Are you thinking about how and where to start rebuilding your credit after bankruptcy?

After going through the bankruptcy process, raising your credit score is an essential step to being financially stable.

Even though your bankruptcy will stay on your credit report for up to 10 years, there are things you can do to start rebuilding your credit today.

That’s why we’ve put together these 5 steps to successfully rebuild credit after bankruptcy.

In this article we are going to cover the following:

What is Bankruptcy?

How Does Bankruptcy Affect Your Credit Score

How Long Does Bankruptcy Show On My Credit Report

Borrowing Money Post Bankruptcy

Check Your Credit Score

Reestablish Credit Promptly

Pay Off Your Monthly Balance

Keep Oldest Accounts Functional

Don’t Apply for Too Many Accounts

What is Bankruptcy

First things first, what is bankruptcy, and how does it affect you?

Bankruptcy is the process in which someone states that they are unable to pay their debts.

There are two main kinds of personal bankruptcy:

- Chapter 7

- Chapter 13

A Chapter 7 bankruptcy is a complete discharge of all your unsecured debts. It will take a few months to reach that final discharge where your debt is gone. In most states, if you file today, your bankruptcy will be discharged in roughly three to four months.

A Chapter 13 bankruptcy, also known as the Wage Earner’s Plan, involves the repayment of your creditors. Over the next three to five years, you will make payments to your creditors in installments through a repayment plan.

How Bankruptcy Affects Your Credit Score

Bankruptcy will have a negative effect on your credit score. As long as the bankruptcy is on your credit report, it will be a factor of your score.

Chapter 7 and Chapter 13 bankruptcies will affect your credit score the same way, but by how much?

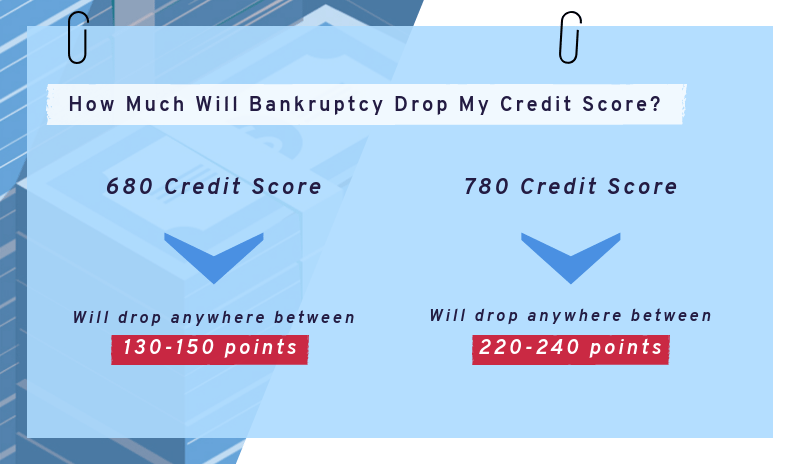

According to FICO, if you have a credit score of 680, expect it to drop anywhere between 130 -150 points.

If you’re starting out with great credit, around 780, you could lose 220 to 240 points.

Those are some HUGE drops.

How Long Does Bankruptcy Show on my Credit Report?

Bankruptcy will remain on your credit report for:

- 7 years for completed Chapter 13 bankruptcies

- 10 years for completed Chapter 7 bankruptcies

Keep in mind that the older these are, the less impact they are going to have on your credit score.

Borrowing Money Post Bankruptcy

Going through bankruptcy makes you a high risk borrower. You have to understand that lenders are going to be very cautious before lending you any additional credit.

So what kind of questions can you expect when you see your lender for a new loan or credit? Here’s some of the things they may be looking for:

- Is your bankruptcy discharged?

- Why?

- If the bankruptcy is not discharged, you are able to add new accounts to it… that’s including the one with the lender you’re currently applying with.

- Why?

- When was your bankruptcy discharged?

- Why?

- The more time passes since your discharge, the better it is for you. Some lenders won’t give you an approval until the bankruptcy is off of the credit report.

- Why?

- How have bills been paid since your discharge?

- Why?

- Lenders need to know how you how you are handling your credit since the bankruptcy discharge. Late payments will hurt you drastically as they show that you still do not have a handle on your finances. Payments need to be made early or on time.

- Why?

- Have you reinstated new credit since your discharge?

- Why?

- It’s beneficial to demonstrate that you’ve set up a new credit account, and have been responsible with the payments. This will show the lender that you are ready for additional credit.

- Why?

Pro Tip

Ask the lender:

What credit reporting agency do they use to pull credit from?

