If your credit card payments aren’t making a dent in your total balance, then you know how frustrating it is to see the interest accruing each month.

It seems like no matter how much money you put towards the payments, you’re just ending up owing more each month after the interest is calculated.

You need a way to pay down your balance, without worrying about the interest adding up in the meantime. Situations like this is when a balance transfer credit card is a great option.

We’ll teach you how balance transfer cards work and go over the pros and cons. This way, you’ll be able to decide if it’s the right choice for you.

Plus, we’ll show you how you can use the card to save money and get out of debt faster.

Lastly, we’ll introduce you the 5 best balance transfer cards on the market today.

So you’ll be able to compare your choices and pick the card with the right benefits for you.

We’re going to cover:

- What Is A Balance Transfer Credit Card?

- Eligibility Requirements

- Balance Transfer Restrictions

- Balance Transfer Fee

- How To Do A Balance Transfer

- Will A Balance Transfer Save You Money?

- Using A Balance Transfer Card for New Purchases

- The Pros of Balance Transfer Credit Cards

- The Cons of Balance Transfer Credit Cards

- Choosing A Balance Transfer Card

- The Best Balance Transfer Cards

- Conclusion

What Is A Balance Transfer Credit Card?

A credit card balance transfer means you’re transferring your outstanding balance on an existing account to a new credit card with a different institution.

Typically, consumers choose this option to take advantage of 0% introductory APR offers. This means they won’t have to pay any interest on their balance for that initial period. Hence, giving them more time to save up and pay off the debt before interest kicks in and the balance increases again.

There are some requirements that will need to be fulfilled in order to be able to qualify for a balance transfer credit card.

Eligibility Requirements

Credit cards have specific eligibility requirements and you must meet their criteria in order to qualify.

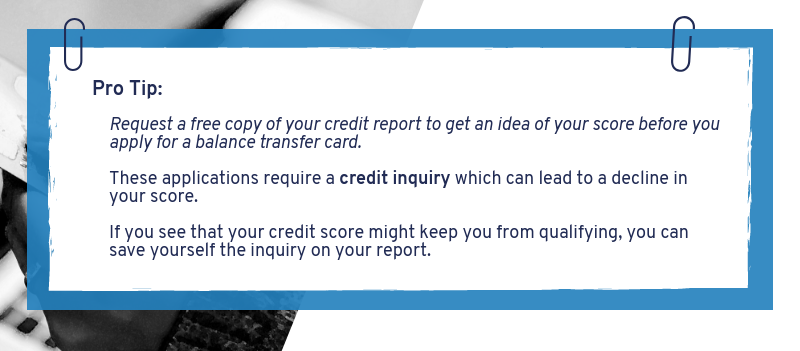

The first thing that’s going to happen is a credit check. Institutions will have credit score guidelines and not meeting those is an automatic denial.

A typical balance transfer card will require a FICO score of at least 670. The higher your score, the better your odds are for an approval.

Next, your credit card history will be analyzed. If you’re delinquent on any accounts or have had a bankruptcy within the last 10 years, your application will most likely be denied.

Lastly, they’ll take a look at your debt to income ratio (DTI). DTI is calculated by dividing your total recurring monthly debts by your gross monthly income, expressed as a percentage.

Your debt to income ratio measures your ability to manage your money and repay the debts you currently have.

This will be considered when it comes to your approval, but it will also help set your initial credit limit once you are approved. After all, a lender doesn’t want to extend you more credit than they think you can afford to pay back.

Balance Transfer Restrictions

So you’ve met the eligibility requirements, and you’re gung-ho to pick a card and get started. But, make sure to pay attention to the common restrictions that come with a balance transfer card.

The last thing you want to do is go through the process of applying for the card and getting an inquiry on your report, only to find out that you won’t be able to use the card for its intended purpose.

First, no institution will let you transfer a balance from one card to another within the same company. So, make sure your prospective card has a different issuer than your current account.

Secondly, balance transfer cards typically come with a limit on the amount you can transfer to the card. You’ll want to double check that your new card has a credit limit high enough to handle the balance transfer.

Balance Transfer Fee

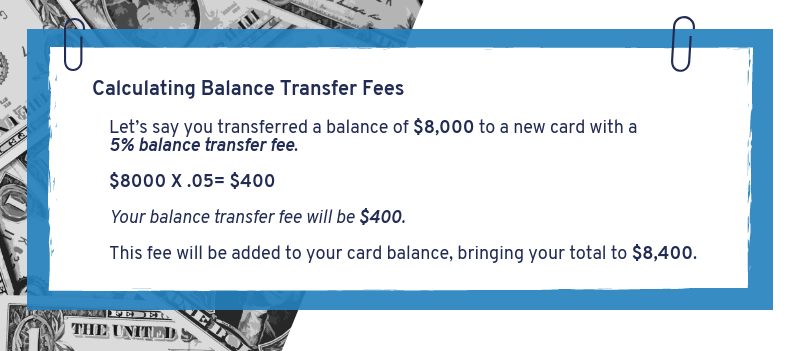

Balance transfer cards may come with a balance transfer fee that you need to be aware of ahead of time.

