Are you curious about the average credit card debt in America, and how you stack up against your peers?

Are you on the verge of maxing out your cards and don’t know how to move forward?

Either way, we’ve got you covered.

That’s why we’ve put together these 13 tips to get out of the average credit card debt.

Here’s what we’ll cover:

- How Big of a Problem is Credit Card Debt?

- 13 Tips to Get Out of the Average Credit Card Debt

- Learn how to Budget

- Avoid the Minimum Payment

- Target One Debt at a Time

- Debt Avalanche Method

- Debt Snowball Method

- Liquidate a Big Ticket Item

- Utilize Extra Cash Flow

- Don’t Close Credit Accounts

- Find a 0% Interest Balance Transfer Card

- Explore Card Consolidation & Personal Loans

- Watch Your Credit Utilization Ratio

- Make Arrangements with Creditors

- Consider Debt Settlement

How Big of a Problem is Credit Card Debt?

The average credit card debt has hit an all-time high in America.

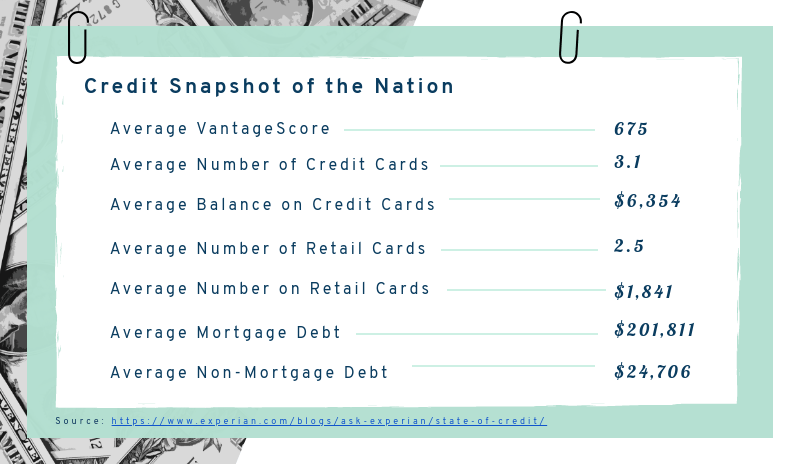

Experian’s annual study on the state of credit and debt in America tells us that the average American has a credit card balance of $6,354.

And credit card debt as a whole is surpassing $1 trillion. Yes, that’s a trillion with a T.

If you’re wondering how you compare to the rest of the nation, check out this chart:

According to a study from ValuePenguin, only 38.1% of all American households carry any credit card debt.

That would mean that the average household with credit card debt has a balance of $16,048.

Experian reported that the average credit card limit is $8,071. That means Americans are spreading their debts across multiple credit accounts.

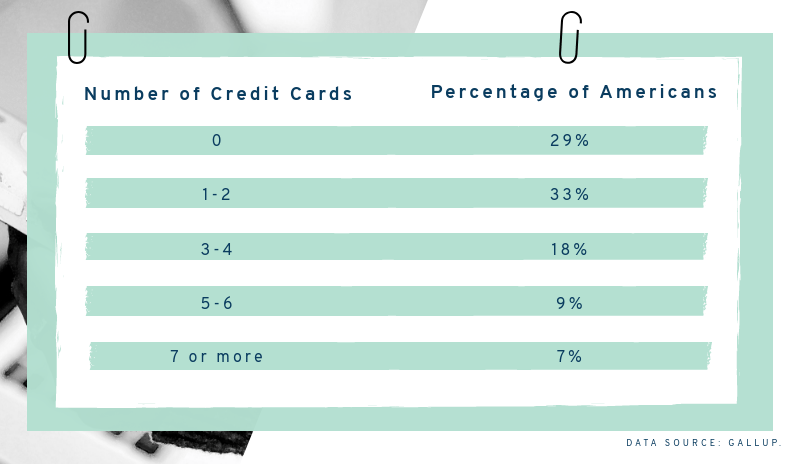

How many credit cards does the average American have?

Let’s take a look:

If the average credit card limit is $8,071 and 33% of Americans have 1-2 cards…it’s not hard to do the math.

Having just 2 cards in a household and maxing them both out will leave you with that average credit card debt of over $16,000.

And don’t forget about the other 34% of Americans who have upwards of 3 credit cards. It’s not hard to imagine the type of financial trouble you can get yourself in with 7 credit cards with an average credit limit of $8,071 on each.

So what exactly are people going into debt to buy?

