When you take a loan out or apply for a credit card, you will hear the term “APR” or annual percentage rate.

But what is APR and what does it mean? Most people do not know what it is or how it works. So, we are providing this handy guide.

We’re going to cover:

- What Is APR?

- How Does APR Work?

- APR versus Interest rate

- Simple and Compounding Interest

- How Simple and Compounding Interest Affect APR

- Formula to Calculate APR

- Understanding Various Examples of APR

- Calculating Your Daily Rate

- Understanding Different Types of APR

- What Factors Impact APR?

- It May Be Possible to Get a Lower APR

- Verify Type of Rate You Are Being Charged

- What is Prime Rate?

- What is LIBOR?

- Pay Attention to Credit Card Statements

- Importance of Understanding APR

What Is APR?

Your annual percentage rate (APR) is what the lender is charging you to borrow money.

Quite simply, this means APR is the price of your loan.

How Does APR Work?

APR is the amount you are paying in order to borrow money.

Let’s say that you borrow $35,000 to purchase a new car, and you’re quoted 5.5% fixed interest APR for a period of five years.

At the end of the five years, you’ll have paid $40,112. That means the cost of your loan was $5,112.

APR versus Interest rate

Using the car loan example, your interest rate on the loan and your APR are the same, 5.5%.

However, if the lender includes an application fee of $500, your APR becomes 6.0971%.

Simple and Compounding Interest

If you take out a student loan or a car loan you usually pay simple interest.

This means when you make your payment, the interest is paid first and then the balance of the payment reduces your principal.

If you make an early payment, the interest charges are lower, which means more of your payment is credited to the base amount of the loan.

Compounding Interest

If you take out a revolving loan, or you have a credit card, you are paying compounding interest.

The lender uses this calculation:

- Outstanding Balance + new purchases + interest on balance = new balance

This means you are paying interest on the interest which means your APR is higher.

Are you curious about the average #creditcarddebt in America, and how you stack up against your peers? 🤷♂️

Are you on the verge of maxing out your cards and don’t know how to move forward? 💳💸

We’ve got you covered.👌 https://t.co/ZrL5wDilhZ pic.twitter.com/5Cr1umwncU

— Get Out of Debt (@getoutofdebtcom) December 19, 2018

How Simple and Compounding Interest Affect APR

If you borrow $1,000 and your interest rate is 10 percent, you are going to pay $100 in interest. This is considered “simple interest” and your payments look like this:

Amount Owed: $1,000 + 100 (interest) = $1,100

You will make 12 monthly payments of $91.66

If you borrow $1,000 with monthly compounding interest and your rate is 10 percent, it is going to look more like this:

Amount Borrowed: $1,000 +104.71 = $1.104.71

You will have to make 12 monthly payments of $92.06

The reason for this is because you are “adding” to your loan every month when your interest is compounded. Therefore, your “cost” to borrow is higher, meaning your APR is higher. Any time you are paying more for money, your APR increases.

To calculate the APR on a loan, you must have certain numbers available including:

- Finance charge

- Loan amount

- Loan term (in months)

