Are you thinking about retirement?

While it might seem like it’s a long way away, the truth is that you need to start saving now.

The earlier you start saving when it comes to retirement, the better.

A lot of people choose to start contributing to their 401k to build up their retirement savings. But, that isn’t the only way to do it.

Have you considered contributing to a Roth IRA before?

You may be asking yourself questions like:

- How does a Roth IRA work?

- What are the benefits of a Roth IRA?

- What are the best Roth IRA options?

Don’t worry, we’re here to answer all those questions and more.

Feeling secure when it comes to your retirement savings is extremely important. So we’ll make sure you have all the information you need.

We’re going to cover:

- What Is A Roth IRA?

- Why Invest In A Roth IRA?

- Who Qualifies For A Roth IRA?

- How Much Can You Contribute To A Roth IRA?

- Choose Your Investment Style

- What Are The Benefits of A Roth IRA?

- How Easily Can You Access Your Money In A Roth IRA?

- How Does Your Roth IRA Grow?

- 6 Best Roth IRA Options

- Conclusion

So, let’s get started.

What Is A Roth IRA?

A Roth IRA is an individual retirement account. It offers tax free growth and withdrawals once you’re in retirement.

Pretty cool, huh?

But, there are some rules when it comes to a Roth IRA.

As long as you’ve owned the account for 5 years and you’re 59 ½ or older, you can make withdrawals without paying federal taxes.

If you plan on making withdrawals before you hit 59 ½, you should expect to pay income taxes on the amount.

Why Invest In A Roth IRA?

It’s recommended that you invest in a Roth IRA if you believe you’ll be in a higher tax bracket once you retire.

But, if you believe your tax bracket is higher now than it will be come retirement, you might be better off with a traditional IRA. This gives you a tax deduction on contributions but will tax you when you receive distributions in retirement.

Who Qualifies For A Roth IRA?

In order to qualify for a Roth IRA you need to have a steady income and meet certain requirements.

The requirements are:

- If you are a Single tax filer, you must have an adjusted gross income of less than $135,000 for 2018 to be able to contribute to a Roth IRA.

- If you are filing Married filing jointly, you must have an adjusted gross income of less than $199,000 for 2018 in order to contribute to a Roth IRA.

How Much Can You Contribute To A Roth IRA?

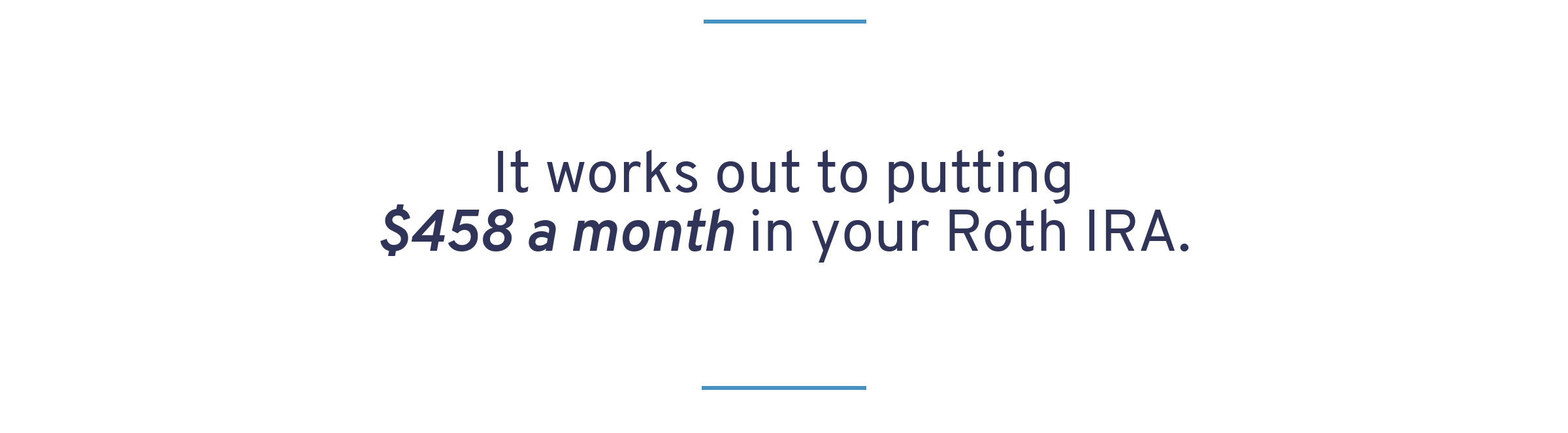

You can invest up to $5,500 a year in a Roth IRA.

So what determines the amount you’ll have by the time you retire?

It all depends on the annual average return of the stock market throughout those years.

So what if you got started late, and you’re worried that you won’t have enough money by the time you want to retire?

Don’t worry, just try to contribute a little more than you normally would.

Maybe you’re 50 years old now and your account isn’t where you thought it would be. Try putting an additional $1,000 in your Roth IRA every year.

