Discover began in 1985, as a subsidiary of Sears, with one credit card as their first financial product. With the addition of additional products over the years, Discover was launched as its own company in 2000.

Discover offers:

- Checking accounts

- Savings accounts

- Private Student loans

- Personal loans

While they started with a singular credit card, Discover has grown to include many financial products, including personal loans.

Let’s take a look at Discover personal loans, and see what they have to offer so you can figure out if this is the best choice for you and your situation.

We’re going to cover:

- How Do Discover Personal Loans Work?

- Discover Personal Loan Rates & Terms

- What are the Eligibility Requirements for a Discover Personal Loan?

- Pros & Cons of Discover Personal Loans

- Who is the Best Fit for a Discover Personal Loan?

- How to Get a Discover Personal Loan

How Do Discover Personal Loans Work?

Discover offers unsecured personal loans, which means you won’t have to put up any assets as collateral for the loan.

These loans come with fixed interest rates and loan limits ranging from $2,500 to $35,000. The repayment of the loan will be in monthly installments over the course of 36 to 84 months, depending on your term length.

If you’re looking into taking out a Discover personal loan, you should start by checking out the interest rate that’s currently being offered.

To see what your rate would be, you can head on over to their Loan Calculator.

You’ll have to input your desired loan amount, length of term and approximate credit score. Once you’ve done this, you’ll receive an estimated payment and interest rate.

Once you’ve established these factors, you’ll move on to select the reason for which you are applying for the personal loan.

There are many reason why you could apply for a personal loan, but here are a few of the most popular:

- Debt Consolidation

- Home Remodeling

- Wedding Expenses

- Vacation Expenses

- Moving Expenses

- Medical Bills

- Financial Emergencies

- Adoption and Fertility Costs

- Auto Repairs

- Small Business

- Pet Emergency

Applying doesn’t take much more than inputting your information and selecting the reason you’re taking out the personal loan. You should receive a response on your approval within a few minutes, and disbursement of the funds should happen within one business day.

Overall, it’s a pretty simple process.

Unsecured Personal loans can really help you when you need it the most. You can use a #PersonalLoan to consolidate credit card debt or pay for an unexpected emergency.

But, there’s a lot more to know about them before you submit that application. https://t.co/jqJEP1GGpT pic.twitter.com/4dVuqdKNC9— Get Out of Debt (@getoutofdebtcom) January 2, 2019