By knowing this information, you’ll have the ability to do business with a lender that works with the reporting agency of your highest FICO score.

5 Steps To Rebuilding Your Credit

1. Check Your Credit Score

As part of rebuilding your credit, you first need to know where your score stands, and where you want to be. While it is essential for everybody to check their credit report regularly, it’s more important for you since you have filed a bankruptcy.

You’re entitled to a free copy of your credit report from each of the three major bureaus once a year.

How to request a copy of your credit report:

You can go online to: annualcreditreport.com

You can call: 1-877-322-8228

You’ll want to keep a record of all the debt incorporated in your bankruptcy. A few months after the debts have cleared, check their status on your credit report.

If you filed a Chapter 7 bankruptcy, these obligations should display an amount of $0. If something isn’t being stated correctly, ask the credit reporting agency to change it, and confirm it with the initial lender.

Want to save money while living on a tight #budget? It’s possible! Here’s how: https://t.co/P2jwXdkDxo #debtfree #financialfreedom #moneymatters #debt #tips #GOOD pic.twitter.com/gY5eouB9rM

— Get Out of Debt (@getoutofdebtcom) April 17, 2018

2. Reestablish Credit Promptly

Dependent on whether you file Chapter 7 or Chapter 13, the bankruptcy will be removed from your credit report in 7 or 10 years.

If there are no new accounts for years, bankruptcy may place you in the same position as a young adult with no credit history. This is something you definitely want to avoid.

There are several ways to start the process of reestablishing your credit after filing bankruptcy:

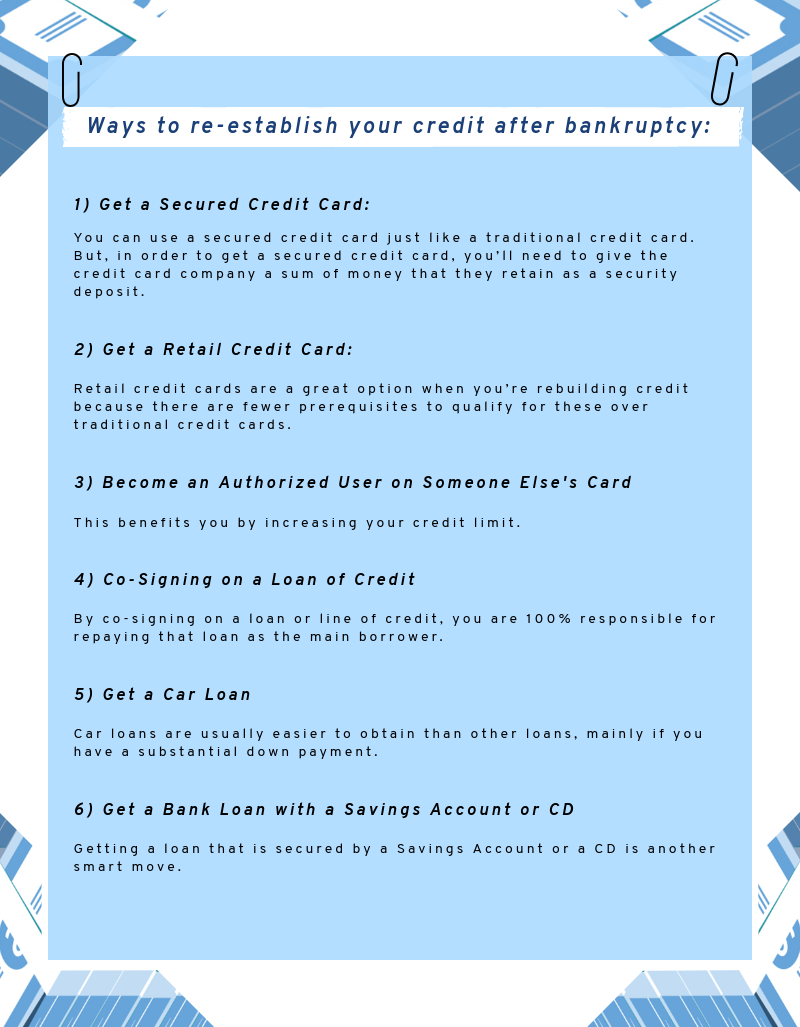

Get a Secured Credit Card

You can use a secured credit card just like a traditional credit card. But, in order to get a secured credit card, you’ll need to give the credit card company a sum of money that they retain as a security deposit.

Example

Let’s say that you would like a secured credit card in the amount of $300.

You’ll give your bank or credit card company the $300 as collateral.