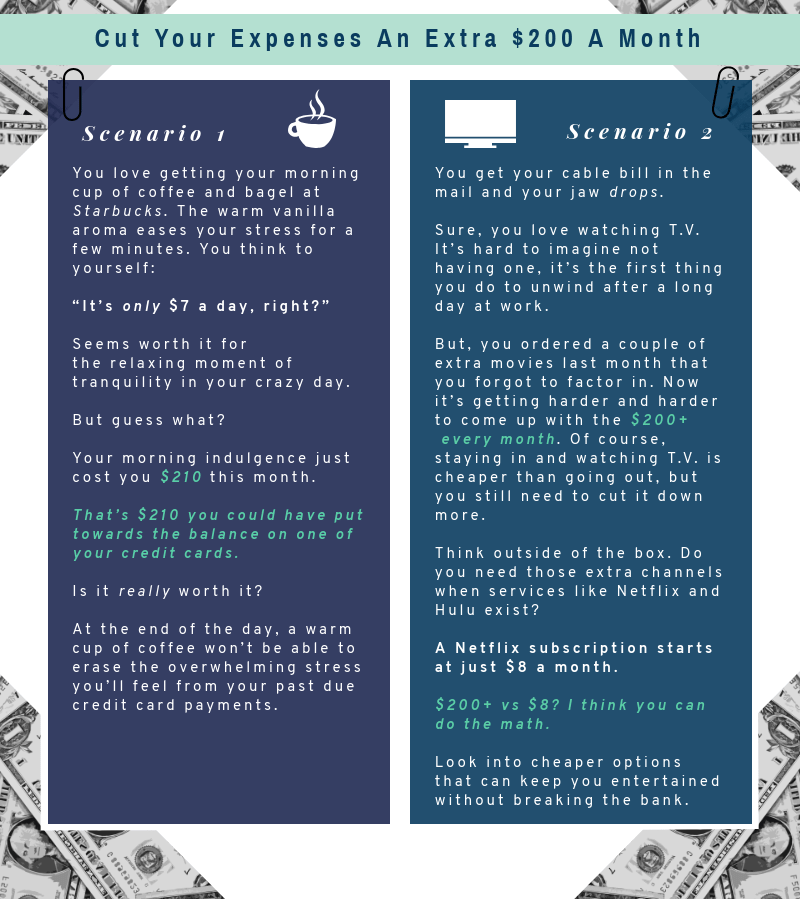

Of a poll taken of 2,089 U.S. adults ages 18 and older, spending money on those little luxuries throughout the month is what’s putting them over the edge.

You might think twice about that early morning Starbucks run when you realize it’s really the reason you’re in the red every month.

I think we can all agree, it’s pretty easy to get yourself into credit card debt. Unfortunately, it’s not as easy to get yourself out.

But, here are 13 tips to help you get out of the average credit card debt today.

13 Tips To Get Out Of The Average Credit Card Debt

1. Learn How To Budget

The first thing you need to do is admit that there’s an issue and make the commitment to fix it.

It may be depressing to take a serious look at your expenses vs your income, but it’s necessary to create a budget.

You’ll want to look at:

- How much money is going out?

- Where am I spending this money?

- How can I eliminate some of these expenses?

By doing this, you’ll be able to reallocate that money towards your credit card debts.

A lot of people don’t realize just how much they’re spending on unnecessary things. You can easily save hundreds of dollars a month. You just have to know where to cut back.

Take a look at these 2 common situations:

Once you take a hard look at where your money is going, you’ll see there’s a ton of ways to cut down.

It’s all about making little adjustments here and there. Think about what expenses you can easily eliminate and reallocate that money to start paying down your debts from there.

2. Avoid The Minimum Payment

One of the best things you can do is to stay away from minimum payments. People get in the mindset of thinking, “If I am able to make the minimum payment this month, I can afford to buy it.”

The reality is that this couldn’t be further from the truth. You should be asking yourself, “When will I be able to pay this off?”

If you’re going to put a purchase on your credit card, ask yourself these questions first:

- Do you know actually know when this will be paid off in full?

- Have you taken the time to truly evaluate this?

People tend to start spending more and more money as their debt rises because they feel like they can still afford it. That’s why you need to look at it in a different way.

Next time you’re about to charge something to your credit card, ask yourself, “If I charge this to my card today, when will it be paid off in full?

If your response is within 3 months, go ahead and run the card! You’ve done your math and know you’ll be able to handle it.

But if you can’t pay it off soon and are going to carry a balance on your card, it’s not a smart move to make. Every month the interest is going to continue to accrue.

By only paying your minimum balance every month, you’ll be adding more interest to your balance and increasing the amount of time it’ll take you to pay it back.

