Most of us do not work for employers who offer a fully-funded pension plan. The result of this is we need to have a method of saving money for our retirement.

While most of us will be entitled to collect Social Security upon retirement, the benefits may be insufficient to maintain our lifestyle.

Many people deposit funds into Individual Retirement Plans (IRAs) to save for retirement, and still others take advantage of employer-based plans such as a 401(k) or 403(b) plan. What confuses many people is the differences between these two plans and how they can benefit from each.

The first thing to keep in mind is these plans must be offered by an employer. Only a business can offer these plans. In some instances, a small business owner may establish a small business 401(k) plan.

Most small businesses do not qualify for a 403(b) because the use of these plans is limited to non-profit organizations, schools, and other government entities.

Here is some additional information you should be aware of regarding these plans.

Classification of Retirement Plans

Both 401(k) and 403(b) plans are considered “Defined Contribution Plans”. Defined contribution means you put your own money into the plan.

- Corporations and businesses offer employees a 401(k) plan.

- Public school systems and most nonprofit companies offer a 403(b) plan.

We all need to save for #retirement. One of the challenges you may face is which plan to choose.

Both #IRA and 401(k)s have great tax advantages for long-term saving, but there is also key differences between the two.

So, which one is right for you? https://t.co/1gFFqiYBR9 pic.twitter.com/pNQ29Rd5EN

— Get Out of Debt (@getoutofdebtcom) January 7, 2019

How Defined Contribution Plans Work

Funds deposited into a defined contribution plan come directly from your paycheck. You decide how much you wish to contribute to the plan.

The net result of this is the amount of taxes you pay on your earnings is lower. This is because the contribution is taken from “pre-tax” dollars.

In some instances, your employer may offer to match all, or a portion, of your contribution. Their contribution is often restricted for a period of time through what is known as a vesting.

- Vesting is typically done over five years. There are two types of vesting which are called cliff vesting and graded vesting.

- Cliff vesting usually means if you leave your company within five years of your employer matching funds, you lose the benefit of all those funds.

Graded vesting means a portion of the employer contribution is vested over time. For example, your employer makes a contribution to your 401(k) and you leave three years later. You will get a portion of the employer contribution fully-credited to your plan.

Employer-Sponsored 401(k) Plans: Understanding the Basics

When you become part of your company 401(k) plan, you decide how much you wish to contribute. Once you do this, your employer will remove funds from your paycheck and the money is put in an account for your use.

The funds for a 401(k) are deducted from your pay before you get it. This makes saving easier since you never see the money.

Usually the amount you contribute is done as a percentage of your pay.

