Are you feeling like you’re drowning in debt and can’t seem to find a way to lower your balances?

Or

Have you been attempting to negotiate a lower interest rate from your creditor with no luck?

You’re probably struggling with:

- High interest rates

- Too many bills to pay

- High monthly payments

- Less spare money to do other things

If all of these things ring a bell and it sounds like we’re talking to you, then a debt consolidation loan might be the right choice for you.

To help you determine if a debt consolidation loan could be the solution to your problem, we’ll go through the ins and outs of the loan and show you how to use one to your advantage.

It’s important for you to keep in mind that a Debt Consolidation is not the only way to get financial relief. There are other options out there that you should explore as well.

We’re going to cover:

- What is a Debt Consolidation Loan?

- How Do Debt Consolidation Loans Work?

- Why Get a Debt Consolidation Loan?

- Pros and Cons of a Debt Consolidation Loan

- How to get a Debt Consolidation Loan

What is a Debt Consolidation Loan?

Right now you probably have multiple debts at different interest rates with payments due on different days. Keeping up with multiple payments with different due dates can be extremely overwhelming and stressful.

But, a debt consolidation loan takes multiple unsecured debts and rolls them into one singular loan.

That means you’ll only have one account to keep track of. This account will have a fixed interest rate, and one monthly payment that you’ll make for a set term. Once that term is up, you’re done paying off your debt!

How does that sound?

Consolidating your debts can take the confusion out of your finances. But, you still need to make sure you keep up with that monthly payment.

YOU are in control when it comes to your debt. 💪 Don’t let #DebtCollectors tell you otherwise.

Find out what collection agencies don’t want you to know!

👉 https://t.co/VRYfNv3quM#TuesdayMotivation #debtfree #Finance— Get Out of Debt (@getoutofdebtcom) January 15, 2019

How Do Debt Consolidation Loans Work

Debt consolidation loans give you the ability to have a more comfortable monthly payment that’s easy to keep track of.

Plus you’ll have a set loan term, so you’ll know exactly when you’ll be finished paying off your debt.

Q: What kind of debt can you consolidate?

A: The fact is that any and all unsecured debts can be rolled into a debt consolidation loan.

What falls under the category of unsecured debts?

Unsecured debts that can be consolidated:

- Credit cards

- Retail credit cards

- Gas Credit cards

- Student loans

- Unsecured Personal Loans or Personal Signature Loans

- Payday loans

- Personal Lines of Credit

- Unpaid Medical bills

- Utility Bills (telephone, electric, gas, cable, and other utility bills)

- Cell phone bills

- Income taxes

- Debt Collections

- Any other type of loan or credit that was extended without a collateral requirement

As you can see, there are many types of debts you can consolidate when you apply for this loan.

Q: Who qualifies for debt consolidation loan?

A: Anyone with good credit should be able to qualify for a debt consolidation loan.

But, what if your credit is less than perfect?

Having some credit hurdles doesn’t mean that you won’t qualify for a debt consolidation loan. But, you should be aware of the fact that you’ll have a higher interest rate and additional fees because you’re a lending risk.

That means you’ll probably end up paying more than someone with a Good credit score. We recommend that you verify all of the loan requirements upfront, before you determine if it’s the right financial move for you.

Q: What type of rates and fees are attached to a debt consolidation loan?

The estimated average interest rate (APR) on a debt consolidation loan is around 18.56%

You’ll most likely get an APR that ranges anywhere from 8.31%-28.81%, but it all depends upon your personal circumstances.

So, let’s take a look at a couple of different scenarios to see how the Average Debt Consolidation Interest Rate changes depending on your loan term and credit score.

