We all need to save for retirement. One of the challenges you may face is which plan to choose.

The two most common plans are IRA and 401(k) plans. Your employer may offer you both plans as part of your benefits package.

In most cases, your employer will offer a 401(k) plan and you will be on your own to establish an IRA.

So, which one is right for you?

We’ll breakdown the plans for you, so you can make an informed decision on how to best save for your future.

We’re going to cover:

- IRA vs. 401k: What are the Differences?

- The Basics of Roth IRA Plans

- Roth IRA Features

- The Basics of a Traditional IRA Plan

- Basics of 401(k) Plans

- Contribution Limits for 401k Plans and IRA Plans

- Deductibility of IRA Deposits on Taxes

- Plan Costs of IRA vs 401(k) Plans

- Withdrawal Rules for IRAs and 401K Plans

- Age 59 or Under Withdrawal Penalties for IRAs

- 401K Plan Withdrawal Rules

- IRA and 401k: Can I Contribute to Both?

- How to Get Started Saving For Retirement

IRA vs. 401k: What are the Differences?

While IRAs and 401k both offer tax benefits, the primary difference between the two is a 401(k) must be established by an employer.

If you are self-employed, you may establish a company 401k plan.

An IRA plan is typically set up by an individual, hence the name Individual Retirement Account. The funds deposited in an IRA are funds which have already been taxed through your paycheck. You may claim these deposits on your taxes to lower your tax burden.

401k funds are nearly always taken out of your paycheck on a pre-tax basis. This lowers the amount of taxes which are taken from your paycheck on a regular basis. Many employers offer a matching amount of funds to their employees.

The Basics of Roth IRA Plans

There are two common IRA plans which you have likely heard of. The traditional IRA and the Roth IRA.

Individuals will be allowed to deposit up to $6,000 if they are under 50 and $7,000 if they are over 50 as of 2019. The funds may be deposited into a traditional or a Roth plan.

To be eligible to deposit into Roth IRAs your adjusted gross income must be below a certain amount. These amounts depend on your filing status as follows:

Tax Status: Single, head of household, or married filing separately not living with spouse

- Income of less than $122,000 – maximum contribution allowed

- Income of $122,000 but less than $137,000 — reduced contribution allowed

- Income of more than $137,000 — no contribution allowed

Tax Status: Married filing separately living with spouse

- Income of less than $10,000 — reduce contribution allowed

- Income of more than $10,000 — no contribution allowed

Tax Status: Married filing jointly or qualifying widow(er)

- Income of less than $193,000 — maximum contribution allowed

- Income of $193,000 but less than $203,000 — reduced contribution allowed

- Income of more than $203,000 — no contribution allowed

Saving for retirement? Or perhaps you’d just like to stop living paycheck to paycheck. Find out how much you should be saving to make this dream a reality! 👉https://t.co/GQw0GrmQgs#creditchat #Retirement #Paycheck2Paycheck #moneysaving pic.twitter.com/UhtjtfOKjp

— Get Out of Debt (@getoutofdebtcom) October 10, 2018

Roth IRA Features

Before deciding if a Roth IRA is right for you, it is important to understand the features of these plans.

- Roth IRA options are broad allowing you numerous investment choices

- If you withdraw money from the account during your retirement, they are not taxed

- This plan also does not require you to take required minimum distributions (RMDs)

- Funds may be withdrawn from the account at any time without penalty

- Roth IRA deposits may not be used to reduce your taxable income

The Basics of a Traditional IRA Plan

While a traditional IRA has the same limits on deposits as a Roth plan, there are no income limits. Some of the other differences include:

- IRA deposits may be used to reduce your taxable income

- You may select any investment including mutual funds, index funds, stocks, or bonds to invest

- With certain exceptions, you will pay a penalty for withdrawing funds prior to age 59 ½

- Earnings are not taxed until withdrawn

- Required minimum distributions begin when you reach age 70 ½

Basics of 401(k) Plans

These plans are more complex because they are offered through your employer. However, there are some features which you should be aware of before you agree to invest in a 401(k) plan.