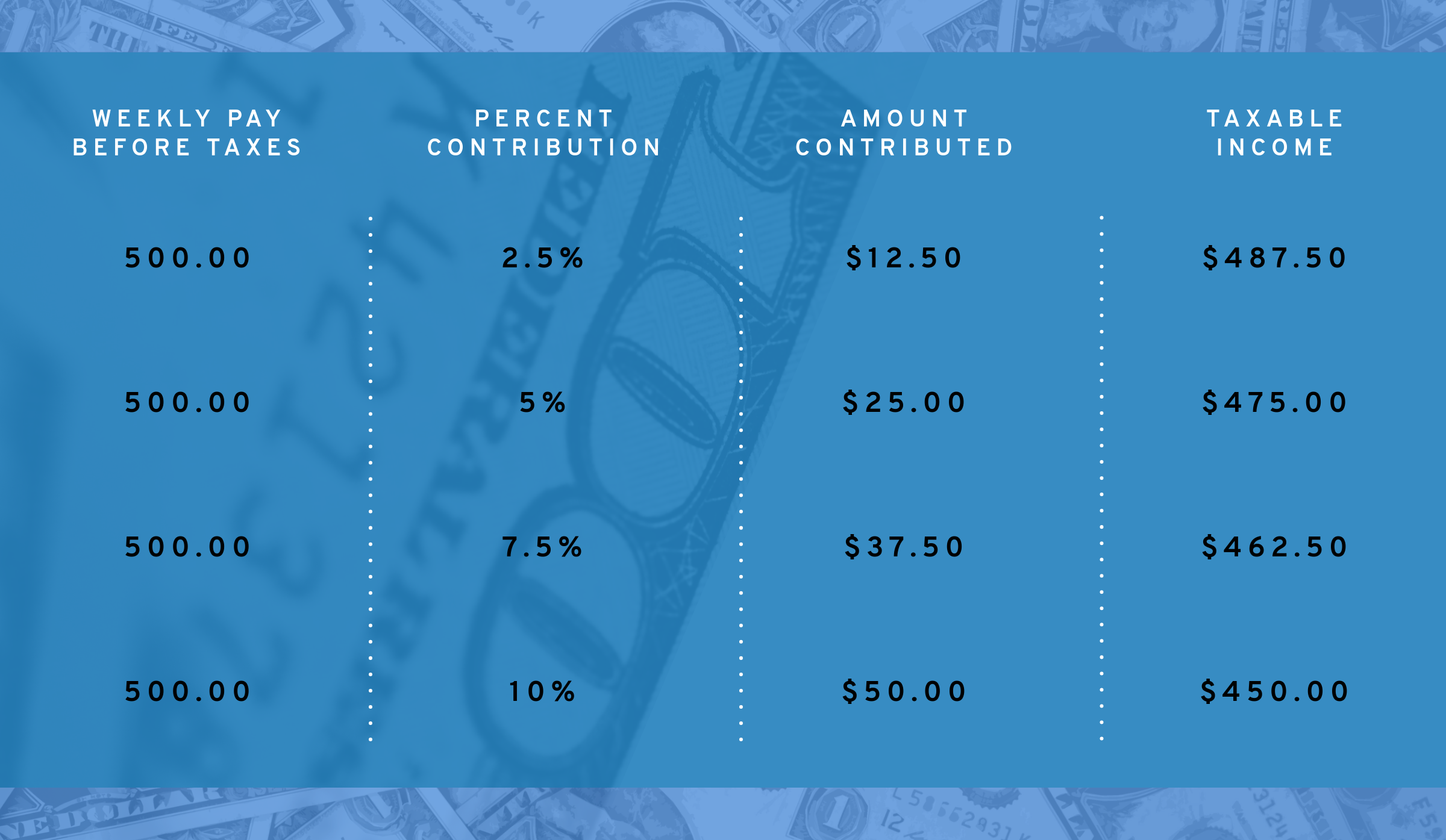

It would work like this:

As you can see, the more you contribute to your 401(k), the lower your taxable income would be.

This is one of the tax benefits involved in contributing to your company 401(k) plan.

401(k) Plans: Who is Eligible to Contribute?

Employees must meet certain criteria before they are allowed to make contributions to a 401(k) plan. Before an employee can contribute, they must be at least 21 years of age.

Employees who have been with a company for less than one year are not eligible to participate in a 401(k) plan.

Some employers may require an employee work with them for two years prior to participating in a 401(k) plan. Employers may not place a maximum age on accepting a participant into a plan.

Plan Sponsorship and Administration

Your employer is considered the sponsor of your plan. However, they do not make decisions about investments. Instead, the sponsor picks a company to serve as the plan administrator.

Typically, a plan administrator falls into one of three categories

- A mutual fund company – Fidelity, Vanguard or T. Rowe Price are examples

- A brokerage firm — Merrill Lynch, TD Ameritrade, or Edward Jones are examples

- An insurance company — MetLife, Prudential, or Nationwide are examples

The Costs of a 401(k) Plan

There are several costs associated with a 401(k) plan including adopting and managing the plan.

Any fees you as a participant pay must provide a benefit to you if they are paid from the assets associated with the plan. Otherwise, the fees are paid from your employers’ benefits account.

You may be charged an annual fee, fees if you request a hardship withdrawal, or fees for various other expenses which are unique to the plan you are participating in.

Elective Deferral Limitations for 401(k) Plans

You can only defer so much of your salary into your 401(k) plan. These limits are set by the Internal Revenue Service (IRS).

For the 2019 tax year, a plan participant may defer up to $19,000 of their pre-tax dollars.

If a taxpayer is over the age of 50, they may also contribute an additional $6,000 which is considered a “catch-up” contribution.