- Interest rate

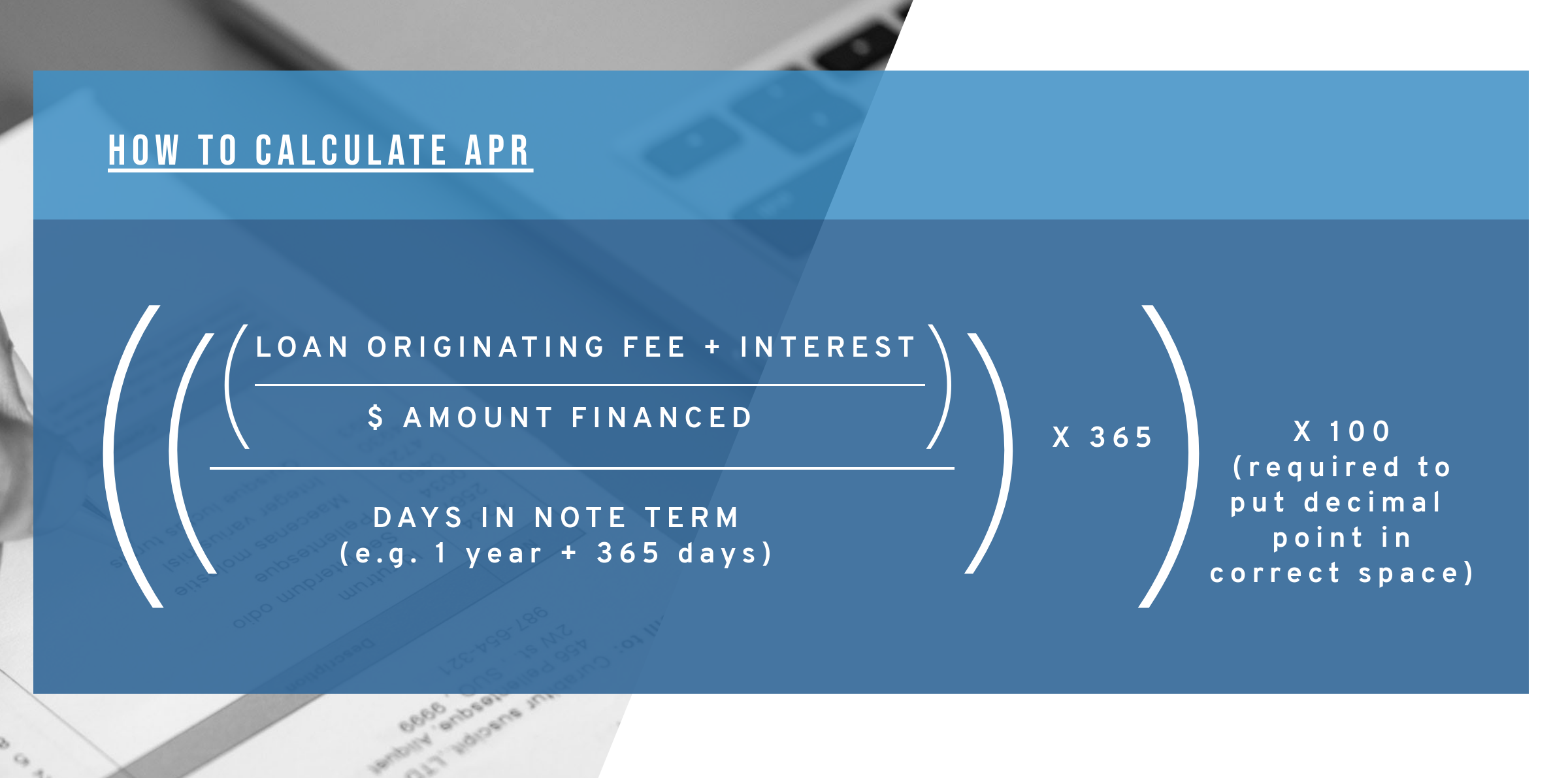

Formula to Calculate APR

The following is the proper equation for calculating APR:

Loan Originating Fee + Interest/$ amount financed/Days in note term (e.g. 1 year + 365 days) x 365 x100 (required to put decimal point in correct space) = APR

You may get a more accurate figure by using an online APR calculator.

Understanding Various Examples of APR

There are three specific types of APR. They are fixed, variable, and tiered.

- A fixed APR does not change. It remains steady no matter how long the credit line is open.

- A variable APR changes at specific times. It may even change daily.

- A tiered APR may change depending on the amount you owe. You may pay a lower APR if you owe less than $750 but a higher APR if you owe more than $750 depending on the credit line.

Calculating Your Daily Rate

To calculate your daily periodic interest rate, you would divide your APR by 365.

If your APR is 6 percent your daily rate is .0164. Check with your financial institution because some calculate using 360 days. If this is the case, your daily rate on a 6 percent APR would be .0166. This is important because it can have an impact on your credit line.

Understanding Different Types of APR

The fine print in agreements may reference your APR in different ways that you should understand.

Credit cards, store lines of credit, or other revolving lines of credit often have different APRs depending on how you are using your credit.

Purchase APR – this is the rate you will pay on a new purchase that is not repaid before your billing cycle ends and your bill is due.

Warnings: If you carry a balance on your credit card, chances are you will pay interest on both your current balance and any new purchase.

Cash Advance APR – if you take cash against your credit card, there will usually be a specific APR which will be charged.

