto your car loan

- Diminished vehicle value after an accident

- Does not cover personal injury claims after an accident

Remember, GAP insurance is only designed to cover the difference between what your insurance company pays from your basic coverage and what the difference is on the amount you owe.

This only applies in the event you are in an accident when your car is considered a total loss.

6. How much does GAP insurance cost?

None of us like the idea of paying too much for car insurance. After all, cheap car insurance makes it easier to make our monthly payments and have money left over for other things.

The good news is that in general, GAP coverage should cost you less than $1o per month.

If your car is valued between $13,000 and $16,000 by Kelley Blue Book, you can expect to pay a monthly GAP insurance premium of between $4.50 and $7.67 per month.

This small amount of money can provide endless peace of mind in the event your car is damaged beyond repair in an accident, or if your car is stolen before you have finished making payments.

The average American is #spending far more on the weekends than they are throughout the week.

However, if your financial goal is to get out of debt, your weekend binge spending is probably hindering those goals. Help curb your #weekend spending. 💪 https://t.co/UGu69fUwqs pic.twitter.com/2a7iAbIQj9

— Get Out of Debt (@getoutofdebtcom) February 22, 2019

7. What factors impact the cost of GAP Insurance?

Like all car insurance, your premium is going to be based on a number of factors including your age, credit score, and gender.

However, other factors may be carefully reviewed before you get GAP coverage including:

- Current value of vehicle

- Your driving record

- Your current insurance coverage

- Where you live

- Where you purchase GAP coverage

Remember, every insurance company has different methods of calculating premiums, so this is a general statement.

There is something else you should remember about GAP coverage: When the amount you owe is less than the value of your car, you can cancel your coverage.

If you have prepaid your GAP coverage, you may be entitled to a refund on the balance of your premium.

8. Do I need GAP insurance?

You may need GAP insurance if:

- You put down no or a very small down payment on an expensive car

- You are concerned about how much your current policy will pay if your car is stolen

- You are concerned about how much your current policy will pay if your car is totaled

- You are leasing a vehicle (If It is not included in the lease)

- You do a great deal of traveling in your car (increased chance of accident)

- You live in a high-crime area (increased chance of theft)

- You drive a high-end car (increased chance of theft)

You should discuss all possibilities with a respected insurance agency if you are considering GAP coverage.

9. In what situations is GAP insurance a good idea?

There are certain situations that practically demand GAP coverage including:

- Luxury car owners who use a low or no down payment loan

- Those with long-term auto loans (more than three years)

- If you financed “extras” (tax, warranties, etc.)

- If you own a car that depreciates rapidly (your dealer can tell you!)

- If your lender requires you to have GAP coverage

What does renters insurance cover? Doesn’t the landlord’s property insurance protect your belongings? How much is it going to cost?

We’ll answer these questions and more as we go through the ins and outs of renters insurance! 👉 https://t.co/GHTVhbinD5#ThursdayThoughts pic.twitter.com/JlkCqFETlq

— Get Out of Debt (@getoutofdebtcom) February 7, 2019

10. Does everyone need GAP insurance?

No! Not every car owner needs GAP insurance. Some of the following instances may mean you do not need GAP coverage:

- You made a large down payment and turned in a valuable car

- You do not have to worry about being “upside down” on your car loan

- You paid cash for your car

- You do not drive a lot of miles and have never been involved in an accident

- You live in a very low crime area

11. Where do I get GAP insurance

There are several ways to purchase GAP coverage. Typically, the least expensive is to deal with your own insurance company. However, there are other options including:

- Your car lender – this is usually the most expensive option

- Your car dealer – this can be expensive also

- Shop around – look for online vendors and make sure they are reputable before sending money

- Ask for referrals – ask your car dealer for a referral to an insurance company that offers GAP coverage

It is important to remember that your premium may be different depending on the insurance company.

For example, if you buy GAP coverage from a dealer or your lender you may pay one upfront premium. This could potentially cost you hundreds of dollars

Another thing to remember about GAP coverage: When you purchase a new car, the dealer cannot sell the coverage to you at the same time they sell you the car. However, this does not mean you cannot actively seek out quotes and information about GAP coverage.

12. What if my insurance company does not offer GAP insurance?

If your own insurer does not offer GAP coverage, ask them for a referral to someone who does. Most car insurance companies work with other companies who sell “add on” policies including GAP coverage.

When shopping around for GAP coverage, it may be worth checking other insurance prices as well. You may be able to save money and still get more coverage.

If you are in the military, check with the agency that offers military insurance coverage as they may offer GAP coverage.

You may also want to call your car dealer and your car lender and ask them if they have a preferred vendor.

13. When does GAP coverage go into effect?

GAP coverage goes into effect when the insurer accepts your application for a policy, and you pay your premium.

Never assume you are covered. Contact your insurance company and confirm the coverage, especially if you are headed out on a long road trip.

It is also worth noting that some insurance companies call this coverage loan/lease payoff. Make sure you ask about both if you are not certain what your company offers.

In Conclusion

GAP coverage can be very beneficial in the event you are involved in an accident and your car is totaled, or if your car is stolen and you owe a lot of money on your car loan.

Insurance companies will not offer you GAP coverage if you do not already have theft and collision coverage. GAP insurance is not a “stand-alone” it is an “add on”.

Buying a new car is exciting. The idea of being in an accident or having your car stolen is not something most of us consider when buying a new car.

It can be quite a shock needing to replace your car while you still owe money on the car that was totaled or stolen. GAP insurance can help protect you from that possibility.

Only you can decide whether GAP insurance is right for you. However, the more money you owe on your car, and the longer you will be making payments, the more sense it makes.

It is also worth pointing out that if you are borrowing a large amount of money, your lender may insist you have GAP coverage. However, they must allow you time to seek out a policy on your own, they cannot insist you purchase it from them.

Keep in mind though, this only gives you three days after you sign your loan documents to find GAP coverage that works for you.

Do you have GAP Insurance? Let us know in the comments!

Leave a Reply