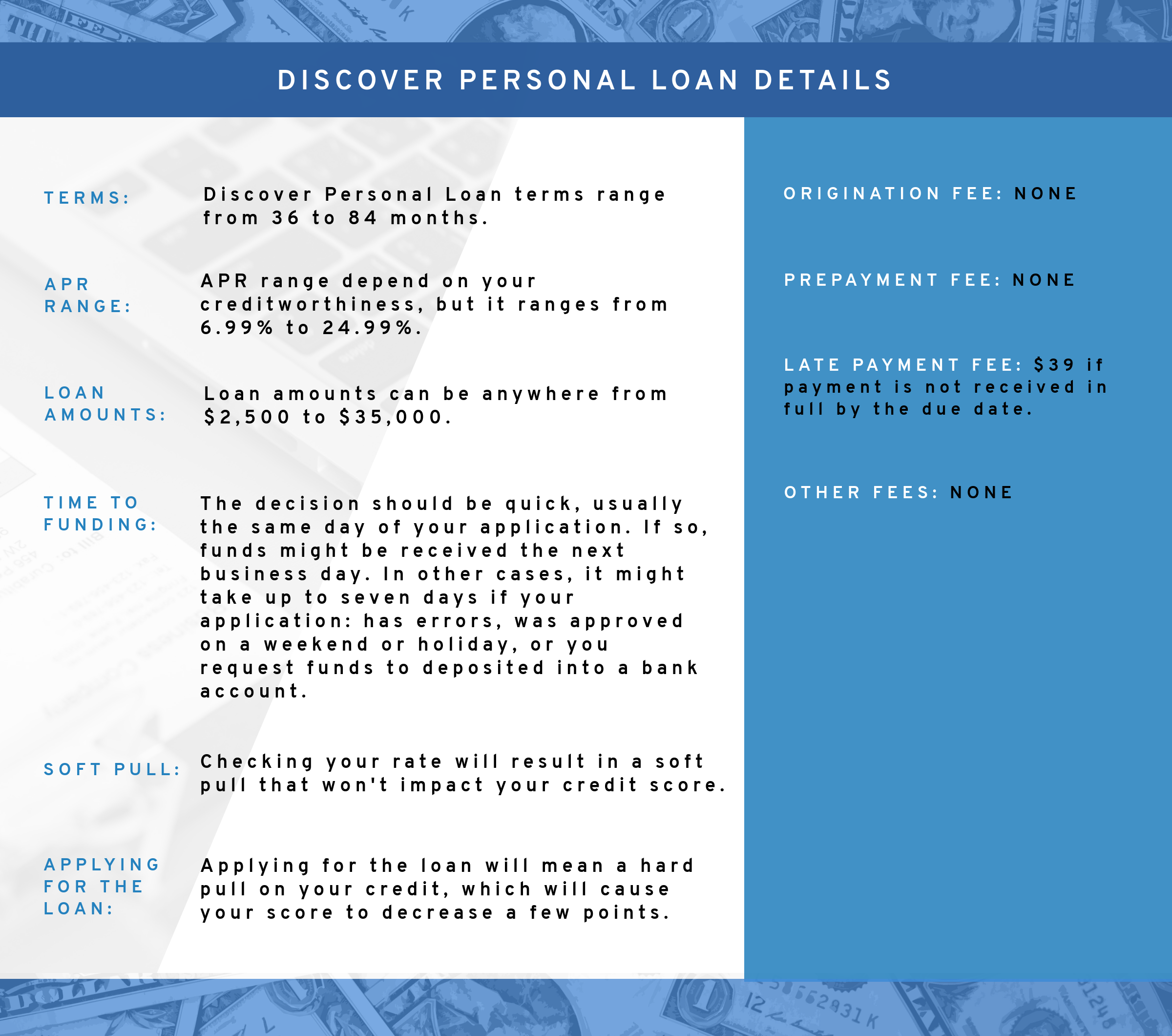

Discover Personal Loan Rates & Terms

Interest rates for a Discover personal loan will range from 6.99% – 24.99%. The interest rate that you get will be dependent upon your creditworthiness. The higher your credit score, the more favorable of an interest rate you will qualify for.

Something cool about Discover personal loans is that you have the ability to apply for a longer term, which allow you to have a lower payment. Plus, Discover is all about charging minimal fees.

What does that mean?

Discover offers personal loans without:

- Monthly Maintenance Fee

- Origination Fee

- Prepayment Penalty

The only additional fee you’ll have to pay is a $38 fee if you miss a payment or pay a partial payment. So there is no need to be concerned about any additional fees on this loan other than any late fees.

Discover Personal Loan Additional Features

- Discover gives you the ability to get free access to your FICO score.

- How convenient is that? You’ll be able to see your credit score, without having your credit pulled. You’ll be able to track any changes that have been made to your credit report and constantly know your score.

- Discover offers a 30 day money guarantee.

- This means that once you take the loan, you’ll have up to 30 days to return the money in full, and Discover will cancel your loan without any fees or interest.

- These will only apply if the money was disbursed to you and not directly to creditors.

What are the Eligibility Requirements for a Discover Personal Loan?

The requirements needed to get a Discover personal loan are:

- Must be a US citizen or a permanent resident

- At least 18 years or older

- Applicant should have a good credit score.

- If your credit score isn’t at least in the ‘good’ range, your odds of getting approved are limited.

- Creditworthiness will be considered.

- You must be able to show that you have a good credit history with on time payments.

- Your debt to income ratio will be looked at.

- Discover will compare your income versus your debts to determine if you can afford to take on the new debt that you are applying for.

- They don’t specify a debt to income ratio requirement, but typically you’ll want to keep your debt to income ratio under 43%.

Pros & Cons of Discover Personal Loans

Everything has its advantages and its disadvantages. When making a decision, it’s helpful to look at these beforehand in order to determine if they’ll have an impact on you or not.

So let’s start with the pros…

Pros of the Discover Personal Loan

- Flexible terms – They offer terms ranging from 36 to 84 months, while most lenders only allow terms of 12 to 60 months.

- Hardly any fees – They don’t require any origination or prepayment fees. The only fees that apply are those for late or partial payments.

- Check your rate before applying – You’ll have the ability to check your rate by doing a soft pull, which will not impact your credit score. In this case, if you’re not satisfied with the rate, you can decide not to apply and your credit will not be impacted in any way.

- Return period – They offer you a 30 day return period. This means that if you change your mind and don’t want to move forward with the loan, you have the ability to cancel your loan within 30 days, without any penalty or interest. But remember that full disbursement must be returned. This is something that you don’t see with most lenders.

- Quick Disbursement – If you apply for a loan during a weekday, you will have the possibility of getting approved immediately and receiving the money the next business day.

- Free Access to your FICO score – They give you the tools to stay on top of your finances with constant access to your FICO score and notification of any recent changes to your credit score.

Cons of the Discover Personal Loan

- Interest rate might be higher than other lenders – Verify what your interest rate might be with their pre-qualification form before you apply. If the rate they give you is not what you are looking for, you can keep shopping around and compare rates with other lenders, until you find a deal you’re satisfied with.