Warnings: Before you elect to take a cash advance make sure you understand the costs. Credit card companies often issue you blank checks. These checks are for cash advances. You will pay a higher interest rate on the funds, and you will likely pay a cash advance fee.

Penalty APR – this is the APR which can be assessed to your credit card for a period of six months if you miss a payment.

Make Note: After six months if you pay on time each month, this APR must be restored to the original. This was due to changes made in the Credit CARD Act of 2009.

Introductory APR – this is a rate often offered as an incentive to obtain new customers. Credit card companies often offer no interest offer credit cards, or low rate cards to encourage you to use their card.

Warnings: Make sure you carefully review any agreement to understand what the interest rate is going forward.

Balance Transfer APR – some credit card companies are willing to accept balances from other credit cards and charge a different APR than that you are paying for new purchases.

Warnings: A transfer APR must be in place for at least six months. However, if you miss a payment or pay late, you could lose any special deal you may be offered such as no interest rate transfer for six months.

Promotional APR – these are used for a limited time or one-time offer. An example may be a furniture store will offer zero percent financing for a limited period such as 12 months.

Warnings: Before accepting any type of promotional deal, make sure the program is zero interest and not deferred interest. Otherwise, you could wind up having to pay the interest rate on the full amount of your purchase.

What Factors Impact APR?

When you are borrowing money, there are several factors which can impact the interest rate you are paying, including your APR. Here are the five top factors:

- Credit Score and History – the higher your credit score, the lower your APR. If you have consistently made payments on time, your APR will be lower.

- Annual Income – if you have stable and high income, your APR is typically lower. Some credit cards require a minimum income.

- Debt to Income Ratio – lenders will divide your monthly debt into your gross income to determine your debt to income ratio. This is less common with credit cards and more common with mortgages and car loans. The lower the ratio, the lower the APR.

- Employment History – it is easy to forget your credit report will include your employment history. The more stable the history, the lower your APR.

- Loan Length and Terms – the shorter the term of the loan, the lower the APR. Revolving credit such as a credit card have higher APRs than mortgage loans.

It May Be Possible to Get a Lower APR

There are three primary ways to lower your APR which are:

1. Get an introductory 0 percent deal – if you have great credit and receive an offer, consider transferring your current balances to a no interest rate card.

Warnings: Before transferring a balance, check for balance transfer fees. The fees may not make the lower interest rate worthwhile.

2. Call your credit card company – even if you do not qualify for a new credit card, your current creditor may be willing to consider lowering your rate.

Warnings: The longer you have had the card, your payment history can work in your favor. If you have missed payments or late payments, this may not work.

3. Improve your credit score – the best way to get a lower APR is to work on improving your credit score.

Warnings: This is a multi-step process that begins with getting a copy of your free credit report and making sure there are no errors.

Verify Type of Rate You Are Being Charged

There are two types of interest rates you should be aware of, fixed and variable. If your rate is fixed, that means it will not change over the term of the loan. Credit cards may be either fixed or variable as well.

Fixed Credit Card Rates

If your credit card has a fixed rate, the credit card company must notify you at least 45 days in advance of an increased rate.

You have the right to opt out of a credit rate increase. If you do, the creditor may cancel your credit card.

If you do not opt out, the credit card company may apply the higher rate to all purchases made beginning 14 days after the initial notice went out.

If you make a late payment and the original terms of your credit agreement state that in the event of a default there is an increase, no notice is required.

If you opened the card using a promotional rate, the creditor does not need to notify you in advance of the expiration of the rate since it is in your original agreement.

Variable Credit Card Rates

A variable rate card increases based on changes in Prime Rate or LIBOR.

What is Prime Rate?

Prime rate is a short-term interest rate. It is used in banks across the United States. Prime rate usually increases anytime the Federal Reserve increases interest rates.

What is LIBOR?

The London Interbank Offer Rate is the rate banks charge to other banks for money in a short term, usually 12 months or less.