- Many employers offer matching funds — this means extra money in your 401k plan upon retirement.

- Reduces taxes from your paycheck — since the funds you deposit in a 401k are taken from your pay before taxes, you may have less taxes taken from your paycheck.

- Investment choices — most 401k plans have a limited number of investment options. There is no flexibility with most plans to invest in anything that is not offered under the plan.

- Withdrawing from a 401k —some plans offer participants the opportunity to borrow against their 401k for hardships, education or to buy a home. Required minimum distributions are required. Early withdrawals are subject to penalties.

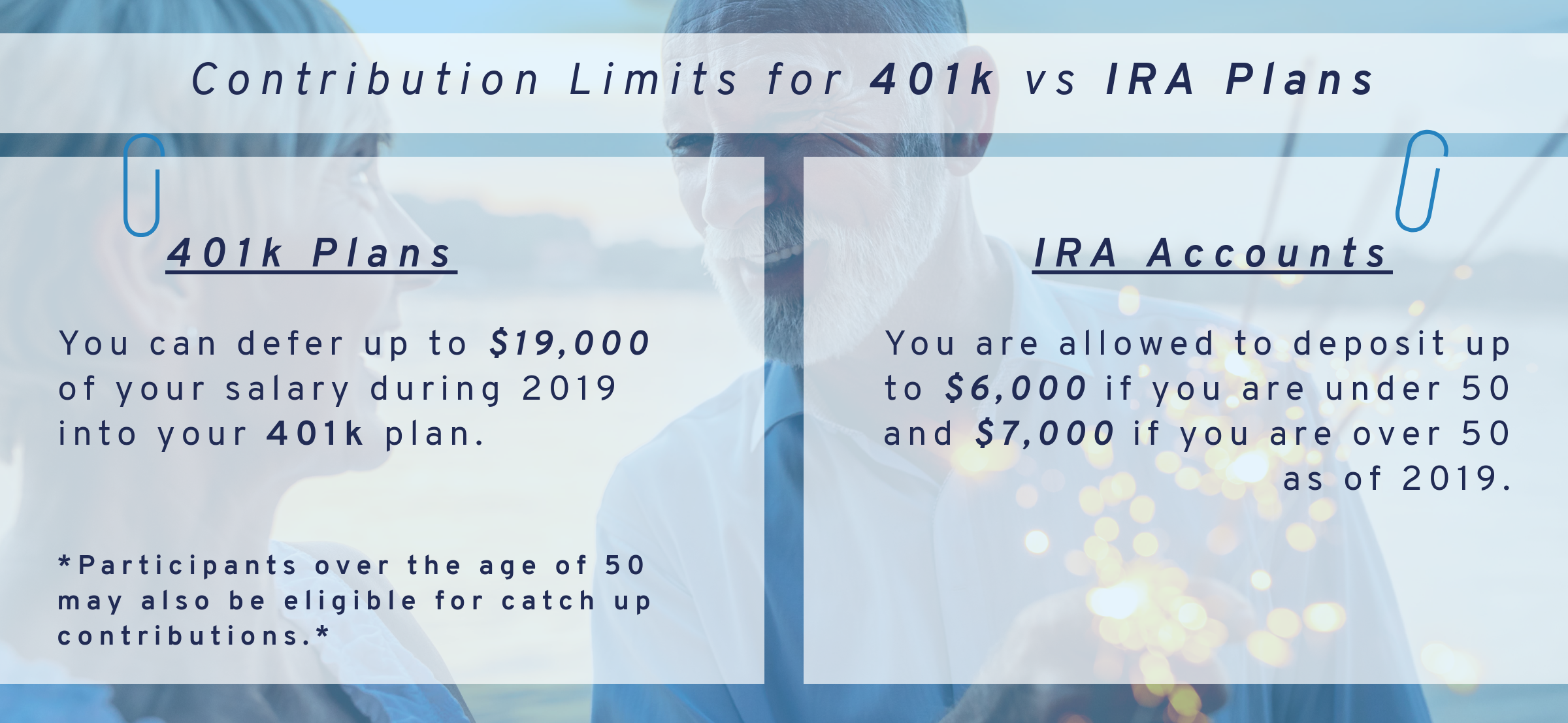

Contribution Limits for 401k Plans and IRA Plans

A 401k plans has high contribution limits. You may defer up to $19,000 in salary during 2019 into your 401k plan. Participants over the age of 50 may also be eligible for catch-up contributions.

For IRA accounts, you are allowed to deposit up to $6,000 if you are under 50 and $7,000 if you are over 50 as of 2019.

Deductibility of IRA Deposits on Taxes

If you are making deposits to both a traditional IRA and a 401k plan, the deposits to a traditional IRA are phased out at different income levels which are:

- Single and contributing to a workplace plan — income $64,000 to $74,000

- Married filing jointly and the spouse making the contribution has a workplace plan — income $103,000 to $123,000

- Married filing jointly and contributor is not covered by a workplace plan, but the spouse is covered — income $193,000 to $203,000

- Married and covered by a workplace place plan but filing separately — $0 to $10,000