Then, they’ll give you a secured credit card that you can use in the amount of $300.

As your credit improves you can ask for additional credit, or they will automatically give it to you as a reward for the proper handling that card.

Get a Retail Credit Card

Retail credit cards are a great option when you’re rebuilding credit because there are fewer prerequisites to qualify for these over traditional credit cards. However, they tend to have high fees and interest rates.

When rebuilding your credit score, it’s important to have different types of credit accounts open.

Keep in mind when applying:

- Try to get a card from a store that you will not go on a shopping spree at.

- Think about a type of card that you can use for a necessary expense

- Look into cards that do not have high start up fees.

These are just a few things to look into before applying. Make sure to keep them in mind!

Become an Authorized User on Someone Else’s Card

Another way of improving your credit score is to become an authorized user on someone else’s card. This benefits you by increasing your credit limit.

However, there are some risks of doing this. Your credit score will only increase if the primary cardholder is using the card responsibly.

Don’t expect to see an increase in your credit score if the primary cardholder:

- Does not make payments on time

- Utilizes more than 30% of their credit

- Or if the creditor does not report the account to the credit bureaus

Any of these things will prevent your score from increasing, and may even cause an additional decrease.

It doesn’t take much to manage your #finances even on a tight #budget. Check out these tips on saving #money: https://t.co/P2jwXdkDxo#debtfree #getoutofdebt #moneymatters #moneymoves pic.twitter.com/YkKJqt07j4

— Get Out of Debt (@getoutofdebtcom) May 23, 2018

Co-Signing on a Loan or Line of Credit

By co-signing on a loan or line of credit, you are 100% responsible for repaying that loan as the main borrower.

Things to keep in mind before co-signing:

- Co-signing is a promise that you will be responsible for the balance if the borrower is unable to make the payments.

- This will show on both borrower and co-signers credit report.

If your co-signed loan is continually paid on time, it should help to improve your credit score.

Get a Car Loan

Car loans are usually easier to obtain than other loans, mainly if you have a substantial down payment.

When should I consider getting a car loan?

Consider a car loan only after your bankruptcy has been finalized for at least 6 months.

How can I get better terms on a car loan?

-

- Put money aside for a down payment

- Find a cosigner who has good credit

- Don’t buy a car that is not in the range you can afford

Get a Bank Loan with a Savings Account or CD

Getting a loan that is secured by a Savings Account or a CD is another smart move.

But how does it work?

- Use money from your savings and open a certificate of deposit or a savings account.

- Request your credit union or bank to give you a loan using the money in the account as collateral.

- The bank will take your ATM card and you will not be able to access these savings.

- Usually, the bank will loan you up to 85% of the balance in the account.

3. Pay Off Your Balance Monthly

Some people might say that carrying a balance month to month is good for your credit score, but this is not always the case. If you have just undergone bankruptcy, you need to use your credit as effectively as possible.

Utilize the strategy of paying off your balances in full every month. This will open up more avenues for you going forward.

The credit bureaus will take notice that you are being responsible with your new credit and know how to handle it properly now. This will cause your credit score to rise over time, and even brings the possibility of a higher credit limit down the road.

So, let’s play it smart to obtain our goal!

4. Keep Older Accounts Functional

Avoid closing accounts, even if they’re not in use. Let your older accounts remain open and functional. The older the account, the more it helps your credit score.

This is because your length of credit history is responsible for 15% of your credit score. Your bankruptcy will have no influence on the age of your oldest account. The longer you keep an older account active, the longer your length of credit history will be. In return, the higher your score will rise.

5. Don’t Apply For Too Many Accounts

When you apply for a new account, the lender pulls your credit, and an inquiry goes on your credit report. When the lender does this, it’s considered a hard inquiry, and it can affect your score.

Hard inquiries take place when you apply for a new loan or credit card. It’s a necessary step the lender takes in order to make sure you qualify.

You’ll want to apply for new credit to build your score post bankruptcy, but be careful not to apply for too many accounts in quick succession. 10% of your credit score is factored by the number of new accounts you have opened in the short term so it’s something you need to pay attention to. Too many hard inquiries will bring your score down, and they remain on your report for up to 2 years.

Conclusion

Coming out of a bankruptcy can be hard, both mentally and financially.

You’ll need to prove to future lenders that you are creditworthy and can maintain healthy credit habits. And the first step is to start rebuilding your credit score.

Take it one day at a time. Rebuilding your credit score after a bankruptcy is a process, and you need to work through it effectively.

What tips and tricks have you used to help raise your credit score after a bankruptcy? Let us know in the comments!

Leave a Reply