Contribution Limits For 401(k) Plans

While there are fixed dollar amounts for deferrals (that is the amount of your salary you are not paying taxes on) there are different limits for the maximum contributions to a 401(k). They are as follows:

- Total contributions cannot be more than 100 percent of your compensation

- A total of $56,000 in 2019 unless you are making catch-up contributions in which case the limit is $62,000

Investment Options for 401(k) plans

Participants in a 401(k) plan direct how their money is invested. While the employer sends the funds to the plan administrator, you decide how it will be invested.

- Most plans will provide you with several options including mutual funds and your company stock plan.

- Some plans may also offer the participant what is called a self-directed investment option.

Saving for retirement can be a daunting task, but with a sound strategy, it’s well within reach.

Be sure to live out the last 20+ years of your life comfortably with these simple retirement plans. https://t.co/Pv1qzsFVLT#FinanceMeme #Reirement #TuesdayThoughts pic.twitter.com/b7DwgzsThl

— Get Out of Debt (@getoutofdebtcom) January 22, 2019

Understanding 403(b) Basics

Like a 401(k) plan, a 403(b) plan is a defined contribution plan. Hospitals, churches, schools and other tax-exempt organizations including the government may offer these plans. Some employers will offer both a 403(b) and a 401(k) plan to their employees.

Eligibility for Contributing to a 403(b) Plan

Under certain circumstances, an employer may exclude certain employees from contributing to a 403(b) plan. Here is who may be ineligible:

- Those who plan to contribute an amount equal to or less than $200 annually

- Any employee who participates in a 401(k) offered by the employer

- Any employee who works less than 20 hours per week

- A student who is performing certain services

- Any employee who is a non-resident alien

If you fall into any of these categories, your employer may exclude you from making 403(b) contributions, but you may be eligible any 401(k) plan they offer.

Costs Associated With 403(b) plans

The fees for a 403(b) plan tend to be higher than a 401(k). This is a result of the types of investments which are allowed. The fees associated with a 403(b) plan may be as high as 2.5 percent.

Your plan administrator should be disclosing fees to you for any plan you enroll in. Make sure you understand how the fees impact your ability to save for retirement.

Elective Deferral Limits for 403(b) Plans

The deferral limits on 403(b) plans is the same as they are for 401(k) plans. There is one exception however, which applies to an employee who has worked for the same employer for 15 years or more.

The limit is increased by the lowest amount of one of the following:

- $3,000

- $15,000, less additional elective deferrals made in prior years

- $5,000 times the number of the employee’s years of service for the organization, less total elective deferrals made for earlier years

Contribution Limits for 403(b) Plans

Annual contribution limits are the same for a 403(b) and a 401(k).

Investment Options for 403(b) Plans

You have fewer options for investments with a 403(b) plan. These plans almost all use annuities. You should check your plan documents because the plans are allowed to offer mutual funds and annuities. You cannot invest in stock directly with a 403(b).

