Have you been getting offers in the mail for a 0% APR credit card, but not sure if it’s the right choice for you?

Let’s break down what it means to get a 0% intro APR credit card so you can make the decision on whether or not it’s a smart move for you to make.

We’ll give you the lowdown on how these cards work, how you can use it to your advantage, and what to look for when selecting one.

Then, we’ll give you our picks for the top 9 0% APR credit cards on the market right now.

We’ll cover:

- What Is APR and How Does It Work?

- Types of APRs

- What Is A 0% APR Credit Card?

- How To Use These Credit Cards To Your Advantage

- What To Look For

- Chase Freedom

- Chase Freedom Unlimited

- Citi Diamond Preferred Card

- Citi Simplicity Card

- Citi ThankYou Preferred Card

- Wells Fargo Platinum Card

- Blue Cash Everyday Card

- Cash Magnet Card

- BankAmericard Credit Card

What Is APR and How Does It Work?

Your credit card’s interest rate is the price you pay for borrowing money.

For credit cards, the interest rate is typically stated as a yearly rate.

This is called the annual percentage rate, or APR.

APR is calculated using an index like U.S. Prime Rate, and then adding some amount of margin the bank charges. The result is the APR.

If you payoff your credit card balance in full each month, you don’t have to pay any interest.

However, if you carry a balance on your card month to month, you will pay the agreed-upon interest on your outstanding balance.

Types of APR

There are different APRs based on the different ways you can use your credit card.

When selecting a credit card, it’s a good idea to get a full picture of their fees upfront.

These include:

- Purchase APR: The rate applied to your purchases on your credit card. This is the “main” APR on any credit card and the one credit companies market.

- Cash Advance APR: Some credit cards allow you to withdraw money from your credit card’s available balance. A Cash Advance APR is generally higher than your purchase APR.

- Penalty APR: This is typically the highest rate associated with your credit card. If you fail to make a payment on time, you’ll see your penalty APR kick in. You don’t have to worry about your penalty APR if you are always on time with your payments.

- Introductory APR: This is the promotional APR a creditor offers. The introductory APR will be in affect for a set amount of time upon activation of your card. It can apply to only specific transactions as well as cash advances, and balance transfers. Make sure you know the terms of your introductory APR before you start charging.

What Is A 0% APR Credit Card?

By securing a 0% intro APR credit card offer, you will not be required to pay interest on your purchases for a specific period of time. These periods typically range from 6 to 21 months.

Once it is up, the card’s ongoing APR will take affect and you will be responsible for any interest that accrues afterwards.

Example

You buy a new T.V. 10 months into a 12-month 0% period. No interest will accumulate on this purchase for the first 2 months. After the 0% period is up 2 months later, interest will begin to accumulate on the remaining unpaid balance.

Let’s say that your new T.V. cost you $1,000. During the first 2 months, you make payments totaling $875. The remaining $125 of your balance will be eligible for interest charges.

If you are able to pay the T.V. off before the 12-month 0% period ends, you will only pay the original $1,000 for it.

A card issuer might not always advertise that they have a 0% intro APR promotion going on at the time. So it’s important that you do your own research.

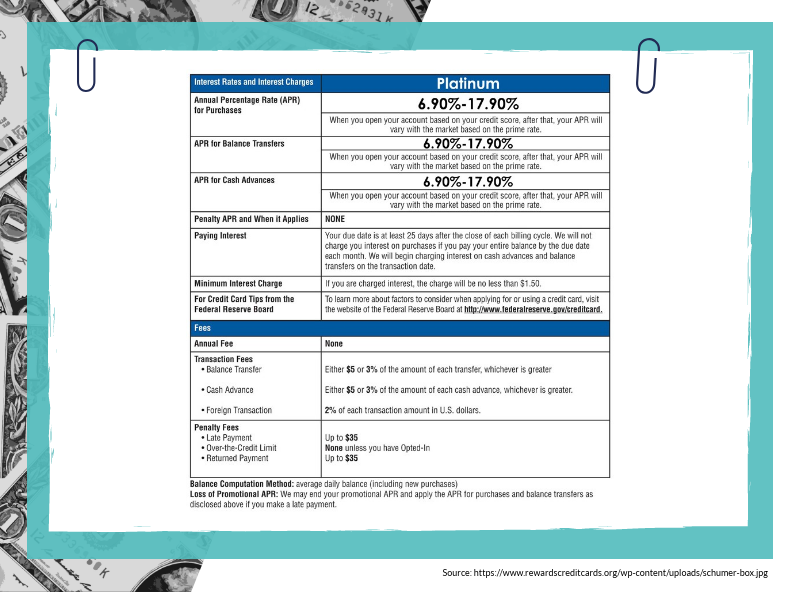

You’re always going to be able to find the rates, fees, terms and conditions in the Schumer Box on the credit card agreement.

