When you are in debt, it is easy to feel trapped. But, you certainly aren’t alone.

Credit card debt in the United States exceeded $1 trillion in 2017.

For many people, this means they are not saving for retirement. Many people are also making only minimum monthly payments, meaning it will take longer to pay off credit card debt.

If you are planning to purchase a home, want to fund your retirement account, or you wish to establish an emergency fund, you must find ways to pay off credit card debt fast.

That’s the only way you’ll be able to have the money you want to do the things that are most important to you and your family. But don’t fret, there are ways to pay off credit card debt fast which can be used.

The five most common tactics are:

Everyone will have different levels of success with each. In some cases, you may start off using one method and change which is fine if you are paying off your credit card debt.

Establish a Plan That Works for You

Escaping credit card debt is never easy. There is no one-size-fits-all solution either.

If you are buried in credit card debt, take a look at all of your options. Figure out a plan that works for you. Once you have decided what method to pay off credit card debt fast works best for you try it.

After six months, review your plan and see if it still makes sense for you.

Remember, you can change plans if your current plan is not working out best for you.

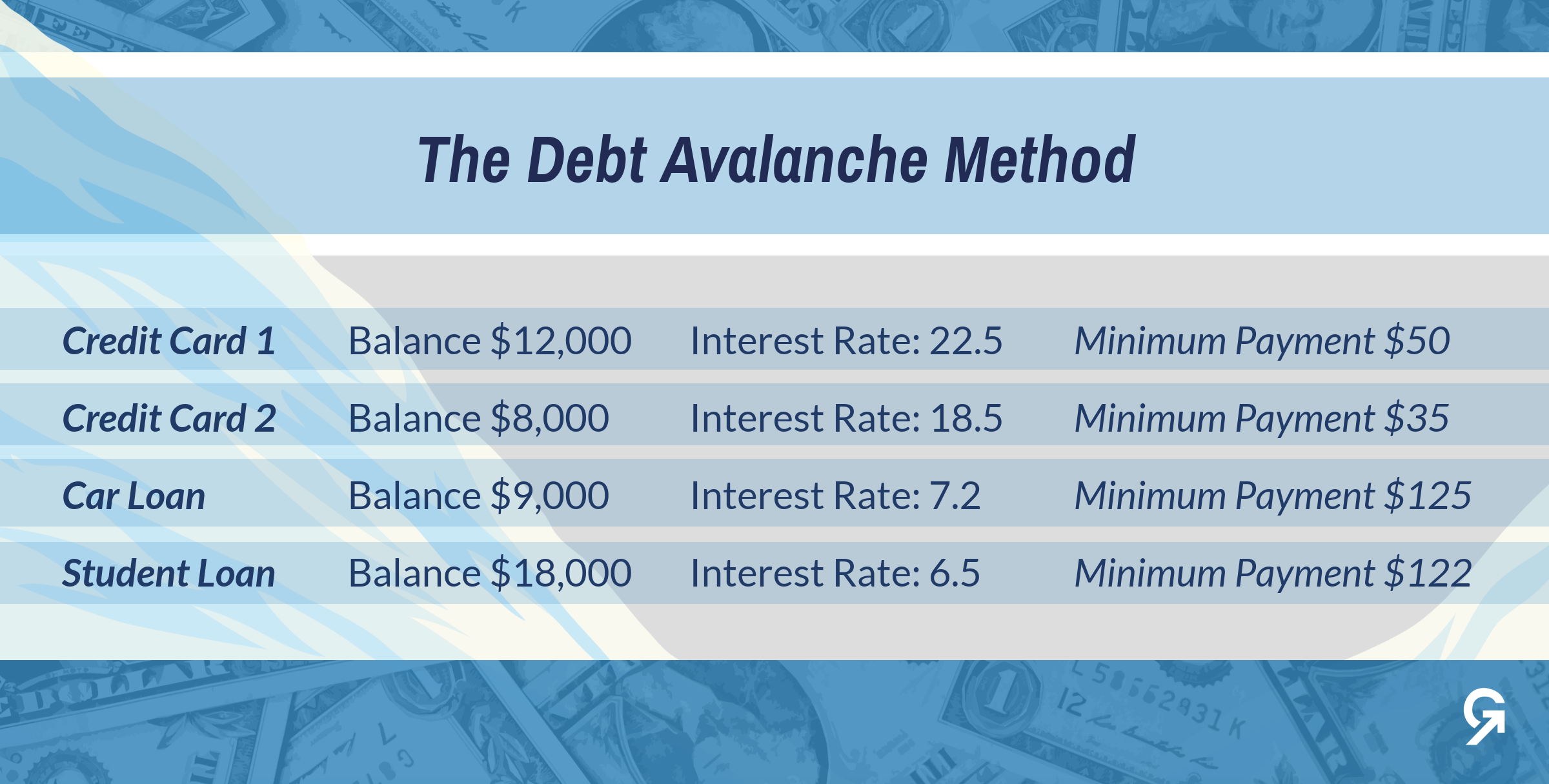

1. Consider the Avalanche Method to Pay Credit Cards

This method requires you to sort your outstanding debts by interest rate.

The theory is you are going to pay off your highest interest rate loans first. Using this method, you will reduce your overall debt since you will pay less interest over time.

If you assume you have $500 per month to pay down debt, you would make your minimum payments on all accounts except Credit Card 1. This card would be paid at the rate of $218 per month.

The result would be instead of carrying a balance on Credit Card 1 for 20 years, you would be completely paid off in four and a half years (estimated), saving you more than 15 years in interest payments.

Once you pay off that loan, you would then pay off Credit Card two using the money you are no longer paying to Credit Card 1. You would do this until you are completely debt free.

This method requires you to be disciplined enough to not increase your credit card debt while you are paying off other credit card debt.

The downside of this method of paying off credit card debt is it can feel discouraging. This may seem to take a long time, but in general, it will save you more money.

If you are the type of person who likes to see “immediate rewards” this may not be the best method of paying off your credit cards.