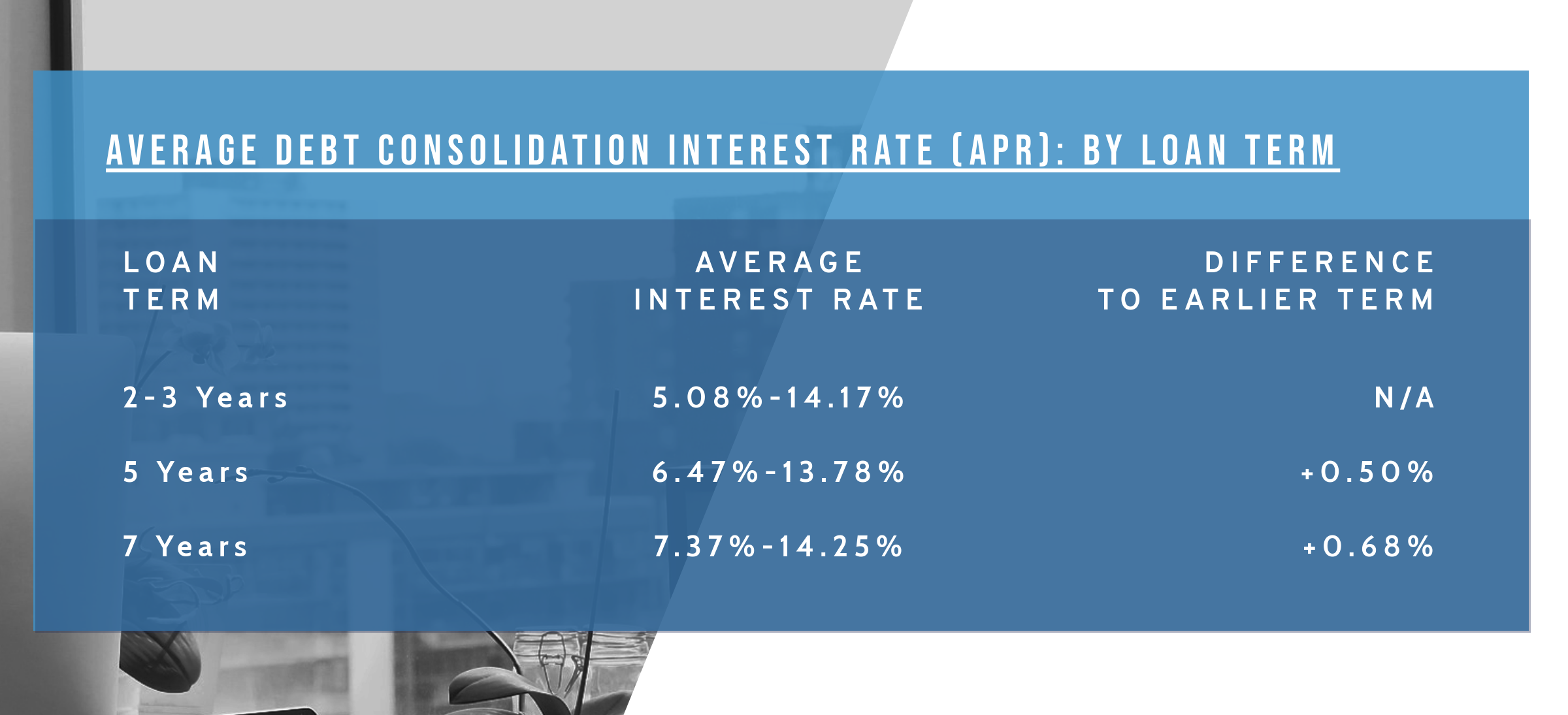

Average Debt Consolidation Interest Rate (APR): By Loan Term

When it comes to the loan term on a Debt Consolidation Loan, the longer the term is, the higher the interest rate will be on average. Additional factors, like your credit score, will play a role as well.

Here are some numbers based on an analysis done by ValuePenguin:

As the analysis shows, the interest rate seems to increase by .50% when the term is longer.

The loan term is not going to be the only thing that influences the interest rate though. Creditors will also examine your credit history to determine what your APR will be.

So let’s compare these:

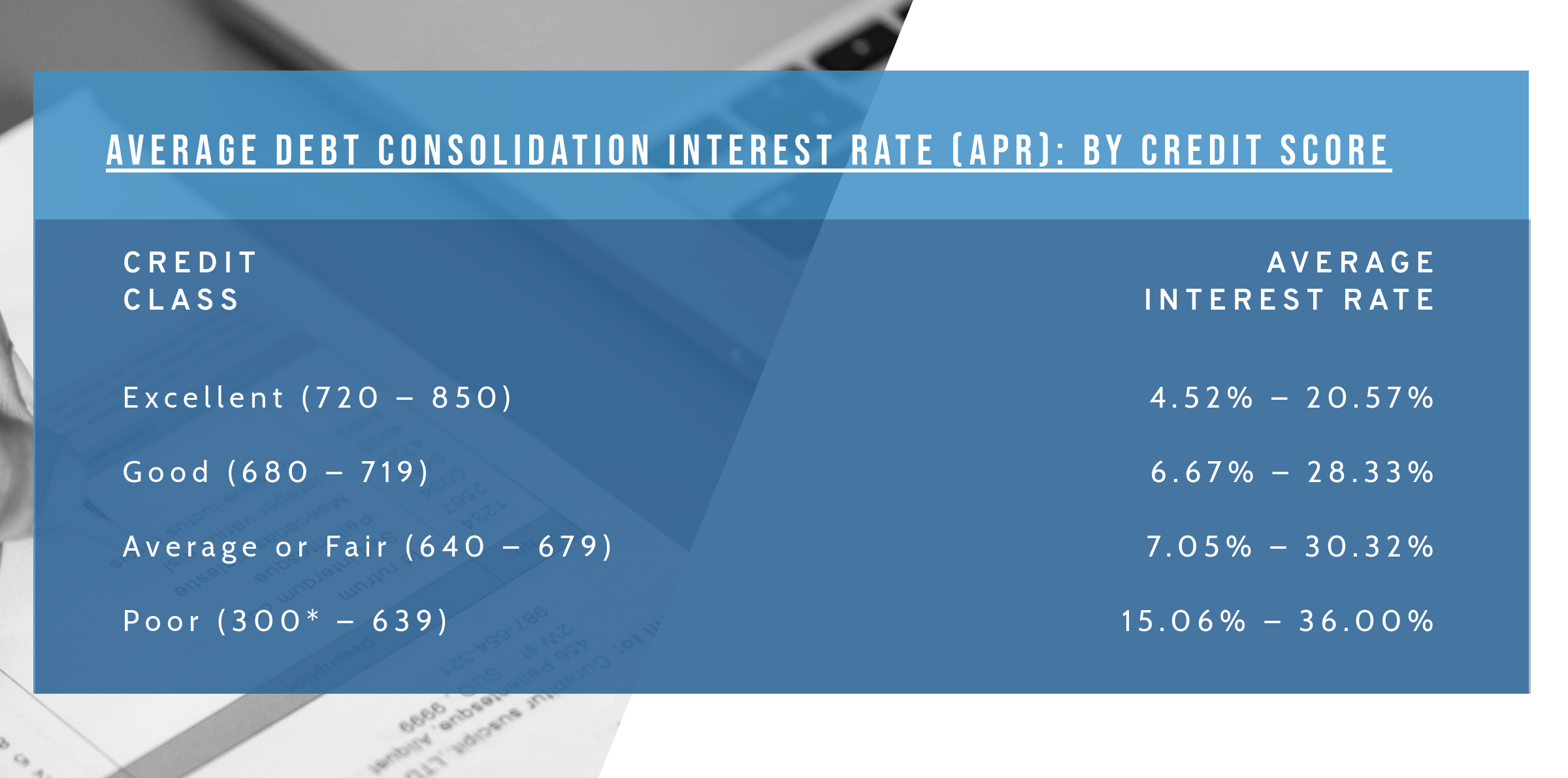

Average Debt Consolidation Interest Rate (APR): By Credit Score

The following information is also based on the analysis done by ValuePenguin. It states that the higher your credit score, the better chances your changes of getting a lower interest rate.

When applying for a loan, most lenders will require a credit score of 580 or higher.

If your credit score is below 600, you may be required to find a cosigner for your application.

Q: Are there any limits on the amount you can consolidate?

There are no limits on the amount of unsecured debt you can consolidate.

Why Get a Debt Consolidation Loan?

A debt consolidation loan is convenient because it gives you the ability to combine all of your debts into one monthly payment. In the end, this is going to save you both time and money.

Plus, it offers you the chance to breathe a sigh of relief.

You won’t be stressed out worrying about which bill needs to get paid on which day or if you’ll have enough money to meet all of your monthly minimums. Instead, you’ll have a better grip on your finances and know exactly when you’ll have your debts paid off.

