Sticking to a budget is just not easy as it seems.

Managing your money and staying on track with your budget can be difficult at times. And if you’re not staying on top of your finances, you might spend way more than you should without realizing.

The best way to stay on track is by creating a budget and an easy budget template to follow. Doing this will help your money go further than it does right now.

When you get your paycheck, you might pay some bills, go out to dinner, and make those little purchases you’ve wanted all week.

But, do you do this without considering what might come up later? Will you have the money to handle anything that comes your way?

This is why creating a simple budget template will help you do so much more with the money you already have.

You’ll be creating a guideline for yourself to follow that’ll help you take control of your finances and save money while setting and saving for your future goals.

First things first, we’ll take you through the process of creating your own budget that fits into your life.

Then, we’ll show you how to create a simple budget template that you can use to track your progress.

We’re going to cover:

Calculate Your Monthly Income

In order to create your budget, you need to know how much money you’re working with. To do this, we’ll start by calculating your income.

List out all the places you have money coming in on a monthly basis.

For a lot of us, this is just our paycheck from our 9-5 job.

But don’t forget to include anything extra. Do you drive for Uber on the weekend? Or have an apartment you lease out?

Don’t leave anything out. You’ll want to include all your different income streams in this final number.

By making sure that you calculate your income correctly, this will ensure that you have a reliable number to create your budget around.

It’s really easy to overestimate what you can afford. Because of this, it’s important to make sure that you’re using your net income, and not your gross salary when making these calculations.

Deductions like social security, taxes, and health insurance are taken out of your gross salary, and so you cannot count this towards your budget. That’s why we use your net income, or your take home salary, to create your budget.

Here’s an example.

Let’s say you have 2 jobs, one full time and one part time.

-

- At your full time job, you have a monthly gross salary of $4,000 and a net take home pay of $3,200.

- At your part time job, you have a monthly gross salary of $2,150 and a net take home pay of $1,710.

You’re going to want to create your budget with an income equivalent to the sum of your net take home pay from every job you have.

So in this instance, your total monthly income would be $4,910.

Want to save money while living on a tight #budget? It’s possible! Here’s how: https://t.co/P2jwXdkDxo #debtfree #financialfreedom #moneymatters #debt #tips #GOOD pic.twitter.com/gY5eouB9rM

— Get Out of Debt (@getoutofdebtcom) April 17, 2018

Add Up Your Monthly Expenses

Now it’s time to list out all of your expenses. This includes anything that you pay in a weekly, biweekly, monthly, quarterly, or yearly basis.

Be careful and diligent when putting your list of expenses together. You really need to make sure that you don’t miss anything so you’ll be able to create an accurate budget.

Start by adding up all of your necessary expenses, the things you need in order to survive.

Necessary Expenses Include:

-

- Mortgage/Rent

-

- Water Bill

-

- Electric Bill

-

- Car Payment

-

- Student Loan Payments

-

- Groceries

-

- Gas

-

- Health Insurance

-

- Auto Insurance

-

- Home/Rental Insurance

- Child Support

Once you have created a list of your necessary expenses, go through and write down how much each one costs you on a monthly basis.

-

- Mortgage – $1,200

-

- Water Bill – $42

-

- Electricity Bill – $89

-

- Car payment – $339

-

- Student loans -$150

-

- Groceries $350

-

- Gas – $140

-

- Health Insurance – $156

-

- Home Insurance – $53

-

- Car Insurance – $109

-

- Child support – $150

- Credit card – $100

Total Obligated Expenses: $2,878

After you have completed your obligated expenses list, it’s time to think about your future goals.

Set Goals For The Future

In order to have a stress free financial future, you need to start thinking about savings, emergency funds, and being debt free now. Doing this will allow you to be much more comfortable in the future, as you’ll have your plan in place.

Start by thinking about your goals for the future, both short and long term. Your short term goals are ones that you should be able to achieve within a years time. Long term goals may take several years to complete.