- Strict application process – While most lenders don’t have a verification process along with their application, Discover may have an agent reach out to you in order to verify your information.

- No autopay discount – Most lenders will give you a discount if you decide to sign up for automatic payments, but Discover will not provide any type of discount for this.

- No grace period for late payments – Discover does not offer a grace period like most lenders do. This means that you will not have any additional time to make your payment past your due date. If you miss a payment, even by a day, you’ll be charged a $39 late fee.

Does the word budget send chills up your spine? 😰

It shouldn’t!

Budgets allow you to have some control over what you spend. 💪 https://t.co/qSmbNdYS5c#budget #TuesdayMotivation #Financial pic.twitter.com/zXEVgjRdZl

— Get Out of Debt (@getoutofdebtcom) February 12, 2019

Who is the Best Fit for a Discover Personal Loan?

If you have multiple debts with high interest rates, applying for a Discover personal loan could help you lower that monthly payment, and can possibly lower your interest rate as well.

By consolidating all of your debts into one, it’ll be easier for you to keep up with your monthly payments as you only have to keep track of one. Plus, it might free up some additional cash.

How to Get a Discover Personal Loan

If you are ready to apply for a personal loan with Discover, you can do it through one of 3 ways:

- Applying through their website – www.discover.com

- Applying over the phone – 1-866-248-1255

- Or you might receive an invitation in the mail to apply for a loan. In this case, you’d need to physically fill out the application and mail it back.

How to Apply Online

When you apply online, you’ll have the ability to find out your interest rate, without having to have a hard inquiry put on your credit. You’ll have this information before you submit your application, so you’ll know ahead of time if this loan is the right fit for your circumstances.

How do you find out your interest rate for a Discover personal loan?

Go to the Personal Loan Section of Discover’s website, as shown below.

To start, you are going to fill out the amount you need to borrow, as well as the purpose for taking out the loan.

You can select one of the following reasons for taking out the personal loan:

Once that’s done, you’ll have to choose the loan term you’d like to have.

Then you are going to fill out the following:

- First Name

- Middle Name

- Last Name

- Address

- Phone Number

- Email Address

Next, you are going to click on Click here to begin

Then you’ll start completing information about your employment:

- Employment Information: (Select one)

- Employed Full Time

- Employed Part Time

- Self Employed

- Not Employed

- Financial Information

- Your Total Annual Income

- How much of that is non taxable (optional)

- Additional Household income (optional)

- How much of that is non taxable (optional)

- Your Total Annual Income

- Do you have a Savings or Money Market Account?

- Yes

- No

- How much is your monthly housing payment?

Then you are going to fill out the following:

- Social Security Number

- Date of Birth

- Citizenship Information (Select one)

- US Citizen

- Permanent Resident

- Neither

And click Continue

At this time, you’ll go over the electronic disclosures and consent agreement. If you agree, check the box that states that you accept it and click Continue

You’ve completed the application.

Once this is done, Discover will process your application within minutes and you’ll receive a response pretty quick. If additional information or clarification is needed you might receive a call from a loan specialist to verify your information.

So, let’s say you’re Approved.

If approved, funds are available to you as soon as the next business day. However, this is subject to change, and any errors on your application will cause the process to take longer.

A delay in the disbursement of your funds may also happen if your application is approved over the weekend. Funds are only distributed on weekdays, and you’ll have to wait until the following business day to be funded.

Keep in mind that if you’ve selected to have the funds deposited into a bank account, that can take up to 7 days to process.

The chart below illustrates Discover’s personal loan details:

Discovery Financial Services, better known as Discover, has a reputation in the Better Business Bureau (BBB) of a A+ Rating.

The BBB shows that Discover has 883 complaints, but they’ve all been closed. This shows that Discover has managed to keep up with their complaints, and resolve any situations.

Illustrated below, you’ll see the most common complaints Discover has gotten over the years:

Conclusion

Before applying for a Discover personal loan, it’s important that you are positive of what you are getting in to. That means really sitting down and looking everything over in order to figure out if this is the right financial move for you.

You should always be careful about getting in additional debt and be sure that you’ll be able to make your monthly payment. Ideally, you’ll even have a little wiggle-room in your budget for unexpected situations.

Overall, Discover personal loans offer reasonable interest rates and flexible loan terms.

Plus, they give you the ability to check your interest rate before applying, without a hard inquiry on your credit report.

So, there’s nothing holding you back from exploring all of your options.

Are you considering taking out a personal loan with Discover? We’d love to hear how they’ve compared with other lenders for you!

Up Next: Wells Fargo Personal Loan Review

Leave a Reply