The fee may be a set amount, or will be calculated based on the amount you are transferring. Typically, you should expect to see a balance transfer fee of 3-5% of the amount of each transfer.

You should note that not all institutions have a balance transfer fee, and some will temporarily waive the fee during the introductory period.

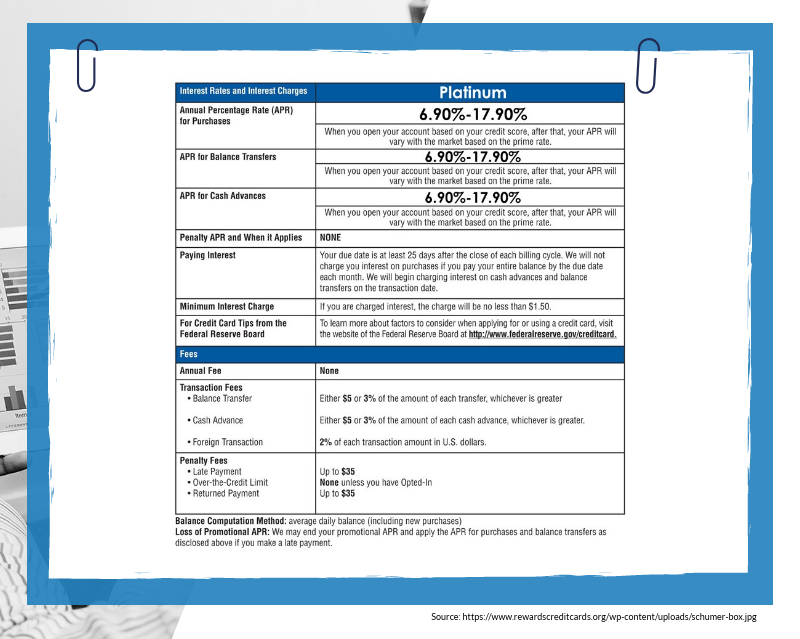

We advise you to carefully read through the Schumer Box before submitting a credit application.

Located on the credit card agreement, the Schumer Box gives you all the rates, fees, and conditions of the card.

It’ll look like this:

How To Do A Balance Transfer

After your application is approved, you’re probably going to have to wait a bit to receive your new card in the mail.

Once it arrives, this is when you’ll be able to initiate the balance transfer.

In some cases, you will be able to request the balance transfer up front when you complete your application. It all depends on the particular institution and their requirements.

In most cases, you’ll have to complete your balance transfer within the first 45-60 days of opening the account for it to qualify for that introductory rate.

As always, different cards have different requirements. That’s why it’s so important to take a good look at the Schumer Box for those specifics.

Will A Balance Transfer Save You Money?

A balance transfer card has the ability to save you a lot of money when you’ve been dealing with high interest credit card debt.

But, a balance transfer card isn’t a blanket solution to your overall debt problem.

There are instances when this type of card doesn’t offer you the best savings in the long run. So, it’s imperative that you do the math and know if this is the best route for you to take.

Take a good hard look at your financial situation and be honest with yourself about whether you’ll be able to pay the balance off during the introductory period.

If you do the math and determine that you won’t be able to pay the balance off in full during that introductory period, you should reconsider applying for a balance transfer card in the first place.

It’s not going to do you much good if your balance sits during the introductory period, and then starts to accrue interest before you’re able to pay it off. This will just put you back into the position you’re in now, maybe even worse.

Expert Advice: Take the time to do the math and determine if a balance transfer is the right option for your current financial situation before you start applying for cards.

Let’s take a look at two different scenarios.

One where opening a balance transfer card can potentially save you a lot of money. And another to illustrate how you could lose money on a balance transfer card if it’s not done under the right circumstances.