You may have goals like these on your list:

-

- Pay off credit card

-

- Save for down payment on a new car

- Build an emergency fund with 4 months of living expenses in it

Once you have compiled a list of your goals, prioritize and rank them accordingly. Then, select one or two that you’d like to achieve first. You’ll work on creating a budget that will allow you to do this.

Let’s say you choose to pay off a $400 credit card, and put $200 towards your 401k.

Now, you’ll add these to your list of expenses.

So let’s say that we will choose the following:

-

- Pay off credit card – $400

- Save in 401K – $200

Once you have decided which ones you are going to start with, add them to your expense list.

Current Expenses:

-

- Mortgage – $1,200

-

- Water Bill – $42

-

- Electricity Bill – $89

-

- Car payment – $339

-

- Student loans -$150

-

- Groceries $350

-

- Gas – $140

-

- Health Insurance – $156

-

- Home Insurance – $53

-

- Car Insurance – $109

-

- Child support – $150

-

- Credit card – $100

-

- Pay off credit card – $400

- Save in 401K – $200

Once you have added your goals to your list of expenses, you can start thinking about your wants, the things you don’t necessarily need.

Determine Your Wants

These expenses are not needed to survive, but we all like to spend money on them.

Wants can include:

-

- Internet

-

- Netflix

-

- Cable

-

- Dining Out

-

- Vacations

-

- Shopping

- Gifts

Here’s a list of typical wants and the estimated costs associated with them.

-

- Internet – $59

-

- Netflix – $11.99

-

- Dining out – $100

-

- Hair cut – $60

-

- Shopping – $140

- Mini Vacation – 3 day & 2 nights -$600

Now add them to your main list:

-

- Mortgage – $1,200

-

- Water Bill – $42

-

- Electricity Bill – $89

-

- Car payment – $339

-

- Student loans -$150

-

- Groceries $350

-

- Gas – $140

-

- Health Insurance – $156

-

- Home Insurance – $53

-

- Car Insurance – $109

-

- Child support – $150

-

- Credit card – $100

-

- Pay off credit card – $400

-

- Save in 401K – $200

-

- Internet – $59

-

- Netflix – $11.99

-

- Dining out – $100

-

- Hair cut – $60

-

- Shopping – $140

- Mini Vacation – 3 day & 2 nights -$600

Once you have completed your list, it’s time to add them all and see your total.

Total: $4,448.99

Subtract Your Net Income From Your Expenses

At this point, you’ve gathered all the information you need to create your budget.

Now it’s time to subtract your expenses from your income. A couple of things could happen here.

You’ll either get:

-

- A positive number

-

- You’ll be at $0

- A negative number

Based on the result, you’ll know whether your current budget works for you or if you’ll need to make some adjustments before you can move forward.

If you ended up with a positive number, that means you’re good to go. You’re not overspending for your income level and this is a great sign of financial control.

But if you have several hundred dollars left, you should go through your budget and see what you can allocate these funds towards. The reality is that when you’re creating your budget, all of your money needs to go somewhere. Whether it’s paying off debt, saving for retirement, or anything else. You should have no money left over after you complete your budget. A big fat zero.

If your expenses and income balanced each other out to leave you with $0, that means you’re where you need to be. You’re in control of your spending and your finances as a whole.

If you do fall under this category, make sure that you have already established an emergency fund. This is a crucial detail as an emergency can be a hard hit on your wallet. Be prepared ahead of time by having that fund in place.

If you ended up in the negative, it means you’re spending more than you can afford to. This is the time to make adjustments to your budget. You should focus on reining in some of your wants. Remember, these aren’t necessities as much as you probably wish they were.

Stop going out to dinner every week. Make it a monthly event instead. Or, cancel your cable service and opt for a cheaper streaming option.

It might not be a change you’ll have to make forever, but your money needs to work for you now. So cut back on some of those wants in favor of some priority expenses.