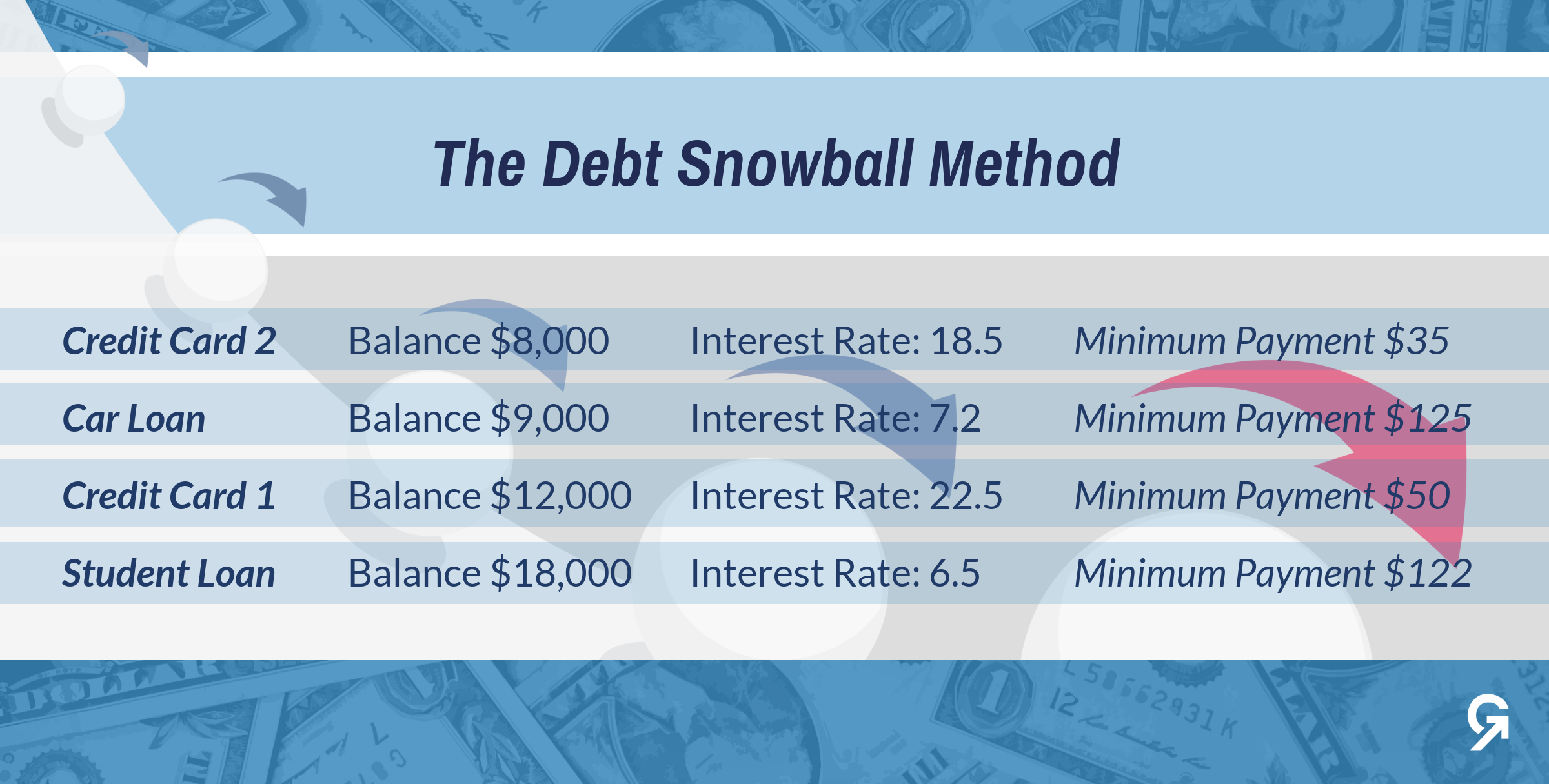

2. Using the Snowball Method of Eliminating Debt

This is the opposite of the avalanche method. Instead of paying down your debt from biggest interest rate, you focus on your smallest balances first.

It’ll look like this:

Assuming you pay the same $500 available, you would pay down credit card 2 first. Instead of the minimum payment of $35 you would pay $218 per month. At this rate, the card would be paid off in approximately three years instead of nearly 20.

This means a substantial amount of interest would be saved. Once that card is paid off, you would begin paying off the car loan using the same $218 per month.

This method to pay off credit card debt fast is very appealing because it can keep you motivated. You will see nearly immediate results since you are paying your balances off faster.

This method makes the most sense if you are the type of person who needs to see progress to stay motivated.

3. Making the Most of Balance Transfers

One of the most overlooked methods to pay down debt fast is using balance transfers. This method is most effective if you have maintained a good payment history.

Using this method, you could transfer your highest interest rate credit card, or multiple credit cards to another credit card.

To make the most of this method, you should look for a card which offers a zero-interest rate for a specific period of time. Many credit card companies offer a 0 percent APR for a period of one year.

During the introductory period, you would pay no interest rate. Therefore, transferring your credit card balances to a single card would allow you to pay down principal without adding interest.

Balance transfers are a good solution if the fee to transfer balances is not high, if the rate after the introductory rate is lower than you are currently paying, and if your current credit cards are current.