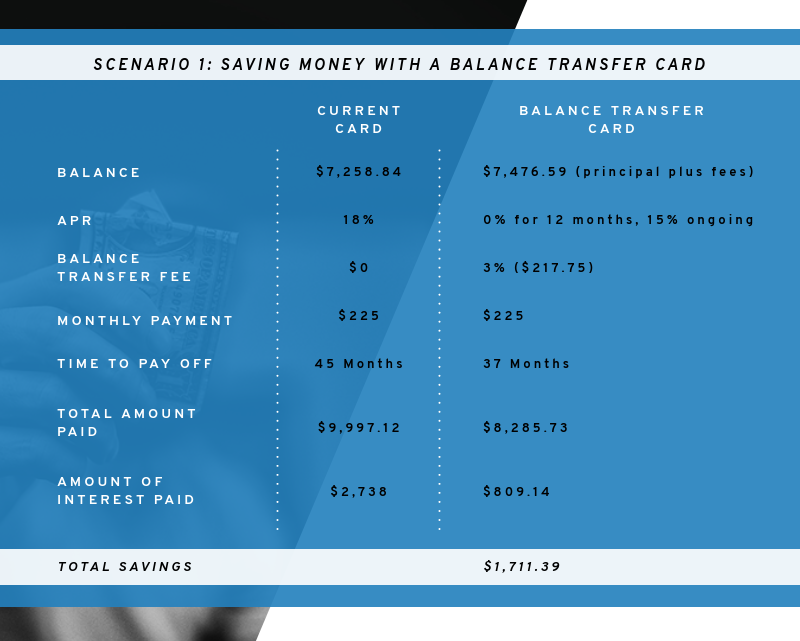

Scenario One: Saving Money With A Balance Transfer Card

Let’s say you have a credit card with a $7,258.84 balance at 18% APR. You’re not adding any new purchases to the card, and you’re consistently paying $225 every month. If you continue on this path, you’ll pay the debt off in 45 months with an additional $2,738 in interest tacked onto your balance. Overall, it’s a $9,997.12 payout.

Now let’s say that you apply for a balance transfer card that offers you a 0% Introductory APR. This card comes with a 12 month introductory period, and a 3% transfer fee. Once the initial period is over, a 15% ongoing APR takes effect.

You go ahead and transfer that $7,258.84 balance to the new balance transfer card, and do not make any additional purchases. You continue paying $225 every month. But by taking advantage of the balance transfer, you’ll only end up paying $809.14 in interest. Plus, you’ll be completely out of debt in just 37 months.

By switching your balance to the new card, and changing absolutely nothing else, you’ll be out of debt 8 months faster, and save yourself $1,711.39.

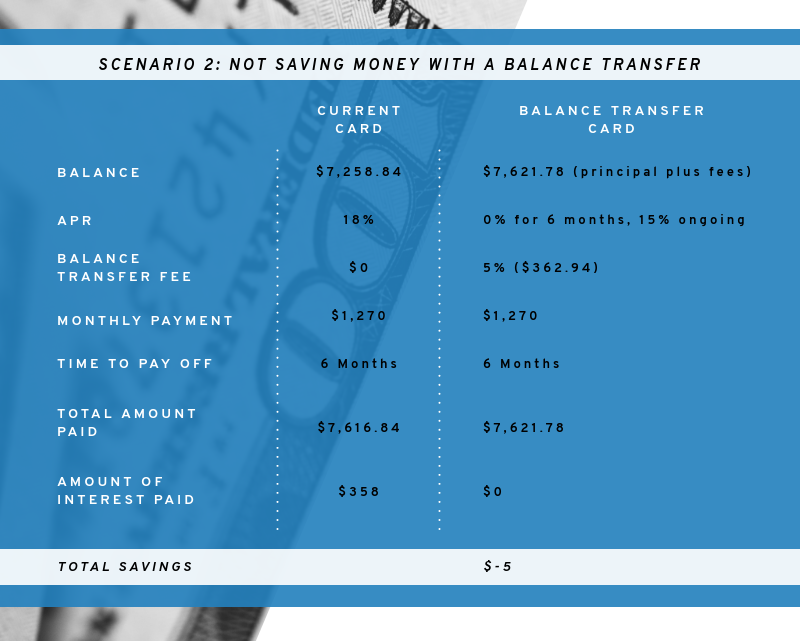

Scenario Two: Not Saving Money With A Balance Transfer

Let’s say you have a credit card with the same $7,258.84 balance with a 18% APR. You’re not adding any new purchases to the card, and you’re working hard to consistently pay back $1,270 every month. If you keep this up, you’ll pay the debt off in 6 months with an additional $358 in interest. Overall, you’ll be paying $7,616.84 in total.

Now let’s say that you apply for a balance transfer card that offers you a 0% introductory APR for 6 months with a 5% transfer fee. Once the initial period is over, a 15% ongoing APR takes effect.