It’ll look like this:

As you can see, the Schumer Box lists out:

- Interest Rates and Interest Charges

- Purchase APR

- Balance Transfer APR

- Cash Advance APR

- Penalty APR and When it Applies

- Paying Interest

- Minimum Interest Charge

- Fees

- Annual Fee

- Transaction Fees

- Balance Transfer

- Cash Advance

- Foreign Transaction

- Penalty Fees

- Late Payment

- Over-the-Credit Limit

- Returned Payment

The Schumer Box is a great quick reference to compare cards and terms.

When you click the “Apply Now” button on most credit card applications, the Schumer Box will be a part of the agreement you’ll sign electronically.

Make sure you reference it before submitting your application.

How To Use These Credit Cards To Your Advantage

If you’re already in debt, you know that interest payments and late fees can make paying your balance off seem impossible.

Maybe you’ve gotten a couple of 0% intro APR credit card offers in the mail. You might be struggling with the debt you already have and think the last thing you should do is open a new line of credit.

But, there’s a lot of advantages to having a 0% APR credit card.

- Rolling Balances

- By transferring your balance to a 0% APR card, you can go from a card with a high APR and “roll” that debt to a card with no APR.

- Reduce Balances Faster

- By utilizing the 0% APR period, you can devote all of your resources to reducing your balance. Since you will not be accruing interest during this period, you’ll be able to make a much more significant dent in your total debt.

- Finance Large Purchases at 0%

- Maybe you’re not already in debt, but you have a large purchase coming up, and you don’t want to fall behind on your bills because of it. This would be another great time to use a 0% APR card. By putting a big ticket item on the card, you’ll be able to stretch the payments out over a longer period of time, without paying anything extra for your big purchase.

It doesn’t take much to manage your #finances even on a tight #budget. Check out these tips on saving #money: https://t.co/P2jwXdkDxo#debtfree #getoutofdebt #moneymatters #moneymoves pic.twitter.com/YkKJqt07j4

— Get Out of Debt (@getoutofdebtcom) May 23, 2018

What To Look For

So you’ve decided that you’re going to benefit from getting a card with a 0% APR introductory period. But, which one is the right one for you?

There’s a couple of factors you should pay attention to when selecting your new card. Don’t forget that all of this information can be found inside the Schumer Box of the credit card offer.

Length of Introductory Period

Make sure you take careful note of how long your 0% APR introductory period is.

The worst thing you can do is to open the card, start making charges, and forget to pay anything off before the no interest period ends.

Ongoing APR

But, something unexpected came up. Maybe your daughter needed surgery or your car broke down. Either way, you’re not going to be able to pay that balance off when your introductory period ends because of what happened.

What happens now?

That’s why you need to look at the ongoing APR of your credit card before you open it. Once your introductory period is over, this is the interest rate that will take affect.

So, if you cannot pay your balance off before the no interest period ends, be prepared to pay the ongoing APR on your purchases.

If you are not comfortable with the ongoing APR, make sure you are 100% positive you can pay the card off before the introductory period ends, or look around for another offer.

Balance Transfer Fees

If you’re applying for a 0% APR credit card for the purpose of transferring a balance, you need look at these fees ahead of time. They can vary greatly depending on the credit card offer.

Some cards do offer free balance transfers as part of their promotion. If you can find one of these offers, great! You’ll be able to transfer your balance and not worry about any additional fees.

But what can you expect if your card doesn’t offer this?

The best balance transfer cards have fees that are typically 2-5% of the amount transferred.

It might be frustrating that you have to pay an additional fee when you’re working on getting out of debt. But, the fee won’t seem so bad when you think about all of the money you’ll be saving from deferring your interest.

In the market for a 0% APR Credit Card? Check out our top 9 picks below.

Chase

Chase Freedom

Quick Stats for Chase Freedom

- Intro APR: 0% on Purchases and Balance Transfers for 15 months

- Ongoing APR: 16.74-25.49% Variable APR

- Balance Transfer Fee: 5% of amount transferred, with a $5 minimum

- No Annual Fee

- Recommended Credit Score: 690-850

Bonus Features of Chase Freedom

- Earn a $150 bonus after spending $500 on purchases within the first 3 months

- Earn 5% cashback up to $1,500 each quarter in combined purchases in bonus categories

- Unlimited 1% cashback on all other purchases

Chase Freedom Unlimited

Quick Stats for Chase Freedom Unlimited

- Intro APR: 0% on Purchases and Balance Transfers for 15 months

- Ongoing APR: 16.74-25.49% Variable APR

- Balance Transfer Fee: 5% of amount transferred, with a $5 minimum

- No Annual Fee

- Recommended Credit Score: 690-850

Bonus Features of Chase Freedom Unlimited

- Unlimited 1.5% cash back on every purchase

- Earn a $150 bonus after spending $500 on purchases within the first 3 months

Citibank

Citi Diamond Preferred Card

Quick Stats of Citi Diamond Preferred

- Intro APR: 0% on Purchases for 12 months

- Ongoing APR: 14.74-24.74% Variable APR, based on your creditworthiness

- Balance Transfer Intro APR: 0% on Balance Transfers for 21 months, but the transfer must be completed within 4 months of opening the account.