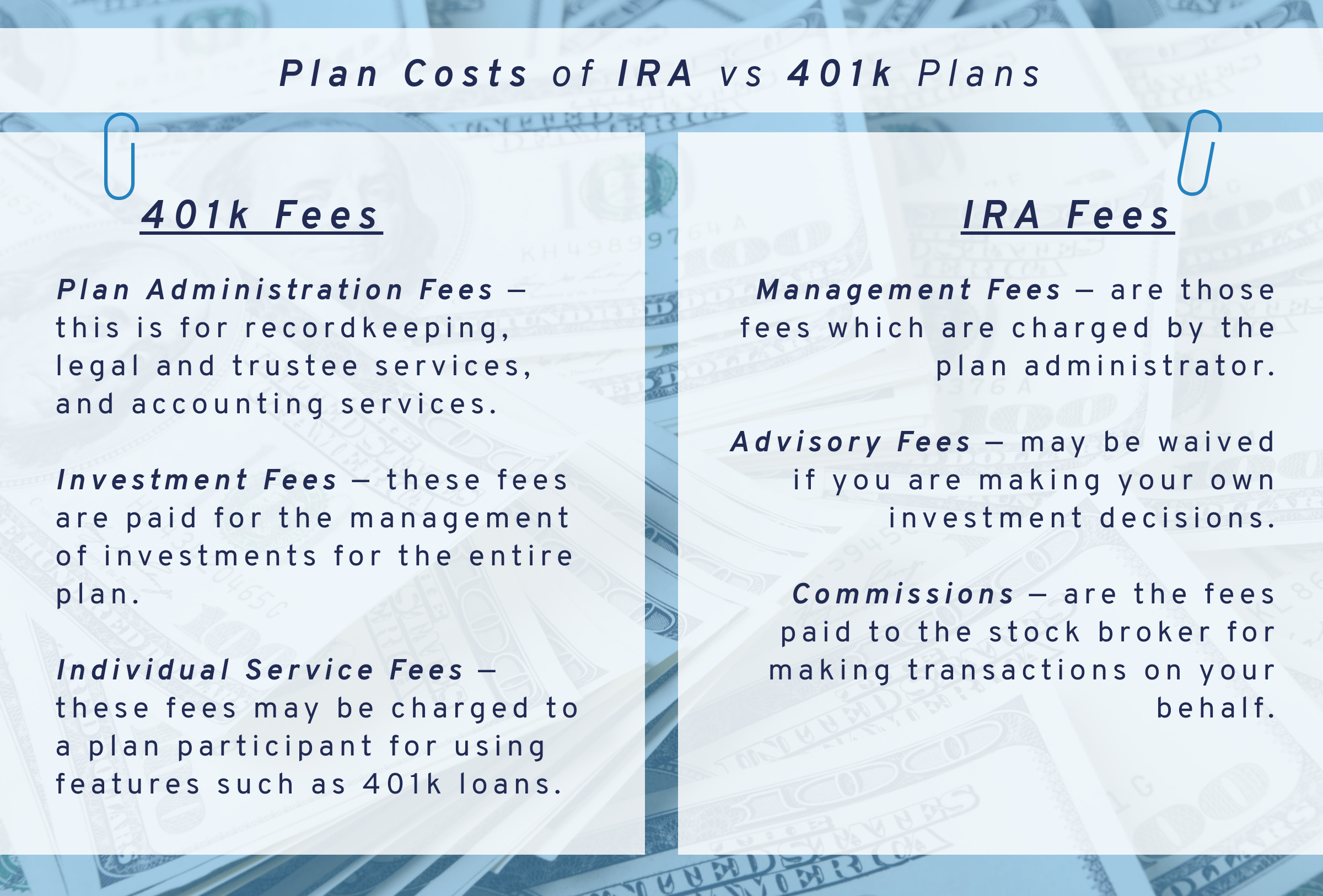

Plan Costs of IRA vs 401(k) Plans

There are costs associated with both IRA and 401k plans. The difference could be substantial and may depend on how your plan is invested.

Both types of plans may have an annual fee which can range from $25 to $100 annually. In addition, there may be additional fees on your investments depending on the type of investment.

IRA fees typically include:

- Management fees — are those fees which are charged by the plan administrator.

- Advisory fees — may be waived if you are making your own investment decisions.

- Commissions — are the fees paid to the stock broker for making transactions on your behalf. Before opening an IRA account, you should ask about what fees are being charged and the amount of each.

When you have an employer-sponsored 401k plan, your fees are typically higher than they would be with your own IRA. The larger the employer, the lower the fees tend to be. This is because a large employer has more room to negotiate. However, the fees could still be as much as 2% annually.

Some of the common fees associated with a 401k include:

- Plan administration fees — this is for recordkeeping, legal and trustee services, and accounting services.

- Investment fees — these fees are paid for the management of investments for the entire plan.

- Individual service fees — these fees may be charged to a plan participant for using features such as 401k loans.

The Department of Labor requires all plan administrators to disclose fees clearly to every plan participant.

Withdrawal Rules for IRAs and 401K Plans