In this case, it’ll still take you the same 6 months to pay your balance off. You won’t be paying anything in interest, but you’ll have a 5%, or $362.94 balance transfer fee.

You’ve been working hard on your own to get out of debt. And in this case, you’re doing everything that you can.

You’re not going to save yourself anything by transferring your balance to a new card. You’re better off saving yourself the hassle and sticking to the plan you’re on now.

Keep in mind that a balance transfer card is not always going to be the most beneficial option.

That’s why it’s important to pay close attention to the numbers and calculate what it’s really going to cost you. That way, you’ll be able to tell what will benefit you best in the long run.

Using A Balance Transfer Card for New Purchases

A lot of cards will bundle a 0% introductory APR on balance transfers as well as new purchases.

You might apply for a card with the intended purpose of using it solely for a balance transfer. But, then it arrives in the mail and you realize there’s some extra room on that credit line.

What’s the harm in using it for a few new purchases?

You’ll be able to buy the things you’ve needed, and you don’t have to worry about paying any interest right now. It seems like a good solution to your current problem.

But you need to be extremely careful and give this a lot of thought.

The problem with using your balance transfer card for new purchases is that you’re making it more difficult for yourself when it comes to the payoff.

Wasn’t the point of getting the card to make the biggest dent you can in your principal while there’s no interest accruing?

Using this card for new purchases is just going to make it that much harder to pay it all back before that introductory period ends.

And once that initial period is over, you’ll be back in the same situation you are now. You’ll be left with a balance that’s constantly increasing due to interest, with no way to pay it down.

When you have made the decision that you’re sick and tired, and you just want to get rid of some debt.😒💳 Check out these 5 easy steps to get started on your way to #DebtRecovery! —-> https://t.co/4qlus5eqDp pic.twitter.com/gL4MGqwLos

— Get Out of Debt (@getoutofdebtcom) September 28, 2018

The Pros of Balance Transfer Credit Cards

When it comes down to it, there’s really 3 main advantages to applying for and using a balance transfer card.

- Pay Less Interest: A lot of times, the interest accruing on your account is the thing that keeps you from making any difference in your total balance. You’re making a monthly payment, but it’s primarily going towards the interest and not decreasing your total debt. Balance transfer cards offer you the opportunity to have an interest free period where you can focus on knocking your balance down.

- Pay Off Sooner: Interest is always accruing, and it can make it hard for you to know when you’ll actually have a card paid off. You have to take into account the fact that your balance is increasing every month. By doing a balance transfer, 100% of your payments during that introductory period will be applied to your balance. That means you don’t have to worry about interest, and you’ll be able to pay it off sooner.

- Possible Credit Score Increase: 30% of your credit score is calculated based on your credit utilization ratio. This refers to the percentage of your revolving credit you’re using, as compared to your total limits. By transferring the balance, you’ll have essentially brought that account back to $0. This will lower your credit utilization ratio, and possibly help you increase your credit score.

The Cons of Balance Transfer Credit Cards

Like everything in life, balance transfer cards have their risks as well. We’ve laid them out for you here.

- Balance Transfer Fees: Most cards will come with a balance transfer fee of 3-5% of each amount transferred. This will increase your total debt, so pay attention to how much extra this fee is adding on.

- Introductory Period Length: Different cards come with different introductory periods. Some balance transfer cards require you to complete the balance transfer within the first 45-60 days of opening the account. If you miss this deadline, you won’t be able to take advantage of the perks that come that introductory offer.

- Credit Limit Restrictions: You’re most likely not going to know your credit limit until after you’re approved for the card. This could become an issue if the amount you’re approved for is not enough to cover the balance you want to transfer, plus fees and interest. At the end of the day, you might not be able to transfer all the debt you were intending to when you started the process.

- Lender Restrictions: You can’t transfer the balance to a new card with the same lender. So be careful when you’re doing your research that you find a viable option with a new institution.

- Promotional Rate Terms: The introductory offers that come with a new card are usually extremely appealing. But, the credit card company is quick to cut these off if you make any mistakes. Bills being paid late or going over your credit limit are grounds for terminating promotional rates.

- Additional Fees: Additional fees hide everywhere and they’re quick to eat up all of your potential savings. These can include foreign transaction fees, annual fees, late payment fees, etc. These will all be found in the terms and conditions located in the Schumer Box of your credit card agreement. Study them before submitting the application.

Choosing the Best Balance Transfer Card

Sorting through all of the options out there could take quite a bit of time. So we’ve rounded up the 5 best balance transfer cards for you.

We’ve broken it down so it’ll be super easy for you to compare the facts and bonus features of each different card.