It doesn’t take much to manage your #finances even on a tight #budget. Check out these tips on saving #money: https://t.co/P2jwXdkDxo#debtfree #getoutofdebt #moneymatters #moneymoves pic.twitter.com/YkKJqt07j4

— Get Out of Debt (@getoutofdebtcom) May 23, 2018

3. Target One Debt At A Time

Being in debt can be extremely overwhelming. The interest is accruing on your credit cards, your minimum payments aren’t bringing your balance down, and you feel like you’re digging yourself a deeper hole every day.

Take a second to breathe. Then, focus on one debt.

Pick the credit card you’d like to pay off first and start making higher payments on that one. Be sure to still maintain minimum payments on your other cards.

By learning how to budget, you should be able to free up some additional money each month from cutting back on your superfluous expenses. Dedicate all of these additional funds to the card you’ve chosen to pay off.

Following this method will give you the ability to pay off one of your credit card balances earlier than you would have otherwise. In return, you’ll feel a boost of encouragement to keep going.

But how do you pick which card to pay down first? There are 2 strategies:

- Debt Avalanche Method

- Debt Snowball Method

We’ll outline them for you below.

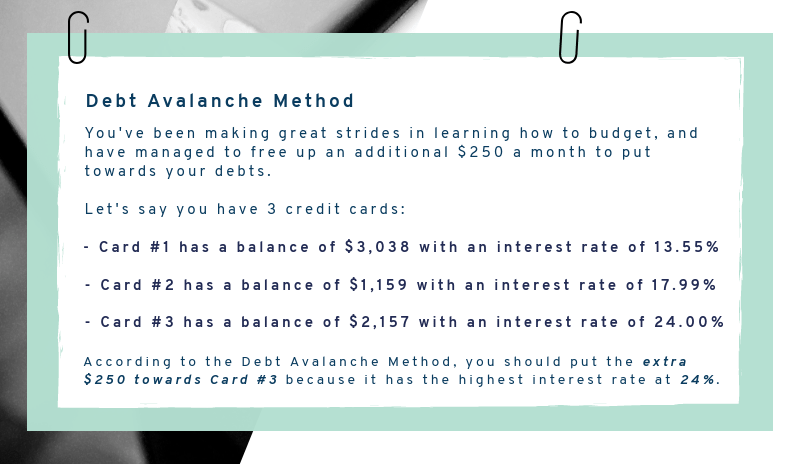

4. Debt Avalanche Method

The Debt Avalanche Method involves paying off the credit card with the highest interest rate first.

Why do it this way?

The sooner you eliminate the balance on that card, the less money you’ll be paying out overall.

Every month you should take the money you’ve saved from learning how to budget, and apply it to your credit card with the highest interest rate. By doing this, you’ll eliminate your debt faster and beat the interest rate clock.

Once you pay that first card off, move onto the next one with the highest interest rate, and so on. You’ll be surprised at how quickly you can conquer your debt.

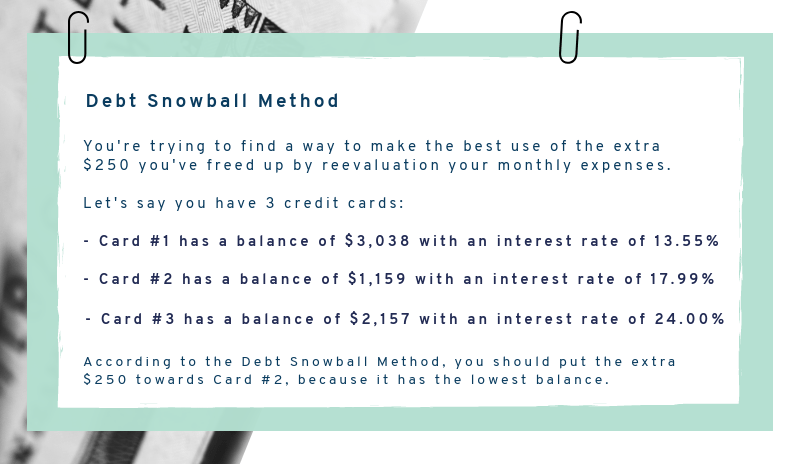

5. Debt Snowball Method

The Debt Snowball Method involves paying off the credit card with the smallest balance first.

Why do it this way?

Completely paying off one of your credit cards will give you peace of mind.

Every month you should take the money you’ve saved from learning how to budget, and apply it to your credit card with the lowest balance. By doing this, you’ll completely pay off a credit card in a short amount of time and it’ll feel great to be able to cross a card off your list.

The key is, don’t stop there! Continue doing this until you have paid off all of your credit card balances.