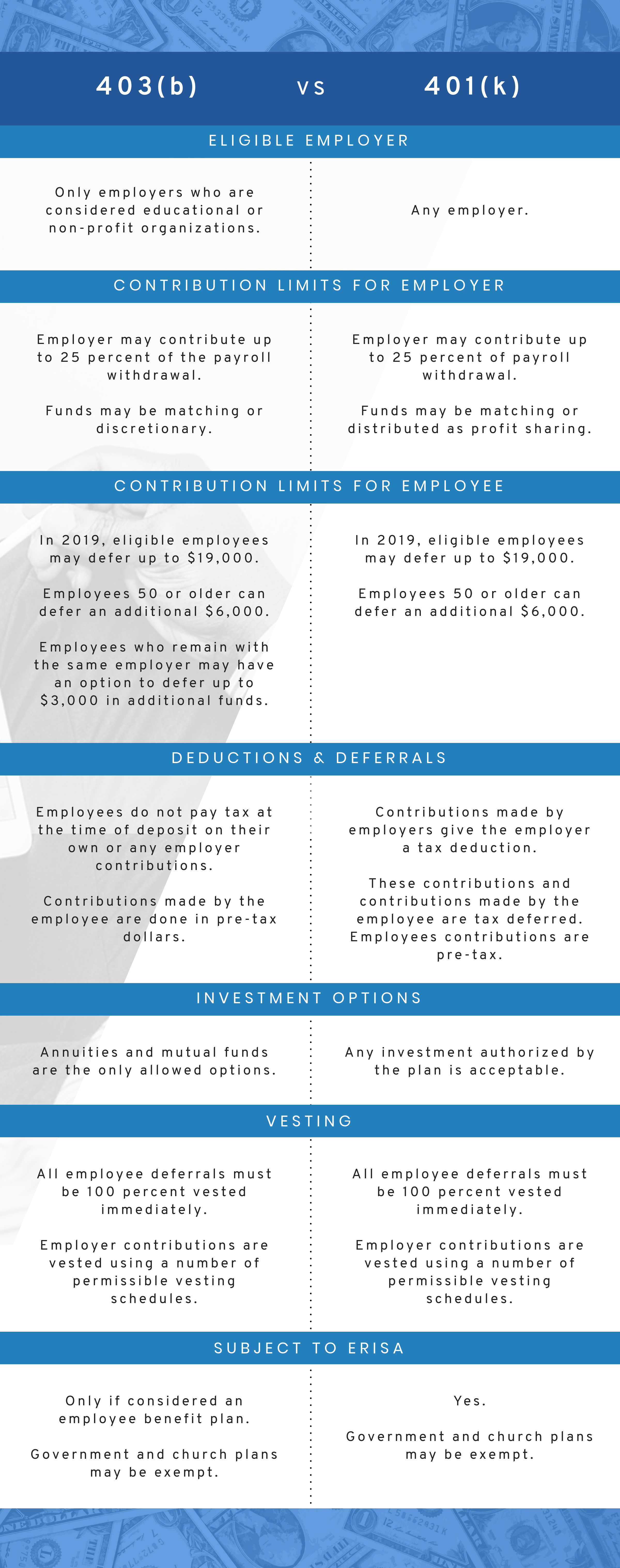

403(b) or a 401(k) Side-by-Side Comparison

Can You Contribute to Both a 401(k) and a 403(b)?

If your employer offers both plans, or you have two employers who are offering different plans, you can contribute to both.

However, it is important to remember that the annual contribution and deferral levels apply. You should speak with a financial advisor.

Should I Contribute to a 401(k) or a 403(b)?

It is important to understand the features of both plans before deciding which you should contribute to. This decision should be made after reviewing what each plan has to offer. Some of the differences can be dramatic including fees. You should review some of the following:

- 403(b) plans not as regulated as 401(k) plans meaning they may have more risk

- Contribution limits are slightly different if you are with an employer for more than 15 years. If you are going to be with an employer for this long, a 403(b) may be more beneficial.

- Fees play a role. Most 403(b) plans have higher fees.

- Matching funds are often not included in a 403(b) plan. If you have the option between a plan that matches funds and one that does not, the matching plan is usually a better option.

- If you wish to have more flexible investment options, a 401(k) may be a better option.

Fact: The average #SocialSecurity check for a retired worker is $1,355 per month (as of Nov. 2016).

Is that enough for you to #retire comfortably?

If not, the time for you to start saving for retirement is NOW!

👉 https://t.co/4e43cK2W5D pic.twitter.com/sVKfd0JcJH— Get Out of Debt (@getoutofdebtcom) January 15, 2019

Finding the right retirement plan is never easy. Each of us needs to decide as to how we want to save for retirement.

Having the ability to have funds taken directly from our pay allows us to start a nest egg without having to worry about doing it on our own.

The first step in retirement planning is determining how much money you will need in retirement on a monthly basis. You will then have to explore all of your options and determine what plan is right for you.

Even if you have a company-sponsored retirement plan, you may still want to invest in an Individual Retirement Account (IRA).

Always speak with a qualified investment advisor before deciding which retirement plans work best for you to help you reach your retirement goals.

Keep in mind, even if you are starting your first job, it is never too early to start planning for retirement by saving money. Taking the steps to start a retirement account today will help secure a better retirement later.

Leave a Reply