When you deposit money into an IRA plan or a 401k plan there are specific rules which govern when and how the funds may be withdrawn.

Typically, you should plan to leave the funds in your retirement accounts alone until retirement, but there are cases when it may be necessary to withdraw the funds prior to retirement.

To withdraw funds from your IRA, you would have to request the firm where the plan is held liquidate part of your shares. This typically involves sending written instructions to the plan administrator indicating the amount of the withdrawal.

Age 59 or Under Withdrawal Penalties for IRAs

- 72(t) Withdrawals — these are equal, periodic payments and may be exempt from taxes and penalties.

- First-Time Homebuyer — you may withdraw up to $10,000 for the purchase of a first home without penalty or additional taxes.

- Educational Expenses — the account holder or immediate family members may be entitled to withdraw funds without penalty for educational expenses.

- Medical Expenses — taxpayers who pay more than 7.5 percent of their income in unreimbursed medical expenses may be able to withdraw the difference from their IRA without penalty.

- Disability Allowance — should you suffer a permanent disability you will be entitled to withdraw your funds from an IRA without penalty.

- Health Insurance — if you are out of work for 12 weeks or more, funds may be withdrawn from your IRA to pay for health insurance premiums with no penalty.

- Involuntary Distribution — withdrawals due to a Qualified Domestic relations Order issued in conjunction with a divorce, or withdrawals because of a tax levy are not subject to taxation or penalty.