6. Liquidate a Big Ticket Item

All we mean is, go sell something!

Big ticket could just mean a couple hundred dollars. Have a garage sale and get rid of some things that are just collecting dust. It might not be valuable to you, but trust us, it is to someone else.

The important thing to remember is that when you sell something, make sure you use the money to pay off your credit card debt.

7. Utilize Extra Cash Flow

Take a moment to think about anywhere else you might get some extra cash every year. Maybe it’s your tax return or a bonus at work.

No matter the amount, apply it towards your credit card debt.

Then, start to think about some other ways you can bring in some extra money.

Side jobs like Uber give you the flexibility to create your own schedule. So you can work as little, or as much, as you need to make a dent in those credit card balances.

Be creative and look for alternative ways to make some extra cash. The money is out there, you just have to go find it.

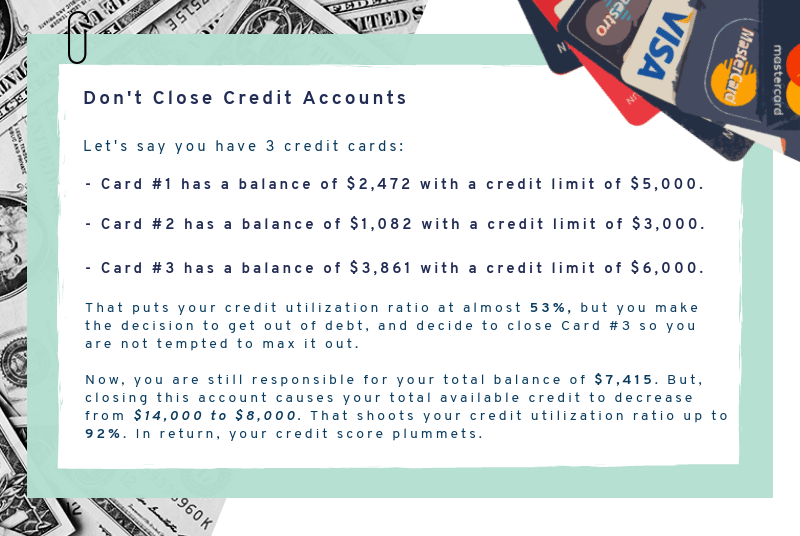

8. Don’t Close Credit Accounts

It makes sense that if you close your credit card accounts, you can’t use your cards anymore. Seems like an easy way to stop yourself from getting into more debt.

But, that’s a big mistake. Closing a credit account will affect your credit utilization ratio.

Your credit utilization ratio is the total amount of credit you are using, as compared to your total credit limit, expressed as a percentage.

When you close a card, you are still responsible for the balance. Yet, your total credit limit decreases. This causes your credit utilization ratio to go up. In return, your credit score drops.

Don’t cancel the card. Leave that credit line open and continue to pay it normally.

Don’t cancel the card. Leave that credit line open and continue to pay it normally.

9. Find A 0% Interest Balance Transfer Card

Find a credit card that will offer you a 0% interest balance transfer.

You might be thinking, but wait, I want to get OUT of debt, not in MORE! Why would I open another line of credit?

What you shouldn’t do is take this as an opportunity to get yourself in more debt with the additional credit line.

Instead, once you get the card, focus all of your efforts on paying down the balance as quickly as you can.

Most of the time these cards keep their 0% rate through 12 or 18 months. You may be able to find one that’s a little longer than that.

For that time, the interest rate clock stops. Any payments you make are going directly towards reducing the principle of your balance.

This is your chance to actually pay back the number you see on your statement. Once that time is up, you can expect another high-interest rate.

So this is your time to be really cognizant of balances and how quickly you can pay them down.

10. Explore Card Consolidation & Personal Loans

We know the concept of taking out more debt to pay off current debts can be confusing and seem counterproductive. But, consolidation and personal loans are definitely options worth looking into.

Consolidation and personal loans will have lower interest rates than your traditional credit cards. Expect to see rates from 6-8% for these loans, as opposed to 15-25% for a standard credit card.

A great thing about taking out one of these loans is that you do not give yourself the ability to continue charging as you would with a balance transfer card.

Once you get the loan, you will have a fixed monthly payment for a specific term. Your monthly payments will be going directly towards the principle on your balance.

Once the balances are paid on your cards, do not continue to use them.

This method will not work if you continue to use your credit cards after taking out the loan to pay the balances off. Doing this will cause your debt to continue escalating.