- Balance Transfer Ongoing APR: 14.74-24.74% Variable APR, based on your creditworthiness

- Balance Transfer Fee: $5 or 5% of each amount transferred, whichever is higher

- No Annual Fee

- Recommended Credit Score: Above 690

Bonus Features of Citi Diamond Preferred

- $0 liability on Unauthorized Purchases

- Citi Identity Theft Solutions

- If you transfer a balance with this offer, you will be charged interest on both New Purchases and any remaining Unpaid Introductory Balances if they are not paid in full by the time your 0% Intro Purchase APR expires

Citi Simplicity Card

Quick Stats for Citi Simplicity

- Intro APR: 0% on Purchases and Balance Transfers for 18 months

- Ongoing APR: 15.74-25.74% Variable APR, based on your creditworthiness

- Balance Transfer Fee: $5 or 5% of each amount transferred, whichever is higher

- No Annual Fee

- Recommended Credit Score: 690-850

Bonus Features of Citi Simplicity

- No Late Fees

- No Penalty Rates

Citi ThankYou Preferred Card

Quick Stats for Citi ThankYou Preferred

- Intro APR: 0% on Purchases and Balance Transfers for 5 months

- Ongoing APR: 15.24-25.24% Variable APR, based on your creditworthiness

- Balance Transfer Fee: $5 or 3% of each amount transferred, whichever is higher

- No Annual Fee

- Recommended Credit Score: 690-850

Bonus Features for Citi ThankYou Preferred

- Earn 2x Points on Dining Out & Entertainment

- Earn 1x Point on all other Purchases

- Points do not expire

Wells Fargo

Wells Fargo Platinum Card

Quick Stats for Wells Fargo Platinum

- Intro APR: 0% on Purchases and Balance Transfers for 18 months

- Ongoing APR: 17.24-26.74% Variable APR

- Balance Transfer Fee: Balance Transfers made within the first 4 months qualify for intro rates and fees

- No Annual Fee

- Recommended Credit Score: 690-750

Bonus Features for Wells Fargo Platinum

- Free access to your FICO Credit Score

- My Money Map Tool

- Account Protection

- Zero liability protection for promptly reported unauthorized transactions

- Rapid alerts

American Express

Blue Cash Everyday Card

Quick Stats for Blue Cash Everyday

- Intro APR: 0% on Purchases and Balance Transfers for 15 months

- Ongoing APR: 14.74-25.74% Variable APR

- No Annual Fee

- Recommended Credit Score: Above 690

Bonus Features of Blue Cash Everyday

- Earn a $150 bonus after spending $1,000 on purchases within the first 3 months

- 3% cash back at U.S. Supermarkets (up to $6,000 a year)

- 2% cash back at U.S. gas stations and select department stores

- 1% cash back on all other purchases

Cash Magnet Card

Quick Stats for Cash Magnet

- Intro APR: 0% on Purchases and Balance Transfers for 15 months

- Ongoing APR: 14.74-25.74% Variable APR

- No Annual Fee

- Recommended Credit Score: 690-850

Bonus Features of Cash Magnet

- Earn a $150 statement credit after you spend $1,000 or more on purchases within the first 3 months

- Earn an additional $100 statement credit after you spend an additional $6,500 on purchases within the first 12 months

- Unlimited 1.5% cash back on purchases

- Reward Dollars can easily be redeemed for statement credit, gift cards, and merchandise

Bank of America

BankAmericard Credit Card

Quick Stats of BankAmericard

- Intro APR: 0% on Purchases and Balance Transfers for 15 months

- Ongoing APR: 14.74-24.74% Variable APR, based on your creditworthiness

- No Annual Fee

- Recommended Credit Score: 690-850

Bonus Features for BankAmericard

- No Penalty APR

Looking For More Options?

Click this link to see additional 0% APR credit cards

By now, you should have a good idea of how a 0% APR credit card really works now and whether it’ll benefit your personal situation.

Finally, if you do choose to apply for one of these credit cards, make sure you pay close attention to the details listed on the Schumer Box. Specifically, make sure you’re aware of the length of your introductory period, and the ongoing APR that’ll take effect afterwards.

Which credit card has the right benefits for you? Let us know in the comments!

Up Next: Best Credit Cards For Bad Credit

Leave a Reply