If you are combining more than one credit card into a new card, it also means you have fewer monthly payments due. This alone could reduce the chances of missing a payment.

Words of Warning: Before you chose a balance transfer to pay off credit card debt fast, make sure you carefully review the credit card agreement. In some cases, there is a balance transfer fee. You should also verify the interest rate after the introductory period to make sure you are not going to be paying a higher rate than you are currently paying.

Balance transfers can be very effective provided you remain committed to paying off credit card debt. The temptation to use the cards which now have a zero balance can be great and should be avoided.

Are you looking for a way to pay off your #creditcard and increase your #FICO score? 🏆💳 https://t.co/WAPcZI9SCu provides resources to help resolve your debt and become financial independent!

✅Pay less interest

✅Get out of debt sooner

✅Build your savings faster. 📈 pic.twitter.com/8rIs5wTlSL— Get Out of Debt (@getoutofdebtcom) November 12, 2018

4. Personal Loan Options for Credit Card Debt

For some debtors, a personal loan may be the best way to pay off credit card debt fast.

For most people, a personal loan has a lower interest rate than a credit card. For those who have good credit, your local bank or credit union will most likely offer the best rates on personal loans.

This option is very helpful if you have several accounts because you will be making only one payment instead of several. If you have auto loans, student loans, or other personal loans, only consolidate those with interest rates higher than what you are offered for a personal loan.