We like to call this the “catch up.” It gives you an opportunity to grow your retirement savings a little.

Choose Your Investment Style

When you decide to invest, there are two ways to do so. You need to pick the option you will feel more comfortable with.

Are You A “Do It Yourself” Investor

If you’re more of a “do it yourself” investor, you can open a Roth IRA with an online broker. Once you’ve done this, you’ll be able to choose your own investments.

You’ll be able to build a diversified portfolio with at least four mutual funds.

Does this sound hard?

You might be surprised to find out that it really isn’t. But, some people just like the reassurance of knowing their money is in good hands. And that’s why this isn’t the only option.

Are You A “Mange It For Me” Investor

If you go this route, you will have someone pick an investment portfolio for you.

The typical recommendation is that you open your Roth IRA with a robo-advisor who will help you build and maintain your investment portfolio.

This online investment service is not expensive. Their fees are smaller comparatively to a financial advisor. You should expect to see fees in the range of .25% up to .50% annually, based on the assets they are managing.

Want to save money while living on a tight #budget? It’s possible! Here’s how: https://t.co/P2jwXdkDxo #debtfree #financialfreedom #moneymatters #debt #tips #GOOD pic.twitter.com/gY5eouB9rM

— Get Out of Debt (@getoutofdebtcom) April 17, 2018

What Are The Benefits of A Roth IRA?

This retirement account has 2 distinct benefits that’ll really make a difference.

Both of these are related to the tax-free benefit that comes with a Roth IRA.

- Unlike other retirement accounts, your contributions can be withdrawn at any time after the age of 59 ½ without penalty or taxes. But if you withdraw money before that age, you may be taxed and penalized.

- Your money grows tax free and the distributions during your retirement are not taxed (if withdrawn after the age of 59 ½) . So this means that if you follow the rules for distributions you will never pay taxes on the money that has generated throughout the years.

How Easily Can You Access Your Money In A Roth IRA?

In a Roth IRA, you can pull your contributions out at any time.

But withdrawing the investment earnings on this account will have a 10% penalty as well that it will be taxed. There are some exceptions to avoid the 10% penalty.

In order to avoid the penalty you would need to fall into one of the following exceptions.

If you’re younger than 59½ and your Roth IRA is less than five years old:

- If you are withdrawing up to $10,000 for the purchase of your first home.

- If you are withdrawing for qualified education expenses.

- If you are withdrawing because you are unemployed and need to pay your health insurance premium.

- If the withdrawal is due to disability.

- If the withdrawal is made to a beneficiary or your estate after your death.

If you’re younger than 59 ½ and your Roth IRA is five or more years old:

- If you are withdrawing up to $10,000 for the purchase of your first home.

- If the withdrawal is made to a beneficiary or your estate after your death.

- If the withdrawal is due to disability.

How Does Your Roth IRA Grow?

A Roth IRA does not pay a set interest rate or return like some other accounts.

Instead, you open your account and start saving some money in it. Once you have the funds built up, you’ll begin selecting investments. The investments you select will dictate how much your money grows.

There are several options you have when it comes to investing. These include mutual bonds, individual stocks, and bonds.

If it’s your first time investing and you need some help, we suggest you open a Roth IRA with a robo-advisor. They will be able to do everything for you, without needing to stress yourself out.

6 Best Roth IRA Options

Did you decide if you’re more of a “Do It Yourself” investor or a “Manage It For Me” investor?

If you haven’t yet, now is when you’ll want to decide your strategy. That way, you’ll know where to find the information you’ll need.

We’ve separated your options below based on your investment style.

For The “Do It Yourself” Investor

Wealthfront

- Account Minimum: $500

- Fees per Trade: 0.25%

- Promotion: First $5,000 will be managed for free

Betterment

- Account Minimum: $0

- Fees per Trade: n/a

- Promotion: Will receive first year free management with a qualifying deposit

Ally

- Account Minimum: $0

- Fees per Trade: $4.95

- Promotion: A $50 cash bonus with qualifying deposit

For The “Manage It For Me“ Investor

Merrill Edge

- Account Minimum: $0

- Fees per Trade: $6.95

- Promotion: A cash bonus of $100 – $600 with a qualifying deposit

Ameritrade

- Account Minimum: $0

- Fees per Trade: $6.95

- Promotion: A cash bonus of $100 – $600 with a qualifying deposit

Ally

- Account Minimum: $0

- Fees per Trade: $4.95

- Promotion: $50 cash bonus with qualifying deposit

Conclusion

It’s never too late to start investing in your future.

A Roth IRA is a great option if you’re looking for a way to build up a nice retirement savings.

If you decide that a Roth IRA is the right route for you, take the time to explore the 6 best Roth IRA options we’ve laid out for you here.

Are you considering opening a Roth IRA account? Let us know in the comments!

Up Next: How Much To Save For Retirement

Leave a Reply