Here are the 9 things you ought to do this 2018 to develop a #strategy that will eliminate #debt faster. Learn more about it here: https://t.co/NVRw3RVwFK#finance #money #tips #resolution #GetOutOfDebt pic.twitter.com/c1VEUd6D9O

— Get Out of Debt (@getoutofdebtcom) March 6, 2018

Optimize Your Money

In this example, our income is $4,910

When you subtract your income ($4,910) from your list of expenses ($4,448.99), you end up with a total of $461.01.

Having a positive number leftover is good! But you need to make sure you’re putting your money to its best use. So go through your budget and see what these funds should be dedicated to.

Out of the $461 left, let’s say that you’re going to distribute it like this:

-

- Pay off credit card – $200

-

- Save in 401K – $200

- Mini Vacation – 3 day & 2 nights -$61

You put the additional $461 towards your goals, and one of your wants. By doing this, you’re back to $0. Right where we want to be.

Now that you have made all of the adjustments needed, it’s time for the next step.

Use Your Budget & Then Review

Now it’s time to actually put your budget to use! Let everyone in your house know about the new plan.

Why is this important?

You need everyone to be on the same page. This is something that everyone in the house needs to help with. If any additional spending occurs, it’ll knock your budget out of balance.

Of course this doesn’t mean that you can’t change anything once you have your plan in place. You just want to make sure you’re aware of all the spending, so you can make the adjustments. No matter what, you need to stay on track.

Make sure that no new adjustments need to be made. By doing this, you’ll ensure that you have full control over your finances at all times.

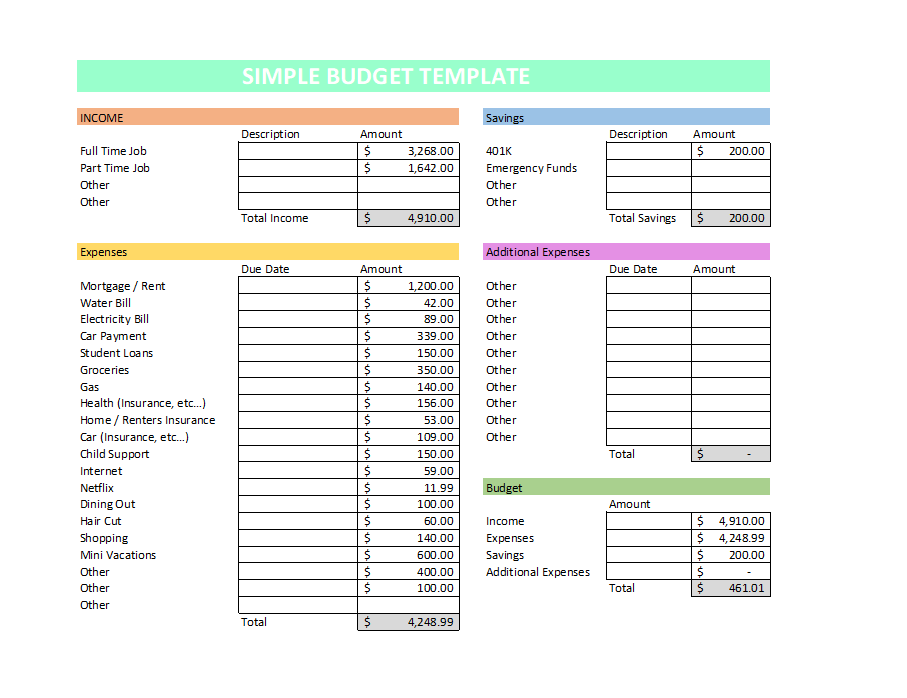

Creating Your Simple Budget Template

You’ve completed your budget plan, now it’s time to add this information into a spreadsheet. We do it this way so you can easily track everything and make changes quickly.

There are 2 different ways you can go about this. You can use a pre-existing spreadsheet, or create your own in Excel.