Q: When is a debt consolidation loan a good idea?

The reality is that if you have a lot of debt that’s attached to a high interest rate, a debt consolidation loan might be able to give you a more favorable rate. Over time, this could mean huge savings for you, and a great reduction in the amount you’ll pay back.

If you are having a hard time keeping up with your payments, a debt consolidation loan may also be a good idea for you. Having one monthly payment, as opposed to 4, 5, etc helps to avoid missing a payment. In return, this will help your credit score increase.

Q: Will a debt consolidation loan hurt your credit?

When you do a debt consolidation loan, there is a lot to consider. Taking out the loan could help to improve your credit score, but it can also lower it if you’re not careful.

Here’s how it could possibly hurt your credit:

- Hard Inquiry Credit Pull – When you submit a new application, the lender will pull your credit to see your score and history. This is called a hard inquiry. When they do this, your credit score will take a hit and your score will decrease by a few points.

- Credit Need – Extending new credit to a borrower is always a risk. So anytime your credit history shows a new account like a personal loan or credit card, your score will lower a few points. But, you should expect to see it increase in just a few months if you keep up with your payments.

- Average Age of Credit– As your accounts age, your credit score increases. But, every time you open a new account, your average credit age goes down, impacting your score.

Let’s explore how a debt consolidation loan can improve your credit:

- Lowers Credit Utilization Ratio – This is a measure of the amount of available credit you have, compared to the amount of credit in use. When you open a new credit account, or take out a debt consolidation loan, the amount of credit you have available will increase and your utilization ratio will decrease. This will cause your score to increase.

- Improves Payment History – Your payment history is the biggest factor that goes into your credit score. So if you take out a debt consolidation loan, make it a habit to make these payments on time. By doing so, your score will improve over time.

#DebtSettlement means a creditor has agreed to accept less than the amount you owe as full payment.

It also means #collectors can’t continue to hound you for the #money and you don’t have to worry that you could get #sued over the debt.https://t.co/EtpLSGPd5r pic.twitter.com/PloNamaXka

— Get Out of Debt (@getoutofdebtcom) January 4, 2019

Pros and Cons of a Debt Consolidation Loan

Pros:

- Possibility to save money on interest – Debt Consolidation loans usually have a lower interest rate than your traditional credit card. So, you’ll be saving money in the long run.

- Eliminate debt faster – You’ll be able to eliminate your debt faster because you’ll have a set monthly payment and loan term. You know that if you pay according to the terms, you’ll be out of debt the time your loan term is up.

- Consolidate monthly bills – Instead of having multiple monthly payments with various lenders, you’ll only have one to worry about.

- Decrease late payments – A debt consolidation loan comes with just one monthly payment which greatly reduces the possibility of you being late or missing a payment.

- No property risk – Debt consolidation loans don’t require you to place any collateral down, so you don’t have to take the risk of losing a valuable asset or property.

Cons:

- Qualifying Credit Score – If you don’t have good credit, it might be hard for you to obtain a debt consolidation loan.

- Interest rates can be high – Make sure the interest rate on the debt consolidation is low enough that you’ll still be saving money in the long run.

- Additional fees tied to loan – These fees can add up quickly and cause you not to save as much as you could be.

How to get a Debt Consolidation Loan

Many different kinds of financial institutions offer debt consolidation loans.

Within these financial institutions you’ll find:

- Banks

- Credit unions

- Finance Companies

If you already are a client at your local bank or credit union, that would be the very best place to start looking for a debt consolidation loan. The fact that you have an established relationship with the institution will open the possibilities of a better offer.

Always look for what’s better for you and your pocket!

Conclusion

A debt consolidation loan could be just the thing you need to organize your finances and get back on track. But, that’s only if you’re willing and able to commit to the agreement with your lender, and make your payments on time.

Without doing that, a debt consolidation loan does have the ability to hurt your credit score and your financial opportunities in the future.

There are many options out there, and sometimes it’s just a matter of finding the optimal financial product to get out of debt quickly and as pain free as possible.

If debt consolidation does not seem like the right fit, debt settlement is another option to lower your payback amount and become debt free faster.

It all comes down to finding a solution that fits your needs.

Would you consider taking a debt consolidation loan? Let us know in the comments!

Leave a Reply