- Reservist Distributions — National Guard and reservists who are called to active duty for 180 days or more can withdraw funds without penalty or taxes.

- Beneficiary Withdrawal — your IRA beneficiary would not pay a penalty on funds they receive after your death.

Taxpayers who are between the ages of 59½ to 70 may take unrestricted funds from their IRA account. However, the funds you deposited plus the earnings will be subject to taxes.

Beginning at age 70, you must accept Required Minimum Distributions (RMD) from your IRA. Failure to take these funds will result in a penalty of up to 50% of the amount that should have been withdrawn.

401K Plan Withdrawal Rules

Withdrawing money from a 401k plan is more complicated than withdrawing from your IRA.

Your plan administrator will have specific rules pertaining to when and how the funds may be withdrawn. Some plans also offer you the ability to take a loan against the vested amount of the plan, so it is a good idea to talk to your plan administrator.

Loans against your 401k may be repaid by direct payroll withdrawal or may be paid separately depending on the plan terms. These funds must be repaid to avoid incurring a penalty and taxes.

If you have exhausted your 401k loan options, you may be eligible for a hardship withdrawal if they are offered by the plan. A hardship is taxable and subject to penalty. In addition, the amount must not be more than the exact amount necessary to satisfy the emergency.

Medical expenses, purchase of a primary residence, prevention of eviction or foreclosure, funeral expenses for immediate family members, educational expenses and damage to your home may be covered under hardship withdrawals.

These funds do not have to be put back into the account, but are subject to a 10% penalty if you are under the age of 59 ½.

Once a 401k participant has reached the age of 59 ½ they may withdraw funds from their 401k without penalty. At age 70 ½ the participant must begin taking RMDs from their 401k.

Want to save money while living on a tight #budget? It’s possible! Here’s how: https://t.co/P2jwXdkDxo #debtfree #financialfreedom #moneymatters #debt #tips #GOOD pic.twitter.com/gY5eouB9rM

— Get Out of Debt (@getoutofdebtcom) April 17, 2018

IRA and 401k: Can I Contribute to Both?

If your employer offers a 401K plan and you have an existing IRA or are considering opening an IRA, you can contribute to both plans.

If you are planning to use IRA contributions for reducing your taxable income the limits previously mentioned apply.

How to Get Started Saving For Retirement

There are some steps you will have to take to get started on your plan to start saving for retirement.

Step One: Determine if your employer offers a 401k plan

Hint: If your employer does offer a 401k plan take advantage of the plan. Remember, in many cases, employers offer a matching deposit. Even with fees, you could wind up saving more money for retirement.

Step Two: Decide if a Roth IRA or a traditional IRA is the best option for you

Hint: If you expect a higher tax bracket after you are retired, then a Roth IRA is your best option. If you expect a lower tax bracket after retirement, a traditional IRA is your best option.

Step Three: Determine eligibility based on current income

Hint: Remember a Roth IRA has income limits, so you will need to make sure you are eligible. While you can contribute to a traditional IRA regardless of your income, the benefits phase out depending on your income and whether you are participating in your employer’s plan.

Step Four: Decide where to open your IRA

Hint: The more you wish to direct your investments, the less likely you are to need to go to a financial adviser. If you are comfortable making your own decisions, you can open an account online in many cases.

Remember, while you may be able to open an IRA at your local bank, the investment options may be seriously limited.

Saving for retirement is a crucial step that many of us overlook for too long. The earlier you can start saving, the better. But, it’s definitely never too late to start.

If you haven’t started saving for retirement yet, the first thing you need to do is determine the type of account that you’d like to invest in. Consider all the factors of an IRA vs 401k account, and choose the option that best suits you and your needs.

From there, it’s just a matter of maintaining your account until it’s time to retire! The sooner you get yourself set up, the more you’ll thank yourself later.

Do you think an IRA or 401k is the better choice for you? Let us know in the comments!

Up Next: How To Save For Retirement

Leave a Reply