Before signing a personal loan agreement, review the terms carefully. Make sure you know when payments are due. Make all personal loan payments as agreed.

Not only is it beneficial to lower your interest rate, but you will also be making a single payment rather than multiple credit card payments.

Here are some tips:

- You can increase your credit score if you keep your credit cards open because you will have a lower credit utilization

- Avoid the temptation to use your credit cards unless there is a true emergency

- Use the savings over your monthly minimum balances to pay the personal loan down faster, or use it to start an emergency fund

Keep in mind, the faster you pay down the personal loan, the faster you will be completely out of debt.

Personal loans are a good option if you can reduce your interest rates, lower your monthly payments, or consolidate multiple payments into one payment. Be sure you verify this is the right option for reducing your overall debt before agreeing to a personal loan.

5. Debt Settlement Could be an Option

Another option to get your debt under control and pay off credit card debt fast is through debt settlement.

If you’re looking for a reputable debt settlement company to help you, check out our list of the 8 best debt settlement companies.

There are some things you need to know:

- Settled debt may be taxable. Your credit card company which is writing off the debt may issue a 1099 form which would require you to claim the amount settled as income

- Debt settlement does not stop lawsuits or collection activities.

- Debt settlement will negatively impact your credit score.

- Debt settlement is not an overnight fix. It takes time for the company to negotiate a reasonable amount with your creditors.

Debt settlement is a good option for someone who has suffered a short-term setback. Divorce, illness or job loss can result in your having problems repaying your credit card debt. This means you may have trouble repaying your debt because you are being hit constantly with late charges and added interest payments.

Before agreeing to debt settlement, make sure what you are paying, and what you may have to pay in taxes makes sense. Otherwise, you gain nothing by negotiating a lower payment with your creditors.

Taking Sensible Steps to Pay Off Credit Card Debt

Here are some things you should keep in mind as you are paying off your credit card debt:

- Establish your budget — make sure you know how much money you have to put towards your debt every month. Regardless of what method you choose, you must make minimum payments. A budget can help you stay on track.

- Avoid adding new debt — except for transferring balances (if it makes sense for your needs) do not increase the amount of debt you have outstanding. This means paying cash for purchases and avoiding new credit except in emergencies.

- Find ways to save money — the more money you can save, the more you have to put towards paying down your credit card debt.

- Establish an emergency fund — one way to work towards avoiding new debt is to set aside money every month in an emergency fund. This way if your car breaks down or an appliance needs repair you will not have to use credit.

The biggest challenge most of us will have is avoiding the temptation to create more debt. This means thinking carefully about major purchases. It is always a good idea to consider saving in advance for big purchases, so you can avoid additional debt.

It doesn’t take much to manage your #finances even on a tight #budget. Check out these tips on saving #money: https://t.co/P2jwXdkDxo#debtfree #getoutofdebt #moneymatters #moneymoves pic.twitter.com/YkKJqt07j4

— Get Out of Debt (@getoutofdebtcom) May 23, 2018

Get Started as Soon as Possible

We all have credit card debt, it is simply a fact of life for most of us. Paying off credit card debt fast is within reach for everyone. Each of us must evaluate our current finances and see what makes the most sense for our family.

The sooner you get started on a plan to pay off your debt, the better off you will be in the long run.

Our financial future depends on us making smart decisions. This means being aware of the amount of debt we have, planning for retirement, and having cash available in the event of an emergency. We each must make a commitment to find the best ways to pay off credit card debt fast and stay out of debt.

When you are planning for your family’s long-term financial health, paying off your debt is the first step. Just think about the peace of mind you will have knowing you have paid off your credit cards and you can move forward with your dreams and goals.

Which strategy will you use to pay off your credit card debt fast? Let us know in the comments!

Up Next: The Debt Snowball Method | Debt Snowball Calculator

nice

I’m growing closer to getting out of debt.

Staff professionalism and attention to details are very superb. I went into conversation with doubt but came out with assurance. They brought my score up 160 points just within a short period of time and all my late payments have been removed from my report as well. I am recommending them to anyone in need of real credit rebuilding.

( PATCHCREDIT at GMAIL COM )