We have created a simple budget template that you can use over and over again. What’s great about it is that you can also customize it as you’d like.

Tip

When customizing the fields make sure that you do not delete the formulas added to the spreadsheet. These formulas are located in the amount and total fields.

You have the ability to title the categories as well. There are fields that have been categorized as other, so you can rename as pertains to your personal budget.

Here’s a preview of the template:

You can access our simple budget template here.

The other option is to make create your own spreadsheet and we’ll show you how to do that now.

Creating your own template can be easy, and it’ll be completely customized to fit your needs.

Before continuing, make sure that you did all the work and now have a budget that fits with your income and expenses.

Then, we’ll show you how to:

-

- Start a template in excel

-

- Enter your income and expenses

-

- Add formulas

-

- Compare your income versus your expenses

- Save your template

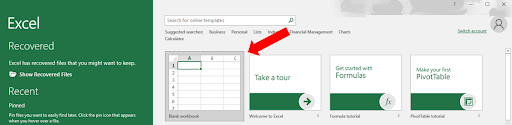

First of all make sure that you have access to Excel in order to be able to start. Remember when you create your own templates, you can easily make changes to it if something no longer works for you.

Start a template in excel

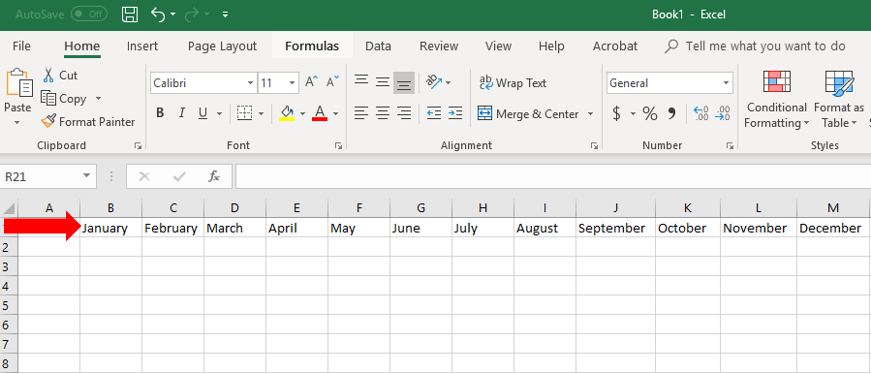

Start by opening excel and selecting blank workbook. As illustrated below:

Once you have opened a new workbook begin working on B1. Type the name of each month as illustrated below:

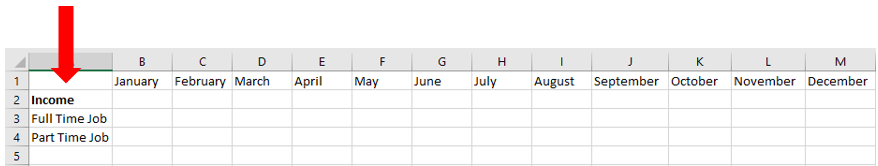

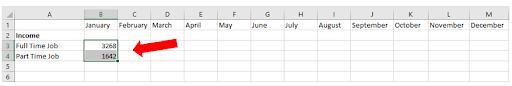

Grab your budget plan and look at your income list:

-

- Net income from full time job – $3,200

- Net income from part time job – $1,710

And list as illustrated:

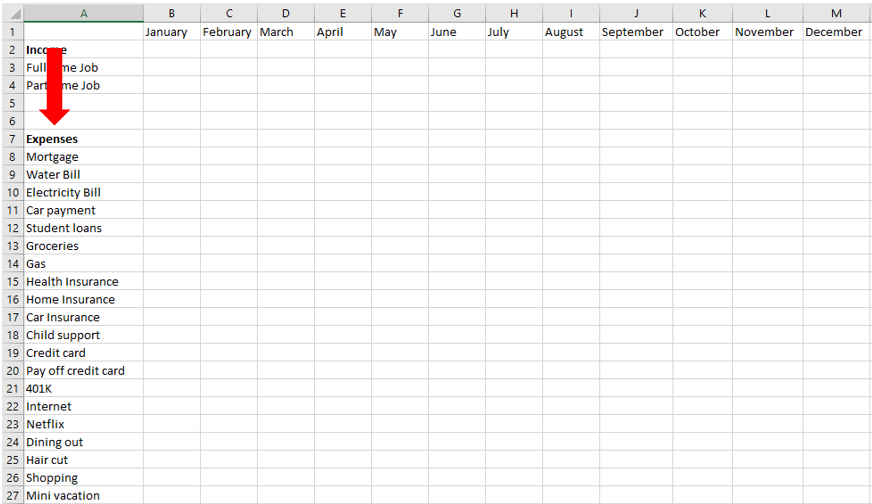

Going back to your budget plan, take a look at all of your expenses:

-

- Mortgage – $1,200

-

- Water Bill – $42

-

- Electricity Bill – $89

-

- Car payment – $339

-

- Student loans -$150

-

- Groceries $350

-

- Gas – $140

-

- Health Insurance – $156

-

- Home Insurance – $53

-

- Car Insurance – $109

-

- Child support – $150

-

- Credit card – $100

-

- Pay off credit card – $400

-

- Save in 401K – $200

-

- Internet – $59

-

- Netflix – $11.99

-

- Dining out – $100

-

- Hair cut – $60

-

- Shopping – $140

- Mini Vacation – 3 day & 2 nights -$600

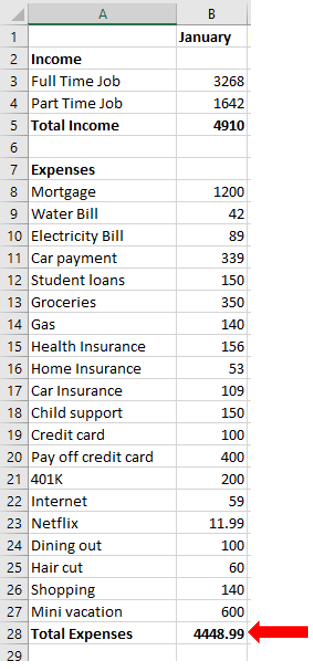

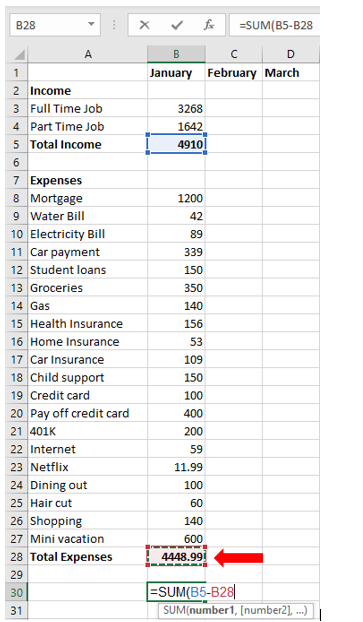

Now list them as illustrated below:

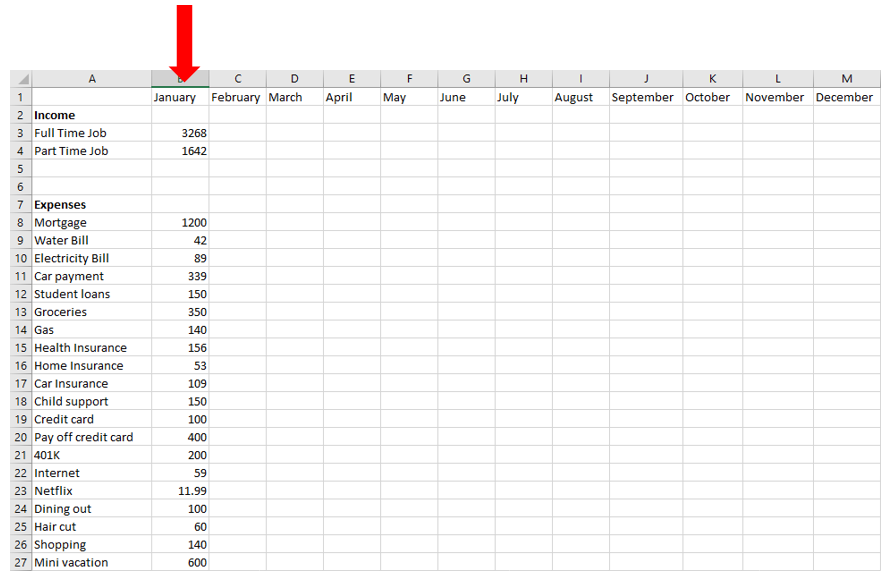

It’s time to add some numbers to this template.

Enter your income and expenses

You are going to select the month that you are creating the budget for and start placing the amounts for each expense.

Once you have listed both your income and expenses we are ready to add some formulas.

Add formulas

If you were to be using a pen and paper, you would need to get a calculator as well to get this part done. But the advantage of using Excel is that it will add the columns for you and you’ll be able to see how much you earn, as well as how much you spend.

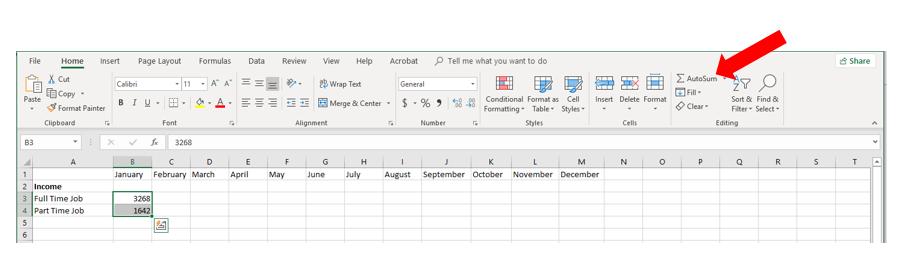

To get started let’s calculate your income.

Click the box where you want to start adding and drag it towards the last one. It should highlight everything as illustrated below:

Click the Autosum button in the top right hand side of your screen

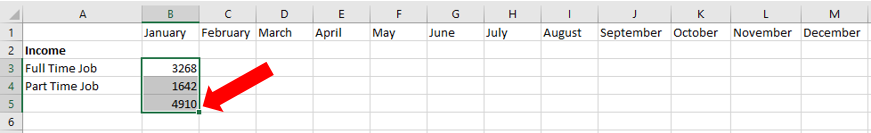

This will automatically add your numbers and give you the result.

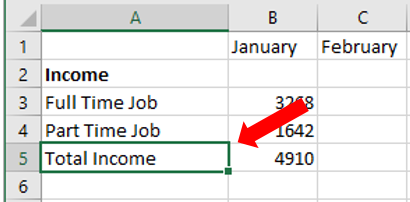

After you have the total number, you can name it how ever you would prefer.

Now you are going to do the same for the expenses

Once you have these numbers, the only thing left to figure out is the difference between your income and expenses.

But how do we do that?