The Best Balance Transfer Cards

American Express Blue Cash Everyday

American Express Blue Cash Everyday Quick Stats

- Intro APR: 0% on Balance Transfers and Purchases for 15 months

- Ongoing APR: 14.74-25.74% Variable APR

- Balance Transfer Fee: Either $5 or 3% of each amount transferred, whichever is higher

- Cash Advance Fee: Either $5 or 3% of each amount transferred, whichever is high

- Foreign Transaction Fee: 2.7% on each transaction, after it’s converted to US dollars.

- No Annual Fee

- Credit Requirement: Good – Excellent Standing

American Express Blue Cash Everyday Bonus Features

- Earn a $150 bonus after spending $1,000 on purchases within the first 3 months

- 3% cash back at U.S. Supermarkets (up to $6,000 a year)

- 2% cash back at U.S. gas stations and select department stores

- 1% cash back on all other purchases

With the American Express Blue Cash Everyday card, your cash back rewards are received in the form of Reward Dollars. These are redeemable for statement credits, merchandise, and gift cards.

American Express EveryDay

American Express EveryDay Quick Stats

- Intro APR: 0% on Balance Transfers and Purchases for 15 months

- Ongoing APR: 14.74-25.74% Variable APR

- Balance Transfer Fee: 0% on Balance Transfers for 15 months

- Cash Advance Fee: Either $5 or 3% of each amount transferred, whichever is higher

- Foreign Transaction Fee: 2.7% on each transaction, after it’s converted to US dollars.

- No Annual Fee

- Credit Requirement: Good – Excellent Standing

American Express EveryDay Bonus Features

- Earn a 10,000 Membership Reward Points after spending $1,000 on purchases within the first 3 months

- Earn 2x points at U.S. Supermarkets (up to $6,000 a year), then 1x from then on.

- Use your card 20+ times on purchases within a single billing period to earn 20% more points on those purchases.

Discover it

Discover it Quick Stats

- Intro Purchase APR: 0% for 6 months

- Intro Balance Transfer APR: 0% for 18 months

- Ongoing APR: 13.74-24.74% Variable APR

- Balance Transfer Fee: 3% of each transfer.

- Cash Advance Fee: – Either $5 or 3% of each transfer, whichever is greater.

- Foreign Transaction Fee: None

- No Annual Fee

- Credit Requirement: Good- Excellent Standing

Discover it Bonus Features

- 5% cash back in categories on a rotation that include gas stations, grocery stores, restaurants, Amazon, wholesale clubs, etc.

- 1% cash back on all other purchases

- Discover will match the cash back you’ve earned at the end of your first year

- They will monitor & alert you if your social security number shows up on a risky site

Citi Simplicity

Citi Simplicity Quick Stats

- Intro Purchase APR: 0% on Purchases for 18 months

- Intro Balance Transfer APR: 0% for 18 months when balance transfers are completed within 4 months from date of account opening

- Ongoing APR: 15.74-25.74% Variable APR, based on your creditworthiness

- Balance Transfer Fee: Either $5 or 5% of each amount transferred, whichever is greater

- Cash Advance Fee: Either $10 or 5% of the amount of each cash advance, whichever is greater

- Foreign Transaction Fee: 3% on each transaction, after it’s converted to US dollars.

- No Annual Fee

- Credit Requirement: Good – Excellent Standing

Citi Simplicity Bonus Features

- No Late Fees

- No Penalty Rates

US Bank Visa

US Bank Visa Quick Stats

- Intro APR: 0% on Balance Transfers and Purchases for 20 months

- Ongoing APR: 11.74-23.74% Variable APR

- Balance Transfer Fee: Either $5 or 3% of the amount of each transfer, whichever is greater

- Cash Advance Fee: 4%

- Foreign Transaction Fee: 2% on each transaction, after it’s converted to US dollars.

- No Annual Fee

- Credit Requirement: Excellent Standing

US Bank Visa Bonus Features

- Flexible Payment Due Dates

- $600 protection offered on your cell phone when you pay your bill with your US Bank Visa.

Conclusion

A balance transfer card has the capability to be a great financial tool that’ll help you get out of debt faster, while paying less interest.

But, everything has its disadvantages as well. You need to make sure you understand the terms and conditions of your new card so there’s no unexpected fees or stipulations.

Once you’ve done the math and you’re sure you’re going to benefit from a balance transfer card, you can start comparing our 5 best balance transfer cards. Look at their quick stats as well as their bonus features to find one that’ll be a good fit for you and your lifestyle.

Have you saved money by doing a balance transfer? Let us know in the comments!

Up Next: 15 Debt Payoff Planner Apps & Tools

Leave a Reply