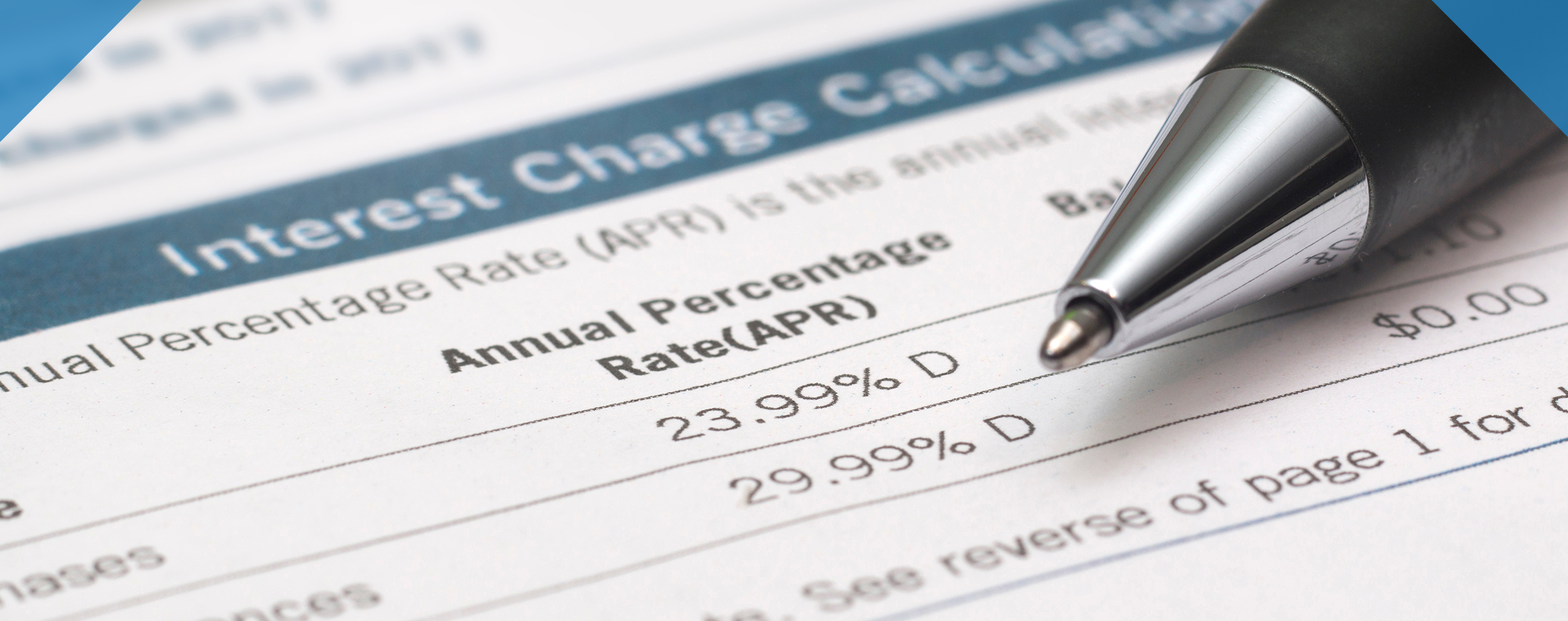

Pay Attention to Credit Card Statements

If you find any errors on a credit card statement, notify the creditor immediately.

If you believe a rate increase was done in error, you should contact your credit card company to find out why. If you are not satisfied with the response, you are entitled to file a complaint with the Consumer Financial Protection Bureau (CFPB).

Before opening a new credit card, make sure you know what rate you are being charged. Make sure you understand your Annual Percentage Rate as well. Be aware of different APRs for different types of charges.

Nearly all of us depend on some type of credit. Car loans, student loans, credit cards, and home mortgages all have different interest rates.

Importance of Understanding APR

Since your APR is based on several factors, it is important to understand how it works.

The cost of money, the APR, is higher the longer it takes you to pay back the borrowed funds. This applies to credit card debt as well.

Never open a new credit line without understanding the true cost of the credit. Always review credit agreements and ask questions if you are confused about anything.

Always check your credit statements for mistakes which could lead to higher interest rates if not addressed.

In Conclusion

Getting out of debt is never easy. Learning how to use credit wisely is very important. The more you know about the cost of borrowing, the better credit decisions you can make.

Using credit wisely is important for the long-term. Your credit score can impact your ability to purchase a new car, a new home, and could impact your insurance premiums as well. Some people may even have problems with their job if their credit score is poor.

Taking the time to learn about your APR and how it impacts you is an important step in learning to better manage your credit. Never hesitate to ask a creditor questions about interest rates, including your APR.

Do you have additional questions on APR? We’d love to help answer them in the comments!

Very informative!!