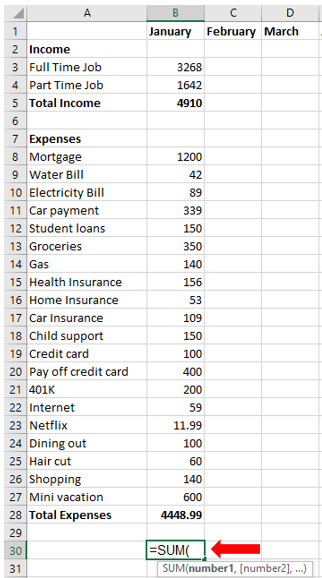

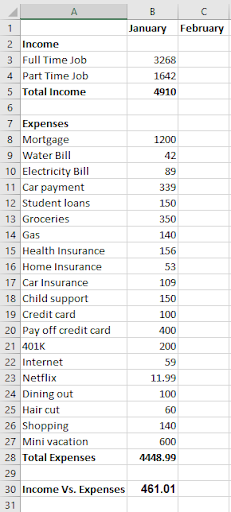

Compare your income versus your expenses

If you want to quickly see if you are spending less than you earn, you can compare them with a formula.

Click on any cell that you would prefer and place this formula in it:

=SUM(

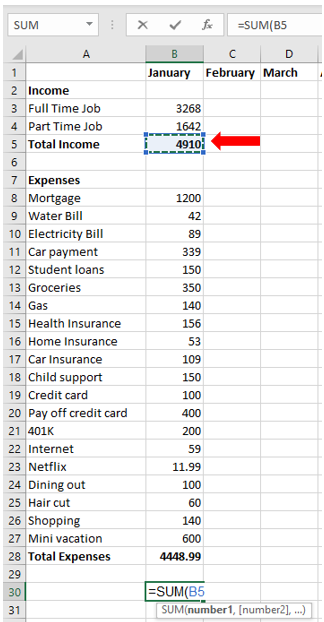

Then select the income cell you want to add

When you select the cell, it will automatically add in blue the cell number to your formula.

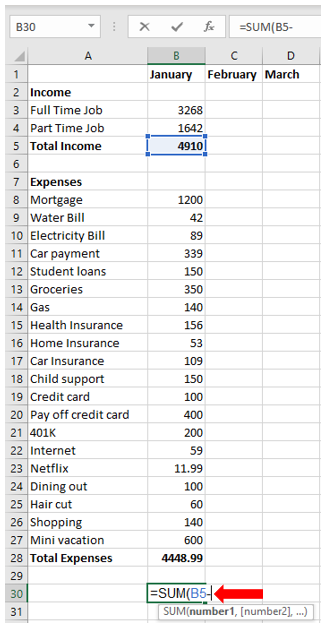

Since we want to subtract one from the other, place a (-) symbol after B5

Now select the other cell that has the total of expenses

When you select the cell, it will automatically add in red (since we are subtracting that number from the first one) to the cell number to your formula.

When you close the parenthesis it will give you the difference between these 2 numbers.

In this case we have a positive result after comparing them.

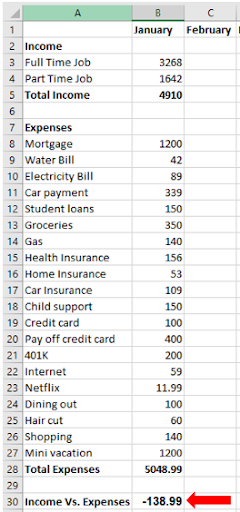

But let’s say that instead of a positive result you get a negative one, you will notice it’s negative since it has a negative symbol before the number.

This would be the moment where you go back and adjust your numbers. Keep in mind that all of these formulas that you have will stay there, so all you need to do is change the number right next to the expense you want to adjust.

For example, I alternated line 27- Mini vacation from $600 to $1,200 and it automatically totaled the expenses to $5,048.99

Once you have done this, it’s time to save the spreadsheet this way you can open and work with it whenever you are going to make adjustments or even to verify if you are right on track.

Saving a blank copy makes it easy for the future or even to send to a family member or friend that needs a budget template.

Conclusion

Creating a budget is not difficult as it seems, you just have to put forth the effort to get it done. Once you have done it, monitoring takes no time and this will allow you to stay on track.

If you want to save yourself the time, download our simple budget template.

We hope that this information comes in handy to you and that you start creating your budget plan today!

Did you use these steps to create your own budget? Let us know in the comments!

Leave a Reply