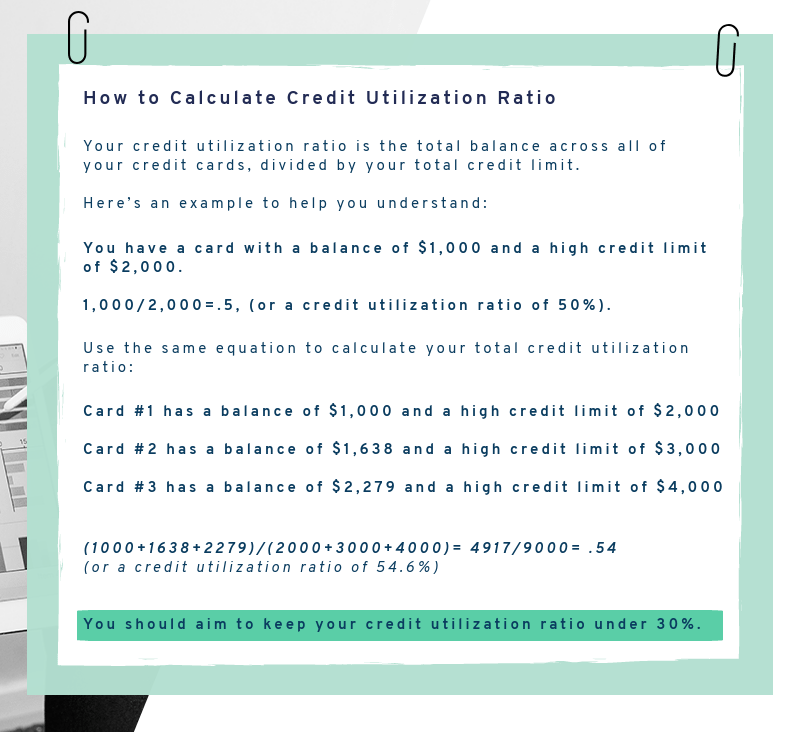

11. Watch Your Credit Utilization Ratio

Be sure to take the time to calculate your own credit utilization ratio.

We show you how to do this in the image below:

The lower your credit utilization ratio is, the better your credit score is going to be. As a rule of thumb, you should always stay below 30%.

In the future you might want to:

- Buy a house

- Get a car loan

- Open a new line of credit

No matter what you’re trying to do financially, a better credit score is going to get you there. The lower you keep your credit utilization ratio, the more opportunities you’ll create for yourself.

12. Make Arrangements With Creditors

If you are just about to be late on your credit card payments, this is a great time to take initiative and look at your options.

Here’s a really good and simple solution…a phone call.

Make a simple phone call to your credit card company and let them know that you’re having some problems. Ask if there’s a possibility of an interest rate reduction. Once they are aware that your cash flow is a little tight, they may be willing to help.

Do not wait until you’re 60 or 90 days past due to make the call. Your creditors will not be willing to work with you once you have become late on your payments.

Keep in mind that there are no guarantees with this. Everyone has different results, but it’s worth picking up the phone and asking. It’s way better to make an arrangement with your creditor than to become delinquent on your payments.

13. Consider Debt Settlement

If you’re feeling like your back is against the wall and you’re saying to yourself:

- I can’t do this

- I feel like I’m drowning in debt

- I don’t have the capacity to follow these tips

- I don’t have the wherewithal to add extra payments

- I don’t know where to start

- I’m frustrated and I don’t know what to do

It might be time to seek out professional help. Utilizing a debt settlement company will allow you to see a light at the end of the tunnel.

They will be able to negotiate a debt reduction plan with your individual creditors or credit card companies. This will allow you to become debt free while paying a substantially lower amount than what you currently owe.

During the process, you will have charges waived, interest rate charges, and late charges removed.

One thing that you should note is that this could be done on your own.

You might think, “Why would I pay a professional when I can do it myself?”

You’re way better at something you’ve done 100 times than something you’ve done once. You’re not going to know which debts you’re allowed to negotiate, how far down you can get your creditor to go, or if you’re even doing it correctly your first time around.

The professionals know the wherewithal of the ins and outs of how the credit card companies operate, and how to work with them effectively to negotiate the best deals for you.

So if you’re feeling too overwhelmed to tackle your debt on your own, debt settlement is definitely a viable option.

There you have it. We gave you 13 awesome tips that you can start using to pay down your credit card debt.

We know credit card debt can be overwhelming, but it doesn’t have to be.

Take a moment to breathe, and then focus. Use these 13 tips to develop a strategy to get your credit card debt under control. You’ll be surprised at how quickly you can make some serious progress.

What tips and tricks have you used to lower your credit card balances? Let us know in the comments!

Up Next: 15 Debt Payoff Planner Apps & Tools

Leave a Reply